Bitcoin Rainbow Chart Alert: The Next 4 Months Could Reshape Crypto History—Is BTC Mirroring Past Breakouts?

Brace for impact—Bitcoin's rainbow chart is flashing signals that could redefine the market. The next 120 days might just be the most pivotal stretch in crypto since the last halving.

Patterns or prophecies?

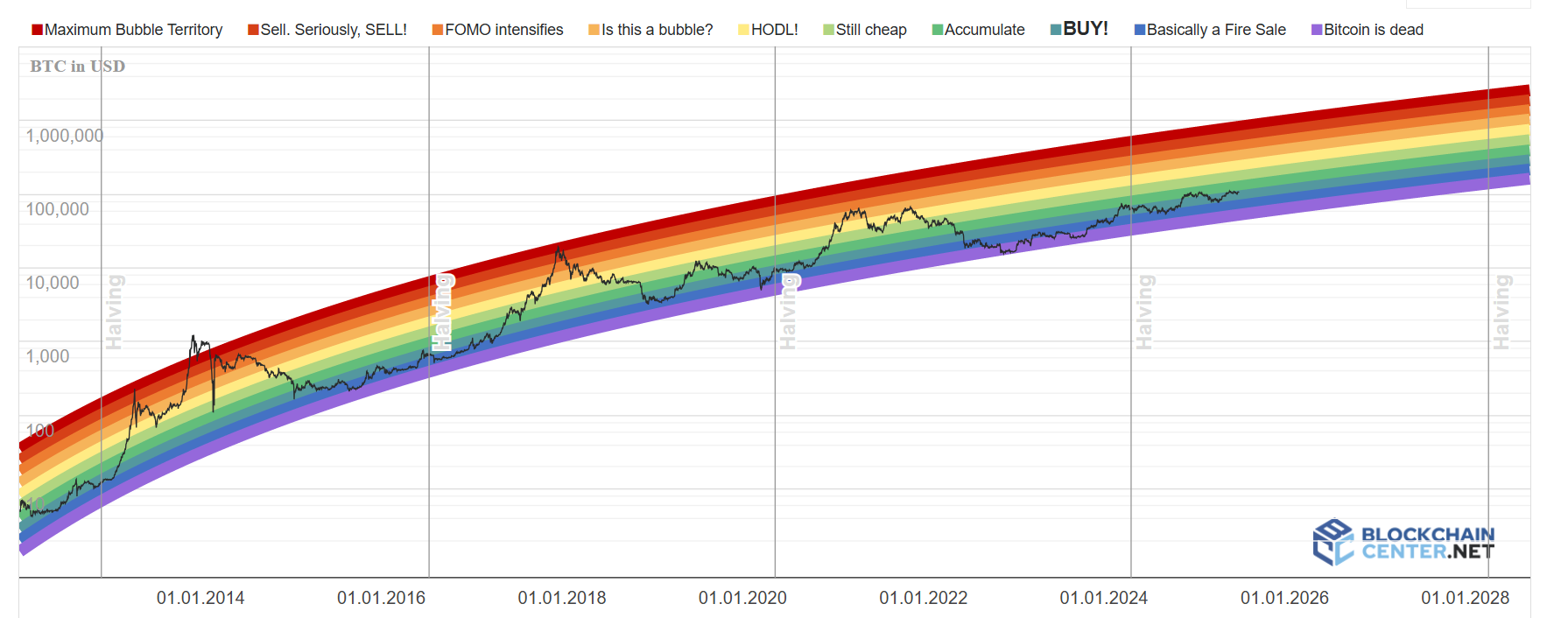

Every trader’s favorite technicolor price model—the Bitcoin Rainbow Chart—is hinting at a historic repeat. If past cycles hold, we’re either staring at generational wealth creation… or the mother of all bull traps (Wall Street’s already placing bets both ways).

When rainbows turn into rocket fuel

The chart’s logarithmic bands have accurately predicted every major BTC cycle since 2011. Now they’re tightening like a spring coil—just like they did before the 2017 and 2020 explosions. This time? The compression period aligns perfectly with post-halving momentum.

Four months to fortune or folly

Key levels to watch: if BTC holds above the ‘belief’ band through Q3, all bets are off. Break the top rainbow tier? Say hello to price discovery mode. But slip below the ‘fire sale’ line? Even the diamond hands might sweat.

Meanwhile, traditional finance ‘experts’ still can’t decide if crypto is dead or the second coming of gold—maybe they’ll figure it out after the next 200% move.

Yet, 99Bitcoin’s analysis shows that USDT’s supply is peaking, and Leveraged shorts are swelling, which are signs we could oscillate either way.

Meanwhile, critiques of popular predictive models like economist Raoul Pal’s M2-Bitcoin correlation make us wonderis this cycle different?

Bitcoin Rainbow Chart: The Battle Between Bulls and Bears

Bitcoin rebounded from a multi-month low of $98k, wiping out bearish positions priced on geopolitical fears. Currently trading NEAR $108,952, BTC is consolidating within the $106k–$108k range as bulls eye a retest of the psychological $110k level.

well-known trader James Wynn has a 40x short position, worth $1.49 million, that hinges on $108,630 as a key liquidation level. Wynn and other bearish traders could face a short squeeze if bitcoin breaks above this zone.

All of this could trigger a new BTC ATH and subsequent alt-season later in the summer.

Altseason loading… pic.twitter.com/sYgCmHNEv7

— Julien Bittel, CFA (@BittelJulien) June 28, 2025

Furthermore, Tether’s circulating supply hit a record $158 billion late last week. Pair this with BlackRock’s steady $1.15B weekly Bitcoin buys, which clearly signals that institutions are positioning with intent.

Critiquing the M2-Bitcoin Correlation

Bitcoin’s run past six figures has reawakened an old debate: Is any of this actually predictable? Raoul Pal says yes, pointing to M2 money supply trends as a crystal ball for BTC. However, 21st Capital Co-Founder Sina says that’s nonsense.

Epic collection of Raul Pal’s disastrous recommendations

People actually pay to listen to him

pic.twitter.com/edqUhEaVsz

— Sina![]()

![]() 21st Capital (@Sina_21st) January 15, 2025

21st Capital (@Sina_21st) January 15, 2025

In a takedown posted June 24, he argued the model’s predictive power dissolves on contact with reality. The more you tweak it, the worse it gets. “It’s not forecasting but forcing a story onto the chart,” he said.

Regardless, the next four months will show if we’re in a “traditional cycle” where Bitcoin goes bananas off of money printing, rate cuts, and geopolitical cooldown, or if Sina is right.

What’s Next for Bitcoin?

Blind faith in legacy Bitcoin models is fading. Analysts like Sina are urging a return to fundamentals: liquidity flows, wallet activity, and real-time network signals.

Pack your bags, boys (and girls), the next few weeks may decide whether BTC breaks orbit or gets dragged back into chop.

Key Takeaways

- Critiques of popular predictive models like economist Raoul Pal’s M2-Bitcoin correlation are spreading

- All eyes are on Powell next month as inflation lingers and labor metrics soften.