BlackRock’s Crypto Gambit: Larry Fink Crowns Bitcoin ’Digital Gold’ in Strategic Pivot

Wall Street's trillion-dollar whale makes its boldest crypto move yet.

The Digital Gold Standard

BlackRock CEO Larry Fink's endorsement sends shockwaves through traditional finance circles—calling Bitcoin 'digital gold' isn't just branding, it's a fundamental reassessment of value storage. The asset manager's new crypto division isn't dipping toes anymore; it's diving headfirst into digital assets.

Institutional Avalanche

When the world's largest asset manager places billion-dollar bets on blockchain, the message echoes across trading floors: digital assets are no longer alternative investments. They're core portfolio holdings. Traditional gold bugs watch nervously as Bitcoin eats their lunch—proving sometimes the best hedge against legacy systems is to build new ones entirely.

Finance's reluctant embrace of what it can't control continues to amuse—watching bankers try to regulate their own obsolescence never gets old.

In an interview with CBS on October 14, Fink said Bitcoin has become a legitimate store of value and a hedge for the modern age. His shift marks more than personal conversion but signals how far Wall Street has moved. Bitcoin is no longer the outsider; it’s Fink’s strongest bet.

BlackRock Crypto: Is It a Better Investment Than Gold? (What They Think)

Larry Fink’s tone has evolved dramatically over the past five years. The world’s largest asset manager now positions bitcoin as a credible diversification tool.“Cryptocurrencies serve the same purpose as Gold – a store of value,” Fink said during his CBS interview.

