Ethena’s Hiring Spree: Your Chance to Shape the Future of USDe Stablecoin

Ethena goes on recruitment offensive as synthetic dollar protocol scales operations

The Talent Hunt Begins

Ethena's expanding its war room - and they're looking for fresh blood to turbocharge their USDe stablecoin ecosystem. This isn't just another crypto hiring round; it's a strategic move to dominate the synthetic dollar space while traditional finance institutions are still figuring out their blockchain strategies.

Building the Next Generation

The protocol's team expansion signals serious growth ambitions. They're not just maintaining code - they're architecting the future of decentralized finance while Wall Street banks charge 2% fees for basic transfers. Positions range from core protocol development to ecosystem growth, suggesting Ethena's preparing for massive scaling.

Opportunity Knocks

For crypto professionals, this represents a rare chance to join a protocol that's actually building something useful rather than just another meme coin. The timing couldn't be better - just as regulatory clarity emerges and institutional money starts dipping toes in the water.

Because let's face it - traditional finance had decades to fix cross-border payments and still can't beat a 15-year-old blockchain. Maybe it's time for some fresh perspectives.

Ethena Crypto Expansion Marks a Turning Point: Is It About to Rocket?

After maintaining a team of roughly 20–25 contributors since 2023, Ethena will add about 10 new hires across engineering, product, and business development.“We are expanding the team meaningfully for the first time with 10 new roles across engineering and product for two entirely new business lines and products,” Young said.

Ethena $ENA might be printing a higher high! If confirmed, a run to $1.30 is on the table. pic.twitter.com/v6rtCcIm4K

— Ali (@ali_charts) October 16, 2025

Both of these initiatives have the potential to be the size of USDe.

The company’s job listings include openings for a Head of Security, Senior Backend Engineer, and several DeFi and Trading Engineers, along with new business development and design roles.

Institutional Momentum Builds Around Ethena: What Does The Data Say For ENA?

Ethena’s upcoming products will build on its stablecoin ecosystem of USDe and USDtb, both designed to maintain on-chain price stability without direct fiat backing. The new initiatives, expected to roll out within three months, could create parallel product lines comparable in size to USDe, which already sits among the top-tier stable assets in DeFi.

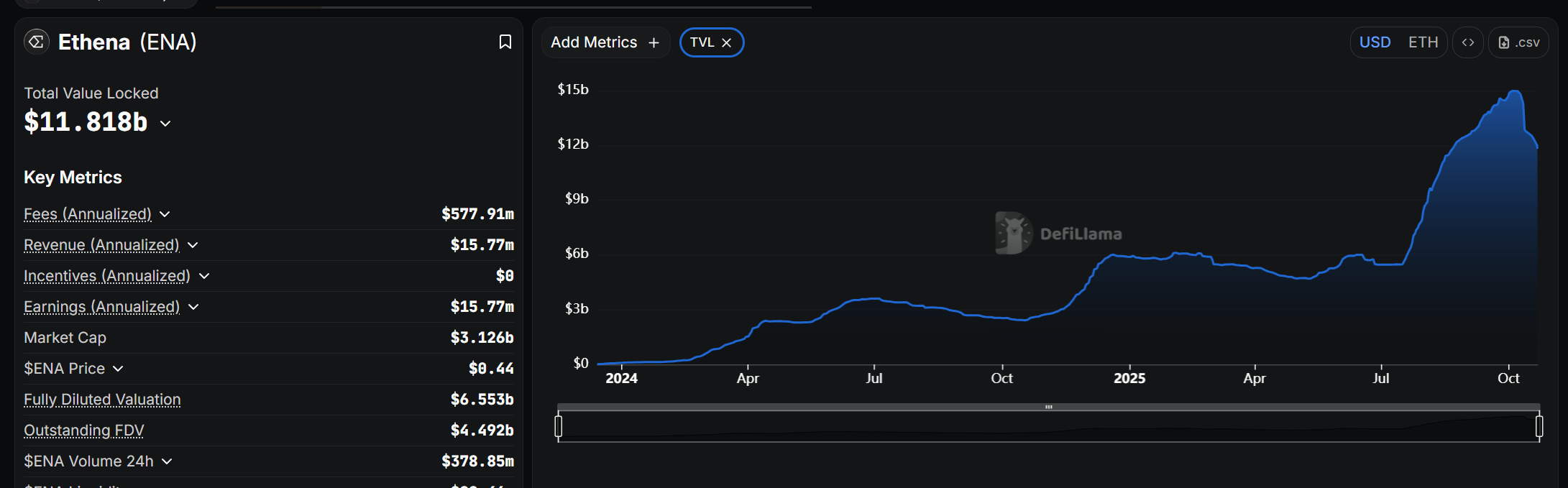

According to DeFi Llama, Ethena’s total value locked (TVL) has risen to nearly $11.8 Bn, up more than 18% month-over-month, driven by integrations across ethereum Layer-2s and Solana-based liquidity venues.

Ethena’s reputation has grown in lockstep with its backers, Binance Labs, Dragonfly, Fidelity, and Franklin Templeton, names that usually don’t fund vaporware. Its reach deepened further in September when M2 Capital, the UAE-based investment arm of a digital asset conglomerate, came on board as a strategic partner, expanding Ethena’s global footprint.

Momentum is already spilling into other networks. Solana’s top aggregator, Additionally, Jupiter, plans to roll out its new stablecoin JupUSD through Ethena’s infrastructure.

A Broader Trend Toward Synthetic Dollar Dominance

As regulatory scrutiny continues around traditional stablecoins like USDT and USDC, Ethena’s “synthetic dollar” model has gained traction. Data from CoinGecko shows trading volumes for USDe have surged more than 25% in the past month, with daily volumes averaging $220 million.

Ethena’s expansion reflects more than growth but a bet on the future of programmable dollars.

Key Takeaways

- How’s your mental health 99Bitcoins fam? Not good? Great? Well for the Ethena crypto it’s been a rollercoaster of a year.

- Ethena’s expansion reflects more than growth but a bet on the future of programmable dollars.