Coinbase Insider Breach Exposes Up to $400M—Crypto’s ’Trustless’ Myth Takes a Hit

Another day, another crypto heist—only this time, the backdoor was wearing a company badge. Coinbase confirms an insider scam bypassed security protocols, potentially draining nine figures from institutional wallets. Who needs hackers when you’ve got employees with access?

Security teams scramble as internal controls fail. The breach exposes the dirty secret of centralized exchanges: your funds are only as safe as the weakest human link. Cold storage? Multi-sig? None of it matters when someone inside flips the script.

Wall Street analysts smirk while tweeting ’not your keys, not your coins’—as if traditional finance hasn’t had its own parade of embezzlement scandals. The real tragedy? This fuels regulators’ fire just as institutional adoption was gaining steam. Brace for impact.

The Attack Started With a Single Email

It all began on May 11, when Coinbase received an email from someone claiming they had stolen customer data. But this wasn’t your usual phishing scam. According to the company, the attackers paid off a handful of contractors and employees to get access to internal tools and information. From there, they used that access to impersonate Coinbase staff and trick users into handing over their crypto.

BREAKING NEWS : COINBASE HACK – issue is KYC. The more we KYC the more at risk the user is. pic.twitter.com/SN2eQKjQWI

NEWS : COINBASE HACK – issue is KYC. The more we KYC the more at risk the user is. pic.twitter.com/SN2eQKjQWI

— Jason Ai. Williams (@GoingParabolic) May 15, 2025

Only a small portion of users, less than 1 percent, were impacted. But considering Coinbase has millions of customers, even that small group could add up to a big financial hit.

A $20 Million Ransom Request? Declined.

Once the attackers had what they wanted, they came back with a demand. They asked Coinbase to pay $20 million to keep the stolen data from being released. Coinbase didn’t flinch. The company refused to pay and went public with the incident instead.

The CEO of Coinbase has rejected a $20M ransom demand

He then placed a $20M reward to find the cyber-criminals behind it pic.twitter.com/LeVp3sTxk7

— Dexerto (@Dexerto) May 15, 2025

They’ve promised to reimburse affected customers and have already taken disciplinary action internally. Any employees who helped leak customer information have been let go. And to take things a step further, Coinbase has set up a $20 million reward fund for anyone who can help bring the attackers to justice.

How Much Could This Cost?

In a filing to U.S. regulators, Coinbase estimated the damage could range between $180 million and $400 million. That number includes the cost of fixing the breach, reimbursing users, and any legal fallout that might follow. It could go up or down depending on what happens next, especially if any funds are recovered or more losses are uncovered.

Investors didn’t take the news lightly. Coinbase stock dropped just over 4 percent after the story went public.

