Bitcoin Smashes $100K Barrier as Crypto Market Cap Hits $3 Trillion—Wall Street Still Calls It a ’Fad’

Digital gold just got a platinum upgrade. Bitcoin’s relentless rally breaches the psychological six-figure threshold—dragging Ethereum, Solana, and memecoins into the stratosphere.

Behind the surge: Institutional ETFs finally swallowing their pride, Hong Kong’s regulatory greenlight, and that classic crypto cocktail of FOMO and leverage.

Meanwhile in traditional finance: Hedge funds quietly allocate 5% to BTC futures while publicly dismissing it as ’rat poison squared.’ The $3T milestone? Just another day for an asset class that wasn’t supposed to survive 2018.

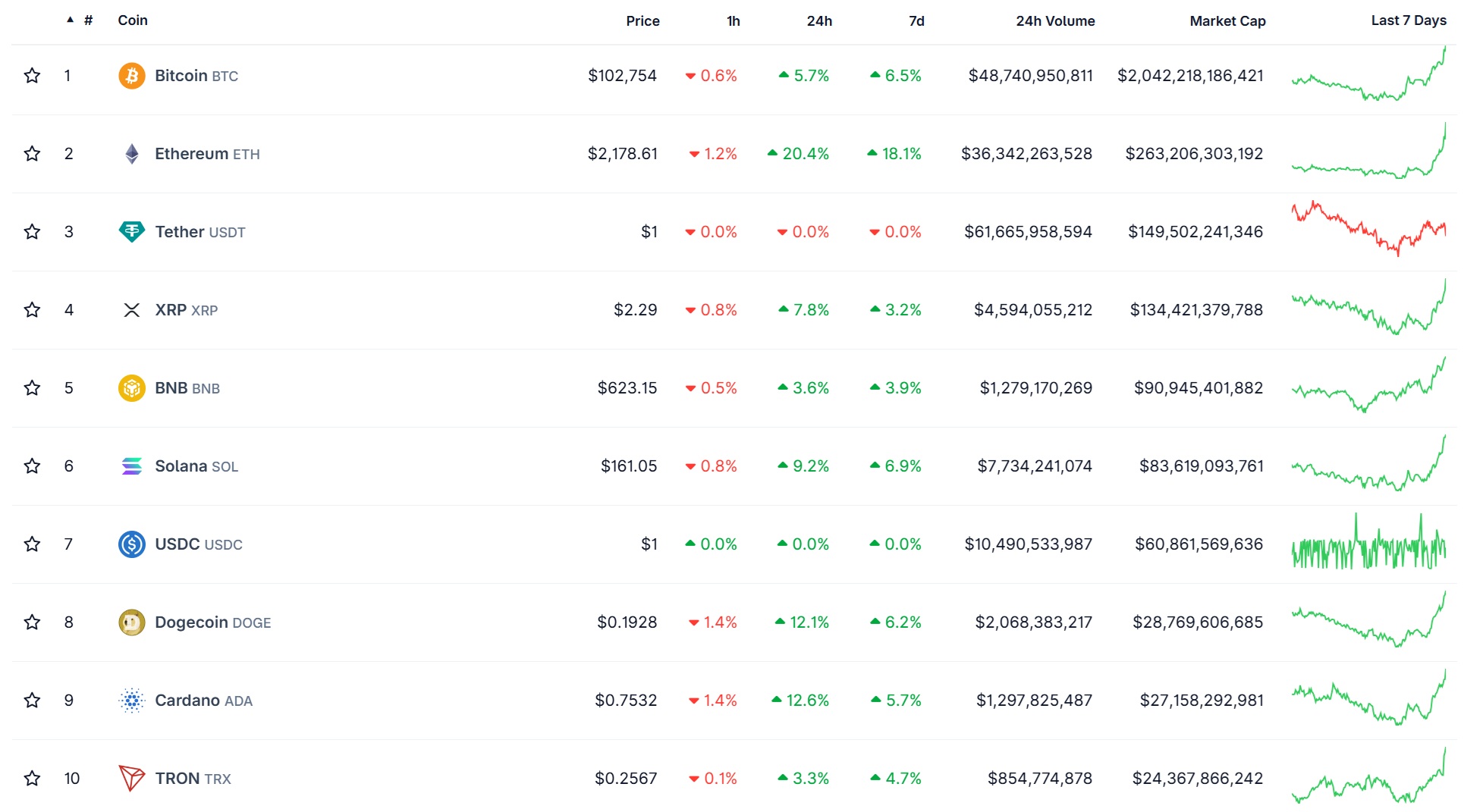

Altcoins rallied after Bitcoin (BTC) breached $100K today – Source: Coingecko

Altcoins rallied after Bitcoin (BTC) breached $100K today – Source: Coingecko

It’s a number we haven’t seen in years, and the timing has plenty of people asking whether this is the start of a bigger breakout or just a short-lived sugar rush.

Bitcoin Breaks $100K Again

At the heart of the rally, of course, was Bitcoin. It jumped more than 5 percent, crossing the six-figure mark to hit $101,329. That’s the first time it’s topped $100,000 since February, and it didn’t get there alone. ethereum also surged by over 14 percent to cross $2,050. Other big names like Solana, XRP, and Cardano posted strong gains too, all contributing to the $3 trillion market cap milestone.

Traders aren’t just chasing green candles here. The MOVE was fueled by some rare good news from the global political front.

The Trade Deal That Lit the Fuse

What really set things off was a joint announcement from President Donald TRUMP and U.K. Prime Minister Keir Starmer. The two leaders revealed a preliminary trade agreement aimed at lowering tariffs and boosting market access between the two countries.

#BREAKING: President Trump announces a MAJOR trade deal with the United Kingdom

#BREAKING: President Trump announces a MAJOR trade deal with the United Kingdom

This ended up being a HELL of a deal for us!

$6 BILLION in new tariff revenue

$6 BILLION in new tariff revenue US tariffs on imports from UK raised to 10%

US tariffs on imports from UK raised to 10% UK tariffs on imports from US lowered to 1.8%

UK tariffs on imports from US lowered to 1.8% $5 BILLION in… pic.twitter.com/ivdx41tTaj

