Jackson Hole Chaos: Markets Brace for Powell’s Final Speech Showdown

All eyes turn to Wyoming as Fed Chair Jerome Powell prepares to drop his final Jackson Hole bomb—and somehow markets haven't imploded yet.

The Calm Before The Storm?

Traders are holding positions tighter than a Bitcoin maximalist at $100K, refusing to flinch despite the potential for hawkish fireworks. Volatility indicators suggest everyone's pretending to be relaxed while secretly sweating over Powell's every syllable.

Powell's Last Dance

The Fed chair's swan song could redefine monetary policy trajectories for 2026. Watch for coded language about rate cuts—or lack thereof. Past performances suggest he'll master the art of saying nothing while sounding profoundly important.

Because nothing says 'stable financial system' like hanging every asset class's fate on one guy's speech in a mountain resort.

Here’s what else you should know and if this is time to sell:

Jackson Hole and Powell’s Balancing Act

Worries are mounting that there was never a rate cut scenario. All economists were projectingrate cuts in 2025, and only retail thinks there still is.

The reasoning for this is that Powell’s tenure has been marked by persistent inflation above the Fed’s 2% target and a labor market that is beginning to show signs of weakness. Additionally, with President Donald TRUMP in office, Powell has to balance those pressures while maintaining the Fed’s independence under growing political scrutiny.

“For four years, inflation has persistently surpassed the Fed’s 2% target,” analysts noted. “Evidence indicates a weakening labor market, undermining the Fed’s dual mandate.”

The internal picture is no less complicated. A rare dual governor dissent in recent meetings shows a divided committee, and newly nominated governor Stephen Miran is expected to be a sharp critic of Powell’s leadership.

Investors are glued to every clue about where U.S. interest rates head next.

There Are 2 Rate Cuts in The Forecast, For Now

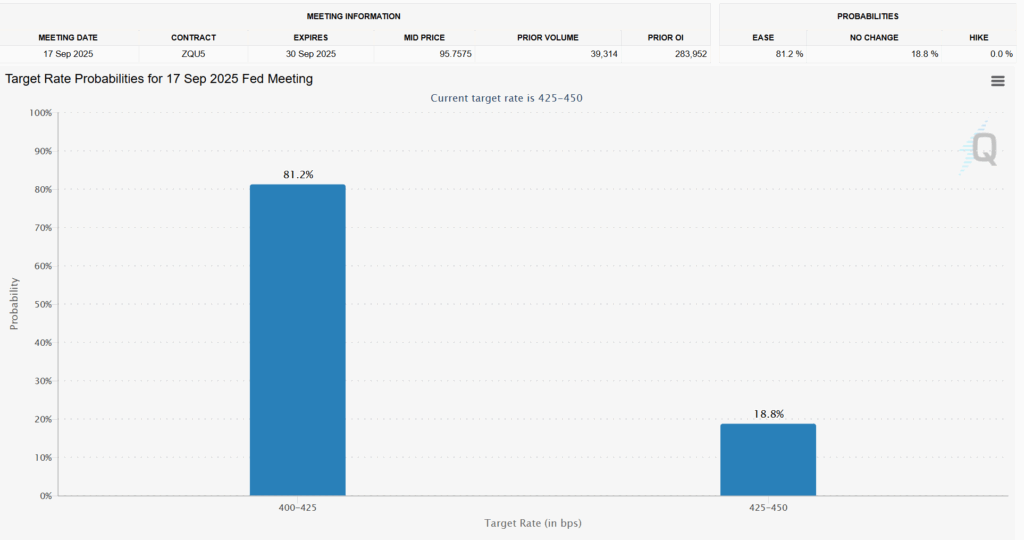

Although the FUD has started that Powell will back out of rate cuts, according to the CME’s FED watch tool there are two rate cuts in the forecast.

