🚀 TON & Chainlink Hit Bottom While Solana & Pyth Network Surge | August 29 Crypto Live

Markets twist as majors diverge—TON and Chainline flirt with local lows while Solana and Pyth push upward momentum.

Bottom Signals or Trap Doors?

TON and Chainlink test key support levels. Are we looking at accumulation zones or the calm before another leg down? Retail watches, whales wait.

Solana’s Momentum Play

SOL isn’t looking back—network activity climbs, defi TVL expands, and the speculators pile in. Pyth rides the oracle wave, feeding real-world data to hungry algorithms.

Because nothing says 'healthy market' like a few tokens mooning while the rest pray for a reversal. Just another day in crypto—where the only thing predictable is volatility.

(PYTH/USD, source –)

TON, on the other hand, hit rough waters, dipping toward $2.60 support amid builder exodus dramas. The community is in frustration over liquidity snags and failed promises. Even with Telegram ties, sentiment is getting more soured and on-chain activity flatlined.

(TON/USD, source –)

Expectation on LINK, SOL, and PYTH Crypto

Chainlink is now consolidating with exchange supplies at record lows. People venting online about supply emissions that are outpacing demand, calling out LINK team for the stagnation. However, the new Reserve program is quietly funneling revenue into buybacks. So, a turnaround could be in the play. LINK comes with SBI and Euroclear partnership, but price is still lagging. On-chain data shows that whales has been snapping up LINK aggressively.

ChainlinkPriceMarket CapLINK$15.85B24h7d30d1yAll timeSolana still having momentum with 600 million weekly transactions and a record of 81% DEX volume dominance. Developer counts blast paet 83% to over 7,600, not to forget the ETF filings from VanEck and Bitwise. Firedancer update also promised 100x scale, drawing in Visa and BlackRock.

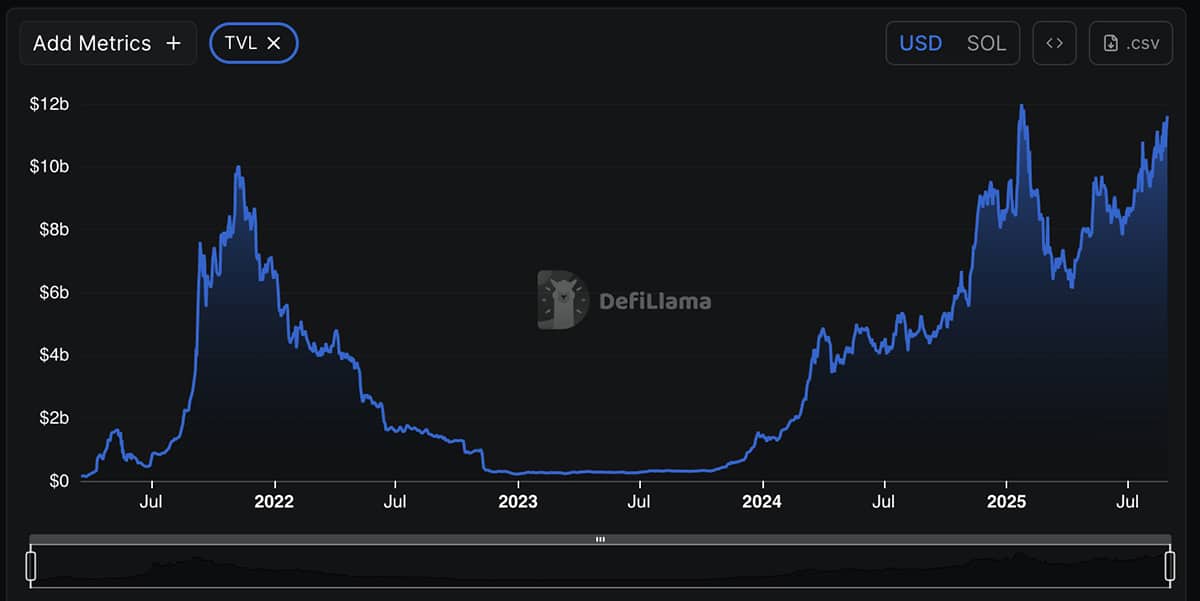

SOL TVL has climbed to yearly peaks, with 107k TPS bursts. Memecoin hype and tokenized stocks have been the reasons for SOL volume bumps. PayPal and upcoming Alpenglow will likely drive Solana beyond $250.

(SOL TVL, source –)

Besides the other players, Pyth has pushed its market cap above $1 billion, a big crypto number not seen since May. The US-Pyth has a partnership to deliver GDP data across 10 chains, pumping the crypto trading volume up to 70%.

Pyth crypto benefited a lot from Solana’s ecosystem, especially with permissionless Governance. PYTH has been rewarding stakers with cross-chain crypto airdrops. As oracles bridged TradFi and DeFi, Pyth explosive adoption could be coming if not ongoing.

There are no live updates available yet. Please check back soon!