LINK vs XRP: Which Crypto Will Dominate Your Q4 2025 Portfolio?

Two blockchain titans clash as Q4 2025 approaches—Chainlink's oracle network faces off against Ripple's payment protocol in the ultimate hold decision.

Infrastructure Showdown

Chainlink's decentralized oracles feed real-world data to smart contracts while Ripple's XRP facilitates cross-border settlements. Both solve critical problems—but which solution gains more traction when institutional adoption accelerates?

Market Momentum Factors

Regulatory clarity finally hits XRP after years of legal battles, while LINK continues expanding its data feeds across DeFi and traditional finance. Network activity spikes for both assets, but adoption patterns tell different stories.

The Verdict

Smart money diversifies across both—because in crypto, putting all your digital eggs in one blockchain basket remains the quickest way to learn about volatility the hard way. Traditional finance might still be scratching its head about Web3, but your portfolio doesn't have to.

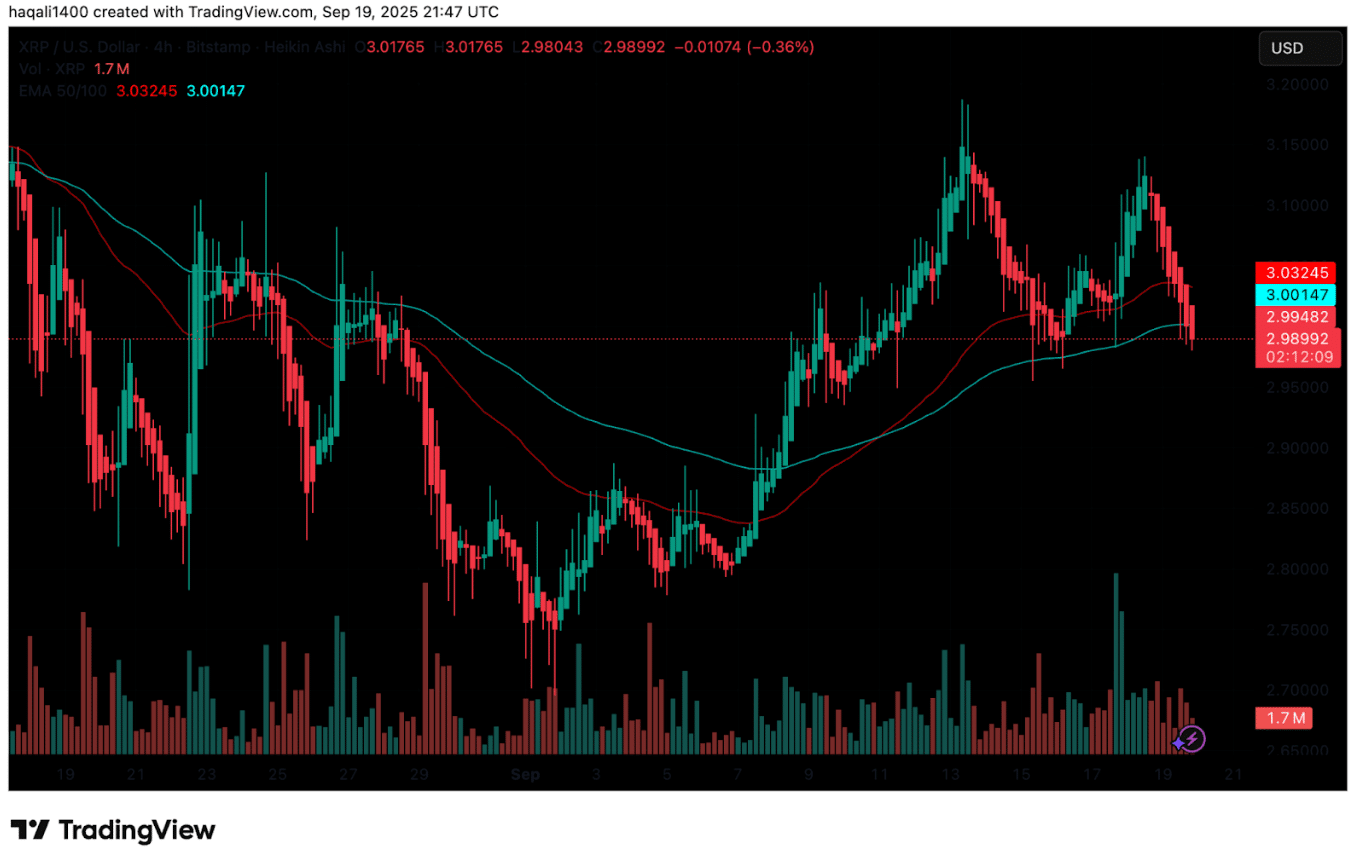

(Source: XRP USDT, TradingView)

