Gemini IPO Aims for $317M Blockbuster as Trump Media Plows $1B into Crypto.com Treasury Strategy

Wall Street meets blockchain in a massive capital play.

The Funding Frenzy

Gemini's public offering targets a whopping $317 million infusion—one of the largest crypto exchange IPOs to date. Meanwhile, Trump Media makes an unprecedented billion-dollar bet on Crypto.com's treasury management approach, signaling institutional confidence in digital asset strategies.

Strategic Moves

This dual announcement shakes traditional finance circles. Established players now scramble to keep pace with crypto-native platforms leveraging aggressive treasury strategies that outperform conventional asset management—because who needs bonds when you have bitcoin yields?

Market Impact

The moves validate crypto's maturation from speculative gamble to institutional asset class. Still, traditional bankers will likely dismiss it as another bubble right up until their clients demand crypto exposure.

Trump Media and Crypto.com Bet Big on Cronos: Why Won’t He Touch Gemini?

Donald Trump’s media empire is expanding deeper into crypto. Trump Media & Technology Group (DJT) announced a deal with Crypto.com to create a new treasury venture built around Cronos (CRO).

The company will merge with Yorkville Acquisition Corp and go public under the ticker MCGA. Trump Media will anchor its corporate reserves with $1Bn worth of CRO tokens, backed by $200M in cash, $220M in warrants, and a $5Bn equity line of credit from Yorkville affiliates. At this point, Trump is running the country like a crypto mafia don.

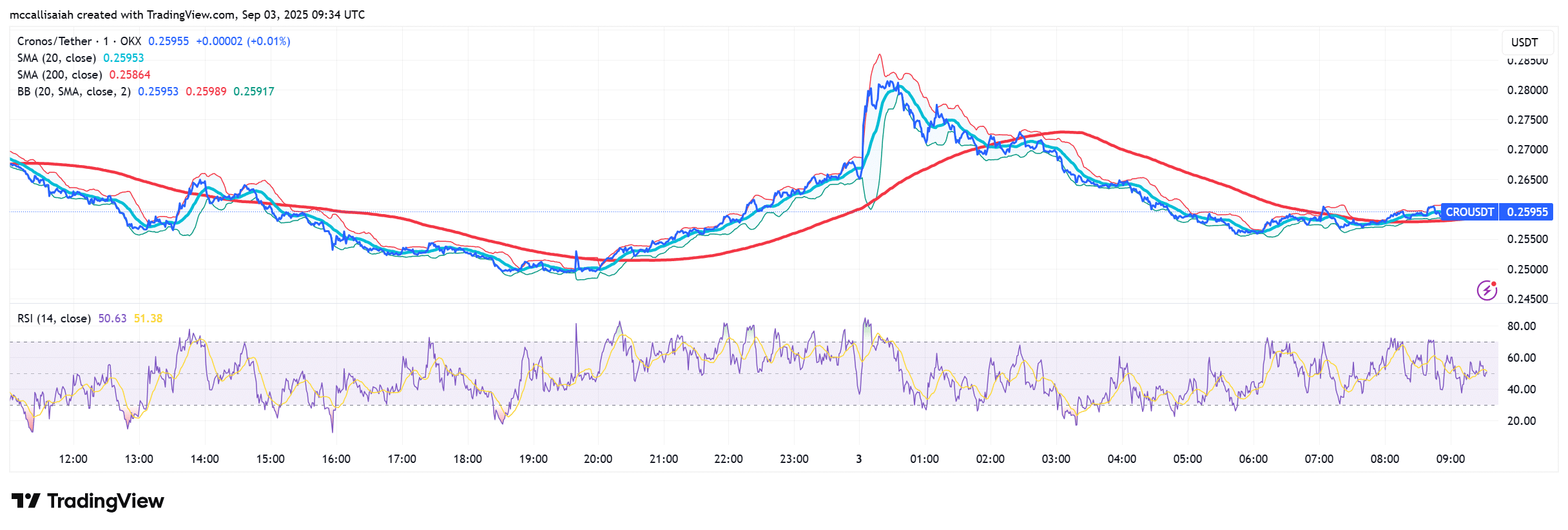

(Source: TradingView)

