BTC/USD Braces for Fed Impact: What Retail Sales MoM Data Reveals for FOMC Decision

Bitcoin holds its breath as Federal Reserve meeting looms—retail sales data just dropped the ultimate teaser.

The Monthly Numbers Game

Retail sales figures aren't just consumer metrics—they're Fed fuel. Strong numbers? Hawkish whispers intensify. Weak data? Dovish hopes get a bump. Bitcoin traders watch this dance like hawks, knowing traditional finance's mood swings ripple straight into crypto volatility.

FOMC's Crypto Conundrum

Rate decisions don't just move bonds anymore—they shake digital asset foundations. Bitcoin's correlation with risk assets means every Fed hint gets magnified through crypto's leverage-laden lens. Forget 'macroeconomic indicators'—traders just want to know if Powell's pouring champagne or vinegar.

The Cynical Take

Because nothing says 'stable monetary policy' like watching billion-dollar algorithms overreact to consumer spending data from shopping malls—truly the pinnacle of financial sophistication.

Currently, BTC is just above $115,000, heading into one of the most important macro weeks of the year.

With the Federal Reserve’s policy meeting set for September 17, let’s talk about the odds that BTC USD breaks new ATHs or crashes below $100,000

BTC USD Range-Bound Ahead of Fed Decision: Are Fed Rate Cuts Enough For $150,000?

As of press time, bitcoin traded at $115,046, slipping 0.2% in the past 24 hours. 99Bitcoins TA reveals that BTC must decisively clear $116,000 to confirm momentum toward the $120,000–$125,000 range. Failure to break out leaves the door open for a retest of $107,500 support.