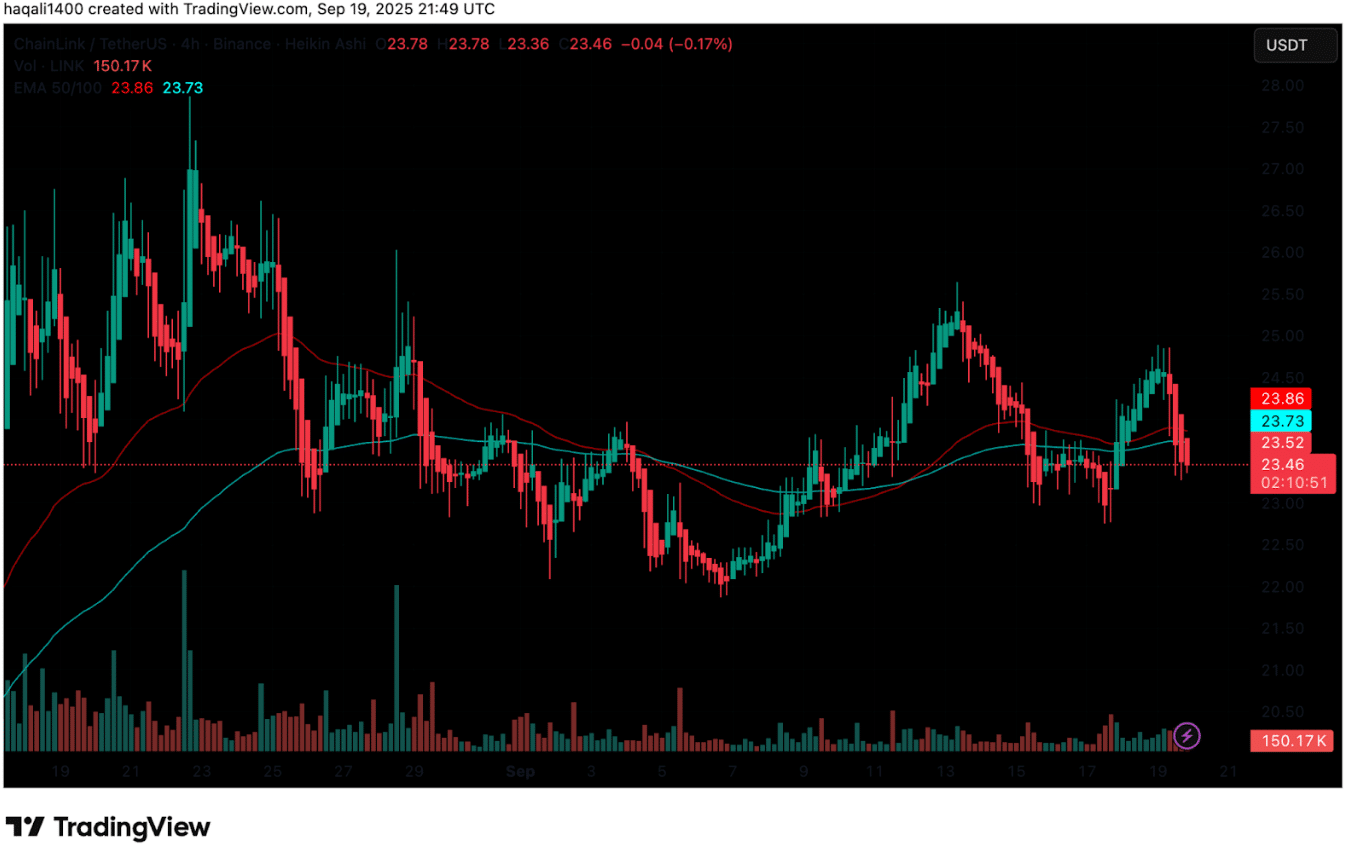

LINK, meanwhile, held at $23.5 on volumes around $1.1 billion, showing a decline of -4.5% in 24 hours.

(Source – LINK USDT, TradingView)

Derivatives trackers show LINK outperforming peers on open interest and funding stability, suggesting steady positioning despite a cooling market after the Fed’s rate cut week.

The two tokens now represent different bets for Q4. XRP traders are monitoring the survival of the institutional flows and tokenization transactions.

The strength of derivatives to LINK holders is a measure of resilience. The following months will determine which of the two will have the more stable hold.

Chainlink Price Prediction: Is LINK Setting Up for a Breakout in Q4 2025?

