EOS Eyes $1.6 Breakout—Analysts Bet on May 2025 Surge

EOS, the blockchain dark horse, is flashing bullish signals as analysts pencil in a $1.6 target for May 2025. After years of ’institutional-grade blockchain’ promises—and Wall Street-grade underperformance—traders are cautiously optimistic.

Technical breakout or last gasp before another rug pull? The charts suggest momentum, but let’s see if the network delivers more than just PowerPoint decentralization.

One hedge fund manager quipped: ’If EOS hits $1.6, I’ll eat my tie—but it’s a Hermès, so I’m hedged either way.’

EOS Rebrands to Vaulta, Token Conversion Underway

That seems to be the past now. There is hope.

EOS is undergoing a bold reinvention, pivoting away from the EOS brand and rebranding to Vaulta. Under the new plan, Vaulta aims to become a Web3 bank with the ambition of being a key player in the institutional DeFi space.

The reinvention is strategic. It will fuse DeFi tools with legacy financial systems and offer multiple services, including wealth management via partners like exSat and Ceffu, a custodian.

Additionally, their services will include consumer payments, enabling users to enjoy instant, real-time settlements through fast and low-cost crypto transactions.

As previously reported by 99Bitcoins, Vaulta is also focused on providing portfolio investment opportunities, where clients can access real-world assets and attractive DeFi investment products.

This strategy will be supported by the Vaulta Banking Advisory Council, featuring prominent crypto figures like Lawrence Truong, former Binance Canada executive, alongside executives from ATA Financial and Tetra Trust, who will be at the driving seat of this transformation.

However, before Vaulta goes live, EOS holders must convert their tokens to A at a 1:1 ratio.

Swapping began on May 14 via the Vaulta Swap Portal and will remain open for four months.

$EOS becomes $A on May 14.

Swap 1:1, No Tokenomics changes, No fees.

Swap securely on May 14 at https://t.co/5wAfMpoxWO pic.twitter.com/65fQZtgG3O

— Vaulta (prev. EOS) (@Vaulta_) May 7, 2025

The conversion is supported by multiple exchanges, including Binance. Afterward, once token holders convert their EOS to A, exchanges are expected to delist EOS.

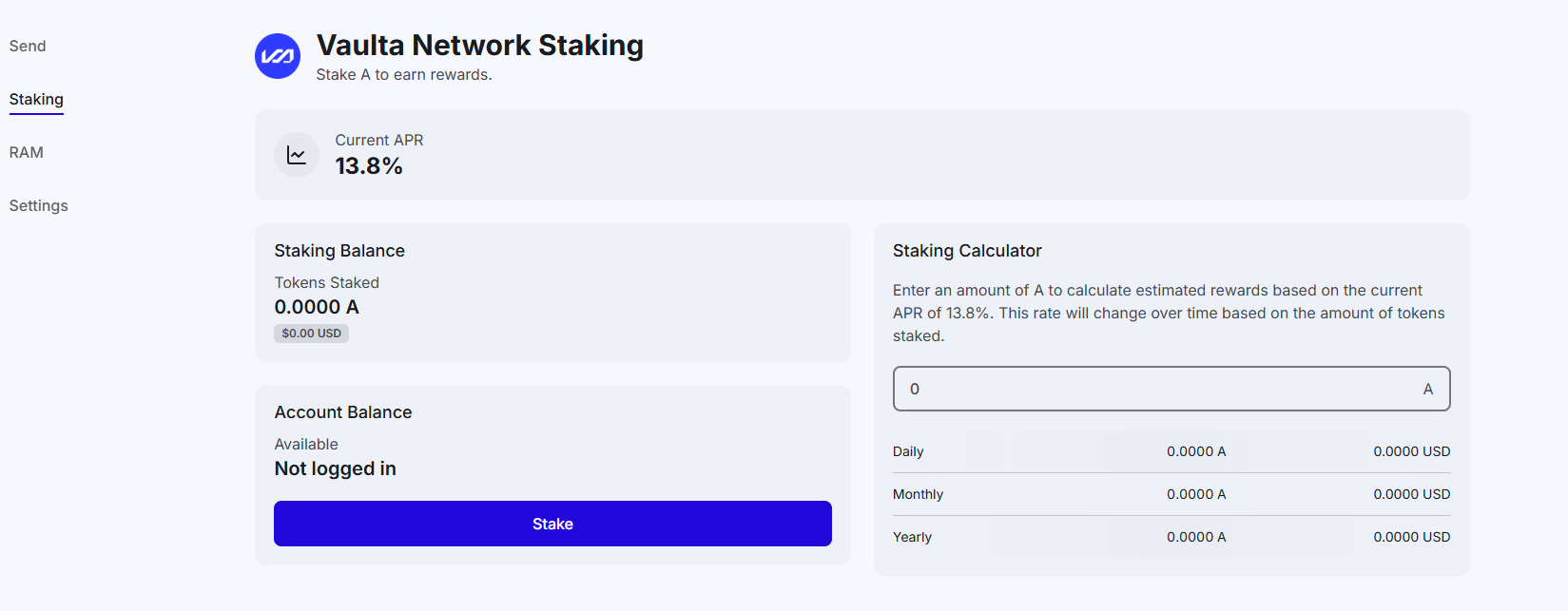

To encourage token swapping, those who stake A will receive a 13.8% yield, significantly higher than the sub-10% yields offered by some of the best cryptos, such as solana and Ethereum.

Will EOS Crypto Rally to $1.6?

Considering Vaulta’s vision and dissociation from the EOS brand, without executing a fork, some traders believe A prices will rise in the coming weeks.

As a result, one X user thinks EOS could soar to $1.6, breaking past 2024 highs in a buy-trend continuation formation.

The next $EOS target will reach new all-time highs. pic.twitter.com/3xmzCdpWtP

— Coinvo (@ByCoinvo) May 14, 2025

Bullish as this outlook is, EOS bulls face challenges. First, the coin must break the $1 psychological level.

If successful, there’s a high probability of EOSUSDT rising to $1.6, assuming trading volume is sustained and other coins, including top Solana meme coins, continue to post higher highs.

A broader market recovery and trend continuation, reflecting the rally of Q4 2024, could accelerate the lift-off, helping Vaulta cement its brand as it seeks to reassure EOS investors and those who believed in the EOS vision back in 2018.

12 Best Crypto Presales to Invest in May 2025 – Top Token Presale

EOS to Vaulta Rebrand: Will EOSUSDT Break $1.6?

- EOS blockchain is rebranding to Vaulta, bridging DeFi with TradFi

- The EOS token conversion is ongoing. Holders to receive A tokens at a 1:1 ratio

- Stakers of A to receive 13.8% APY, better than what Ethereum and Solana offer

- Will EOSUSDT break $1 and rally to $1.6?