BONK on the Brink? Technical Indicators Flash Red as Meme Coin Stumbles

Another day, another meme coin teetering on the edge—welcome to crypto’s casino economy. BONK, the Solana-based token that rode the hype wave to absurd heights, now shows ominous technical fractures.

Key support levels shattered like a degenerate trader’s margin account. RSI diving deeper than a VC’s conviction during a bear market. Volume drying up faster than liquidity in a rug pull.

Is this the final ’woof’ for the dog-themed token? Or just another fakeout in an asset class where ’fundamentals’ means which influencer last shilled it? Either way—watch those stop losses, folks.

(@champtgram) May 28, 2025

(@champtgram) May 28, 2025

There are people like Champ who think there is still “bread” left in the coin. He points out some good fundamentals, too. I WOULD not say my technical analysis is always correct. But I think it is also important to consider multiple scenarios, even if the long-term price is projected to make a new ATH.

BONK Jumping Up Or Plunging Down? Technical Analysis Speaks

(BONKUSD)

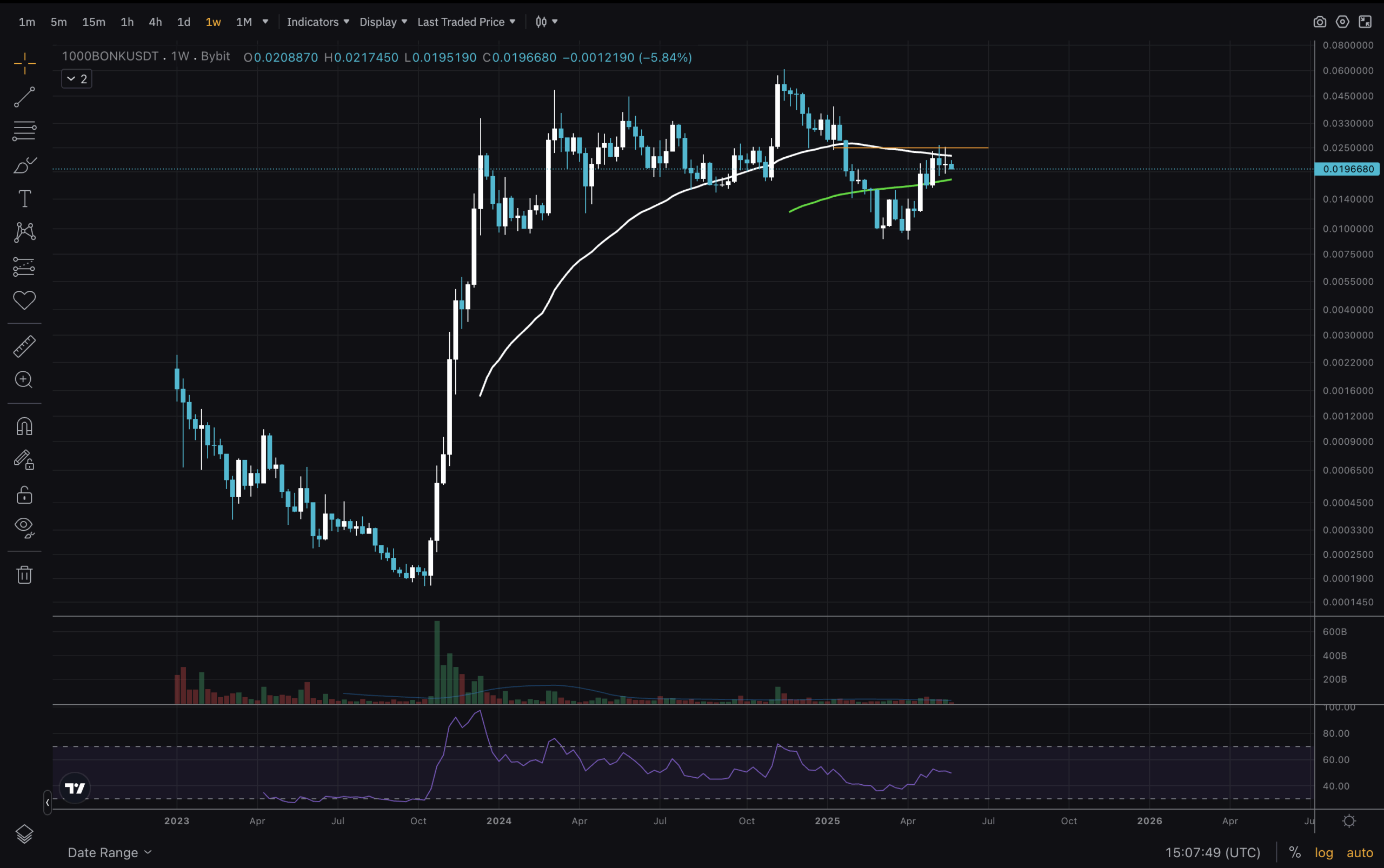

BONK chart on the Weekly timeframe. I’m using 1000BONKUSDT on Bybit for simplicity’s sake. Let’s start with simple moving averages and market structure. We see a massive run at the end of 2023.

Most of the 2024 price range was spent, and this year it went below its previous low (orange line), and the last 3 candles were rejected from that level, which aligns with MA50. The two bottoms of this upper range are at the same price of $0.0095. That’s an important support level.

(BONKUSD)

Next, for our analysis, we will look at the Daily timeframe. Here, the BONK price ranges around the Moving Averages. This month, it broke below MA200 and tested its underside twice, both times rejected.

For a MOVE to the highs to happen, it must reclaim that level. MA50 and MA100 are potential supports that sit a bit higher that the $0.0095 level. What can be scary (or exciting) to traders is this huge empty space after the massive pump at the end of 2023.

Concluding Thoughts on BONK Price Action

(BONKUSD)

At the end, we will analyse the 4H chart. Here, MA50 and MA100 rejected the price. And is now breaking below MA200. Go back and look at the RSI levels on the previous charts and on this one now. On the Weekly, it looks like it can go either way. It is still in the bullish area daily, but the rejection from MA200 and breaking below it on 4H timeframe could turn out to be a good r:r entry for a short. Even though fundamentals are strong, sometimes price retraces, and it might be time for it with BONK.

Stay SAFE and don’t let other traders get your money!

Join The 99Bitcoins News Discord Here For The Latest Market Update

Is This The End of BONK? Technical Analysis Gives Warning Signs

- Price has been in the upper range for a year – can be accumulation or distribution

- RSI might need to cool down more

- Potential move down to $0.0095 or lower

- Needs to reclaim MA200 on 1D for