$5 BILLION in… pic.twitter.com/ivdx41tTaj

— Nick Sortor (@nicksortor) May 8, 2025

The U.S. is cutting tariffs on British cars and metals. In exchange, the U.K. is dropping its digital services tax and easing up on tariffs for American products. It’s a deal with big implications for trade, and apparently for crypto too.

Wall Street’s Reaction? Also Green

The news didn’t just lift crypto. Traditional markets perked up as well. The Dow gained over 250 points, with the Nasdaq and S&P 500 also posting gains. It looks like investors are viewing this agreement as a step toward de-escalating trade tensions, which have been rattling nerves lately.

When traditional markets breathe easier, crypto tends to ride the same wave. And that’s what we’re seeing now.

Bitcoin hits $100K: Institutions Are Watching Closely

Behind the scenes, big institutions are paying attention. More firms have been dipping into digital assets, especially since spot bitcoin ETFs got the green light earlier this year. That means when confidence returns, it comes with serious money.

And now that the market cap is back in the $3 trillion range, there’s growing belief that we might be gearing up for the next leg of a longer bull run, assuming regulatory issues don’t throw a wrench into the engine.

So, What’s Next?

Crossing $3 trillion is more than just a headline number. It’s a reminder that crypto is still closely tied to global sentiment, especially when big political deals hint at smoother economic waters ahead. Whether it’s Bitcoin leading the charge or Ethereum making big moves, digital assets are back in the spotlight.

For now, the mood is optimistic. But this is crypto. As always, it can change fast.

Key Takeaways

- Bitcoin surged past $100,000, helping push the total crypto market cap above $3 trillion for the first time since early 2025.

- The rally was fueled in part by a new trade agreement between the U.S. and the U.K., which boosted investor confidence across global markets.

- Ethereum gained over 14%, while Solana, XRP, and Cardano also posted strong gains, contributing to the bullish momentum.

- Traditional financial markets also responded positively, with the Dow, Nasdaq, and S&P 500 all moving higher on trade optimism.

- Institutional investors are watching closely, and with crypto back at $3 trillion, some see signs of a new bull run taking shape.