HYPE Crypto Shatters ATH Records: Primed to Outpace SOL in Q4 Dominance?

HYPE just detonated crypto's echo chamber—smashing through all-time highs with the kind of velocity that leaves SOL bulls sweating.

Q4 Showdown: The Underdog Flex

No fluff, no hopium—just raw performance metrics. While SOL grinds through upgrade delays, HYPE’s architecture cuts transaction costs by half and bypasses legacy congestion. Retail piles in; institutions lurk. The chart doesn’t lie—it screams momentum.

Finance’s open secret? Most traders would chase a meme coin if it green-candled hard enough—but HYPE’s tech stack actually justifies the frenzy. For now.

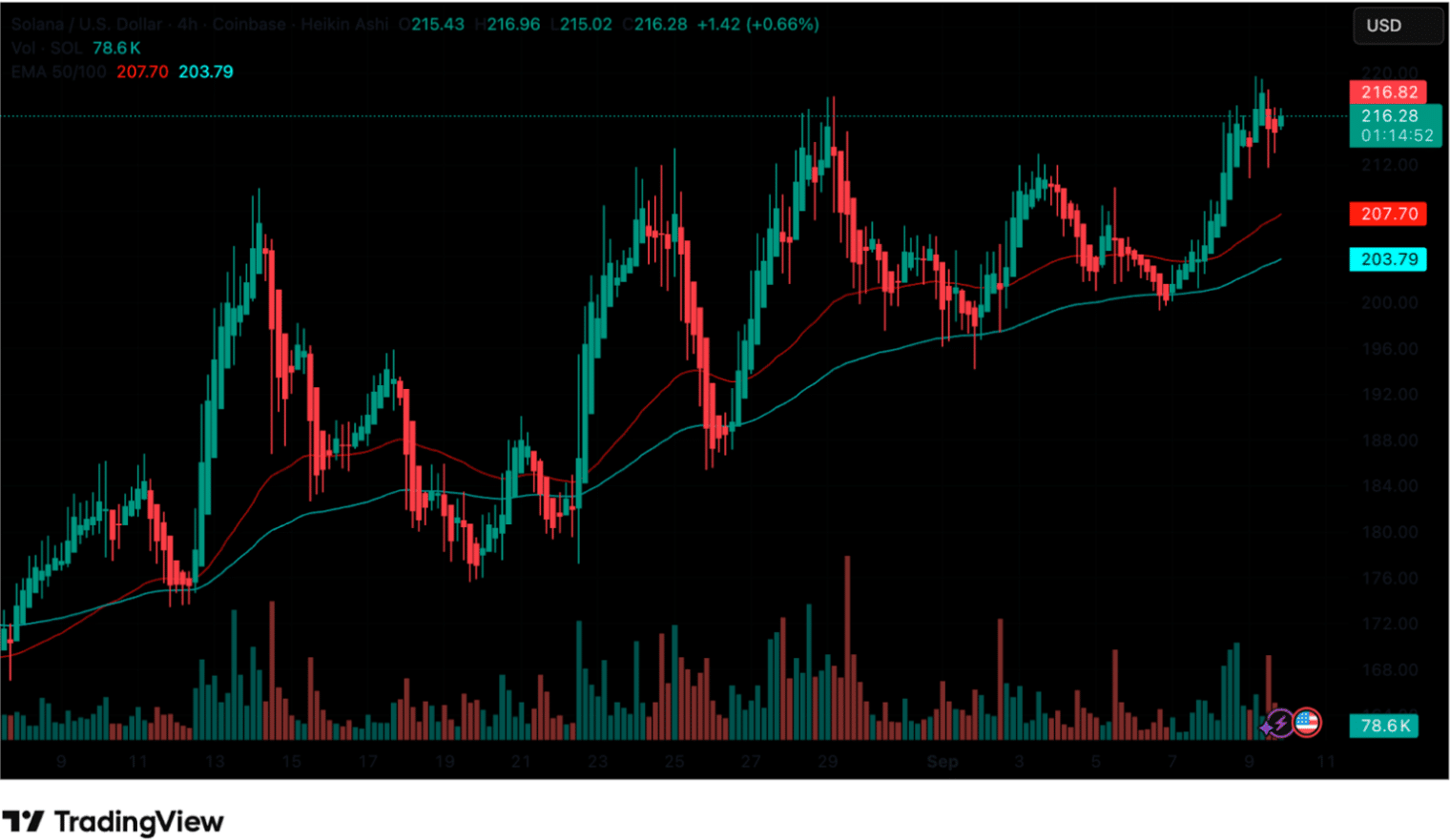

(Source – SOL USDT, TradingView)

HYPE Price Analysis: Is HYPE’s Current Uptrend a Signal for More Gains in Q4?

