Analysts Predict Ethena Soaring to $1 and Chainlink Rocketing to $100: Is This the Next 100X Crypto Opportunity?

Market analysts are placing bold bets on two digital assets poised for explosive growth—Ethena targeting the $1 milestone while Chainlink eyes the $100 threshold.

The Price Targets Breakdown

Ethena's trajectory toward the dollar mark represents a significant psychological barrier for the emerging protocol, while Chainlink's projected climb to triple digits signals massive institutional confidence in oracle infrastructure. These aren't random predictions—they're based on growing adoption metrics and fundamental network activity that's catching Wall Street's attention.

The 100X Question

Could either of these assets deliver life-changing returns? The crypto space has always rewarded early believers in fundamental technology, though let's be honest—most traditional finance analysts still can't tell the difference between a blockchain and a spreadsheet. The real question isn't whether these targets are achievable, but which ecosystem developments will actually drive sustainable value beyond speculative hype.

Market momentum suggests we're witnessing more than just wishful thinking—we're seeing the maturation of real-world crypto utility finally getting priced in.

Could Crypto Ethena Hit $1 Soon and Achieve Next 100x?

Ethena crypto has quickly emerged as one of the hottest DeFi projects this year. Built on Ethereum, Ethena powers USDe, a censorship-resistant synthetic stablecoin designed to generate yield through delta-hedging strategies with staked ETH and derivatives.

USDe has been integrated into numerous small projects, up to partnering with Binance, where it has been embedded across the entire platform of 280M+ users and $190Bn+ in assets. Since the GENIUS Act, USDe has been leading the charge in stablecoin growth with $6.4Bn.

Ethena’s USDe leads stablecoin growth post-GENIUS Act with over $6.4 billion, surpassing USDT and USDC. pic.twitter.com/E98wiwpUFZ

— Coinvo (@ByCoinvo) September 16, 2025

But this isn’t the only news around Ethena. One of the most anticipated moves is the fee switch, which the team has now turned on. The Ethena Foundation confirmed that the Risk Committee’s parameter has been met, triggering the fee switch activation.

This news dropped couple days ago but no further information has been detailed about the implementation. Once the decision is take, a vote will be casted and ENA holders should be asked to confirm the proposed framework.

Some account on the social network already are trying to show how much the holders will receive according to previous data.

The Ethena Foundation can confirm that the fee switch parameters set by the Risk Committee have now been met and the ENA fee switch is expected to be activated following Ethena Risk Committee sign off on the implementation details and further governance process