This Isn’t Just a Coinbase Problem

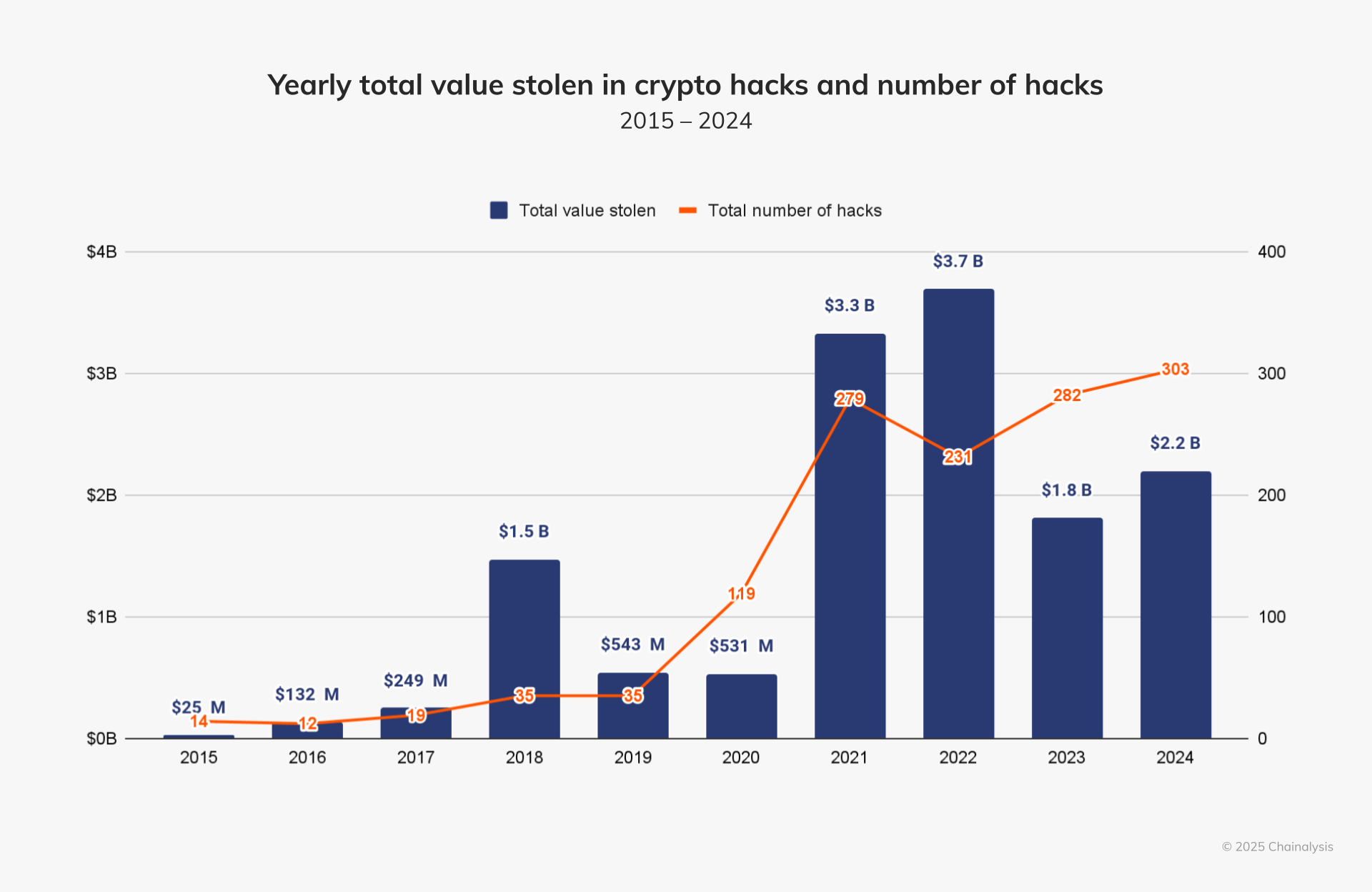

The crypto space has had a rough time with security lately. According to data from Chainalysis, hackers made off with more than $2 billion in stolen funds in 2024 alone. And as the industry grows, so do the targets. It’s no surprise that attackers are getting more creative and going after bigger fish.

This isn’t the first time a major platform has faced an insider threat or phishing scheme. But Coinbase’s situation shows how complex and costly these attacks are becoming, even for well-established companies.

What Coinbase Users Should Know

Coinbase is urging users to stay alert. The company is reminding everyone that it will never ask for passwords, two-factor codes, or requests to send crypto somewhere else. If something feels off, users are advised to lock their accounts and report it immediately.

Coinbase Hack: A Harsh Lesson for the Industry

With the Coinbase hack, we’re seeing how even the biggest crypto platforms can be vulnerable from the inside out. This is a clear sign that crypto platforms, no matter how big, need to stay sharp. And for users, it’s another reason to be extra cautious. In a space where trust can be fragile, one breach like this can Ripple far beyond the people directly involved.

Key Takeaways

- Coinbase is facing losses between $180 million and $400 million after a targeted insider-driven cyber attack compromised its internal systems.

- Attackers allegedly bribed contractors and employees to gain internal access, then impersonated Coinbase staff to trick users into handing over crypto.

- Coinbase refused to pay a $20 million ransom and has instead gone public, promising to reimburse affected users and investigate the breach.

- The company has fired insiders involved in the scam and launched a $20 million bounty fund to track down those responsible for the attack.

- The hack highlights growing cybersecurity threats across the crypto industry, where even top-tier platforms are vulnerable to insider manipulation.