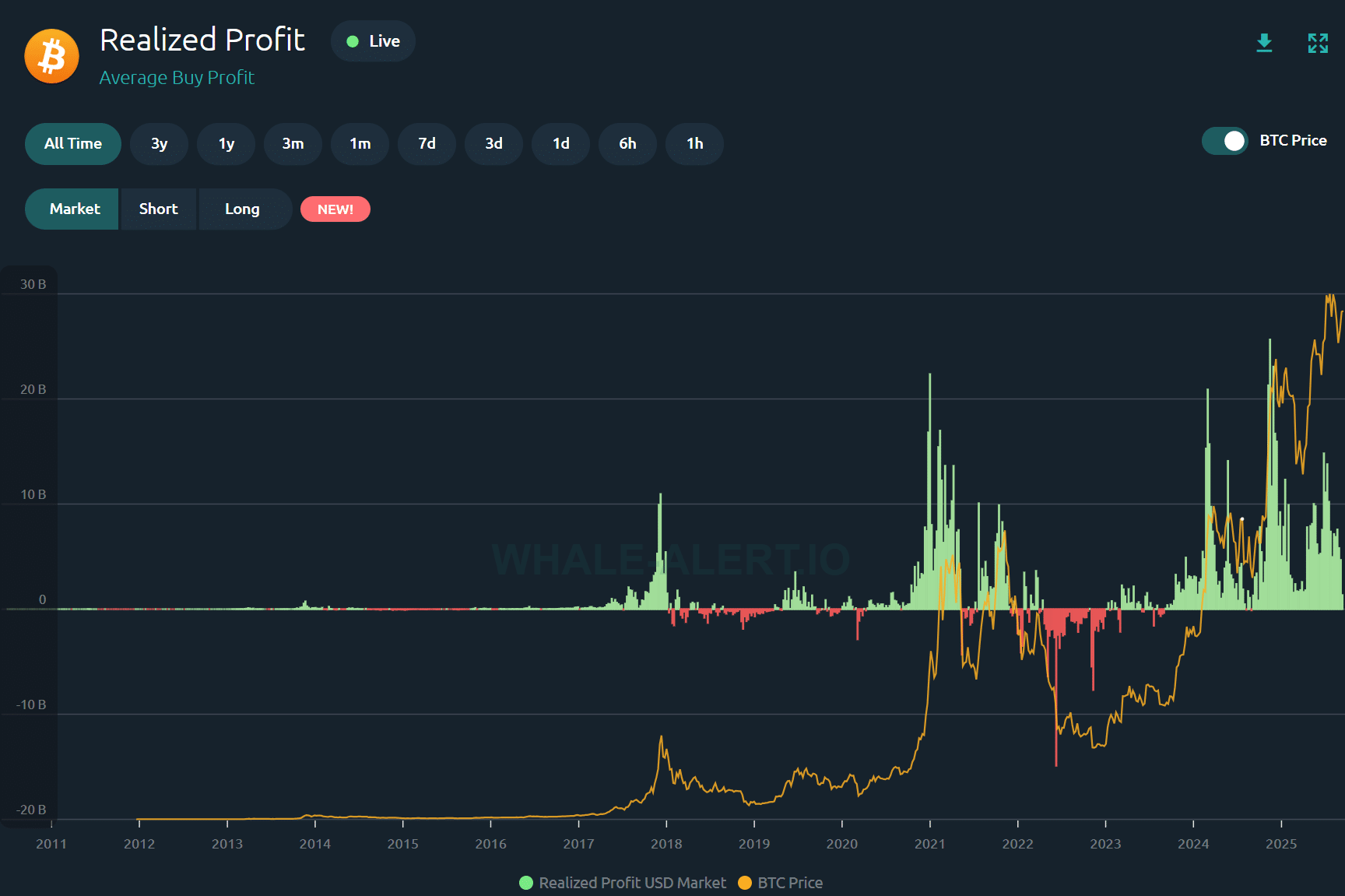

On-chain data showed short-term holders realizing $189 million in daily profits last week, a factor that adds near-term selling pressure.

“Bitcoin now sits at the center of macroeconomic tension, which could drive it in either direction depending on Fed policy direction,” said MEXC chief analyst Shawn Young.

According to the CME FedWatch tool, markets are pricing in a 96% chance of a 25-basis-point rate cut. Moreover, if Jerome Powell delivers a dovish Fed tone, it could send Bitcoin surging past $120,000 as capital rotates out of bonds and into risk assets.