The Ethena Risk…

— Ethena Foundation (@EthenaFndtn) September 15, 2025

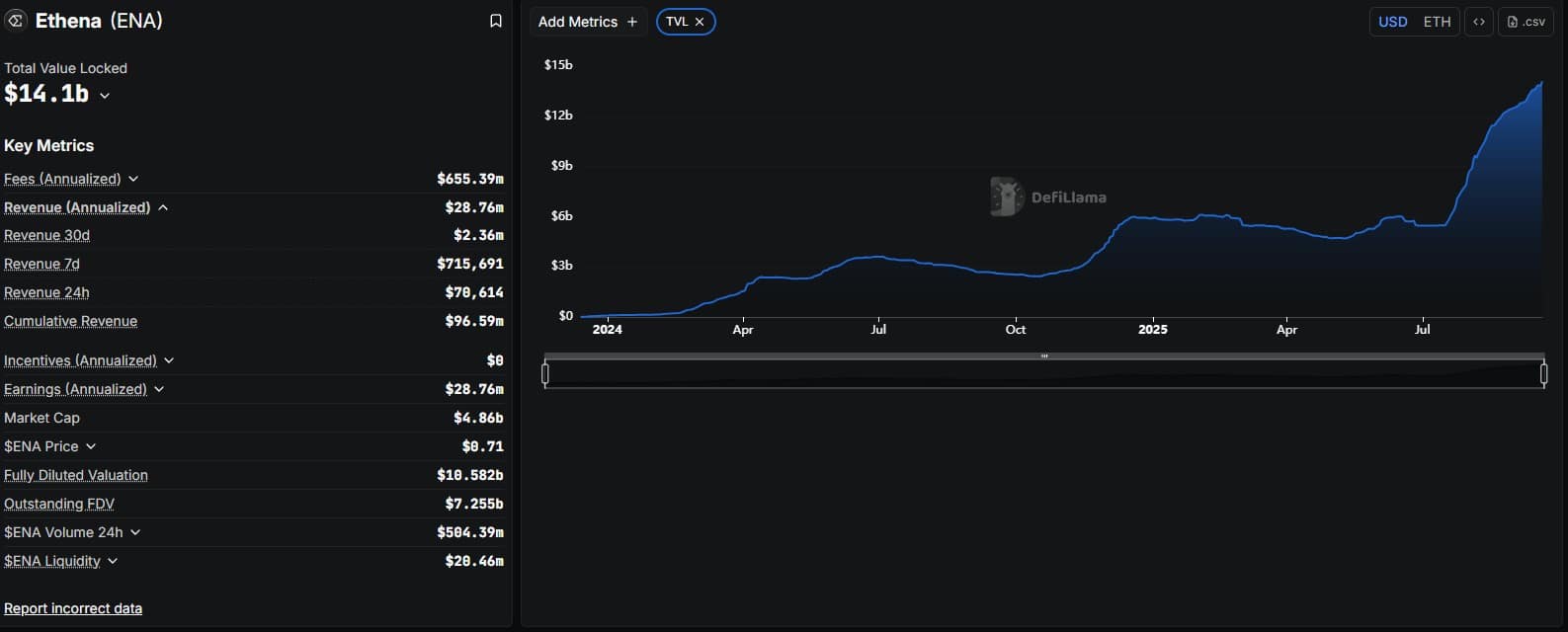

So far the Ethena has been very successful, according to defillama the project has $14.1Bn TVL, with annualized fees of over $655M. The cumulative revenue of the project is staggering $96.5M.

Unfortunately if we are searching for next 100x crypto ENA would be not a suitable competitor because of her $4.8Bn market capitalization, which by no means make it a bad project, quite the opposite.

Ethena has been one of the most popular choices across the crypto space. With constantly growing TVL and amazing earnings, ENA is poised to hit the $1 mark.

Price wise Ethena is making huge W patter which can lead even further up to next huge resistance of $1.3 on a weekly time-frame. On daily, ENA is consolidating right now on the $0.61 level which play as strong support for the price. Another key indicator RSI is resetting while the price consolidate in this tight range.

If we continue with the bullish market sentiment and good news from Ethena project we can see W pattern finished and possibly battling for new ATH.

Is LINK Targeting $100 Amid Supply Crunch?

Chainlink remains the backbone of DeFi, connecting real-world data like prices and weather to blockchain apllications. Its secure oracles power everything from decentralized finance to real-world asset (RWA) tokenization, a narrative now worth tens of billions.

Recent reserve update shows that Chainlink has accumulated 43K LINK amassing more than 323K LINK that should support the long-term growth and sustainability of the network.

RESERVE UPDATE

Today, the Chainlink Reserve has accumulated 43,067.70 LINK.

As of September 18th, the Chainlink Reserve holds a total of 323,116.40 LINK.https://t.co/oxMv5N3rFC

The Chainlink Reserve is designed to support the long-term growth and sustainability of the… pic.twitter.com/1TNJNMudBG

