Worldcoin Under Fire: Thai Regulators Storm Iris-Scanning Operations in Bold Crackdown

BANGKOK—Regulators just raided Worldcoin's biometric data collection sites across Thailand, sending shockwaves through the crypto community.

The Privacy Invasion Crackdown

Thai authorities stormed multiple locations where Worldcoin was scanning irises in exchange for digital tokens. Officers seized equipment and detained staff during coordinated raids that targeted what regulators call 'unlawful personal data collection.'

Global Regulatory Storm Intensifies

This marks the latest escalation in Worldcoin's worldwide regulatory nightmare. The project's controversial approach to digital identity—trading eye scans for crypto—has drawn scrutiny from Germany to Argentina. Now Thailand joins the growing list of nations pushing back against Silicon Valley's most ambitious—and some say reckless—attempt to create a global digital passport.

Privacy advocates cheer while crypto traders watch nervously as another 'world-changing' project learns the hard way that regulators don't care about your white paper when you're collecting biometric data from millions. Because nothing says financial innovation like trading your iris patterns for tokens that might be worthless tomorrow.

Worldcoin Raid Brings Back Troubled Memories For Sam Altman: Kenya Blasts “Coercive” Worldcoin

This is also not an isolated incident. Since launching in 2023, Worldcoin has faced suspensions, investigations, or outright bans in Kenya, Brazil, Spain, Portugal, Germany, and Hong Kong, with authorities repeatedly questioning consent standards and biometric data governance.

In Kenya, courts went so far as to order the deletion of previously collected iris data, calling the project’s monetary incentives for sign-ups “coercive.”

Worldcoin itself insists it only operates in countries where the law allows.

Thailand’s raid now adds another layer of geopolitical risk to the project, raising questions not only about WLD token distribution, but also the long-term feasibility of a biometric-based crypto identity system operating across fragmented regulatory landscapes under financial incentives.

With pressure mounting, investors are asking the inevitable question: how is the market reacting, and where does WLD price action go from here?

WLD Price Analysis: Thai Raid Fails to Hit Worldcoin Price – Is $1 On The Cards For October Close?

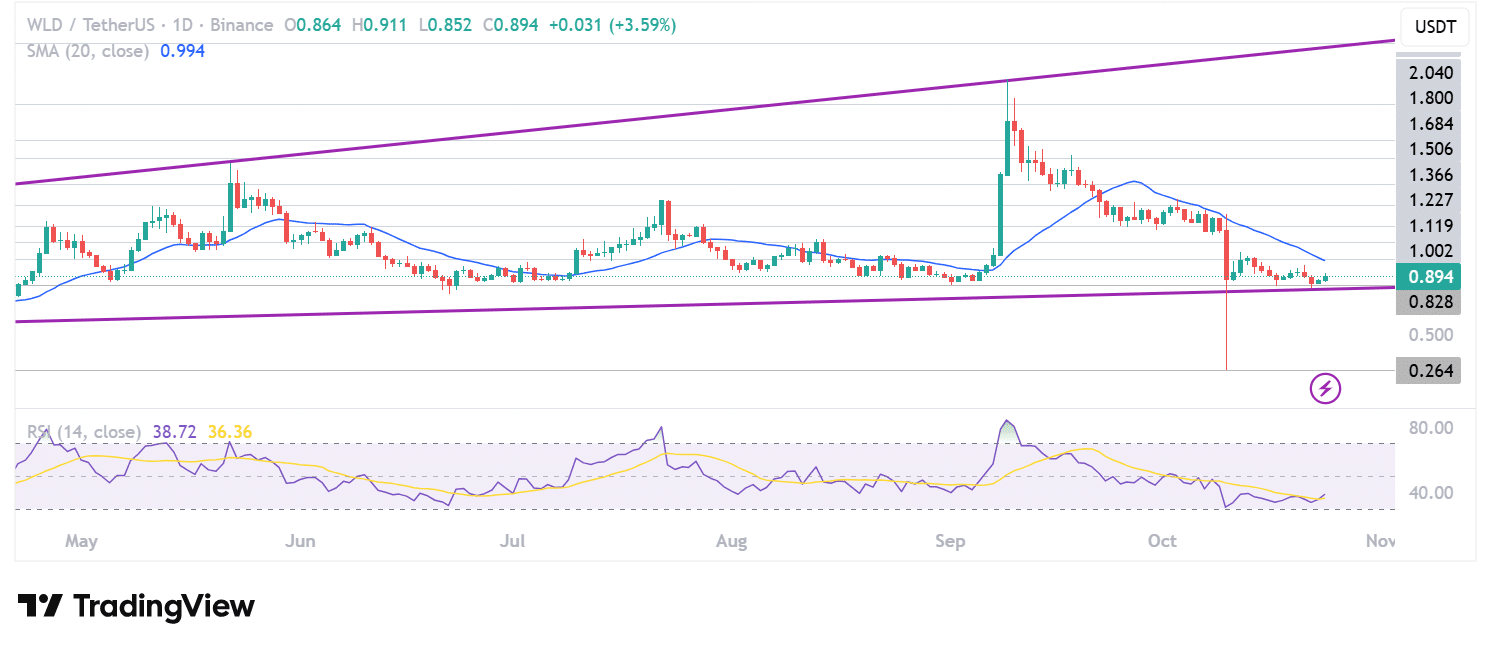

The Worldcoin Price remains largely static, despite months of a bull market and some choppy volatility. WLD price remains roughly where it was in April, June, and August 2025, with WLD currently trading at a market price of $0.83 (representing a 24-hour change of +3.48%).

With price action showing little reaction to the Thai police raid, WLD continues to consolidate above the lower trendline support at $0.8, following the capitulative dip down to $0.26 on October 10.

(Source – TradingView, WLD USDT)

As support appears to hold here, WLD traders are awaiting a tumbling 20DMA (at $0.99) to reach attainable levels before attempting any upside push, with the moving average forming the first immediate challenge to any upside move.

While the WLD trading channel suggests that upside is on the table, the broader weak crypto market sentiment threatens the WLD price structure the longer bulls fail to push it to the upside.

Examining Worldcoin’s RSI indicator, a low reading of 38 suggests significant upside potential in the chart, with $1 forming an immediate psychological target if the 20-day moving average (DMA) flips to support in the coming days.

DISCOVER: Best Meme Coin ICOs to Invest in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates