Tether’s $800M Gold Hoard Revealed: Inside the Stablecoin Giant’s Hard Asset Play

Tether just flashed its Midas touch—over $800 million in physical gold now backs the world’s largest stablecoin. The revelation comes as regulators globally tighten scrutiny on crypto reserves.

Shiny insurance policy or PR gambit?

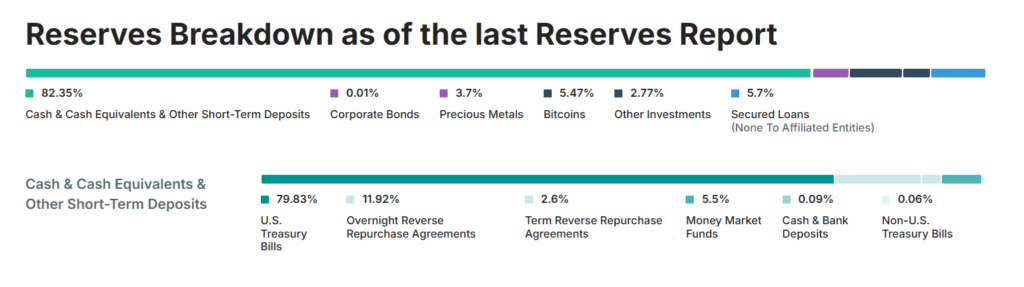

While the gold reserve adds tangible asset backing, skeptics note it’s a drop in the bucket compared to Tether’s $110B+ commercial paper holdings. ’Nothing says trust like a 0.7% gold hedge,’ quipped one Wall Street analyst.

Vaults over volatility

The move mirrors crypto’s broader pivot toward hard assets—a tacit admission that even stablecoins crave the scent of physical certainty. But with bullion prices hitting all-time highs, Tether’s timing raises eyebrows. Did they buy the top, or is this just the opening bid?

One thing’s clear: in an era where ’backed by nothing’ is a badge of honor for some tokens, Tether’s playing a different game. Whether that game is chess or three-card monte remains to be seen.

A Glimpse into Tether Gold’s Market Strength

Tether Gold (XAUT) is now officially backed by more than 7.7 tons of physical gold, according to a third-party attestation from BDO Italia released Monday. That’s over $800 million in value.

So who knows — maybe Tether is becoming better than the Fed?

Riding a broader shift toward hard assets, XAUT ROSE from $3,123 to $3,344 between late March and April, pushing its market cap to $825 million. As XAUT grows, gold is having a moment—and so is tokenized gold.

@Tether_to released its first official attestation for Tether Gold ( $XAUT ) for Q1 2025:

@Tether_to released its first official attestation for Tether Gold ( $XAUT ) for Q1 2025:

– 7.7 tons of gold backing 246,523 XAU₮ tokens

– $770M market cap

– Fully regulated in El Salvador

– Each token = 1 troy ounce of real gold stored in Switzerland. pic.twitter.com/7PZRATpWfQ

— Satoshi Club (@esatoshiclub) April 28, 2025

Tether CEO Paolo Ardoino made sure to fan the flames, jumping on social media to frame XAUT as the stablecoin world’s golden alternative.

“While central banks are stacking up hundreds of tons of gold, XAUT is set to become the standard tokenized gold product for the people and institutions,” said Ardoino.

His statement comes as central banks increasingly pivot toward gold. A report from the World Gold Council revealed that 29% of central banks plan to boost their gold reserves within the next year.

Why Tether XAUT and Gold Are Gaining Ground

Digital gold solves a few old problems: no vaults, no insurance premiums, no shipping. XAUT promises bullion without the baggage.

But Tether’s path to legitimacy is still under review. The recent attestation confirms the gold exists—but critics say it’s not enough. The lack of deeper financial disclosures continues to raise eyebrows, echoing familiar concerns from the USDT debate.

()

Even so, it seems like Tether is finally trying to clean up its act. With Paxos and others circling the same space, competition could finally force the tokenized gold market to tighten up—or flame out.

The New Digital Standard?

XAUT gives risk-averse capital a path into crypto without leaving gold behind.

Whether it becomes a flagship or just a flashy side bet, one thing’s obvious: gold on-chain is starting to trend.

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Increasingly, Tether is becoming the new Fed, as it has now announced that it is entering the precious metals market.

- Tether Gold (XAUT) is now officially backed by more than 7.7 tons of physical gold, according to a third-party attestation from BDO Italia released Monday.

- XAUT gives risk-averse capital a path into crypto without leaving gold behind. .