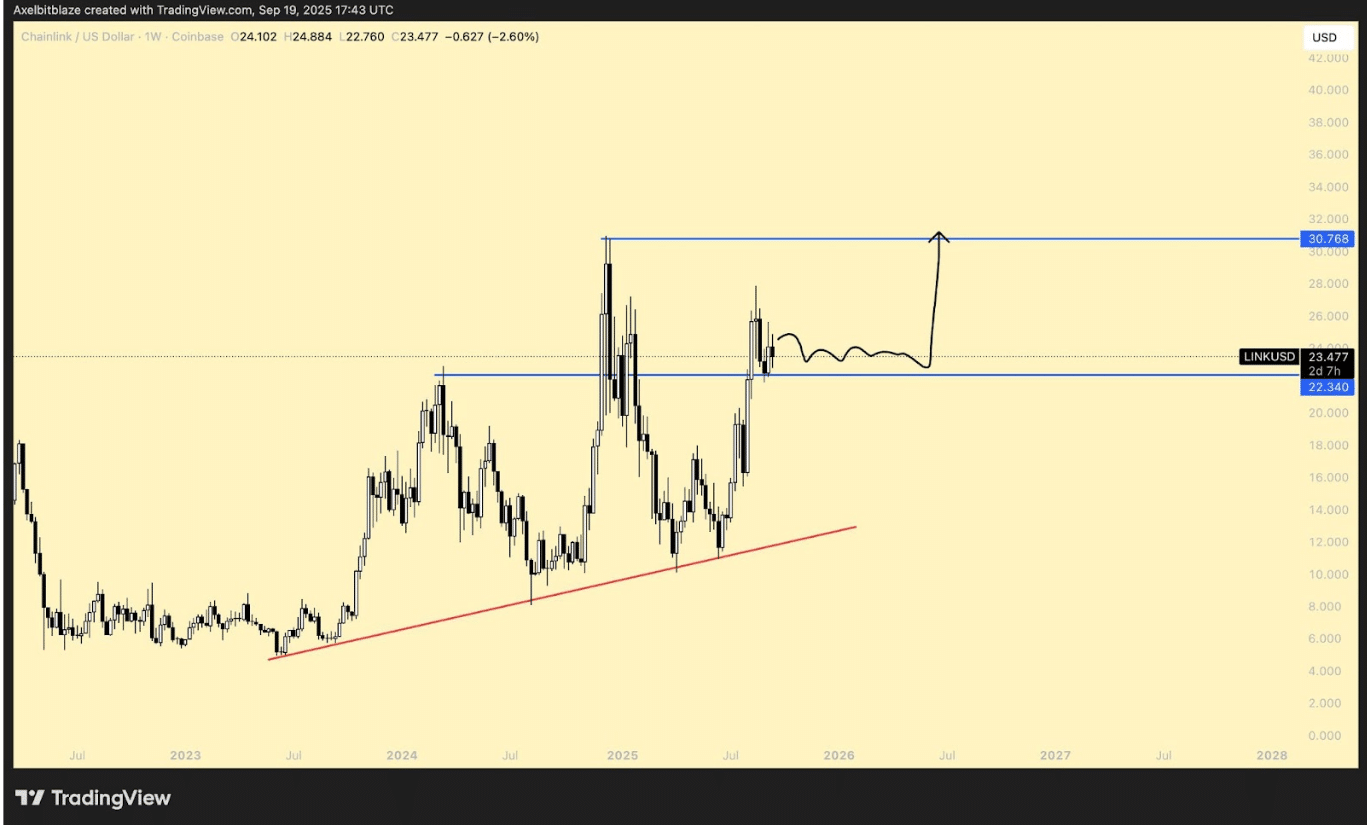

According to a crypto analyst, Chainlink (LINK) has overcome a significant obstacle and is approaching the $20 value again, which served as a resistance level that limited the token throughout the previous year.

21/

Now let's take a look at $LINK chart and see what it says.

LINK has fully reclaimed $20 level, which has been one the major resistance level.

This confirms LINK is an uptrend, and now only $30-$34 level is left to be reclaimed before a new ATH.

Once that happens, $LINK… pic.twitter.com/HDsAjysRT8

— Axel Bitblaze![]() (@Axel_bitblaze69) September 19, 2025

(@Axel_bitblaze69) September 19, 2025

The breakout supports an increase in the weekly chart and switches to the $30-$34 range, the next important area before LINK can seek new all-time highs.

(Source: X)

The charts indicate that the rise has been consistent since the middle of 2024, with an increasing trendline that goes back to the beginning of 2023.

The reversal of $20 into bullishness has strengthened the mood of bulls; whereas price movements around $23-$24 are an indication that LINK is taking a break before its next outbreak.

As observed by analysts, $30 has served as a ceiling in the previous cycles, and therefore, it is the final significant obstacle before price discovery. The form will be like an accumulation pattern where the highs and lows are NEAR a flat resistance band. This arrangement is usually followed by considerable upward swings, especially where there is a support trendline over the long run. This is projected to be a short trade of sideways between $22 and $26 to a potential push to $30.

