Sei Crypto Outshines Solana: Native USDC & CCTP V2 Supercharge Cross-Chain Liquidity

Move over, Solana—Sei just rewrote the playbook. With native USDC integration and CCTP V2 deployment, this blockchain isn’t just competing; it’s eating lunch.

The Liquidity Moonshot

No more wrapped asset gymnastics. Sei’s direct USDC support slashes settlement times from 'maybe tomorrow' to 'right damn now.' CCTP V2? That’s the secret sauce letting liquidity teleport between chains without the usual 5% 'banker tax' on bridges.

Why TradFi Should Sweat

While Wall Street still charges $25 for wire transfers, Sei moves millions for pennies. The kicker? It works on weekends—unlike your local branch.

The Verdict

Solana had its moment. Now, Sei’s cutting through DeFi’s red tape like a blockchain Ginsu. Will it last? Who cares—the yields are juicier than a VC’s margin call.

(

SEIUSDT

)

(

SEIUSDT

)

1. $600M TVL and Counting: Sei’s Rapid DeFi Expansion

Since early 2024, Sei’s Total Value Locked (TVL) has surged from just $13 million to overby July 2025. The network is attracting dApps, liquidity providers, and serious attention from DeFi developers.

Moreover, SEI is trading 5x below its ATH yet by almost every metric it has imporved since then. We could be looking at a coin like Sui, or, hopefully, Ethereum, that smashes its previous ATH.

BREAKING: $SEI defi (@YeiFinance ) crossed $400,000,000 first time ever![]()

Sei summer beginning![]() pic.twitter.com/EHybGxr0Q5

pic.twitter.com/EHybGxr0Q5

— Ryuzaki Sei (@Ryuzaki_SEI) July 11, 2025

High TVL reflects DEEP liquidity and real usage. It also sends a message to competitor L1s that Sei isn’t just scaling, it’s dominating in activity growth.

2. Wallet Adoption and Institutional Trust on the Rise

One of Sei’s most underreported success stories is its user growth. Overhave been created in the past year, marking a jaw-dropping. That’s a clear indicator that Sei is resonating with users far beyond early adopters.

Further legitimizing the network is regulatory approval from Japan’s Financial Services Agency, opening the door to institutional flows in a market known for tight oversight.

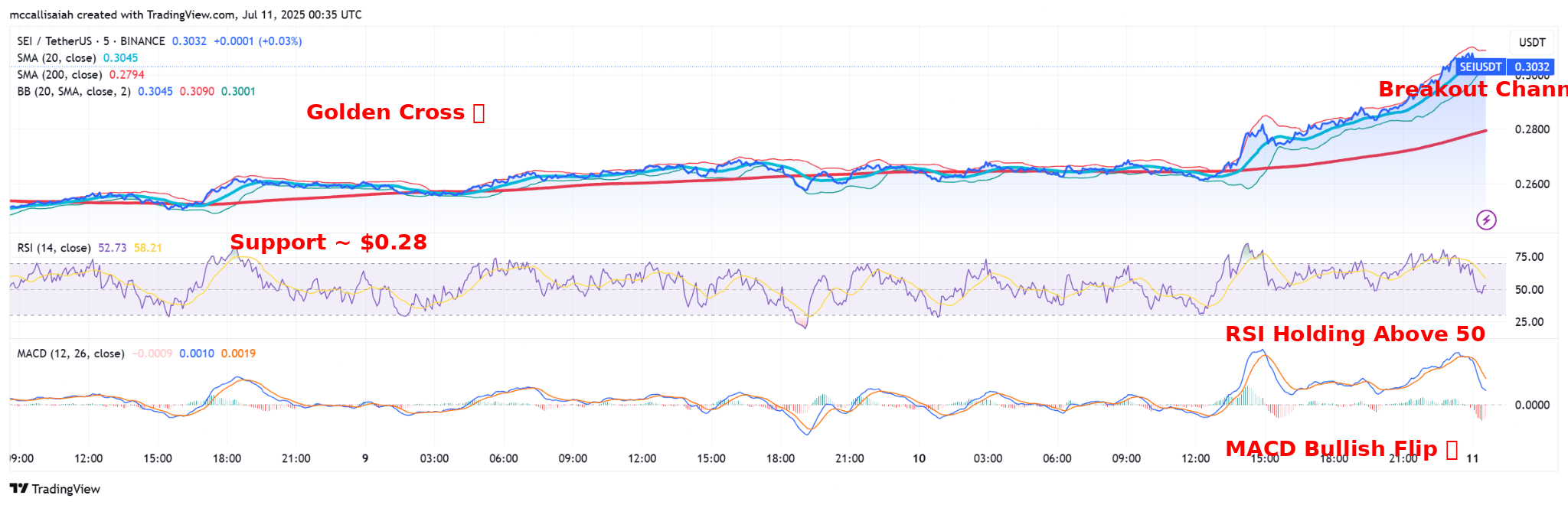

3. Technical Signals Flash Bullish Momentum for SEI

Lastly, While the token is still clawing back from its $1.15 peak, currently hovering NEAR $0.33there are bullish signals forming on the charts:

-

Golden Cross confirmed, with the 20-day SMA crossing above the 200-day SMA

-

MACD has flipped bullish, maintaining positive territory

-

Bollinger Bands are widening with price riding the upper band—volatility is back

$sei will follow $sui pic.twitter.com/7IJ7nwrVzv

— KNIGHT (@cryptoknight890) July 10, 2025

After multiple retests, $0.28 has established itself as a solid floor for SEI. Price structure is coiling into a rounded base, with early signs of a textbook cup-and-handle.

Final Thoughts: SEI Has Found Its Second Wind

With macro tailwinds building and the Iran ceasefire cooling global tensions, risk-on assets are back in play and SEI is benefiting.

Between booming user growth, regulatory wins, and major stablecoin integrations, Sei is shaping up to be core blockchain infrastructure with 2021 ethereum or Solana of 2023. You heard it here first.

Key Takeaways

- Sei Crypto is ditching the training wheels and is shaping up to be one of the standout altcoin plays of the bull market.

- With macro tailwinds building and the Iran ceasefire cooling global tensions, risk-on assets are back in play and SEI is benefiting.