Altcoins Surge as Bitcoin Dominance Craters to 57%: Is the Fed Narrative Losing Its Grip?

Digital assets roar back to life as altcoins steal the spotlight from Bitcoin's throne.

Market Shakeup

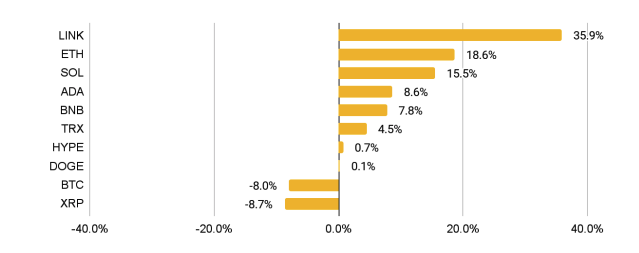

Bitcoin's dominance metric plunges to 57%—its lowest level in recent memory—as capital floods into alternative cryptocurrencies. Ethereum leads the charge with double-digit gains, while Solana and Cardano post impressive rallies that leave traditional assets in the dust.

Narrative Shift

Traders increasingly dismiss Federal Reserve policy concerns, betting instead on crypto's inherent momentum. The fear-driven correlation with traditional markets weakens as digital assets reclaim their rebellious identity. Even regulatory chatter fails to dampen the bullish sentiment sweeping through exchanges.

Institutional money continues playing catch-up—proving once again that Wall Street's 'risk management' often means missing the biggest opportunities.

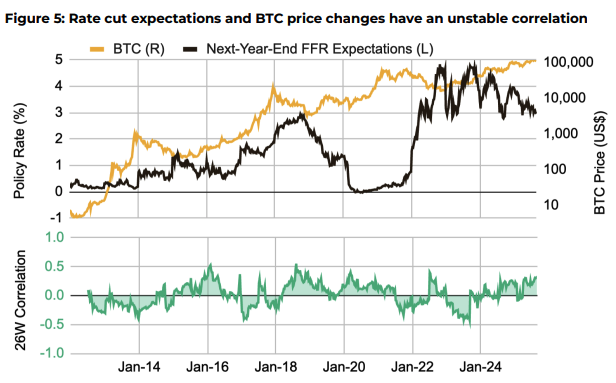

BTC price and rate cut expectations historical correlation | Source: Binance Research

BTC price and rate cut expectations historical correlation | Source: Binance Research

Instead, the relationship between BTC price and interest rates is more complex. Since rate cuts are likely already priced in, the driver for Bitcoin’s price is how these expectations change. Critically, the market will react to whether the Fed’s decision differs from what is already priced in.

Why altcoins outperformed Bitcoin

This also shows up in relative price performance between Bitcoin and altcoins. In August, out of the top ten altcoins, only one underperformed Bitcoin, which declined 8% in that period. Meanwhile, ethereum (ETH) rose 18.6%, thanks to accumulation from both institutions and retail. ETF inflows and corporate treasury accumulations were the main contributing factors to Ethereum’s performance.

At the same time, solana (SOL) rose 15.5% due to a mix of institutional interest and technical updates. For one, SOL corporate treasuries started to gain momentum, while the Alpenglow upgrade boosted overall market sentiment.