Aave Quietly Dominates Ethereum Lending This Bull Run: When Will AAVE Finally Pump?

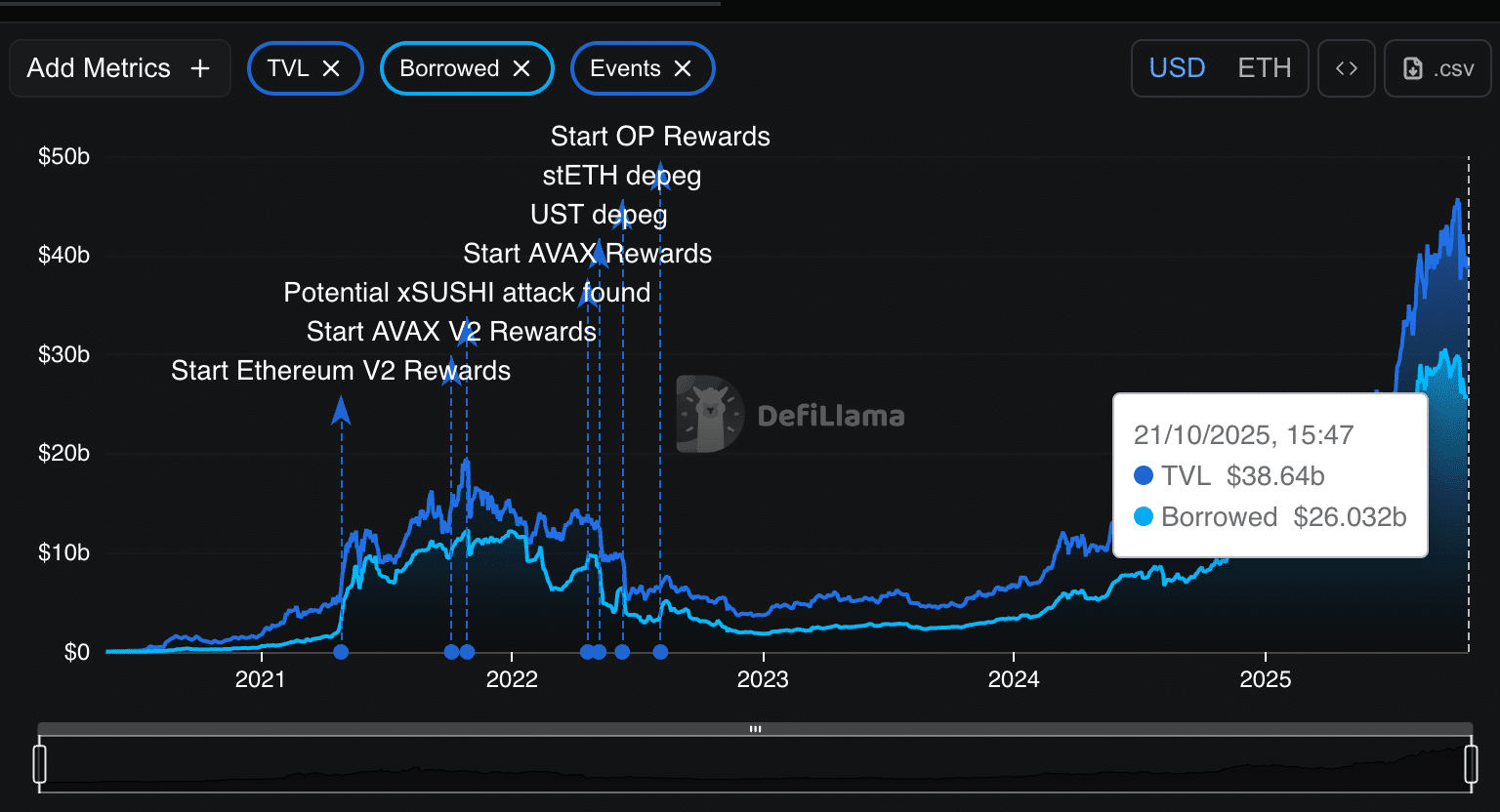

Aave's silent takeover of Ethereum's lending markets has become the bull run's best-kept secret. While flashier protocols grab headlines, the decentralized lending giant has been methodically capturing market share.

