Coinbase’s Decentralized Revolution: Will It Redefine Startup Funding for Good?

Silicon Valley's playbook is crumbling—and Coinbase just lit the match.

The crypto giant's latest move could bulldoze traditional VC gatekeeping, handing power back to builders. No more begging for warm intros from Sand Hill Road. No more dilution through stacked funding rounds. Just code, community, and capital colliding on-chain.

The New Fundraising Stack

Forget pitch decks—protocols are the new prospectus. Smart contracts replace term sheets. Token holders vote instead of partners debating over whiskey. It's messy. It's volatile. And it's growing faster than a DeFi yield farm in 2021.

The Regulatory Tightrope

SEC subpoenas are already piling up like empty LaCroix cans at a startup office. But when has red tape ever stopped crypto? (Well, except for that one time—okay, several times—but you get the point.)

The Bottom Line

Wall Street's still betting on slide decks and golf-course handshakes. Meanwhile, a 19-year-old in Estonia just raised $20M between TikTok breaks. The future's unevenly distributed—and Coinbase might've hit the fast-forward button.

*'Disruptive innovation'? Try disruptive* insolvency *for legacy finance models.*—Some bitter VC on Twitter

Why Is Coinbase’s x402 Protocol Seeing a 10,000% Surge in Transactions?

Armstrong’s comments align with Coinbase’s growing focus on decentralized finance tools. The company has recently integrated Echo, a blockchain-based fundraising platform that was acquired earlier this year.

Echo has helped more than 200 startups raise over $200 million to date, offering a glimpse of how an onchain startup economy might look.

With Coinbase already running Base, its layer-2 network that supports decentralized apps, this expansion into startup funding signals a broader ambition: to make entrepreneurship as borderless and transparent as the blockchain itself.

Echo has helped over 200 startups raise more than $200 million. While it will operate independently for now, Armstrong said Coinbase plans to fold it into its broader infrastructure over time. The move WOULD give founders direct access to Coinbase’s $500 billion in custody assets and its global investor base.

Armstrong also said Coinbase is speaking with U.S. regulators about updating fundraising rules that prevent non-accredited investors from participating in early-stage rounds.

Opening that access, he argued, would help make startup ownership more inclusive a Core part of Coinbase’s open finance vision.

Analysts said the company is doubling down on Base, its layer-2 blockchain, to pull in more onchain activity.

They added that if a Base token is launched, it could create a $12–$34 billion market, with Coinbase’s share estimated between $4-$12 billion.

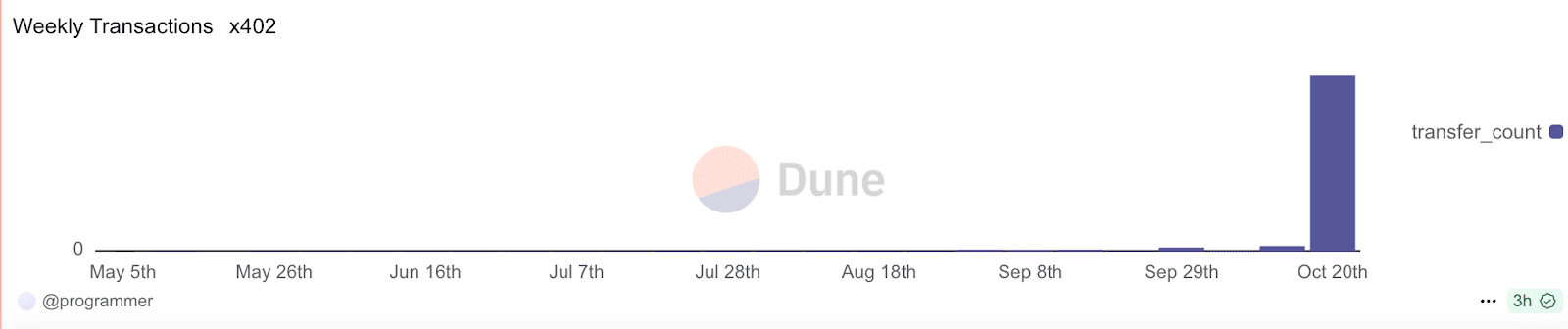

According to Dune Analytics, transaction activity on x402, an internet payments protocol launched by Coinbase in May, has jumped more than 10,000% in the past month.

(Source: Dune)

The protocol revives the old HTTP 402 “Payment Required” status code, transforming it into a tool for direct web payments in stablecoins, eliminating the need for credit cards or banks.

Here’s how it works: when a user or AI agent requests a paid service online, x402 triggers a 402 response that asks for a stablecoin payment.

What’s Behind the 10,000% Surge in Coinbase’s Onchain Payment Activity?

The transaction is signed, sent, and confirmed onchain within seconds. Coinbase’s team says the idea fixes what they call “the internet’s first mistake,” the absence of a built-in payment LAYER when the web was created.