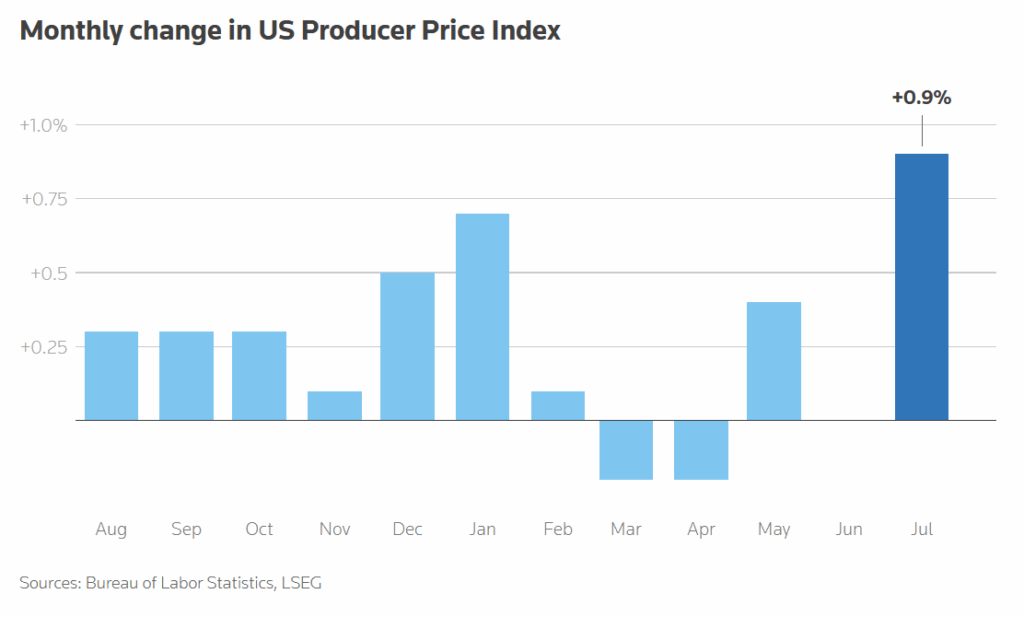

The data also paints a split picture. Headline CPI cooled more than expected, but producer prices climbed and consumer surveys revealed higher inflation expectations.

Prediction markets like Polymarket also give the FED a 67% chance for a 25 bps rate cut.

Meanwhile, U.S. job numbers add their own contradictions with unemployment holding NEAR 4%. Flows into defensive assets such as gold and silver remain strong, with gold holding around $3,340/oz and silver near $37.8/oz.

Across equities, defense stocks ROSE 1% as speculation over a Ukraine-Russia peace framework weighed on sentiment, while oil firm Aker BP gained 3.1% after announcing a significant discovery in the North Sea.

Asian markets were mixed, with Japan’s Nikkei 225 falling 0.68% as the yen weakened against the dollar, while China’s Shanghai Composite gained 0.50%. In the euro zone, investors are also awaiting flash PMI data for August, with results from Germany, France, and Britain expected later in the day.

So, Should You Sell Ahead of Jackson Hole?

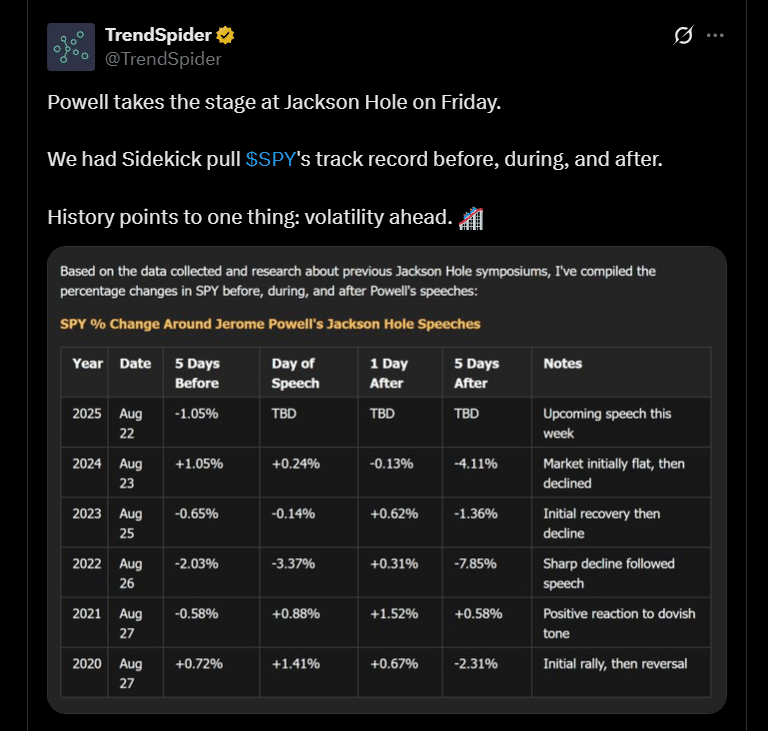

Looking at the past two Jackson Hole events, markets pumped then dumped, and this year we might see the same.

It’s best to avoid trading with leverage and maybe not bet the farm on YZY coin. With all that said, we do see a different macro picture under Trump so we should see tech and crypto extend their rallies in Q4.

Key Takeaways

- Jackson Hole, Wyoming, Fed meeting is what started the great bear market of 2020, when Powell announced rate hikes, and now that might happen again.

- Worries are mounting that there was never a rate cut scenario. All economists were projecting 0 rate cuts in 2025, and only retail thinks there still is.