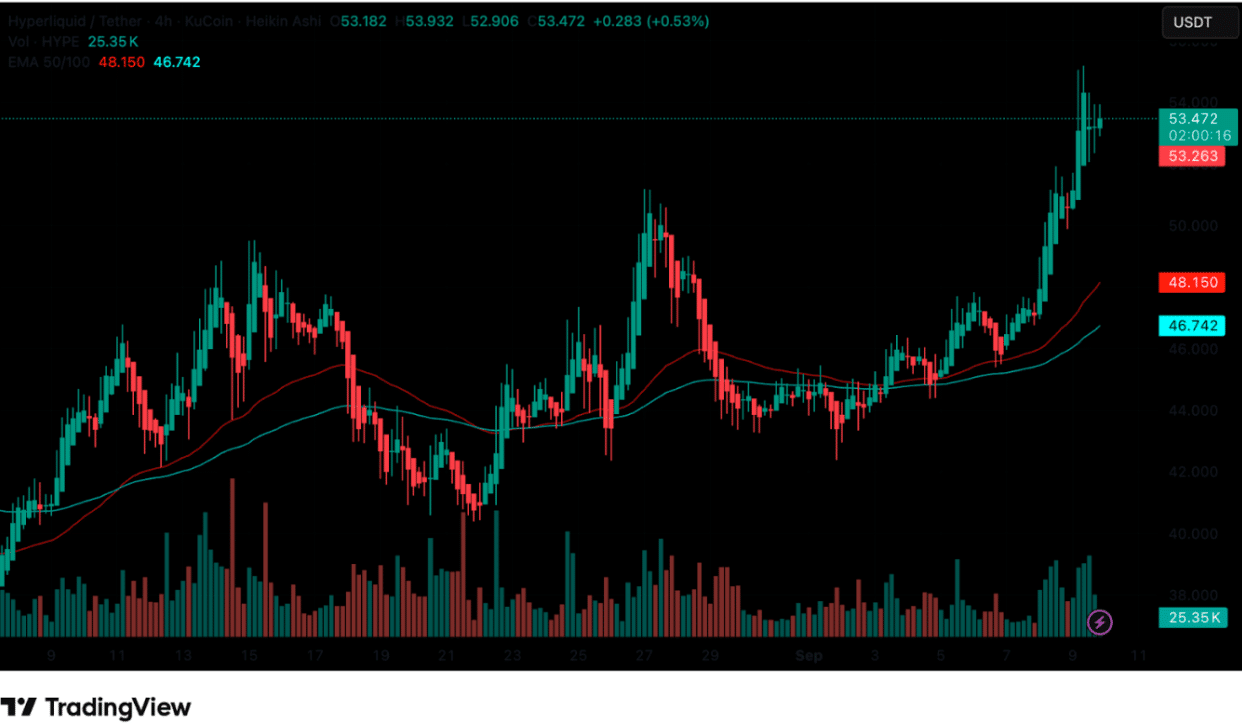

HYPE’s 4-hour chart shows strong upward momentum.

After weeks of consolidation between $44 and $47, the token broke out in early September, pushing decisively above both the 50-day EMA at $48.15 and the 100-day EMA at $46.74.

The crossover triggered a wave of buying, sending the price past $53 and marking its sharpest rally in recent weeks.

(Source – HYPE USDT, TradingView)

The MOVE was confirmed by rising trading volumes and successive green candles, signaling strong buyer conviction.

Resistance emerged NEAR $54, leading to a small pullback toward $53, but selling pressure has remained limited.

With the shorter EMA trending above the longer line, the bullish structure remains intact.

The breakout has also flipped the $44-$47 zone from resistance into a support base. If current momentum holds, the next upside target sits between $55 and $57.

On the downside, first support is near $50, followed by the EMA cluster around $47-$48. For now, market signals point to continued bullish control as long as volume stays high.

Currently, the HYPE price is trading at $53.4, showing an increase of +5.6% in the last 24 hours.

Can Hyperliquid’s Bidding War and Institutional Backing Push HYPE Even Higher?

Nasdaq-listed Lion Group announced it will begin converting its SOL and sui holdings into HYPE, the native token of Hyperliquid.

The announcement comes as competition intensifies over control of the platform’s proposed USDH stablecoin, a key piece in its DeFi infrastructure.

Ethena Labs has become the sixth bidder to oversee Hyperliquid’s USDH, submitting its proposal in a detailed Tuesday blog post.

The stablecoin WOULD be fully backed by USDtb, a token tied to BlackRock’s BUIDL fund and set to be issued through Anchorage Digital Bank.

Ethena’s pitch includes routing 95% of reserve revenue back to the Hyperliquid community. It also calls for a validator “guardian network” to be elected by users, an added LAYER of security designed to strengthen protocol trust.

As the bidding war unfolds, BitGo has added institutional custody support for both HYPE and HyperEVM. This adds credibility and could ease access for larger investors, especially those concerned about custody risks in DeFi.

According to DefilLlama data, Hyperliquid posted $106M in revenue during August, driven by nearly $400Bn in perpetual futures volume.

Estimates suggest the exchange now commands about 70% of the DeFi perps market numbers that reflect solid fundamentals and growing user confidence.

VanEck CEO Jan van Eck has publicly praised Hyperliquid’s product design and governance structure on X.

Dear Hyperliquid community,

We are impressed by your product, the technology, the decentralized governance, and the method of your rollout.

And we think we can be part of a trusted, compliant solution.

We provide research to the community, for free, in an effort to be…

— Jan van Eck (@JanvanEck3) September 8, 2025

His comments came just as HYPE touched new price highs, a moment that many took as validation from traditional finance circles.

On September 9, crypto trader James Wynn opened a 10x Leveraged long position on HYPE using referral rewards. According to Lookonchain data, he’s earned over $117,000 in referral bonuses to date.

https://TWITTER.com/lookonchain/status/1965444540640428374

But his latest trade didn’t go well, and the position was liquidated within 24 hours, just like several of his previous HYPE trades. Traders have taken note, with some joking that trading against Wynn has become a viable strategy.