EU Trade Deal vs. Trump’s Tariff War: How Bitcoin (BTC/USD) Could Skyrocket Next

Geopolitical tensions just got a new fuel injection—and crypto markets are primed to react. As Brussels and Washington clash over trade policies, Bitcoin's role as a hedge against traditional finance chaos looks stronger than ever.

Here's why traders are watching the charts:

The Dollar Squeeze Play

When tariffs fly, fiat currencies tremble. Bitcoin's historic inverse correlation with the DXY could trigger major volatility—and opportunity—for BTC/USD pairs.

Institutional Safe Haven?

Gold's old-school. With EU-US trade flows potentially disrupted, crypto's proving its mettle as the 21st-century store of value (much to bankers' dismay).

The Cynic's Corner

Wall Street will still find a way to package this volatility into a structured product with 2% fees. Meanwhile, Bitcoin keeps cutting out the middlemen.

EU Prepares for Tough Talks as Trump’s Tariff Threats Loom

This week, European Commission President Ursula von der Leyen extended an olive branch, declaring the EU prepared for a trade pact with the United States. “All options remain on the table,” she said in a NATO meeting in the Hague.

The stakes are monumental, with President TRUMP threatening toslap 50% tariffs on EU goods, a move that could cripple industries like automotive and steel. Germany, already bearing the brunt of existing tariffs up to 25%, feels the pressure acutely.

Belgian Prime Minister Bart De Wever distilled the sentiment, urging, “We must avoid tariffs at all costs.”

In case you forgot:

President Trump's 90-day tariff pause now only has 13 days remaining.

This means without any new trade deals, on July 9th, tariff rates will rise as follows:

1. Country-specific "reciprocal tariffs" return

2. Tariffs of up to 50% on EU imports

3. 30%…

— The Kobeissi Letter (@KobeissiLetter) June 26, 2025

The European car industry is particularly vulnerable, with EU trade negotiator Maroš Šefčovič warning, “The car industry of Europe is clearly bleeding. Tariffs at this level are unsustainable.”

While the bloc considers retaliatory measures worth $95 billion should talks fail, von der Leyen proposed a broader vision of “redesigning” global trade rules, aiming for more balanced rules.

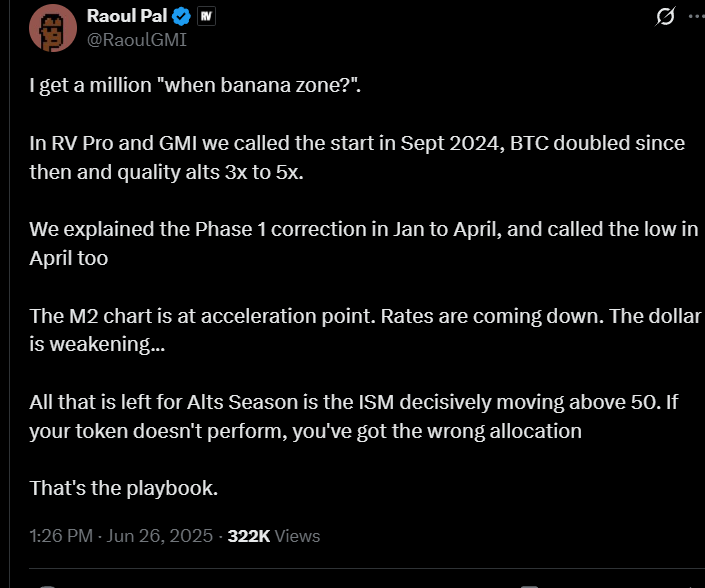

BTC USD Strength Amid Institutional Shift and Geopolitical Tensions

Behind the noise of trade talks, Bitcoin is quietly shifting hands. Wallets holding 1,000+ BTC have added 507,700 BTC over the past year, nearly 1,460 per day, according to CryptoQuant.

With daily issuance now ~450 BTC post-halving, institutions are absorbing more than retail is shedding, setting the stage for

Moreover, after brief turbulence from U.S.-Iran tensions, BTC bounced back to $107K. “This isn’t just crypto,” said analyst James Toledano. “It’s the weak dollar, falling oil, and rate cut bets driving the rebound.”

The EU’s struggle with trade barriers exposes deep vulnerabilities within its Core industries, but Bitcoin’s steady performance in turbulent times tells a different story.

This widening gap between faltering old-world systems and ascendant digital alternatives speaks volumes about where the Meta is trending.

Key Takeaways

- With tariffs looming like the sword of Damocles. Everything is chopping, including BTC USD.

- Behind the noise of trade talks, Bitcoin is quietly shifting hands.