Ethereum Breaks Resistance: $3,000 Target in Sight as ETH Defies Market Gravity

Ethereum’s price action is turning heads—again. After weeks of consolidation, ETH just sliced through key resistance levels like a hot knife through institutional FUD.

The Setup: Network upgrades and surging DeFi TVL are fueling the rally. Even the SEC’s usual saber-rattling couldn’t derail this train.

Next Stop? Traders are eyeing the psychological $3K barrier. Last time ETH flirted with this zone, it triggered a 20% correction—but this time, the derivatives market smells blood.

Of course, some Wall Street ’experts’ still insist crypto is a bubble. Funny how they never say that about their own leveraged repo markets.

Will ETH Crypto Break $3,000?

Technically, ETH is well-positioned to extend gains and even outperform Bitcoin in the short to medium term, especially if it closes above $3,000.

The ETHUSDT candlestick chart shows a breakout formation. Despite a slight slowdown yesterday, the uptrend remains intact as long as $2,400 holds.

If prices breach $2,800 by the close of today, ETH has a high probability of reaching $3,000. The next targets WOULD be the 2024 high of $4,100 and, later, the 2021 peak of $4,900.

Data from Sentora reveals that over $1.2 billion worth of ETH was withdrawn from centralized exchanges last week.

$1.2 billion worth of ETH has been withdrawn from centralized exchanges in the past 7 days.

This sustained trend of net outflows, intensifying since early May, signals continued accumulation and reduced sell-side pressure. pic.twitter.com/fMYJmPOnB0

— Sentora (previously IntoTheBlock) (@SentoraHQ) May 14, 2025

Withdrawals have accelerated since early May 2025, signaling that owners are HODLing or engaging in DeFi activities, a bullish sign for ETH.

Ethereum Foundation Announces Trillion Dollar Security Initiative

The Ethereum Foundation recently announced the “Trillion Dollar Security” (1TS) project, to be executed in three phases.

This initiative aims to fortify Ethereum, making it a secure and robust LAYER for global financial use.

0. Announcing the Trillion Dollar Security (1TS) initiative: an ecosystem-wide effort to upgrade Ethereum’s security to help bring the world onchain.

— Ethereum Foundation (@ethereumfndn) May 14, 2025

The goal is to ensure Ethereum can handle demand from billions of users, each confidently storing at least $1,000 onchain, while smart contracts manage over $1 trillion in value.

This project responds to moves by BlackRock and other institutions leveraging Ethereum for tokenization and driving DeFi growth.

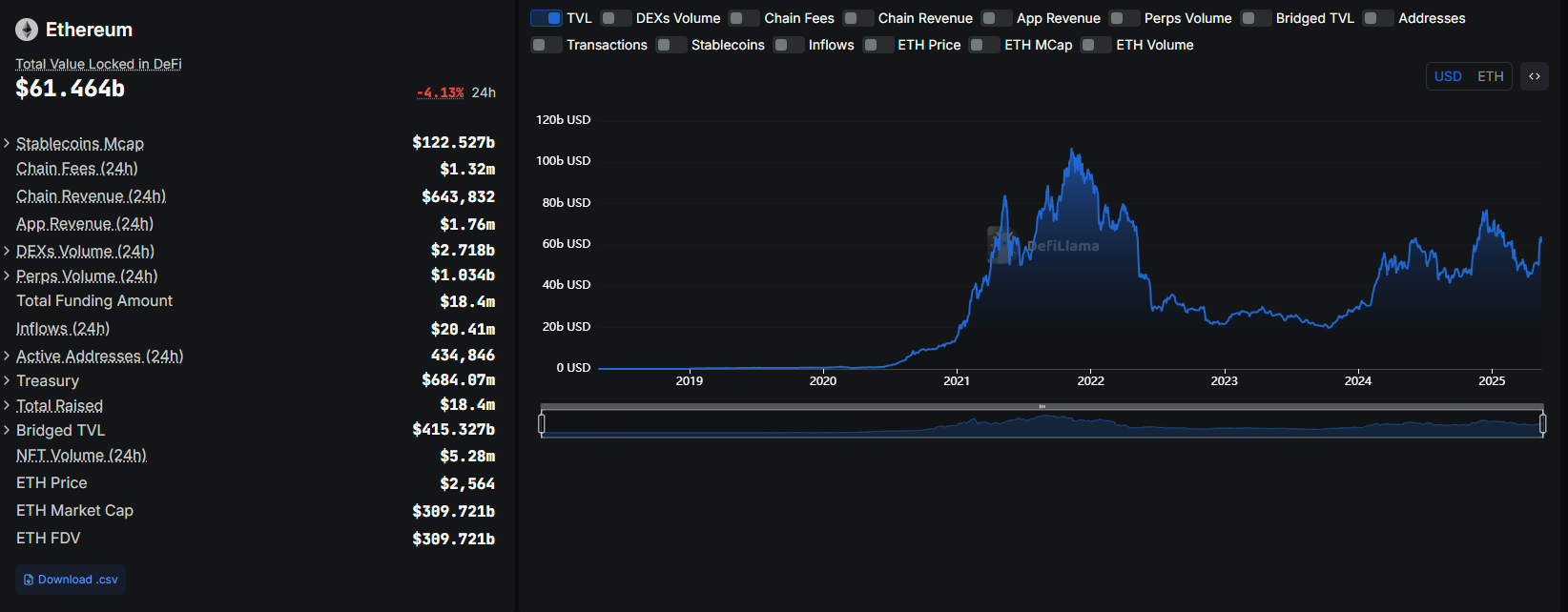

Currently, the Ethereum DeFi ecosystem commands over $61 billion in total value locked (TVL). It is projected to expand, especially if laws in the United States promoting tokenization, looking at stablecoin regulation priorities, are fast-tracked.

BTCS Follows Strategy and Builds an ETH Plan

BTCS, a U.S.-based blockchain firm, is capitalizing on Ethereum’s momentum.

Yesterday, the company announced it will issue up to $57.8 million in convertible notes, led by ATW Partners. Proceeds will expand their Ethereum validator node operations, increasing ETH exposure while earning staking yields.

Charles Allen, CEO of BTCS, said:

“Similar to how MicroStrategy leveraged its balance sheet to accumulate Bitcoin, we are executing a disciplined strategy to increase our Ethereum exposure and drive recurring revenue through staking and our block building operations—while positioning BTCS for meaningful appreciation should ETH continue to rise in value.”

This MOVE aligns with broader institutional trends.

According to SosoValue, institutions purchased over $63 million in the last 24 hours, pushing cumulative net inflows to $2.53 billion.

Spot Ethereum ETFs in the U.S. now control nearly 3% of ETH in circulation.

9 High-Risk High-Reward Cryptos for 2025

Ethereum Price Up 35%: Will ETH Crypto Break $3,000?

- Ethereum rallying, nears $3,000 as ETH crypto adds 35% in one week

- Ethereum Foundation announces the Trillion Dollar Security initiative to strengthen the network

- BTCS raising funds to expand Ethereum validator operations

- Institutions accumulating more ETH as prices tick higher