The Stealth Dominance

Aave's under-the-radar expansion across Ethereum's DeFi ecosystem reveals a platform executing while others hype. The protocol's multi-chain strategy and institutional-grade features have positioned it as the go-to lending solution for serious players.

The AAVE Price Conundrum

Despite fundamental strength, AAVE's token price continues to lag behind protocol growth. The disconnect between platform adoption and token performance has investors wondering when the dam will break.

Market mechanics suggest accumulation phases often precede explosive moves. With lending volumes hitting new highs and institutional adoption accelerating, the ingredients for a significant revaluation are brewing.

When fundamentals and price finally converge, the move could be violent—proving once again that in crypto, the quiet ones often make the most noise while the loudest hype machines typically deliver the emptiest promises.

(Source: DeFiLlama)

Its increase represents a more general trend of DeFi lending towards larger, safer pools following the acute deleveraging of 2022-2023.

Capital is concentrating on well-audited protocols with deep liquidity and conservative parameters, areas where Aave continues to lead.

Developers are also preparing the launch of Aave v4, a major upgrade designed to connect liquidity across multiple chains. That MOVE could further strengthen its position as the backbone of Ethereum-based credit markets.

Currently, Aave dominates in terms of scale and stability. Whether this strength will be reflected in the AAVE token as the larger market seeks its second leg up is the next question.

The recent trend of Aave is correlated with the gradual increase of its GHO stablecoin and the anticipation of the next v4 upgrade.

The new version will enable liquidity chain linkage and streamline the liquidation process, an action perceived as pivotal to the scaling of decentralized lending.

Founder Stani Kulechov described v4 as a path to “deep liquidity for DeFi.” Industry analysts say the upgrade will introduce a hub-and-spoke structure that links multiple networks through a shared liquidity layer, potentially reducing fragmentation across Aave’s markets.

The AAVE token traded NEAR $236 in the past 24 hours, gaining about +2.5%. Its market value stood at around $ 3.6 billion, with prices ranging between $219 and $236.

