Chinese Capital Floods In as Bitcoin Price Smashes Through $114K Barrier

Chinese investors are diving headfirst into Bitcoin as prices break all previous records—hitting a staggering $114,000.

The Great Wall of Capital

Massive inflows from mainland China are fueling this historic rally. Investors—tired of traditional market volatility and regulatory hurdles—see Bitcoin as the ultimate hedge. And who can blame them? While the Shanghai Composite wobbles, crypto just keeps climbing.

Global Ripples

This isn't just a local phenomenon. The surge is sending shockwaves through international markets. Hong Kong exchanges report record volumes, while Western funds scramble to keep up. Even the most skeptical traders are now paying attention.

Regulatory Whispers

Beijing hasn't officially blessed this frenzy—but they haven't stopped it either. Some see this as tacit approval; others call it strategic ambiguity. Either way, money talks louder than policy drafts.

Future Forecast

Analysts predict this is just the beginning. With institutional adoption accelerating and retail piling in, $150k looks increasingly likely. Of course, traditional finance pundits will call it a bubble—right up until their hedge funds start buying the dip.

Bitcoin Price Analysis: How is Bitcoin Trading Post Purchase?

Bitcoin is holding NEAR $114,400, with intraday moves between $113,200 and $114,700. The broader market remains upbeat as traders bet on US rate cuts after inflation data met expectations.

The timing of Pop Culture Group’s entry coincides with what analysts see as a key technical setup for Bitcoin.

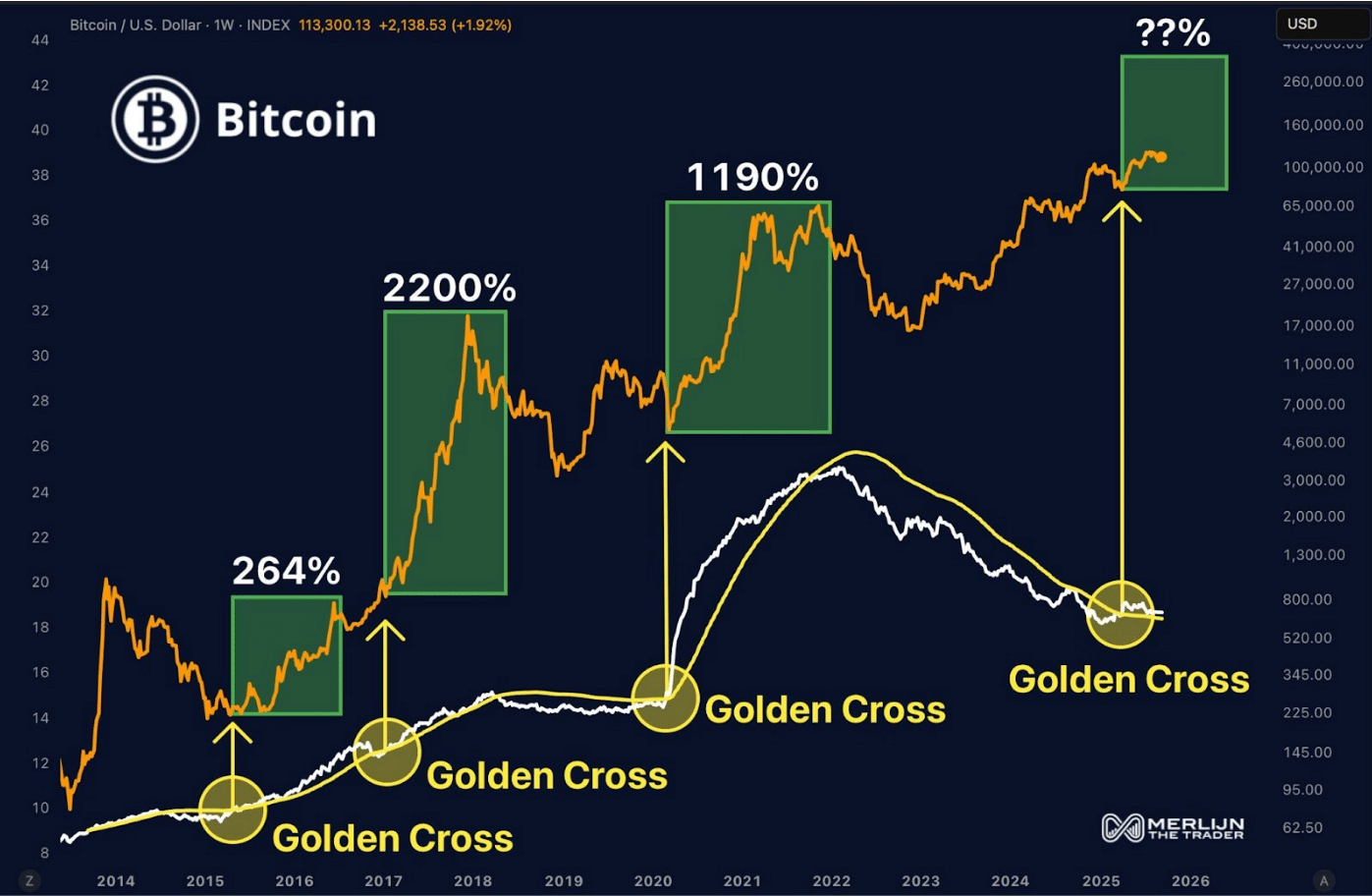

Merlijn, a crypto analyst, shared the chart on X, which shows bitcoin has formed another “golden cross” when the 50-week moving average rises above the 200-week moving average.

Bitcoin Stages Recovery | ETH Blasts $4.4K | Altcoins on Fire!

Watch here:![]() https://t.co/bCksAuGhg0 pic.twitter.com/S16RPAtZG0

https://t.co/bCksAuGhg0 pic.twitter.com/S16RPAtZG0

— Merlijn The Trader (@MerlijnTrader) September 11, 2025

This crossover is widely viewed as a bullish signal.

In past cycles, golden crosses have preceded strong rallies. Bitcoin increased 264% in 2015, 2,200% in 2016, and 1,190% in 2020 with the cross, signal, and record highs, respectively.

(Source – X)

Bitcoin is trading today between $113,000 and $114,000 in a consolidation band. The trend is similar to previous stages, in which the asset established a bottom and then significant upward movements.

Analysts observe that the long-term trend is characterized by higher highs and higher lows.

Golden crosses do not predict future results, but history indicates that they tend to coincide with the beginning of the multi-year growth cycles.

The question that the traders are contemplating now is whether this latest signal will lead to another giant rally or whether it will hang in the middle of the resistance.

Bitcoin is still steering the market, even as ETH clears $4,400 and altcoins heat up.

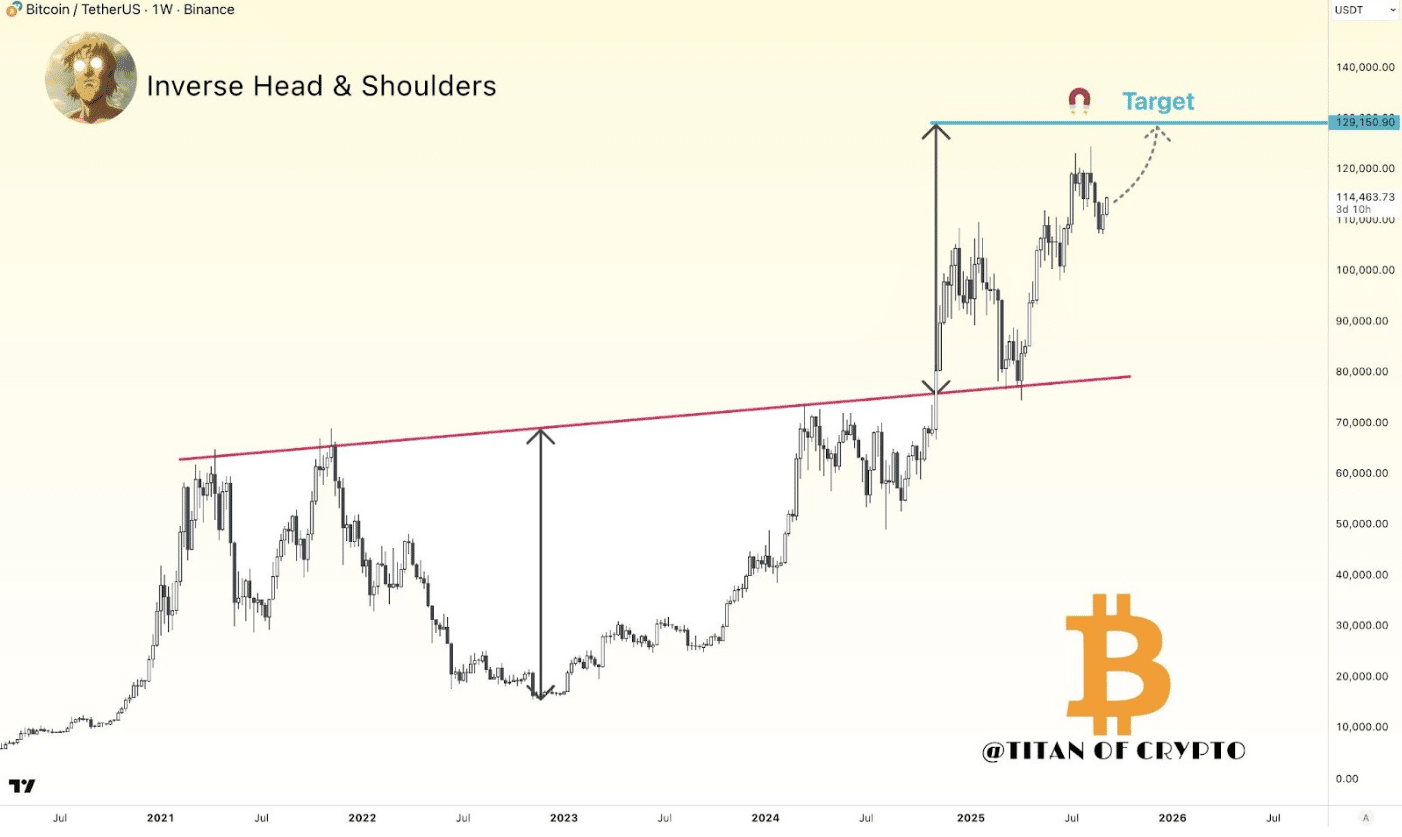

Chart analyst Titan of Crypto keeps a long-term Bitcoin target of $129,000. The view rests on an inverse head-and-shoulders pattern that has held up through recent swings.

(Source – X)

On the weekly chart, price broke decisively above the neckline, drawn against the 2021–2022 peaks.

That breakout completes the pattern and points to a measured MOVE toward $129K. Bitcoin is trading around $114,463 after a strong run earlier this year.

The retest near $80K acted as a clean support check before the move higher. As long as price holds above the $110K area, the bullish case stays intact. Lose that zone, and momentum could fade.

