🚀 Bitcoin Holds Strong Above $118K as FOMC Looms – ETH ETF Shatters Records & Top Altcoins to Watch Now

Bitcoin defies gravity—again—while Wall Street sweats over Fed whispers. Meanwhile, Ethereum's ETF debut makes traditional finance look like dial-up internet. Here's where smart money's flowing next.

The BTC Floor: $118K and Counting

No panic here. Bitcoin's trading like it owns the place, brushing off FOMC jitters with the confidence of a bull who's seen this movie before. Traders are either geniuses or gambling addicts—jury's still out.

ETH ETF: The New King of Liquidity

Ethereum's exchange-traded funds aren't just breaking records—they're rewriting the playbook. Suddenly, your grandma's pension fund wants exposure to gas fees and monkey JPEGs. What a time to be alive.

Altcoin Alphas: The Hunt for the Next Rocket

Forget 'safe' assets. The real action? Projects that actually ship code between Twitter flame wars. (Pro tip: If the whitepaper mentions 'Web5,' run.)

Bottom line: The crypto train left the station—and Goldman Sachs is still fumbling for its MetroCard.

Best Altcoins to Buy Right Now? From ETH To Hyperliquid and Solana Offer Unique Upside for August 2025

ETH ETFs saw $65.14 million in inflows, with BlackRock’s ETHA leading the charge at $131.95 million. ETH ETFs now hold $21.5 billion in assets and are becoming an increasingly important part of the altcoin landscape.

Corporate treasuries are now accumulating ETH, with firms like SharpLink Gaming surpassing the ethereum Foundation’s holdings. Over $1.6 billion in ETH has been acquired by major corporations in the past month, suggesting long-term conviction.

$ETH ETF inflows are absolutely skyrocketing right now.

Follow the smart money! pic.twitter.com/BCh8g0ULdA

— Mister crypto (@misterrcrypto) July 29, 2025

Ethereum remains the leading altcoin and a key signal for broader market trends. With spot ETH ETFs now logging 17 consecutive days of inflows totaling $5.2 billion, institutional confidence is surging. ETH/BTC technicals have flipped bullish, and analysts increasingly view Ethereum as the foundation of the next crypto cycle.

