🚀 Bitcoin to $125K by July? Polymarket Betting Frenzy Says ’Buckle Up’

Bitcoin's price prediction markets are flashing bull signals—hard. Polymarket traders are doubling down on a $125,000 BTC moon shot before July wraps, defying even Wall Street's most optimistic models.

The gamble: Either these degens spotted an institutional FOMO wave the suits missed... or they’ve been huffing hopium between margin calls.

Why it matters: Prediction markets often sniff out sentiment shifts before traditional metrics catch up. This wager implies traders see a perfect storm—ETF inflows, supply shock, and maybe even a Fed pivot.

The kicker: If Bitcoin actually nails this target, hedge funds will suddenly 'discover' crypto's 'fundamental value' just in time to take credit. How convenient.

A majority now backs BTC to clear $125,000 before July’s clock runs out; another sign that institutional and retail euphoria is outpacing caution as crypto legislation takes shape in D.C.

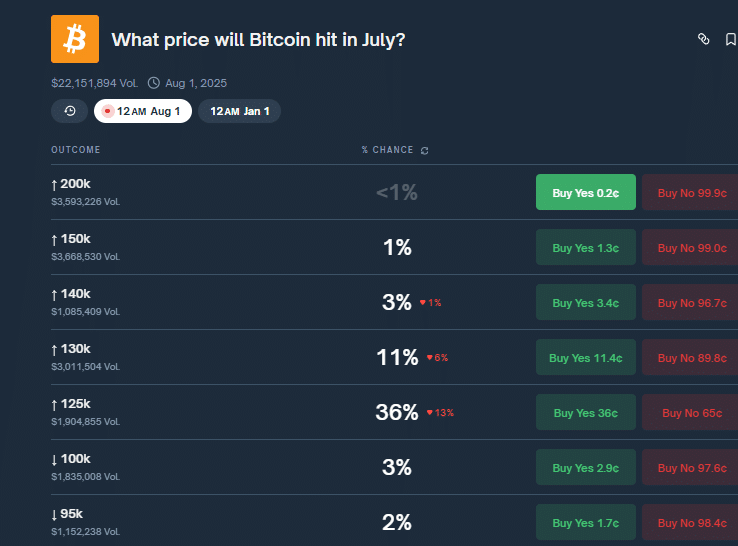

Current odds show 36% betting on a $125K breakout, while belief in loftier highs thins out fast: only 11% see $130K in reach, with just 3% gunning for $140K and a lone 1% clinging to $150K. Here’s what the TA says if Bitcoin can rise to $125,000:

Trump Signs Pro-Crypto Bills as Market Momentum Builds

This market Optimism follows a flurry of legislative victories for the crypto sector. On Friday, President Donald Trump signed the GENIUS Act into law, marking the first major federal framework for stablecoins. The House also advanced the CLARITY Act and Anti-CBDC Act, marking what Republicans called “Crypto Week” in Washington.

Speaker Mike Johnson echoed the administration’s full-throated support for the digital asset industry:

“The CLARITY Act, GENIUS Act, and Anti-CBDC Surveillance State Act deliver on President Trump’s vision to make crypto a Core pillar of the U.S. economy.” – Mike Johnson via X

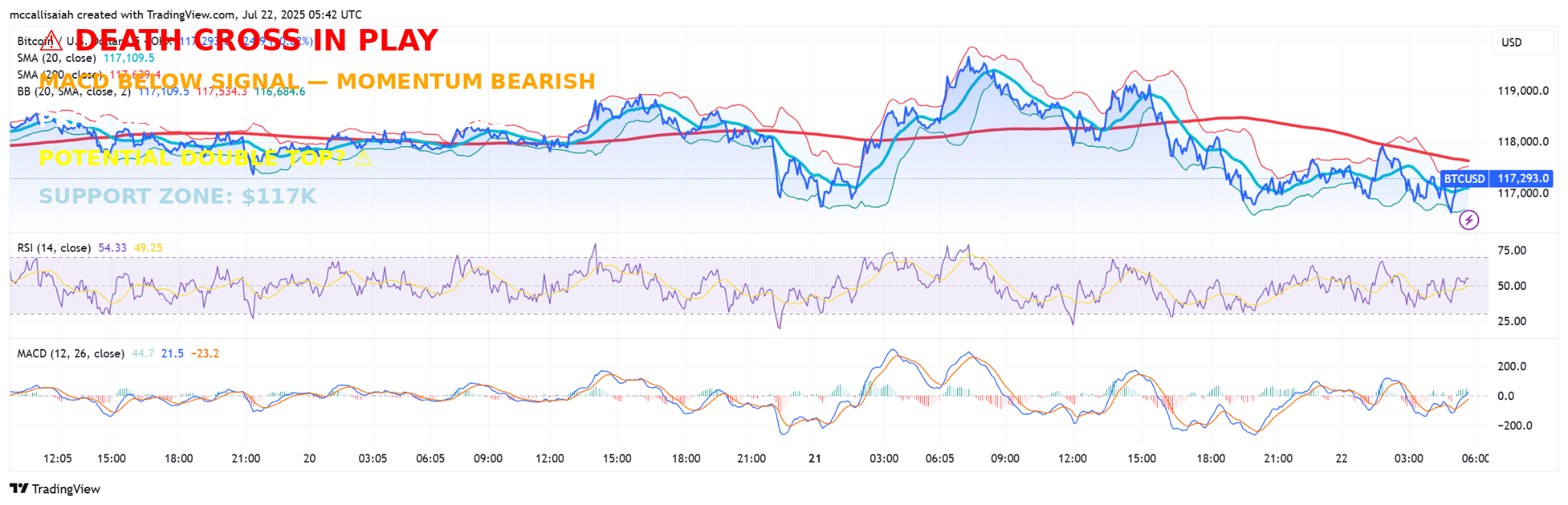

Despite the hype bitcoin is starting to show some concerning weakness here. After a bounce off the $117,000 level, we’re now seeing a potentialstarting to form. Definitely something to keep an eye on.

-

20 SMA just crossed below the 200 SMA, signaling a classic death cross (that is since slowly reversing).

-

Bollinger Bands are tightening up after a volatile stretch, hinting at a bigger move coming soon.

-

No sign of a clean bullish pattern—if anything, the choppiness and MACD divergence hint at indecision or bearish pressure building.

Trump might have injected the market with lots of clarity and bullish news, but TA-wise, Bitcoin still looks a little shaky unless bulls defend $117K hard.

Polymarket Eyes U.S. Comeback After $112M QCX Deal

In a parallel development, Polymarket announced a $112 million acquisition of QCX, a U.S.-regulated derivatives exchange, to bring its platform back into the American market. The MOVE follows the conclusion of DOJ and CFTC investigations, which had previously restricted the platform’s operations in the U.S.

“We are laying the foundation to bring Polymarket home,” said founder and CEO Shayne Coplan in a Monday press release.

With compliance in hand, Polymarket could become more than a VPN sideshow. This could be the start of a new digital Las Vegas.

Key Takeaways

- A majority now backs BTC to clear $125,000 before July’s clock runs out; another sign that institutional and retail euphoria is outpacing caution.

- After a bounce off the $117,000 level, we’re now seeing a potential double top pattern starting to form.