Crypto Bloodbath October 14: Whales Bet Against Bitcoin as Powell Looms - Which Digital Asset Will Skyrocket Next?

Markets tumble as institutional whales place massive short positions against Bitcoin ahead of Powell's crucial testimony. The crypto space braces for impact while hunting for the next breakout candidate.

WHALE WATCHING INTENSIFIES

Major players accumulate bearish positions, signaling potential further downside. Trading volumes spike 40% as panic spreads across exchanges. Retail investors scramble while institutions position for volatility.

POWELL'S SHADOW LOOMS LARGE

The Fed chair's upcoming remarks threaten to trigger another leg down. Market makers adjust liquidity provisions ahead of potential regulatory bombshells. Traditional finance veterans smirk about 'digital tulips' while counting their paper profits.

NEXT EXPLOSIVE ASSET HUNT

Traders rotate into altcoins showing relative strength during the carnage. Several decentralized protocols defy the broader selloff, posting double-digit gains amid the bloodshed. The smart money already positions for the eventual rebound.

Blood runs red across crypto screens, but seasoned investors know these fire sales create generational buying opportunities. The very whales shorting today will likely be the ones fueling the next parabolic move—because in crypto, the only thing more predictable than volatility is Wall Street's hypocrisy toward digital assets they can't control.

Ethereum

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

.cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) {

stroke: #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-trend.positive {

color: #008868 !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive {

border: 1px solid #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.positive::before {

border-bottom: 4px solid #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-graph-container.negative svg path:nth-of-type(2) {

stroke: #A90C0C !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative {

border: 1px solid #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.negative {

color: #A90C0C !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-trend.negative::before {

border-top: 4px solid #A90C0C !important;

}Ethereum

ETH

$4,003.48

1.14%

Ethereum

ETH

Price

$4,003.48

1.14% /24h

Volume in 24h

$45.28B

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $('.cwp-graph-container svg').last();

if (svg.length) {

var originalWidth = svg.attr('width') || '160';

var originalHeight = svg.attr('height') || '40';

if (!svg.attr('viewBox')) {

svg.attr('viewBox', '0 0 ' + originalWidth + ' ' + originalHeight);

}

svg.removeAttr('width').removeAttr('height');

svg.css({'width': '100%', 'height': '100%'});

svg.attr('preserveAspectRatio', 'xMidYMid meet');

}

});

Learn more

lost 4% to $4,012,

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

.cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) {

stroke: #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-trend.positive {

color: #008868 !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive {

border: 1px solid #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.positive::before {

border-bottom: 4px solid #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-graph-container.negative svg path:nth-of-type(2) {

stroke: #A90C0C !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative {

border: 1px solid #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.negative {

color: #A90C0C !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-trend.negative::before {

border-top: 4px solid #A90C0C !important;

}

BNB

BNB

$1,202.46

1.13%

BNB

BNB

Price

$1,202.46

1.13% /24h

Volume in 24h

$8.73B

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $('.cwp-graph-container svg').last();

if (svg.length) {

var originalWidth = svg.attr('width') || '160';

var originalHeight = svg.attr('height') || '40';

if (!svg.attr('viewBox')) {

svg.attr('viewBox', '0 0 ' + originalWidth + ' ' + originalHeight);

}

svg.removeAttr('width').removeAttr('height');

svg.css({'width': '100%', 'height': '100%'});

svg.attr('preserveAspectRatio', 'xMidYMid meet');

}

});

Learn more

plunged 10% to $1,205, and

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

.cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) {

stroke: #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-trend.positive {

color: #008868 !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive {

border: 1px solid #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.positive::before {

border-bottom: 4px solid #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-graph-container.negative svg path:nth-of-type(2) {

stroke: #A90C0C !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative {

border: 1px solid #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.negative {

color: #A90C0C !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-trend.negative::before {

border-top: 4px solid #A90C0C !important;

}

XRP

XRP

$2.47

1.73%

XRP

XRP

Price

$2.47

1.73% /24h

Volume in 24h

$7.35B

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $('.cwp-graph-container svg').last();

if (svg.length) {

var originalWidth = svg.attr('width') || '160';

var originalHeight = svg.attr('height') || '40';

if (!svg.attr('viewBox')) {

svg.attr('viewBox', '0 0 ' + originalWidth + ' ' + originalHeight);

}

svg.removeAttr('width').removeAttr('height');

svg.css({'width': '100%', 'height': '100%'});

svg.attr('preserveAspectRatio', 'xMidYMid meet');

}

});

Learn more

fell 5.5% to $2.47. The declines came as markets awaited Powell’s remarks before the National Association for Business Economics (NABE) in Philadelphia, scheduled for 12:20 p.m. ET.