— Chainlink (@chainlink) September 18, 2025

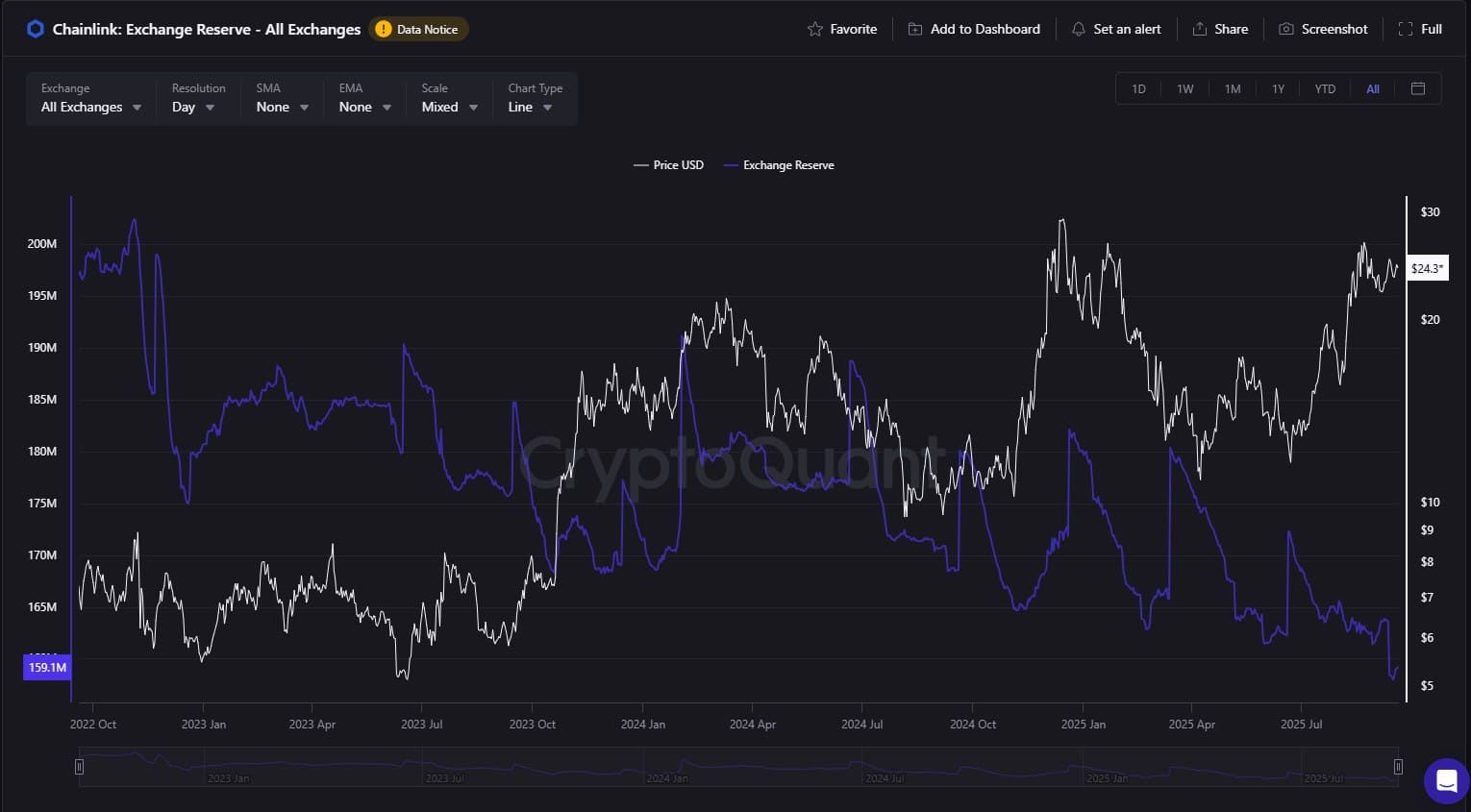

Right now LINK price is at $24.3 with 91% increase for the last three months and despite the huge market capitalization of the project $16.5Bn almost everybody is bullish. That is because an reliable oracle is is important for the functionality not only of the DeFI sector but also for the whole market.

As of today we can see that the LINK supply on exchanges has dropped to a multi-year low which hint us that institutions are adopting the network.

On the daily time-frame we can see that Link is trying to make a bullish pennant supported by the price constantly making higher highs. On top of that a consolidation of the price in tight triangle pattern also is giving us a hint that something is brewing on the bigger picture.

On a weekly time-frame we can see that the price is make wider and wider ranges swinging like a sling-shot. After Bitcoin finish his bullrun and most of the money start pouring to bigger caps like LINK this could mean new ATH.

Some suggest that $100 is an achievable target given the project’s importance to the crypto space. And if that happens it WOULD take tremendous time or maybe not, after all this is crypto. But lets leave the speculations for another time and focus on the charts.