India Joins OECD: Will Begin Sharing Crypto Transaction Data By 2027 - Here’s What It Means For Your Portfolio

India just flipped the transparency switch on crypto—joining the OECD's global data-sharing framework by 2027.

The Regulatory Hammer Drops

New Delhi's move plugs the world's second-largest internet population into a massive financial intelligence network. No more hiding behind pseudonymous wallets—every major transaction now faces cross-border scrutiny.

Tax authorities worldwide get a direct feed into Indian crypto flows. Think they won't chase every rupee? Think again.

Market Impact: Bullish or Bearish?

Short-term pain for privacy maximalists—long-term gain for institutional adoption. Regulatory clarity typically fuels mainstream entry, not exit.

Exchanges face compliance headaches, but legitimized markets attract capital. Always follow the money—even when it's being watched.

Global Domino Effect

India's participation pressures other holdouts to fall in line. The OECD framework now covers over 100 jurisdictions—creating a de facto global standard.

Chainalysis and other analytics firms just hit the jackpot. Compliance departments everywhere are ordering champagne—and passing the cost to traders.

The Bottom Line

Increased transparency kills illicit flows but validates the entire asset class. Governments want their cut—and they're building the infrastructure to take it.

Another step toward crypto's inevitable institutionalization. The anarchists weep while VCs cash checks—some things never change in finance.

From April 2027, all Indian Crypto holders, domestic & abroad, will come under OECD’s CARF framework.

A global tax pact (MCAA) will be signed in 2026.

Huge step for Crypto transparency & accountability.

Source:… pic.twitter.com/Hy0wiXZCVG

— Sapna Singh (@earnwithsapna) September 2, 2025

India, US Lead Cryptocurrency Adoption – Chainalysis Report

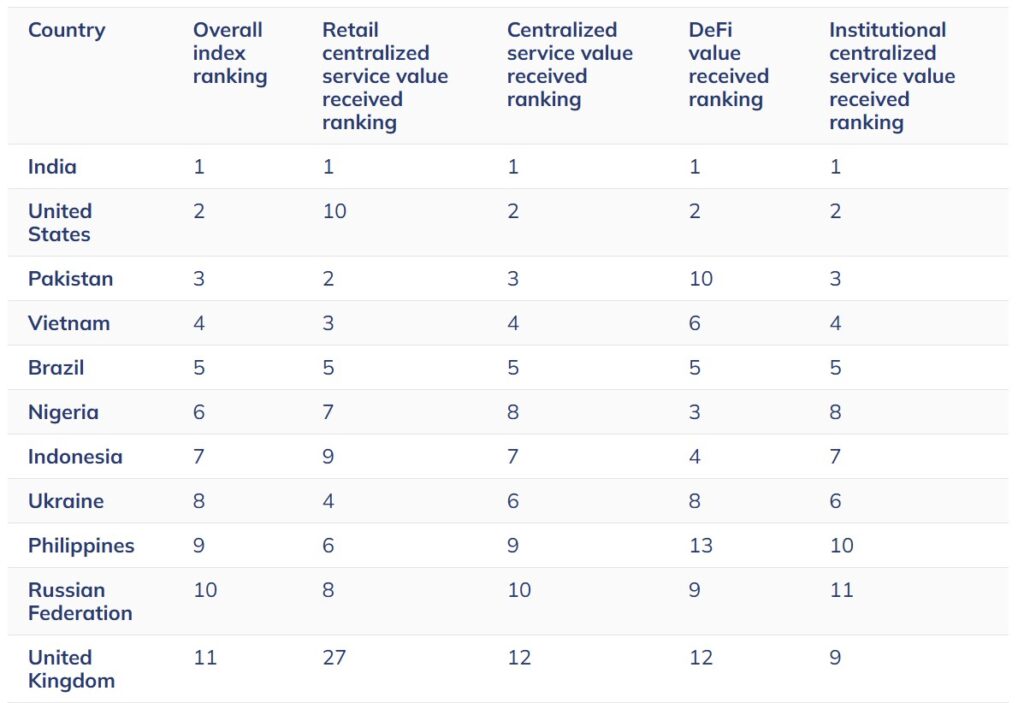

According to Chainalysis’ recent study published on 2 September 2025, India stood first and the US stood second in crypto adoption across the world.

“In 2025, APAC furthered its status as the global hub of grassroots crypto activity, led by India, Pakistan, and Vietnam, whose populations drove widespread adoption across both centralized and decentralized services,” the report stated. According to the study, total crypto transaction volume in APAC grew from $1.4 trillion to $2.36 trillion. It driven by robust engagement across markets like India, Vietnam, and Pakistan.

Meanwhile, North America climbed to the second-highest regional position in the presence of regulatory momentum. This includes the approval of spot Bitcoin ETFs and clearer institutional frameworks, that helped legitimize and accelerate crypto participation across traditional financial channels.

According to the study, North America and Europe continue to dominate in absolute terms, receiving over $2.2 trillion and $2.6 trillion, respectively, in the past year.

India’s Crypto Tax Talks Add Momentum To Asian Crypto Policy Reforms

The Central Board of Direct Taxes (CBDT), India’s direct tax authority, has reportedly consulted domestic crypto platforms regarding its current VIRTUAL digital asset (VDA) framework.

Industry insiders revealed that the CBDT questioned the effectiveness of the current taxation system on crypto and sought input on whether they require a standalone legal regime.

The focus seems to be on the 1% tax that authorities deduct at source (TDS) on crypto trades, the restrictions on loss offsetting, and the ambiguity around offshore transactions.

The CBDT further requested inputs regarding the shortlisting of government agencies that WOULD oversee the development of the new crypto framework.

Key Takeaways

-

India’s adoption of CARF follows years of tightening oversight of digital assets, now extending to offshore holdings that have historically been difficult to track.

-

Reports indicate CARF will extend to exchanges, brokers, and relevant wallet providers, and cover assets such as stablecoins, derivatives, and some NFTs, aligning with OECD technical guidance for comprehensive reporting.