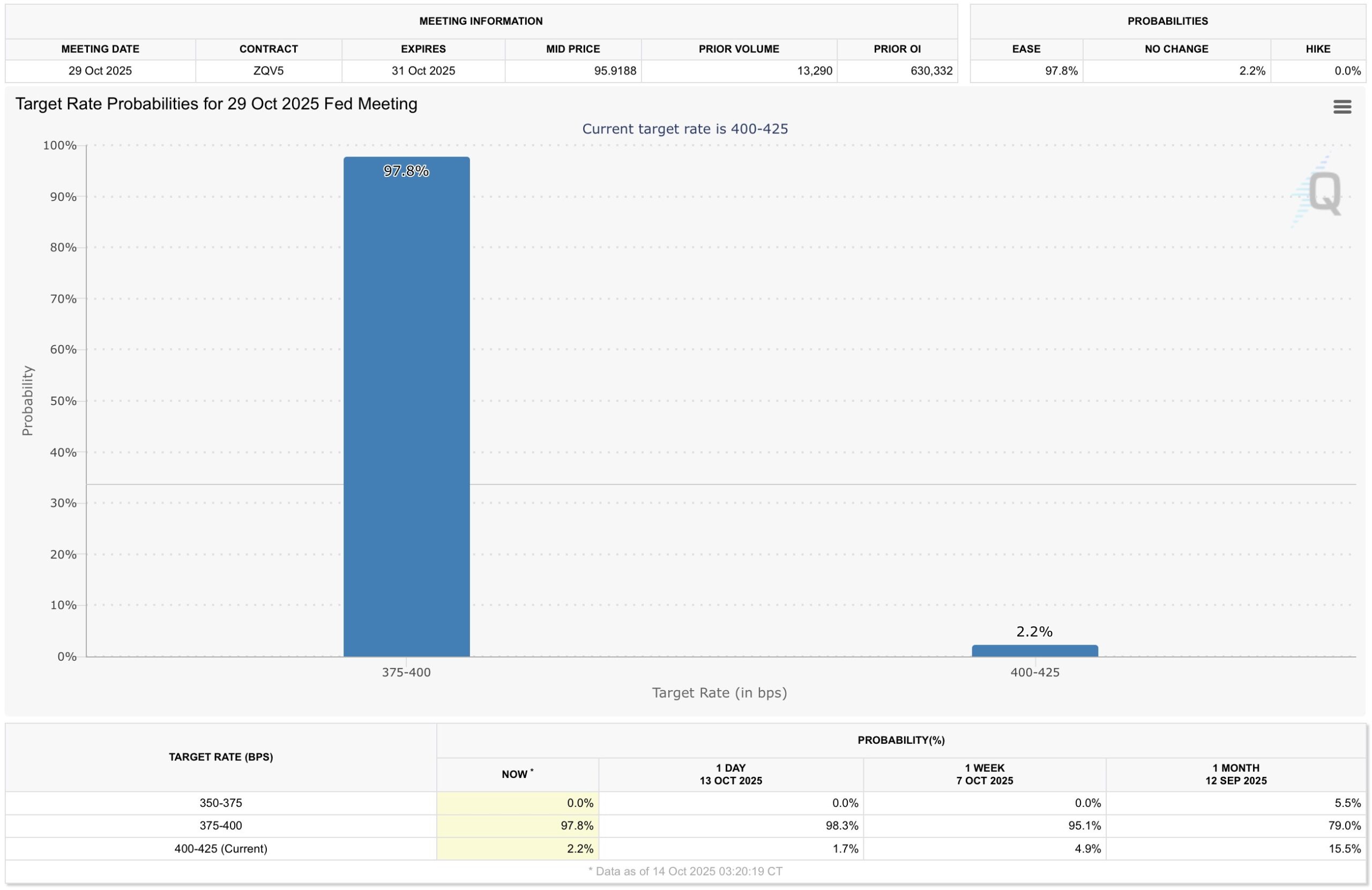

His comments will mark his first major public appearance since the Fed’s September policy meeting, which revealed DEEP divisions among officials on the pace of future rate cuts.

At that meeting, the Fed cut rates by 0.25% to a range of 4.00%–4.25%, but opinions were split over whether further easing is needed this year. Powell has since stressed that decisions will depend on incoming data — a challenge made harder by the ongoing U.S. government shutdown, which has halted several key economic reports.

With no new data on jobs or inflation, Powell’s speech may provide crucial clues on how the central bank plans to steer policy amid uncertainty.

Markets are also watching how Powell balances the Fed’s dual mandate of full employment and price stability. Inflation has remained above 2% for nearly five years, while labor data suggest emerging weakness. If Powell focuses on employment risks, traders may expect more rate cuts: a scenario that could stabilize crypto prices. A stronger focus on inflation, however, could signal a pause in easing and keep digital assets under pressure.

Markets are watching closely for any signal on interest-rate direction that could sway risk sentiment.

On-chain data shows heavy short activity by large traders. Whale 0x9eec9, with $31.8 million in realized profit, now holds $98 million in shorts across DOGE, ETH, PEPE, XRP, and ASTER. Another, 0x9263, with $13.2 million profit, has $84 million in short positions on SOL and BTC.