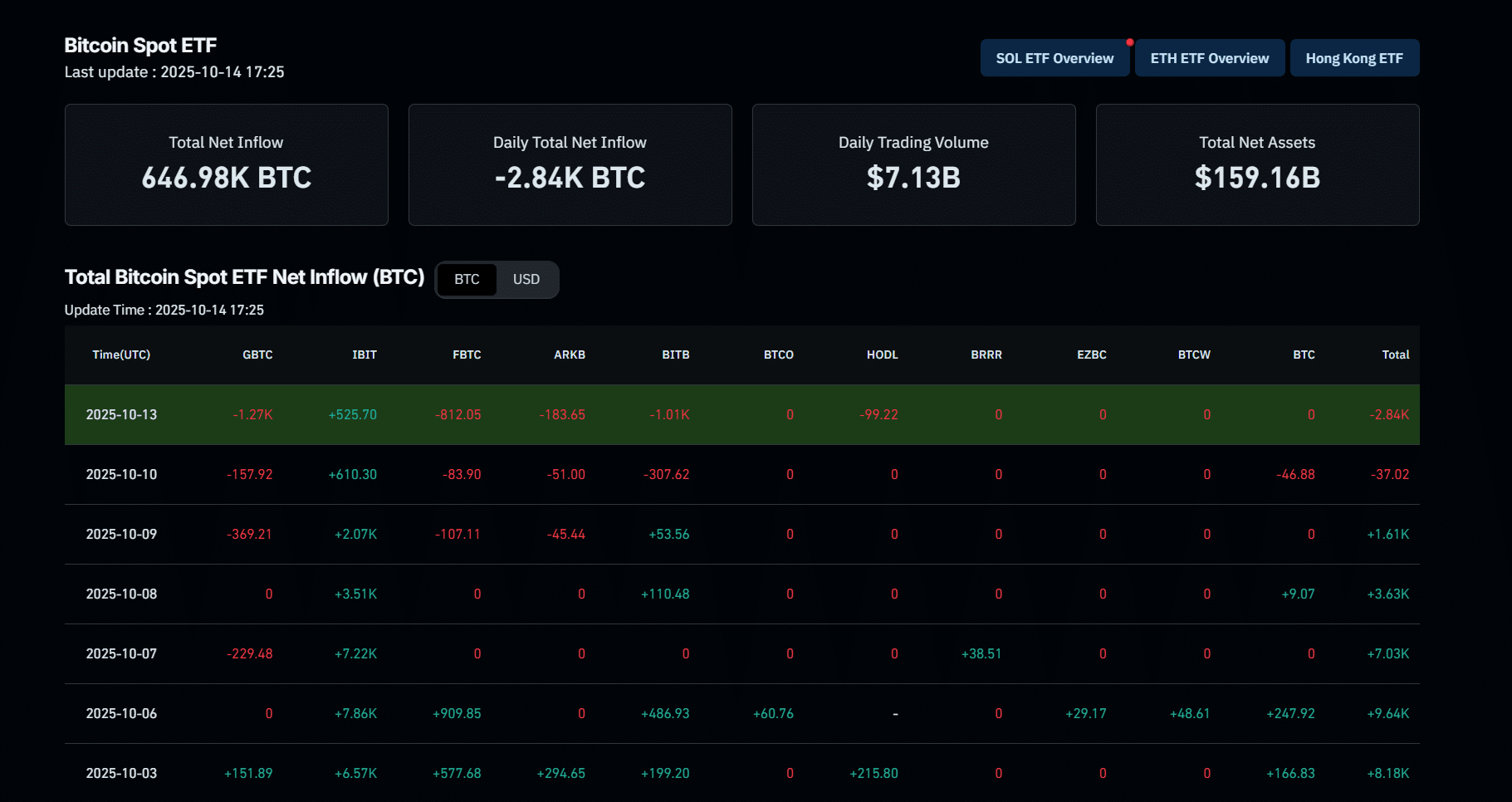

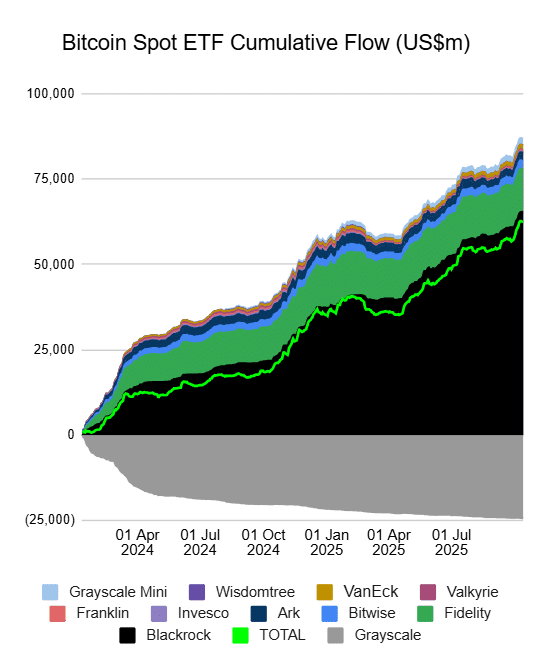

BlackRock’s conviction comes with numbers to back it up. The iShares Bitcoin Trust (IBIT) is on pace to become the fastest ETF in history to hit $100 Bn in assets, a milestone that cements crypto’s place in institutional portfolios.

Launched just 435 days ago, IBIT has already pulled in more than $244 Mn in annual fees, outperforming long-established giants like the iShares Russell 1000 Growth ETF. Bloomberg’s Eric Balchunas called it “absurd,” a testament to how fast BTC has moved.

Is 2026 Bitcoin’s Institutional Era? The Irony of Wall Street’s Conversion

Bitcoin sits around $112,000, still king of a $3.8 Tn market, according to CoinGecko. It slipped 7.5% this week, but the money hasn’t left exchanges. Glassnode shows this is the biggest outflow of BTC since mid-2024, a sign big players are quietly accumulating again.

Institutional demand hasn’t cooled either. Farside Investors logged almost $6 Bn in ETF inflows during the first week of October.

Jamie Dimon, CEO of JPMorgan, once called Bitcoin a “fraud.” Now, his firm offers Bitcoin trading to clients through approved channels. Larry Fink’s pivot mirrors the same trajectory: from dismissal to full-scale embrace.

With institutional products driving billions in inflows, the era of dismissing Bitcoin as a passing fad is over. However, this also means the underground cypherpunk energy of BTC is mostly gone as well; now it has moved to other projects like

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

.cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) {

stroke: #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-trend.positive {

color: #008868 !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive {

border: 1px solid #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.positive::before {

border-bottom: 4px solid #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-graph-container.negative svg path:nth-of-type(2) {

stroke: #A90C0C !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative {

border: 1px solid #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.negative {

color: #A90C0C !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-trend.negative::before {

border-top: 4px solid #A90C0C !important;

}Zcash

ZEC

$223.94

16.47%

Zcash

ZEC

Price

$223.94

16.47% /24h

Volume in 24h

$748.85M

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $('.cwp-graph-container svg').last();

if (svg.length) {

var originalWidth = svg.attr('width') || '160';

var originalHeight = svg.attr('height') || '40';

if (!svg.attr('viewBox')) {

svg.attr('viewBox', '0 0 ' + originalWidth + ' ' + originalHeight);

}

svg.removeAttr('width').removeAttr('height');

svg.css({'width': '100%', 'height': '100%'});

svg.attr('preserveAspectRatio', 'xMidYMid meet');

}

});

Learn more

.

Bitcoin USDs Breakout and BlackRock’s Timing

Larry Fink’s about-face feels like the moment Bitcoin finally crossed the Rubicon. What started as the butt of everyones joke from Wall Street has turned into record ETF inflows and boardroom strategy sessions.

Volatility and an underlying cypherpunk energy still define BTC, yet it’s no doubt an institutional asset now. Is that a good or bad thing? Depends who you ask: we’re still all-in after all these years.

Key Takeaways

- Larry Fink and BlackRock Crypto have changed their tune. The BlackRock CEO, who once dismissed crypto as a fad for speculators, now calls BTC “digital gold”

- Fink’s about-face feels like the moment Bitcoin finally crossed the Rubicon.