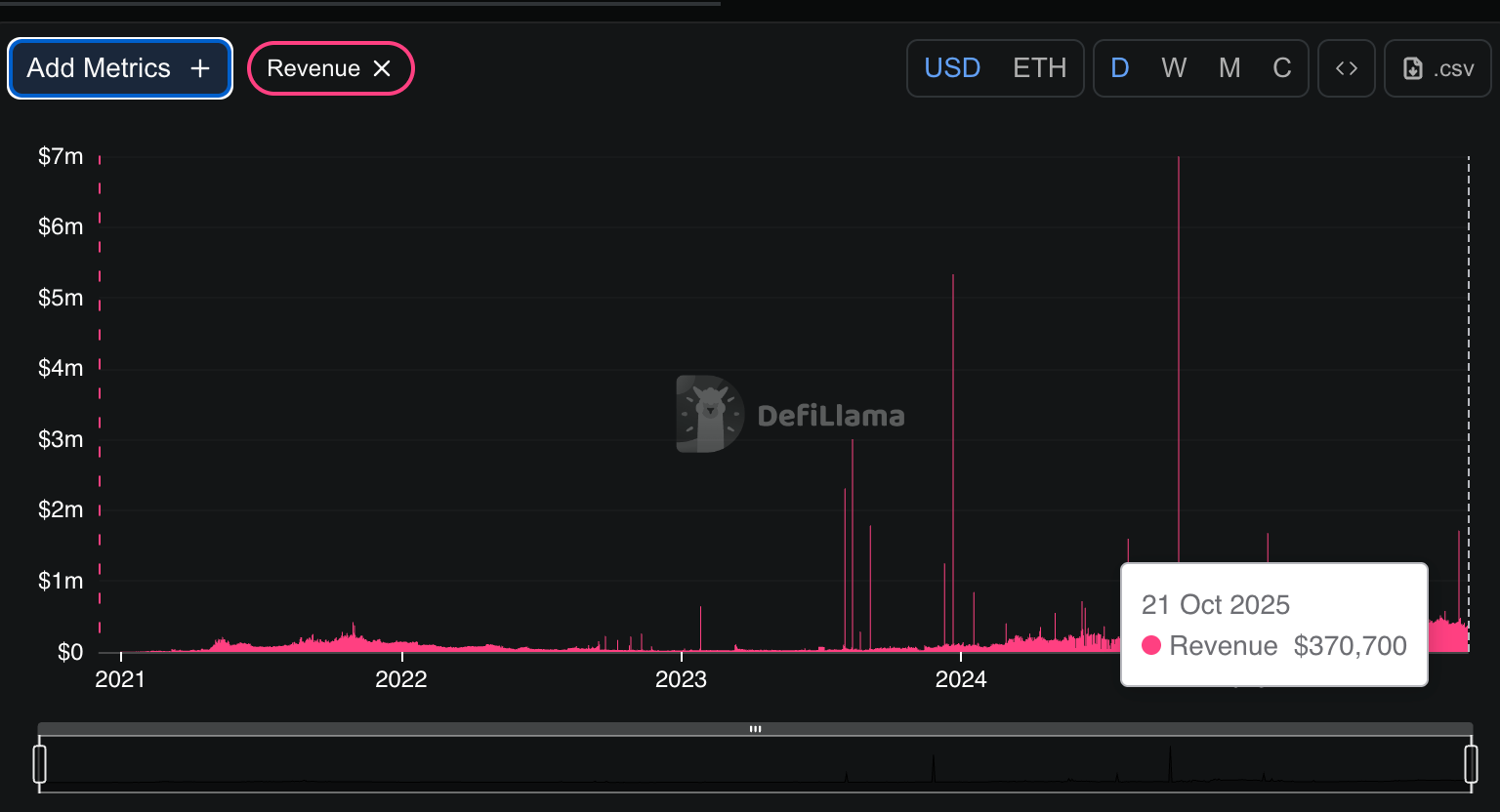

Still, the token remains far below its previous cycle highs, reflecting investor caution about how protocol earnings translate into token value ahead of the v4 rollout.According to Aave’s dashboard, the protocol generated roughly $370,700 in revenue over the past 24 hours, with annualized earnings of about $95 million.

(Source: DeFiLlama)

Those figures are closely tracked by stakers and safety module participants, who view them as indicators of future yield and long-term sustainability.

AAVE Price Prediction: Why Is AAVE Struggling to Break Above the $260-$280 Resistance Zone?

The AAVE/USDT chart shared by crypto analyst Popeye points to a textbook Wyckoff-style distribution pattern.

$AAVE

Daily – looks like a text book distribution.

Careful with longing any dip or sweep, distributive ranges usually ends up with a long downtrend. pic.twitter.com/NHpv3Mgpyx

— Popeye (@SailorManCrypto) October 21, 2025

Having experienced a significant surge, the token has since stabilized between approximately $220 and $340, with low highs in between. This pattern typically indicates declining demand and the onset of a market peak.

Failures to overcome the resistance, despite several attempts, followed by a more recent dismissal at approximately $260, indicate that sellers rule the day.

Further statement of increasing supply pressure is a sharp fall to below $200.

Price has since been moving off the low-end range but is being held on the lower end against the resistance of end levels, with little power to buy.

According to the Wyckoff scheme, AAVE may be in the markdown phase, where distribution WOULD shift to extensive declines.

Analysts say a strong recovery above the $260–$280 area, accompanied by increased volume, would be needed to shift sentiment. Without that, the setup favors continued weakness and the risk of a sustained downtrend.