Besides the #BitcoinOG who made over $160M shorting $BTC and $ETH during the crash, two other whales with significant profits on #Hyperliquid are also heavily shorting the market.

Whale 0x9eec9 — with $31.8M in profit — currently holds $98M in shorts across $DOGE, $ETH, $PEPE,… pic.twitter.com/qZfJIbO6ba

— Lookonchain (@lookonchain) October 14, 2025

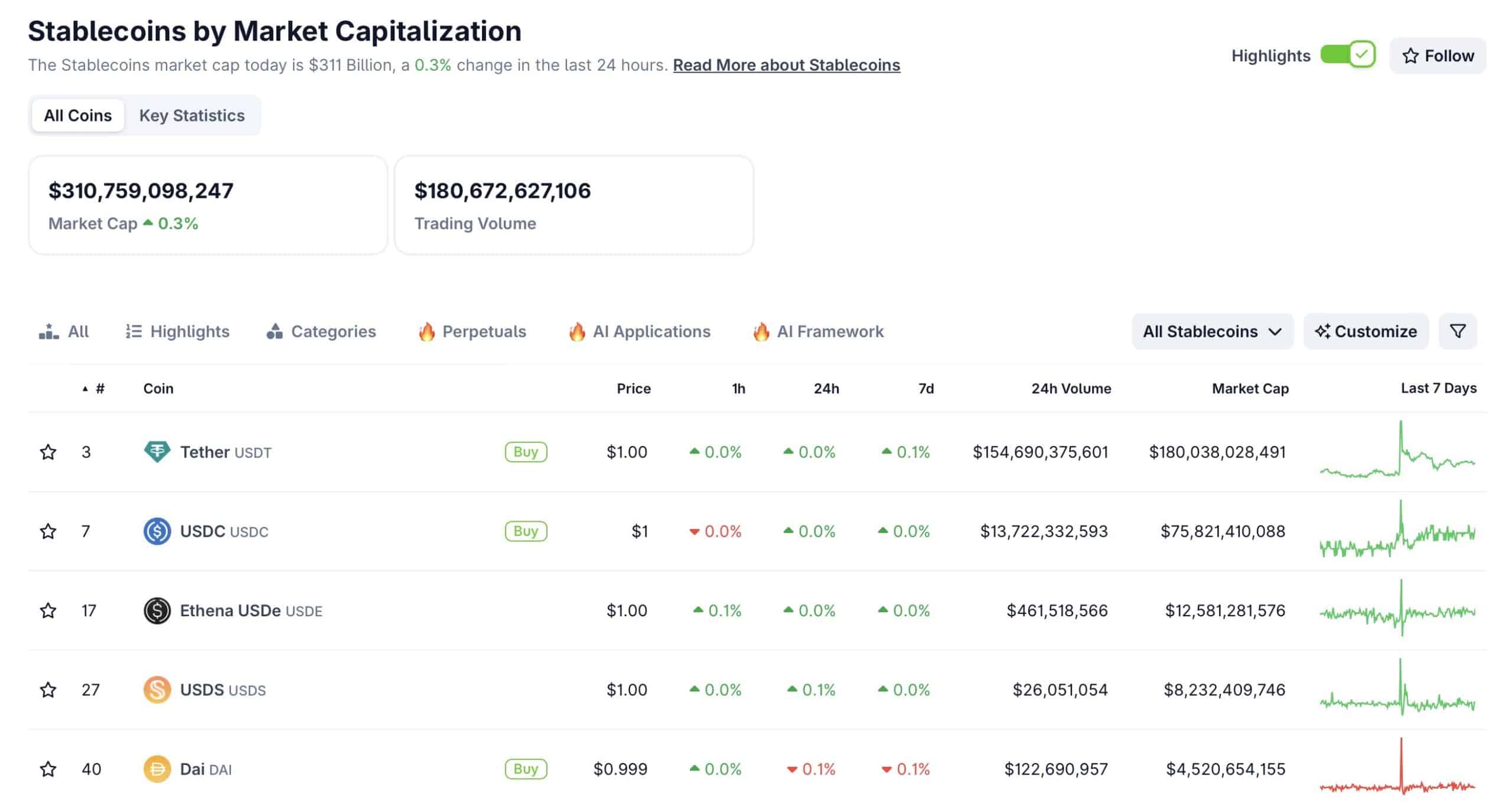

Next Crypto to Explode During This Dip? Stablecoin Market Hits $310 Billion Market Cap

While sentiment is cautious, corrections like this often set the stage for the next breakout phase. Traders are scanning for assets showing resilience — coins with strong liquidity, healthy on-chain activity, or large stablecoin inflows.

The stablecoin market, now at a record $310.7 billion, indicates significant buying power sitting on the sidelines. If Powell’s tone eases or Bitcoin stabilizes above key support, capital could rotate quickly into undervalued altcoins. Historically, such conditions precede sharp rebounds, meaning the next crypto to explode could emerge soon once macro pressure subsides.

There are no live updates available yet. Please check back soon!