If LINK secures a weekly close above $30, analysts believe momentum could accelerate into uncharted territory. For now, $22 is the level to watch as support. The coming weeks will reveal whether LINK is ready to shift from recovery into a full breakout phase.

XRP Price Prediction: Why XRP Appeals to Risk-Takers Ahead of Q4 2025?

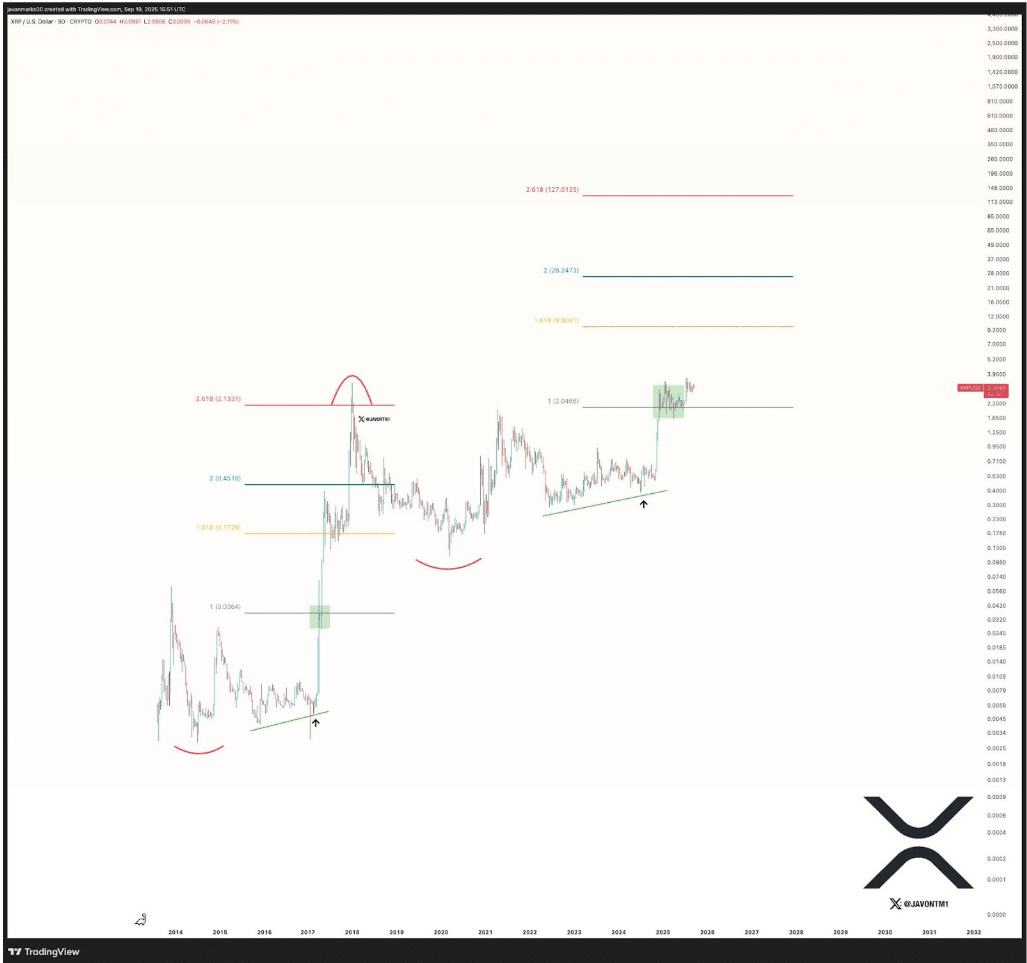

According to Javon Marks’s analysis, XRP may be gearing up for a major move. His chart points to a possible 226% rally that could lift the token to $9.90, with room for a further push toward $20 if momentum holds.

(Source: X)

The setup is clear on the weekly chart. XRP has broken out of a long accumulation phase, building higher lows since 2020.

A steady ascending support line underpins the trend, and each similar breakout in the past has led to triple-digit gains.

Fibonacci projections place $9.90 as the first key target, with higher levels stretching beyond $20.

Price action above $1.30 shows bulls back in control.

Consolidation at these levels could FORM the base for another strong advance, echoing past cycles where sideways phases gave way to parabolic runs.

Beyond technicals, XRP’s upside is also tied to broader catalysts, including exchange-traded fund approvals and tokenization partnerships. This adds fuel to the bullish scenario but also keeps the token event-driven and volatile.

In comparison, Chainlink (LINK) has already reclaimed $20 and is working toward $30-$34, levels that WOULD clear the way for new highs. LINK’s path looks steadier, backed by consistent adoption rather than sudden bursts.

For Q4 2025, the contrast is sharp: XRP appeals to traders seeking breakout gains, while LINK offers a stronger case as a stable long-term hold.