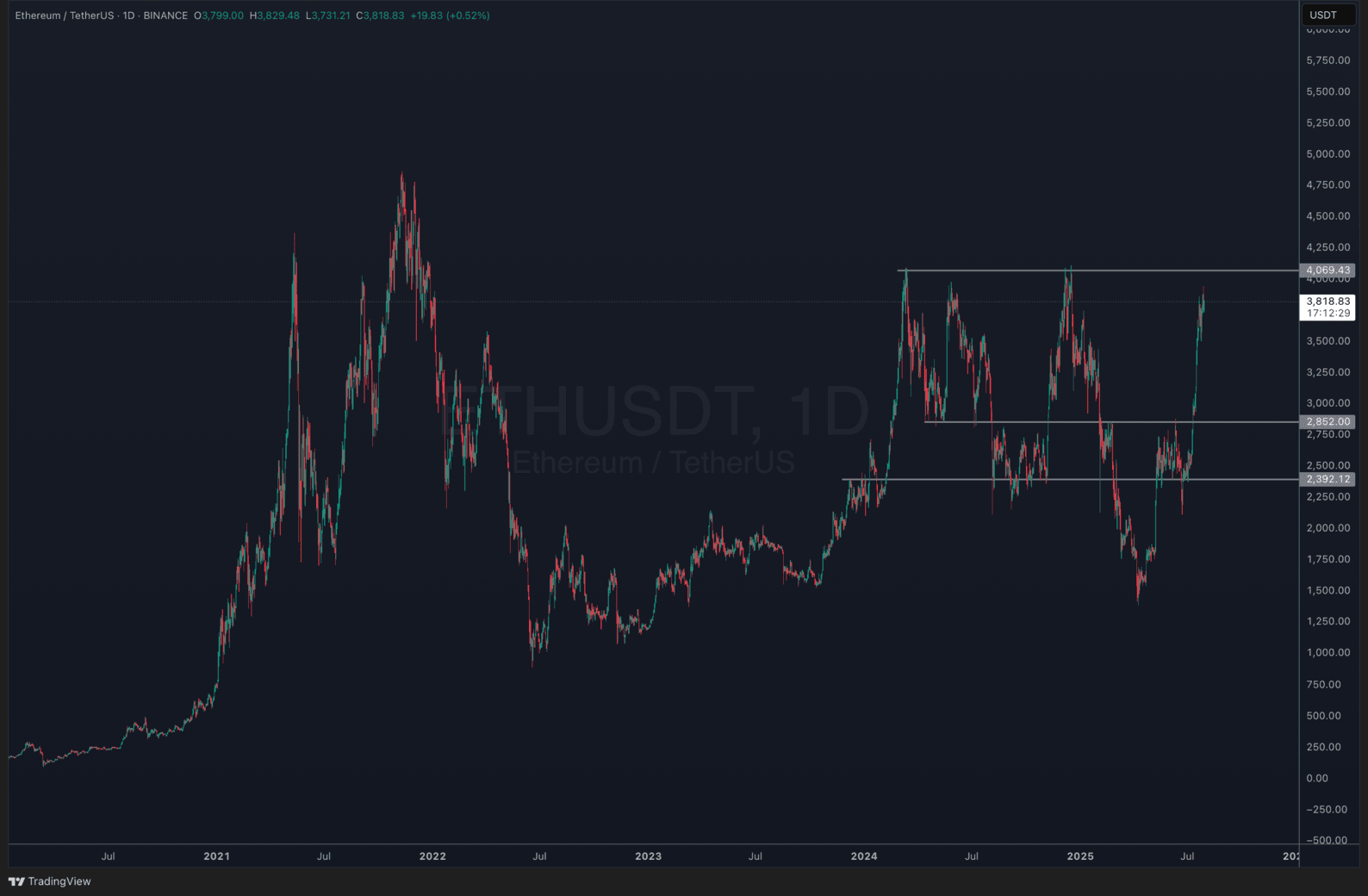

(ETHUSDT)

Ethereum is approaching key resistance at $4,069 after a strong rally from below $2,400. A breakout could target $4,500–$5,000, supported by record ETF inflows. The structure favors bulls, but confirmation is needed above this level to sustain momentum. A new ETH ATH could kickstart the highly awaited altcoin season.

At the same time, Hyperliquid (HYPE) is also making numbers. Built on a custom Layer 1 optimized for high-speed, on-chain perpetuals, it offers gasless, low-latency execution and deep order books.

As traders seek alternatives to centralized exchanges, Hyperliquid’s blend of performance and transparency positions it as a top choice for advanced users. Its rapid growth and strong developer activity make it a key altcoin to watch. Currently trading at $43,93, HYPE could be aiming for the $100 target next.

Solana, meanwhile, has regained momentum after past network issues. With fast transactions and minimal fees, it’s once again a hub for DeFi, NFTs, and tokenized assets. Upgrades like Firedancer have boosted reliability, while rising user activity and institutional interest support continued upside. SOL remains a leading LAYER 1 with long-term growth potential.

36 minutes ago

World Liberty and New Wallets Snap Up Over $2.7B in Ethereum Since July

![]()

ETH accumulation continues. Trump’s World Liberty recently spent 1 million USDC to buy 256.75 ETH at a price of $3,895 about 24 hours ago.

So far, World Liberty has accumulated a total of 77,226 ETH, valued at around $296 million, with an average purchase price of $3,294. This position currently shows an unrealized profit of approximately $41.7 million.

In addition, a new wallet (0x286f) added another 12,749 ETH, worth about $48 million, 12 hours ago.

Since July 9, nine new wallets have collectively bought 628,646 ETH, totaling around $2.38 billion. This significant accumulation signals strong interest and confidence in Ethereum from fresh investors and large buyers.