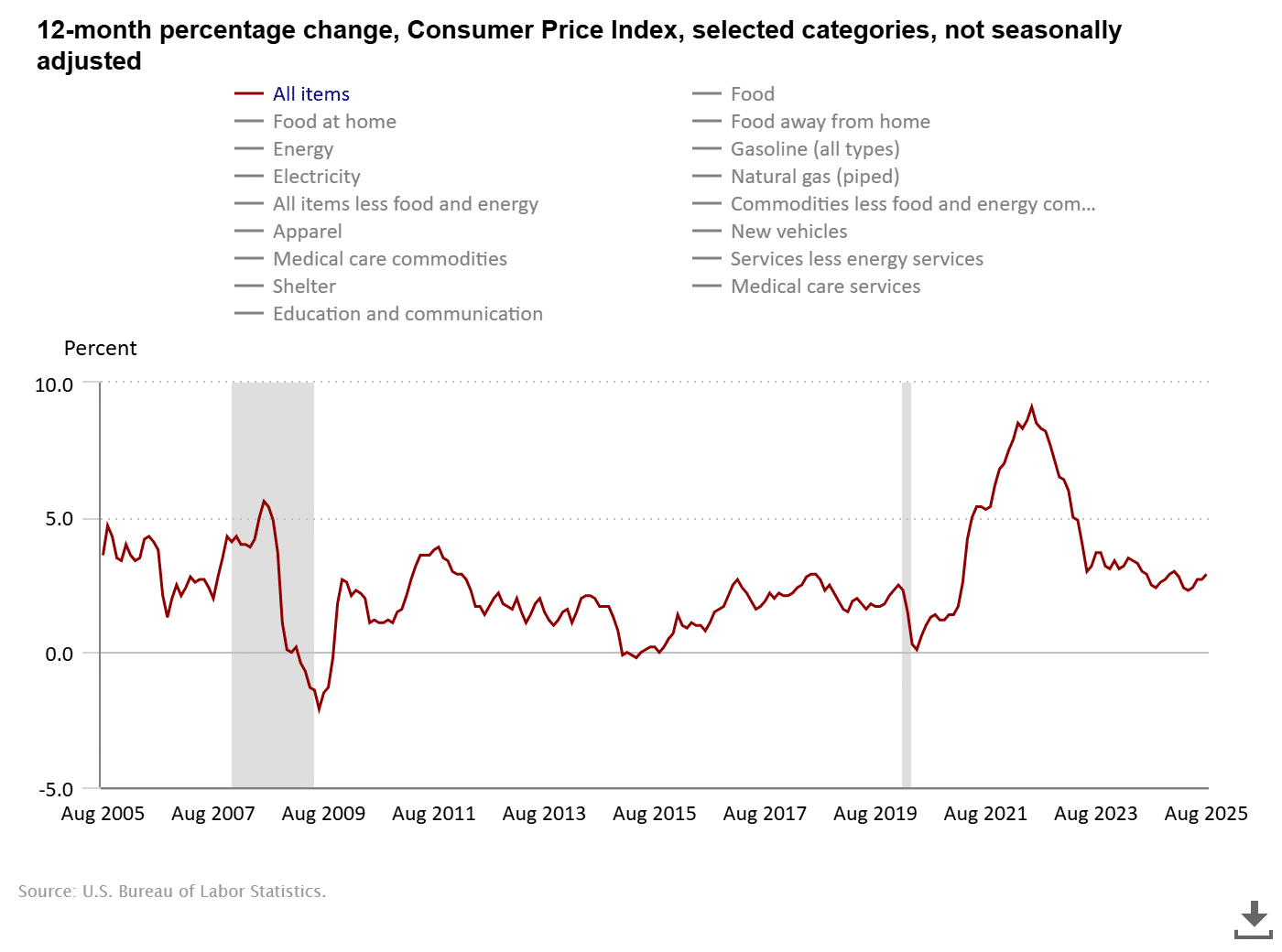

Regardless, it’s a Catch-22 for the Fed, as they’re staring down weaker labor data that supports cuts, but sticky inflation NEAR 3% complicates the Fed’s path forward.

Bitcoin has been stuck in a wide “air gap” trading range between $108,000 and $116,000 since August.

Clearing resistance at $116K could open the way for a stronger recovery for it and other top cryptocurrencies, while repeated rejections risk dragging BTC toward $105K.