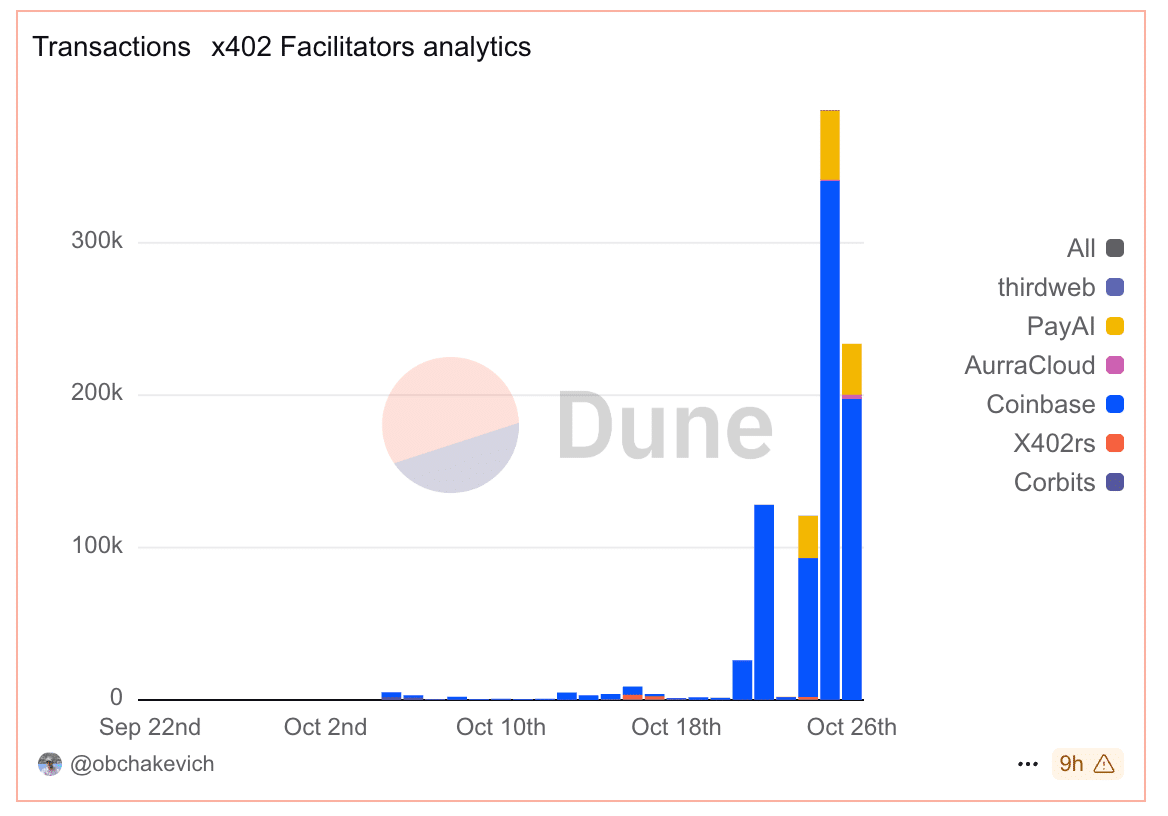

From October 14 to 20, the protocol processed nearly 500,000 transactions, representing a 10,780% increase from the previous month.

On Friday alone, it processed 239,505 transactions, while Thursday’s volume reached $332,000, according to Dune data.

(Source: Dune)

The surge signals growing interest in frictionless, onchain payments that could change how money moves across the internet.

The surge aligns with growing interest in agentic AI self-operating systems that can perform blockchain transactions without human control.

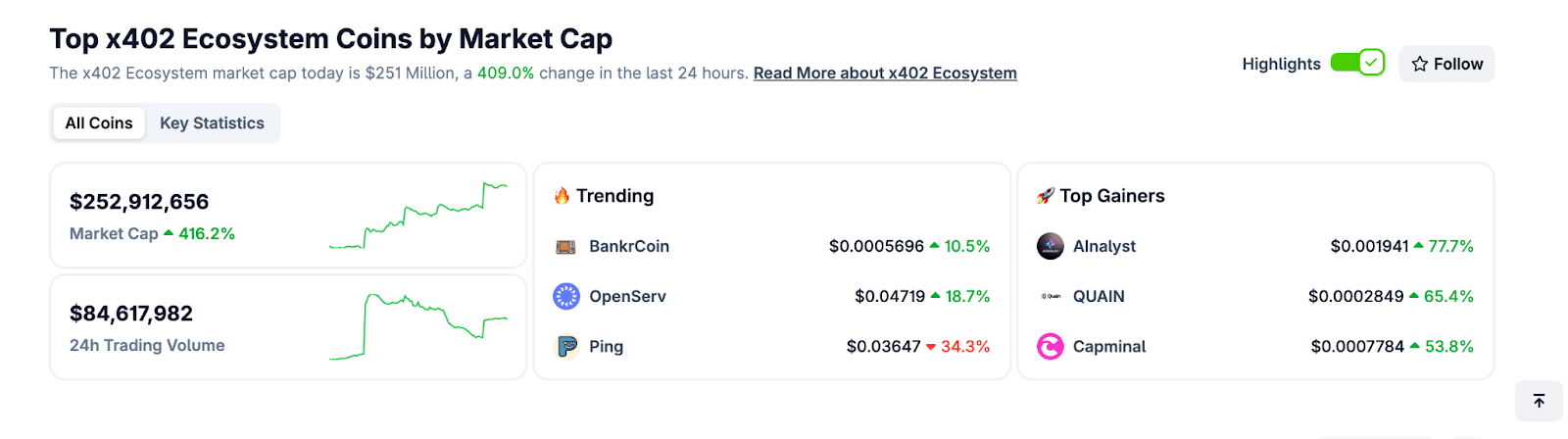

CoinGecko has since added a tracker for the x402 ecosystem, which has rapidly expanded into a $180 million market, jumping 266% in the past 24 hours.

(Source: Coingecko)

Coinbase developers Kevin Leffew and Lincoln Murr wrote in August that these agentic systems can autonomously manage tasks such as API calls, data storage, and computation.

They described a future where self-driving taxis could pay for fuel in stablecoins, and applications could automatically buy decentralized storage using onchain funds.

Developers are already experimenting with Coinbase’s x402 protocol, using it to create new tokens and memecoin projects. KuCoin Ventures stated that this “x402-powered” movement is driving a new wave of token launches.

Join The 99Bitcoins News Discord Here For The Latest Market Updates