Breaking: Ripple’s XRP on Brink of Banking License as SEC Battle Reaches Make-or-Break Moment

Ripple's XRP stands at a historic crossroads—regulatory approval could send it soaring while failure risks a brutal crash.

The SEC's long-running lawsuit takes backseat as banking license rumors spark frenzy. Institutional adoption hangs in the balance.

Critical support levels loom like tripwires beneath XRP's price. One false move and the 'bankers' coin' might need an actual bank bailout.

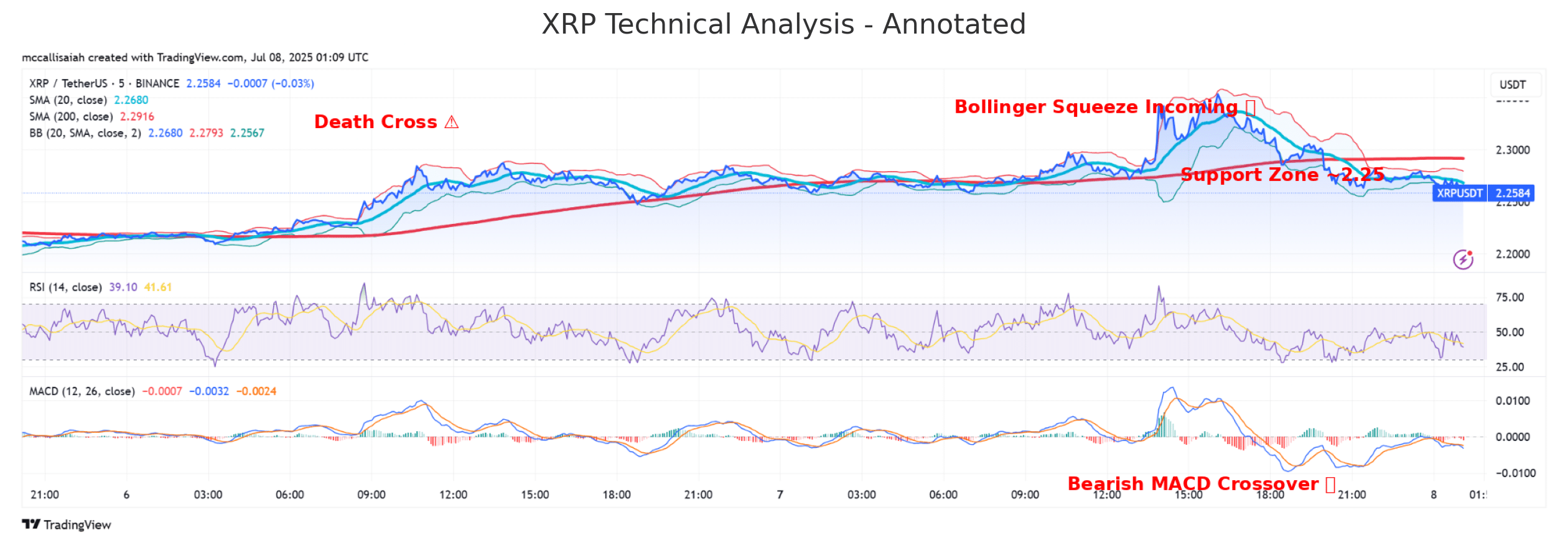

Death Cross and MACD Add Bearish Pressure

Ripple Labs is making a play for Wall Street legitimacy. A July 2 filing with the U.S. Office of the Comptroller of the Currency seeks a national bank charter that WOULD let Ripple operate as a federally regulated trust bank.

If approved, it puts XRP in the running for institutional-grade use, from cross-border payments to potential stablecoin infrastructure.

99Bitcoins analysts see the move as a strategic end-run around slow-moving crypto regulation, potentially clearing a path for Ripple to secure Fed master account access and an eventual XRP spot ETF.

bros, it’s only just beginning for us. Long-term, it could mean a solid tradfi-defi integration for XRP with more liquidity management and use cases for the token.

Conversely, technical indicators aren’t doing XRP bulls any favors. A “death cross” recently formed on the daily chart, with the 20-day moving average crossing below the 200-day. That’s historically a bearish signal, often followed by extended downside.

At the same time, the MACD has flipped negative, crossing beneath the signal line.

Head and Shoulders Pattern Raises Breakdown Risk

Adding to the short-term bear case, XRP is flashing a head-and-shoulders pattern on the daily chart. If $2.23 gives out, the next stop could be $2.20 or lower, with $2.15 waiting in the wings. Volume has also dried up since the last rally.

Lower timeframes show more of the same. XRP’s been boxed between $2.25 and $2.35 for hours now. A brief bounce off $2.26 got smothered at resistance, suggesting the bulls may be losing steam.

XRP pump did NOT die

she’s taking a breather, there’s a difference

— danny (@defiphvntom) July 7, 2025

Despite recent weakness, the broader trend still favors the bulls. The daily chart shows a series of higher lows since XRP bottomed at $1.908, and the 10 to 100-day EMAs continue to flash buy signals. However, the 200-day SMA now sits above current price at $2.36, acting as a lid on further upside.

XRP on the Edge: $2.25 or Bust

XRP keeps climbing out of its $1.90 bottom, marking higher lows and clinging to buy signals from short and mid-term EMAs. Yet the 200-day simple moving average, now at $2.36, isn’t budging.

If support at $2.25 breaks with conviction, the structure risks unwinding toward $2.20 or lower. On the other hand, a bounce with volume could reignite momentum and set up another test of the $2.35–$2.40 range.

Traders should watch $2.25 like a hawk because it’s the fulcrum for what happens next.

Key Takeaways

- TXRP is applying to become a bank in the latest Ripple SEC news.

- Despite recent weakness, the broader trend still favors the bulls. The daily chart shows a series of higher lows since XRP bottomed