Bitcoin’s Next Chapter: Why BTC’s Current Weakness Sets Stage for Monumental Gains

Bitcoin traders brace for impact as short-term headwinds test market resilience.

Market Turbulence Creates Buying Opportunities

Current volatility shakes out weak hands while smart money accumulates positions. Traditional analysts miss the bigger picture—Bitcoin's decentralized nature fundamentally outperforms legacy finance systems.

The institutional accumulation phase continues beneath surface-level price action. Major players use this period of uncertainty to build strategic positions, recognizing Bitcoin's long-term value proposition against inflationary fiat currencies.

Coinbase CEO Brian Armstrong's $1 million per Bitcoin prediction by 2030 gains traction among serious investors. The math works: increasing adoption meets fixed supply—economics 101 that Wall Street economists still struggle to comprehend.

While traditional finance worries about quarterly earnings, Bitcoin builders focus on the next decade. The network grows stronger during these consolidation periods, proving once again that decentralized systems outperform centralized ones during times of uncertainty.

Remember: Wall Street analysts said the internet was a fad too. Now they're trying to explain why a decentralized asset they dismissed for years is eating their lunch.

(Source: TradingView)

BTC USD Shaky: What’s Next? Will Bulls Return and Stop the Bleeding?

The daily chart shows the uptrend from early April remains intact. As expected,BTC ▼-0.28% prices didn’t rise linearly. It took weeks for bulls to rebound from $74,000 to $100,000. Once prices broke $110,000, bitcoin bulls gained momentum, pushing bears back and hitting all-time highs.

BitcoinPriceMarket CapBTC$2.26T24h7d30d1yAll time

However, despite the rapid climb to $124,000, prices reversed immediately. Since August 14, BTC USD has trended lower and may fall below the psychological $110,000 level. If this happens, analysts expect a wave of long liquidations, possibly accelerating the sell-off to $100,000 or lower.

Eyes on Spot Bitcoin ETF Inflows and RRP

Several fundamental factors will determine whether bulls find support or sellers press on. At the forefront are inflows to spot Bitcoin ETFs. Recently, institutions have been redeeming shares for BTC, possibly selling in secondary or OTC markets. If inflows don’t resume soon, retail investors may see this as a bearish signal and exit to secure profits.

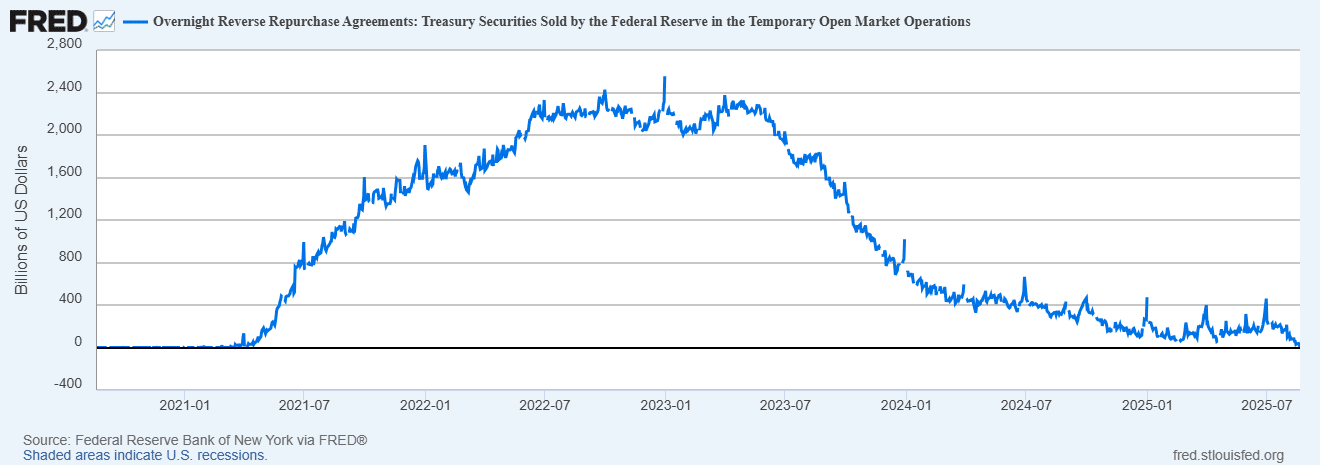

While institutions play a role, an analyst on X suggests Bitcoin and crypto may decline further due to the Federal Reserve’s actions, particularly as it rebuilds its reverse repo facility (RRP). In recent months, the RRP balance has dropped to near-zero, creating uncertainty about future liquidity injections.

If anyone actually want to know why Bitcoin is being faded here it is because all the liquidity has been drained out of the reverse repo facility finally and we don’t know where the next source of liquidity injection will come from.

— Magoo PhD (@HodlMagoo) August 20, 2025

The Federal Reserve’s overnight Reverse Repo Facility (RRP) allows eligible institutions, like regulated banks and money market funds, to park excess cash at the central bank in exchange for treasury securities, earning a small yield.

A high RRP balance signals excess liquidity in the financial system, while a low balance indicates tighter liquidity, with less cash flowing to risky assets like crypto. Analysts view a low RRP balance as a sign of reduced liquidity.

Why the Federal Reserve’s RRP Balance Matters for Bitcoin and Crypto

As of August 20, the RRP balance was $35 billion, the lowest since April 2021, down from $214 billion at the end of July. If more funds are withdrawn, the balance could hit zero by the end of the month. This decline is largely due to the Treasury issuing short-term bills to rebuild its Treasury General Account (TGA), siphoning cash from the financial system.

(Source: Federal Reserve)

Since Bitcoin is a risk asset, it thrives in high-liquidity environments where cash is abundant, allowing institutions to speculate. As liquidity tightens, investors may pull back from speculative assets like Bitcoin and top solana meme coins, exacerbating the sell-off.

Historical patterns support this. In 2022, Bitcoin crashed to $15,500 after the RRP balance peaked at over $2 trillion. As the RRP drained in 2023, Bitcoin prices ROSE with increased liquidity. With the RRP nearly depleted and the Treasury rebuilding its TGA, excess cash will likely be absorbed, driving Bitcoin and some of the best cryptos to buy lower from current levels.

BTC USD Under Pressure, Will Bitcoin Price Recover Above $125k?

- BTC USD drops from $124,700 peak, risking a fall below $110,000

- Institutional redemptions of spot Bitcoin ETF shares signal bearish sentiment

- A low RRP balance of $28.8B signals tighter liquidity, which is hurting crypto

- Bitcoin’s sell-off may drag Solana meme coins and other risk assets lower