Ethena DEX Smashes $250M TVL Before Launch — ENA Primed for Explosive Growth?

Ethena's decentralized exchange just crossed a staggering $250 million in total value locked—and it hasn't even officially launched yet.

The Pre-Launch Phenomenon

While traditional finance waits for quarterly reports and board approvals, DeFi protocols like Ethena are rewriting the rulebook. Hitting a quarter-billion dollars in TVL during pre-launch phases would make any Wall Street banker spill their morning coffee.

ENA's Impending Momentum

The native token stands at the edge of what could become one of 2025's most dramatic price surges. With this level of pre-market validation, ENA could easily bypass the typical post-launch growing pains that plague lesser projects.

Market analysts whisper about perfect storm conditions—institutional interest meets retail FOMO, all while traditional finance still tries to figure out what a 'decentralized exchange' actually means.

Will ENA deliver on its explosive potential, or become another case study in crypto hype cycles? The market's about to find out.

Can Terminal’s “Yield Skimming” Improve DeFi Liquidity and Make ENA the Best Crypto to Buy Right Now?

At launch, users can expect support for USDe, sUSDe, and USDtb, the latter backed by BlackRock’s BUIDL paired against major assets such as ETH and BTC.

The exchange is built around yield-bearing stablecoins. The idea is simple: let users hold interest-earning base assets while accessing spot markets, making it easier for DeFi apps to plug in and use capital more efficiently.

Sam Benyakoub, Terminal’s co-founder and CEO, said the project wants to build DEEP liquidity pools for trading Ethena’s synthetic dollar, USDe, against a wide range of assets, including crypto and tokenized real-world instruments.

Terminal describes its model as “Yield Skimming.” The system collects the yield from assets such as sUSDe and feeds it back into the market.

The goal is to support liquidity providers, traders, and token holders by putting that yield to work on the platform.

The team says this approach is meant to align incentives so that trading activity and liquidity grow over time without depending only on outside rewards.

Interest has picked up ahead of launch. The project says more than 10,000 wallets joined its pre-deposit program.

Early users are expected to receive airdrop rewards when tokens go live.

Public details on Ethena’s website suggest that as much as 10% of Terminal’s governance token supply may be set aside for sENA holders through the Terminal Points program.

Points began accruing on June 28. Final rules, allocations, and timing will be confirmed closer to the token event.

ENA Price Prediction: What Levels Must ENA Clear to Confirm a Bullish Reversal?

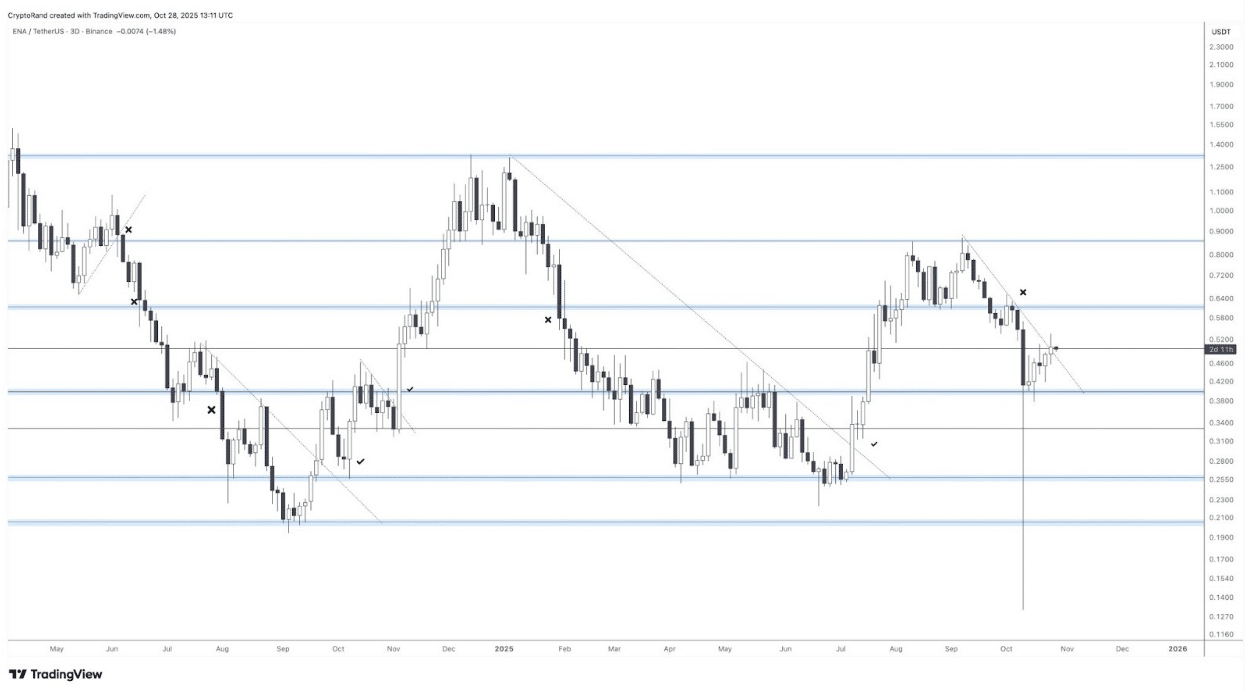

Ethena’s ENA is trying to steady after weeks of pressure. Price action is now testing a descending trendline that has capped gains since early September.

Crypto investor Rand flagged the move, saying ENA is “pushing straight over the downtrend resistance” and could be setting up a bullish turn.

Eyes on $ENA, pushing straight over the downtrend resistance.

Looking to trigger the bullish reversal![]()

![]() More trade set ups at: https://t.co/N3WuQcWWkm pic.twitter.com/3vPggmmo0M

More trade set ups at: https://t.co/N3WuQcWWkm pic.twitter.com/3vPggmmo0M

— Rand (@crypto_rand) October 28, 2025

On the three-day chart, ENA bounced from the $0.42–$0.46 demand area, a zone that has sparked brief recoveries before.

The rebound has carried the price into $0.52–$0.58, a clear resistance band that flipped from support in late September. Price is pressing into this band while meeting the downtrend drawn from the $0.80 swing highs.

A clean break above the diagonal and the $0.58 ceiling WOULD open room toward $0.64, then $0.72. Those zones marked prior supply during the late-Q3 slide.

(Source: X)

If buyers fail to reclaim $0.58, ENA remains at risk of another leg lower, with support at $0.46 and deeper downside toward $0.34.

ENA has been moving lower since July, creating a wide downward channel. Each bounce shows traders are still protecting key price areas.

Late in October, the price briefly dipped below $0.20 before being bought up. That tells us some buyers are stepping in when the market sells off too hard.

Right now, momentum looks flat. There’s no strong trend either way. What happens next depends on whether ENA can close above the descending trendline.

If it breaks and holds above it, that would signal an early shift toward a recovery. If it fails again, the broader downtrend may continue through the end of the year.