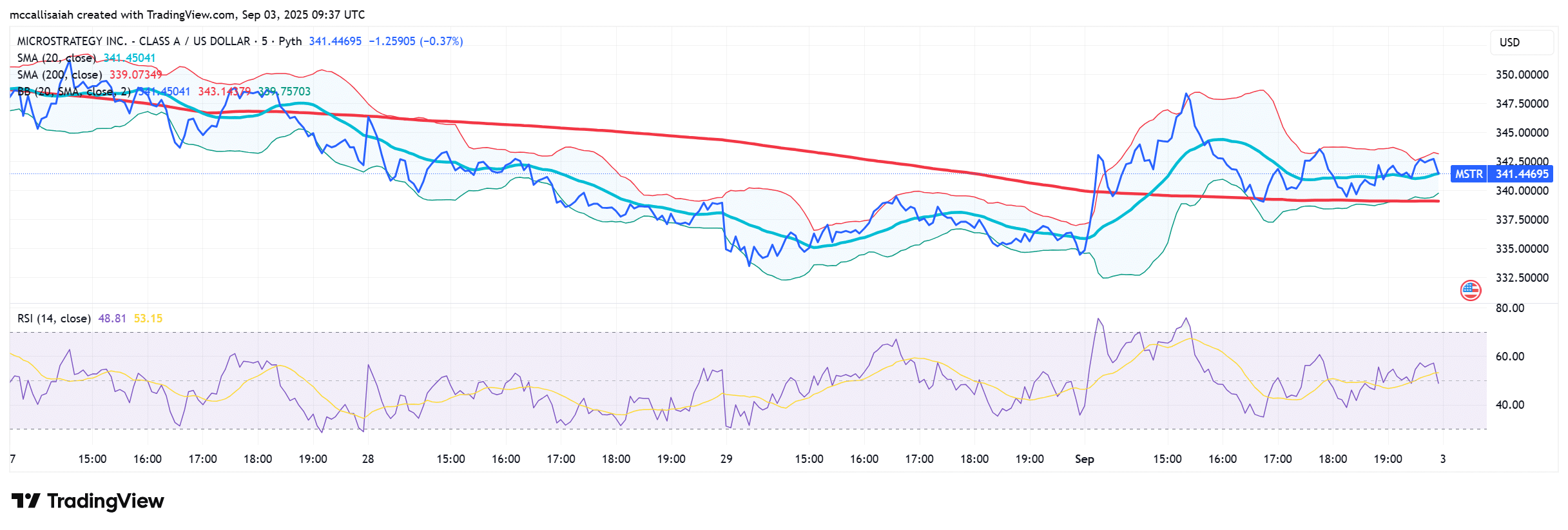

(Source: TradingView)

The MOVE sent CRO up +29.6% to $0.20, according to CoinGecko, while Yorkville’s stock slid -2.2% to $10.42.

“By anchoring Truth Social’s rewards economy and corporate reserves in CRO, Trump Media is effectively institutionalizing the token,” said Alice Liu, head of research at CoinMarketCap.

Trump Media shares also ROSE +6.6% to $18.36, buoyed by the news.

Bitcoin Treasury Strategy Stocks You Need to Invest In

The Trump-Cronos move mirrors Michael Saylor’s playbook at MicroStrategy, which effectively transformed a software company into a Bitcoin vault now holding close to $100Bn. Investors have bought in, sending MSTR shares up fivefold alongside Bitcoin’s rally in 2024.

(Source: TradingView)

(Source: TradingView)

Corporate treasuries are testing similar waters with tokenized reserves. Circle went public in June with a $1.2Bn IPO, its stock jumping +168% on the first day.

Additionally, the SoftBank- and Tether-backed SPAC launched a $3.6Bn bitcoin treasury firm earlier this year.

Can Gemini and Trump Media Deliver in a Crowded Market?

For Gemini, the IPO is a chance to restore confidence after past regulatory battles, including a dropped SEC case and a $5M CFTC settlement earlier this year. For Trump, well, it’s business as usual. Everything he touches turns to Gold because he’s the freaking president.

Crypto.com is the latest venture, and we’ll see what else Trump pumps (and hopefully doesn’t dump like WLFI token) by year’s end.

Key Takeaways

- Gemini seeks a $317M IPO while Trump Media launches a $1B Cronos treasury venture.

- Crypto.com is the latest venture Trump has pumped and we’ll see what else he boosts by year’s end and hopefully doesn’t dump like WLFI token.