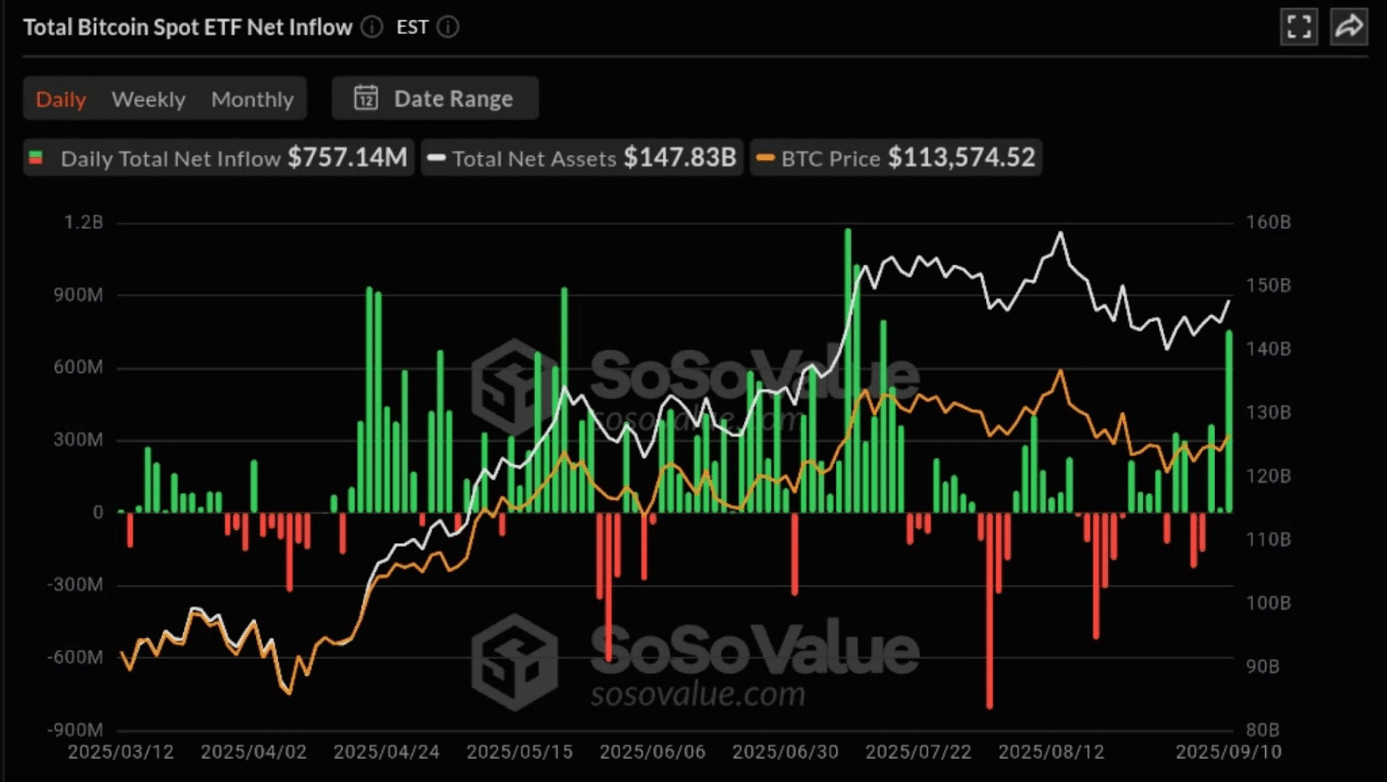

According to SoSoValue data, net inflows hit $757.14M as of today, the strongest in two months.

The green bars shoot back into the positive area following a rough period, yet a WHITE line indicates a price that escalates over $113,500.

(Source: Total Bitcoin ETF Net Inflow, SoSo Value)

(Source: Total Bitcoin ETF Net Inflow, SoSo Value)

Previously witnessed outflows in July and August had been a drag on sentiment. However, new institutional buying is restoring confidence. That is important since consistent ETF bids tend to cushion the pullbacks and can push the price upward.

If $110K holds and inflows persist, $129K remains a realistic target. If not, expect a slower grind and deeper tests of support

How Are Chinese Firms Finding Ways Into Crypto Despite Restrictions?

Markets are leaning toward a September rate cut after US inflation data matched forecasts, giving risk assets a boost.

Bitcoin briefly crossed $114,000 as traders priced in a 25 basis point move from the Federal Reserve. CPI numbers remain central to the short-term range.

There are still restrictions on trading in the mainland, yet the companies related to China still trade via overseas listing and allotment of treasury shares.

The recent Bitcoin acquisition by Pop Culture Group reflects a bigger trend of Asian companies experimenting with Web3 strategies in spite of stated restrictions.

Spot ETF flows are driving much of the price action, and inflows hit multi-week highs this week, aligning with Bitcoin’s push back toward resistance at $115K.

Trading volumes over the last 24 hours remain strong, showing more influence from macro flows than retail churn.

Analysts see $115K as the key hurdle. A clear break and hold could draw in momentum traders chasing higher levels. Failure to push through may trap BTC between $104K and $114K.