LINEA, APX, and CVX Prices Explode: Top Altcoin Picks for 2025’s Bull Run

Three altcoins just ripped through resistance levels—LINEA, APX, and CVX lead the charge as crypto markets heat up.

What’s driving the pumps?

DeFi narrative strength, fresh protocol upgrades, and a surge in institutional interest. LINEA’s Layer-2 scaling solution gains traction, APX’s real-yield mechanism hooks yield farmers, and CVX’s vote-locking Convex model keeps accumulating power.

Timing the next leg up.

Market cycles favor momentum—these tokens show sustained volume, bullish on-chain metrics, and strong holder distribution. No guarantees, but the charts hint this isn’t a fluke.

Ride the wave—or watch from the shore.

Just remember: in crypto, everyone’s a genius in a bull market. Until they’re not.

Which Altcoin Looks Strongest: LINEA, APX, or CVX?

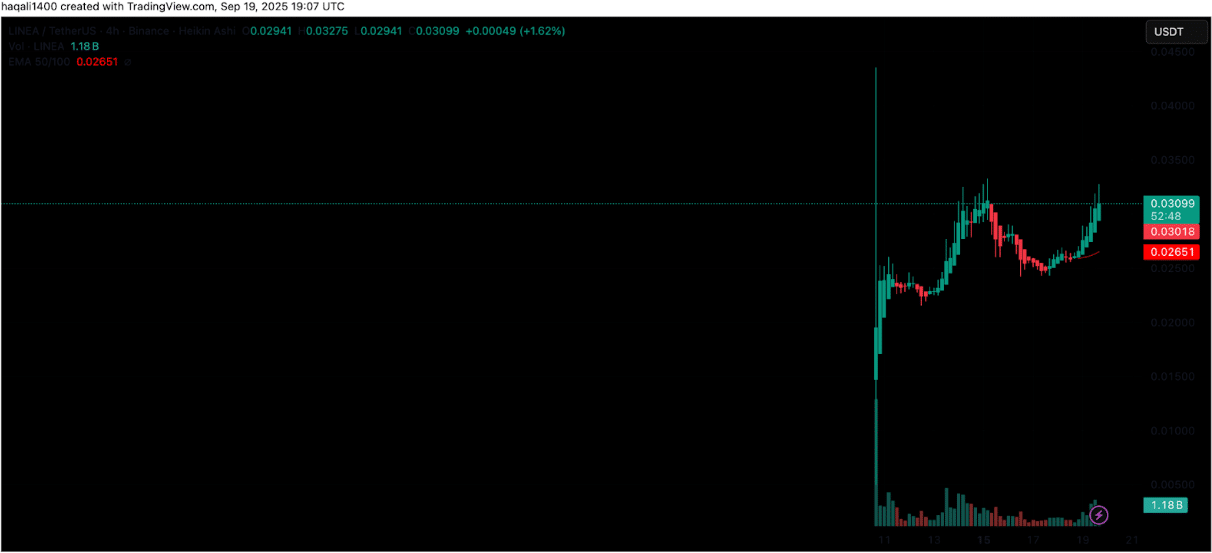

LINEA rose about +17% in the past day, trading NEAR $0.0307 with roughly $552M in volume and a market cap of around $475M. Listings and ongoing claims thickened order books and improved depth.

(Source – LINEA USDT, TradingView)

The project says its 90-day claim window opened on September 10 and runs until December 9, 2025, at 23:59 UTC. That keeps distribution steady into year-end.

