Crypto Soars Again: BTC Smashes Records With $112k All-Time High

Bitcoin just flexed its dominance—briefly punching through $112,000 in a parabolic rally that left traditional assets eating dust. Here’s why digital gold is stealing the show.

The institutional floodgates are open

BlackRock’s spot ETF now holds more BTC than MicroStrategy. Pension funds are quietly allocating. Even your dentist’s portfolio has a ‘crypto bucket’ now.

Macro winds at crypto’s back

The Fed’s rate cuts sent fiat scrambling for hard assets. BTC’s fixed supply looks mighty tempting when central banks treat money printers like a casino buffet.

Network effect goes brrr

Lightning Network adoption tripled this year. Developers are shipping more code than ever. Meanwhile, Wall Street still can’t agree on Excel formatting.

Cynical take? This pump has more legs—until the next ‘unexpected’ 30% correction reminds everyone crypto moves faster than a hedge fund’s risk management team.

The move brought Bitcoin’s market cap to $2.22 trillion, while total crypto market capitalization reclaimed $3.47 trillion, levels last seen in mid-2025.

FUD for BTC continues with some Twitter users writing: “People expect Bitcoin to perform as well as it did in the past ten years for the next ten years. A persistent power outage or a Chinese lab with a quantum computer will send your bags to zero.”

Still, bitcoin keeps outrunning the S&P and most altcoins, refusing to follow anyone else’s script.

Tariffs, Rate Bets, and the Return of Bitcoin as a Hedge

The rally came just days after President Donald TRUMP announced new tariffs on several countries including Japan, South Africa, and Malaysia, with some rates reaching 40%. 99Bitcoins analysts say this geopolitical uncertainty has boosted Bitcoin’s appeal as a macro hedge.

This milestone also triggered a flood of liquidations within total, andfrom Bitcoin shorts alone.

“Bitcoin’s increasing status as a SAFE haven asset in the face of fiat debasement… confirmed by the first US state signing a Bitcoin reserve bill into law.” — Katalin Tischhauser, Sygnum Bank

I don't think most people understand the $BTC rally we are about to see… pic.twitter.com/GgIanG2Put

— Coinvo (@ByCoinvo) July 8, 2025

Bitcoin’s uptrend, which began following Trump’s Liberation Day speech in April, has coincided with growing dislocation from traditional assets.

According to Sygnum Bank, Bitcoin has increasingly decoupled from the S&P 500, particularly during equity corrections.

Derivatives Market Reset Could Fuel Continuation

Supporting the breakout is a sharp decline in Bitcoin reserves held on exchanges, a key signal that long-term holders are tightening supply. According to Glassnode, exchange balances fell from 3.11 million BTC in March to 2.99 million BTC by late May.

This drop in available supply suggests a possible supply shock in the making.

Anthony Pompliano tells CNBC:

"Every Wall Street firm and asset manager will adopt #Bitcoin and crypto.

They won't have a choice!" pic.twitter.com/YamBZOsWib

— Bitcoin News (@BitcoinNews21M) June 26, 2025

Wednesday’s price surge followed a heavy liquidation of overleveraged short positions, clearing out weak hands and setting the stage for a healthier trend.

Meanwhile, Bitcoin’s exchange-traded volume reached $28.18 billion, marking a significant increase in momentum heading into mid-July. With investor sentiment firming and institutional flows returning, the market may be entering the early phases of a new bull cycle.

What’s Next For BTC? (Good Things)

Bitcoin is now just 7% below the total crypto market’s all-time high valuation of, set in December 2024. With short interest reduced and macro conditions favoring hard assets, the next few weeks will prove decisive.

As long as spot flows stay dominant and exchange reserves continue to decline, Bitcoin appears well-positioned to extend its lead, and, hopefully for us altcoin holders, take the rest of the market with it.

Key Takeaways

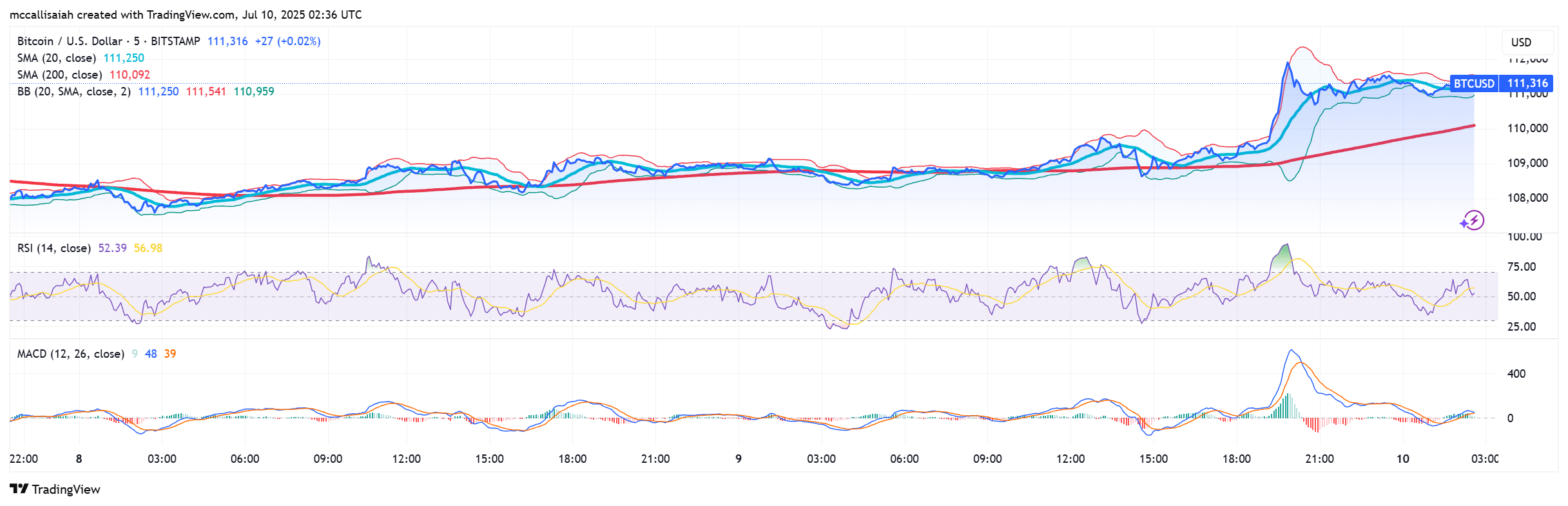

- BTC officially broke into uncharted territory Wednesday, notching a new all-time high of $112,040 on Bitstamp after a 3% intraday gain.

- All eyes are on Powell this month as inflation lingers and labor metrics soften.