A Divided Fed, A Divided Market: Here’s What Powell Needs to Say at FOMC

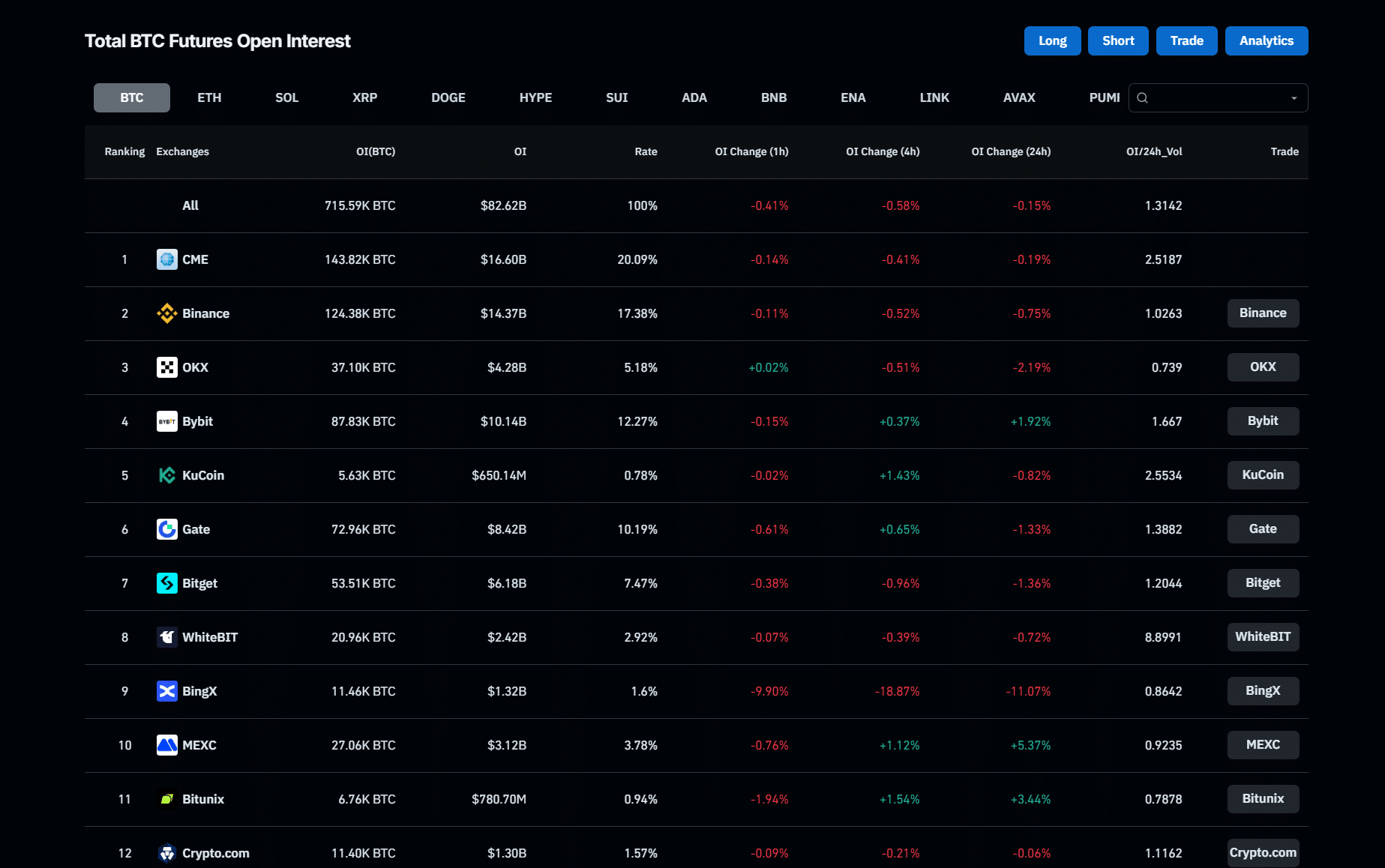

ETF flows and treasury demand suggest institutions are preparing for a bullish resolution from the Fed. Spot Bitcoin ETFs logged $2.3 billion in inflows last week, the highest in months, signaling aggressive positioning ahead of the Fed meeting.

Additionally, CoinGlass data shows that Bitcoin open interest is held by a firm.

One more metric of interest: According to the latest Census Bureau data, US retail sales ROSE +0.5% in July, in line with forecasts. June’s figure was revised higher to +0.9%. The report, which tracks changes in retail spending excluding food services, is closely watched as a barometer of consumer demand and overall economic strength.

For Bitcoin, we need to see a dovish Fed ,and continued ETF inflows could set up a breakout toward $125K and beyond. But if Powell is too cautious in his rhetoric, we may see BTC trapped between $107K and $115K, waiting for the next catalyst.

Key Takeaways

- Everyone is expecting BTC USD to pump after the rate cuts. You know what that means. This is the start of seeing if $200k is on the table.

- For Bitcoin, we need to see a dovish Fed and continued ETF inflows could set up a breakout toward $125K and beyond.