COTI Mainnet Upgrade Launches Tomorrow: Will This Be the Catalyst for a $0.1 Price Surge?

Crypto's sleeping giant just set its alarm. COTI's mainnet upgrade goes live tomorrow—and the entire ecosystem is holding its breath.

The Technical Overhaul

This isn't just another routine update. The upgrade promises enhanced scalability, reduced transaction costs, and improved network stability—exactly what institutional players demand before jumping in.

Market Mechanics at Play

Traders are positioning for volatility. The $0.1 psychological barrier represents a 150% surge from current levels—a move that would require serious volume and fresh capital. Historical patterns show COTI tends to rally on major network milestones, but past performance never guarantees future results (as the lawyers love to remind us).

The Cynic's Corner

Let's be real—mainnet upgrades have become crypto's version of corporate earnings calls: everyone hopes for a pop, but sometimes you get the dreaded 'sell the news' reaction. If this fails to move the needle, even the most ardent supporters might start questioning the thesis.

Bottom line: Tomorrow isn't just about technology—it's about market psychology meeting network fundamentals. Watch the volume, watch the order books, and maybe keep one finger near the sell button just in case.

COTI Price Prediction: Can the Falling Wedge Pattern Spark a Breakout for COTI?

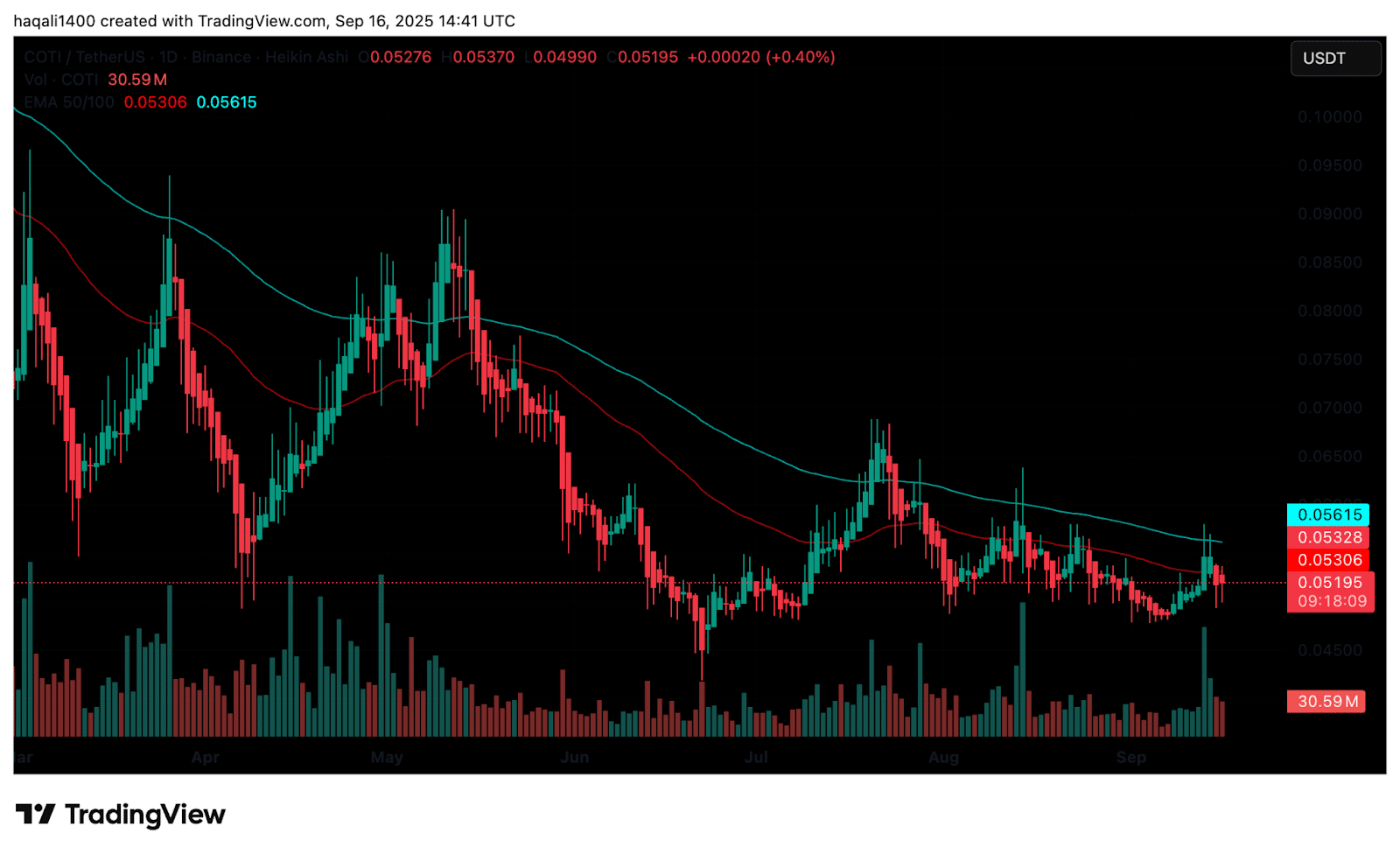

On the market side, COTI is trading at around $0.053 at press time, up roughly +5% on the day, with a market capitalization of $125.5M and 24-hour trading volume of about $13.1M.

(Source – COTI USDT. TradingView)

Price action shows an intraday range between $0.0496 and $0.0534.

Technical indicators paint a mixed picture. COTI trades below its 30-day simple moving average (around $0.052) and its 200-day SMA (around $0.062).

The relative strength index remains neutral. Analysts point to these levels as the next hurdles if momentum builds following the upgrade.

The upgrade is expected to set the stage for the October fork, so traders are watching closely to see if renewed confidence can help the token push back toward the $0.10 mark.

The COTI community is paying close attention to technical setups.

Analyst Javon Marks highlighted this week that the token is “working on a breakout of a smaller falling wedge,” a formation that often signals an upward move.

(Source – X)

For months, COTI has been consolidating inside a narrowing downward channel of lower highs and lower lows. The current wedge is developing within a broader recovery pattern that began after the steep drop from 2021 highs.

This layered structure suggests the token may build strength for a larger reversal once resistance is cleared.

The smaller wedge mirrors a larger wedge breakout earlier in the cycle, leading to a strong rally. If this setup breaks upward, analysts say it could trigger another sharp follow-through.

Projections based on past moves outline a potential surge of more than 800%, with price targets around the $0.50 mark. Such a breakout WOULD mark one of the strongest recoveries for COTI since its previous cycle peaks.

For now, traders are waiting to see if COTI can secure a clean breakout from the wedge. Strong trading volume and a decisive daily or weekly close above resistance would likely confirm the move. The longer-term projection points to the chance of a sharp recovery, but that depends on key support levels holding firm.

If the breakout holds, COTI could shift out of its long consolidation and into a new uptrend, with $0.50 becoming the next major target. If not, the token may stay stuck in its current corrective range, leaving the rally on pause.