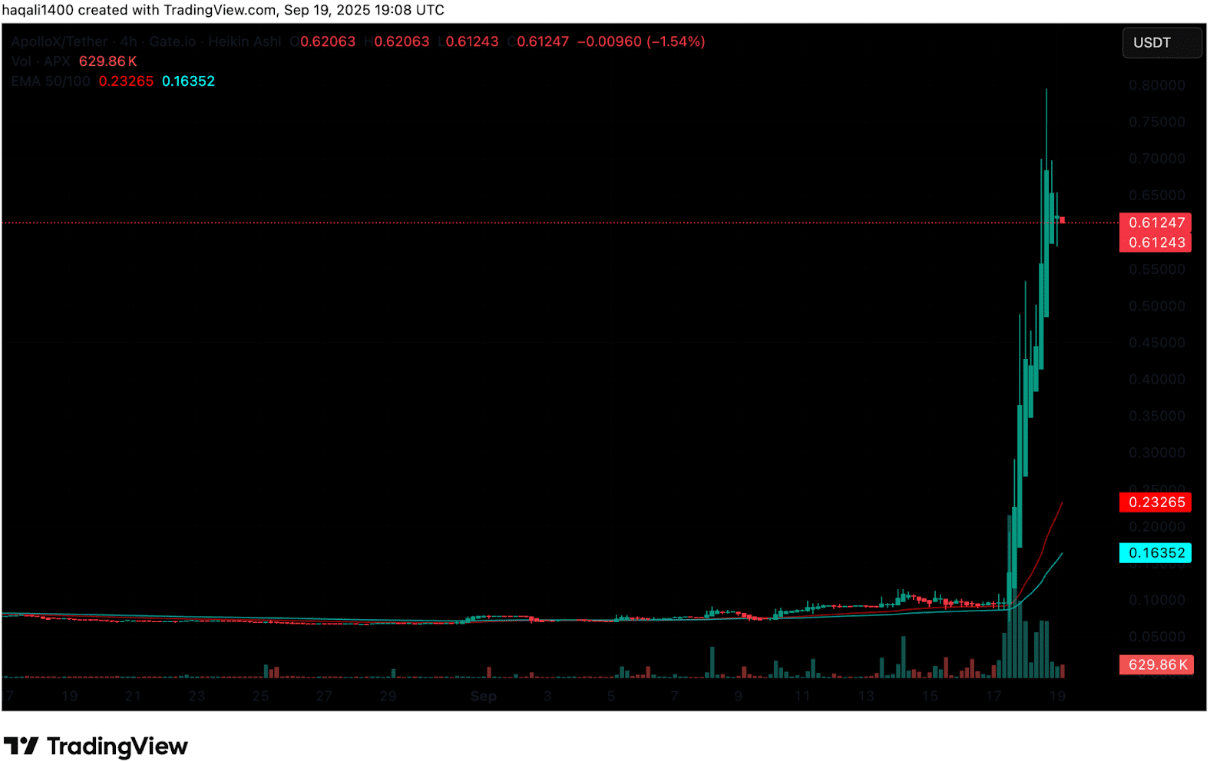

APX traded around $0.74-$0.79, up roughly +14% on the day and about +750% on the week as the token transitions to $ASTER.

Charts show a sharp seven-day climb, with some intraday variance across venues.

(Source – APX USDT, TradingView)

Binance Alpha backed the move, with the $ASTER migration executed on September 19. Aster said the APX Token Upgrade page went live on September 17, the same day as the TGE.

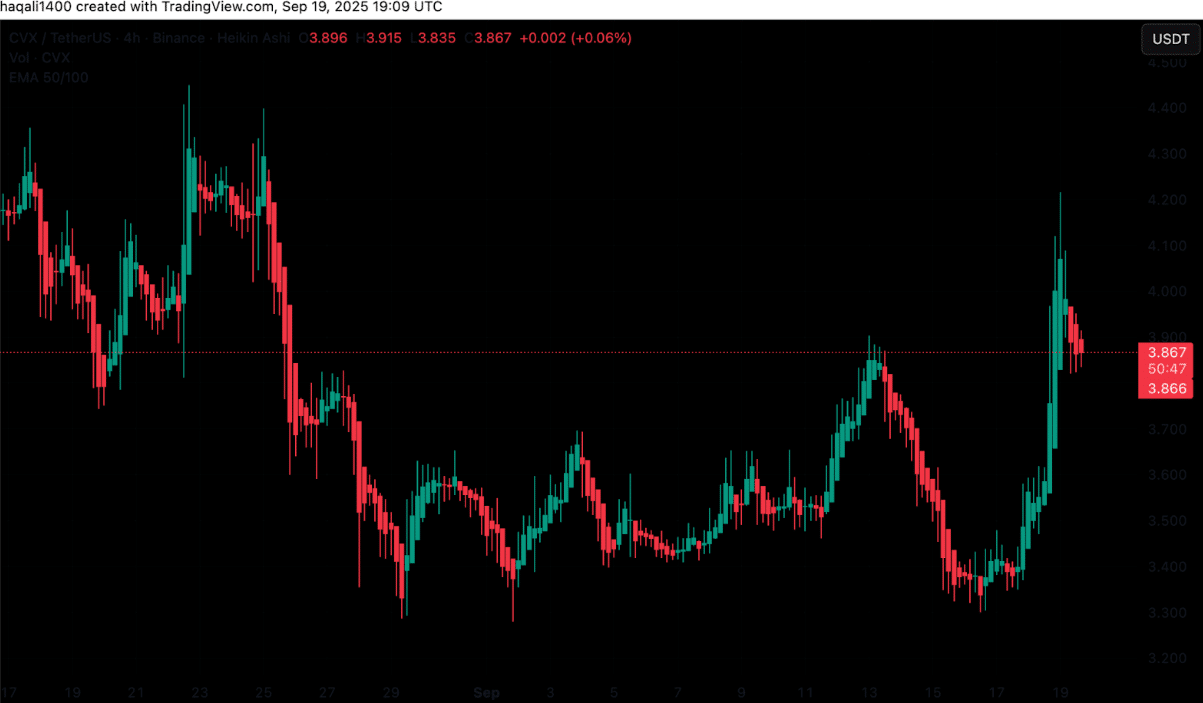

CVX hovered near $3.85-$3.90, up about +8% on the day, with turnover between $50M and $65M. The MOVE followed a fresh focus on Curve Finance’s income plan.

(Source – CVX USDT, TradingView)

Curve’s “Yield Basis” proposal WOULD return 35%-65% of its value to veCRV holders, with voting scheduled through September 24.

That matters for Convex, which aggregates veCRV as part of its yield strategy.

Watch the pace of LINEA claims and new listings, execution milestones for the APX → ASTER swap, and the Curve vote outcome.

Those three levers could decide which of LINEA, APX, or CVX keeps the lead.

Is Linea (LINEA) the Best Altcoin to Buy in 2025 After Its Airdrop and Market Surge?

Linea’s distribution mechanics, the APX-to-Aster migration, and Convex’s exposure to Curve incentives have been the main forces shaping market moves this week.

Linea’s first-wave airdrop, based on a July snapshot and open for claims since September 10, has kept supply and demand in constant motion as recipients weigh whether to hold or sell.

Meanwhile, the APX-to-Aster token migration has become the standout story.

Backed by Binance Alpha, the upgrade drew attention after on-chain trackers flagged large holders moving millions of APX into the swap.

Linea reiterated its 90-day claim window on the project’s hub. Aster pointed to its September 17 token generation event and live upgrade page. Binance Alpha’s involvement added operational clarity around the APX migration, reducing uncertainty for traders.