Ethereum Whales Gobble Up ETH: Should You Dive Into This Dip Too?

Massive wallets are loading up on Ethereum as prices dip—sparking speculation about what the smart money knows that retail doesn't.

The Whale Feeding Frenzy

While mainstream investors panic-sell, crypto's wealthiest players are treating the ETH discount like Black Friday. These deep-pocketed traders aren't just dipping toes—they're diving headfirst into accumulating positions that could reshape the market's trajectory.

Timing the Crypto Tides

Following whales has always been a popular strategy, but it's not without risks. Sometimes they're early—other times they're just wrong. Remember when billionaires were buying tropical islands with their crypto profits? Now they're buying the dip while financial advisors still can't spell 'blockchain.'

The real question isn't whether whales are buying—it's whether their appetite signals a market bottom or just another temporary rally before the next regulatory headache drops.

How Is BitMine’s Massive $827 Million ETH Crypto Purchase Impacting the Market?

The Friday-to-Sunday sell-off, fueled partly by US-China trade headlines, triggered a wave of forced liquidations across exchanges.

BitMine confirmed that it added around 202,000 ETH over the weekend, worth about $827 million at an average price of $4,154.

![]()

BitMine provided its latest holdings update for Oct 13, 2025:

$12.9 billion in total crypto + "moonshots":

– 3,032,188 ETH at $4,154 per ETH (Bloomberg)

– 192 Bitcoin (BTC)

– $135 million stake in Eightco Holdings (NASDAQ: ORBS) (“moonshots”) and

– unencumbered…

— Bitmine (NYSE-BMNR) $ETH (@BitMNR) October 13, 2025

This lifted the firm’s total holdings to 3.03 million ETH, marking what it called the halfway point toward its target of owning 5% of the total supply.

“We acquired 202,037 ETH, pushing our holdings to over 3 million,” said Tom Lee, the company’s chairman, calling the post-crash pullback a clear buying opportunity.

One major wallet repurchased 7,817 ETH (about $32.5 million) NEAR $4,159, just hours after panic-selling during the drop.

前天 $3,764 "恐慌" 割肉 ETH 的高吸低抛鲸鱼,涨起来又以 $4,159 的价格上车了![]() :

:

他在 3 小时前用 3251.1 万 DAI 重新买回 7,817 枚 ETH。

前天大跌后以 $3,764 的价格恐慌清仓,今天涨起来后又以 $4,159 的价格重新买回。等于是他这一波低抛高吸,没了 820 枚 ETH ($340 万)。… https://t.co/scsBfdE5uc pic.twitter.com/OctwKxd8Qz

— 余烬 (@EmberCN) October 13, 2025

Another over-the-counter desk picked up 14,165 ETH, approximately $55 million through market-making channels, according to recent trading alerts.

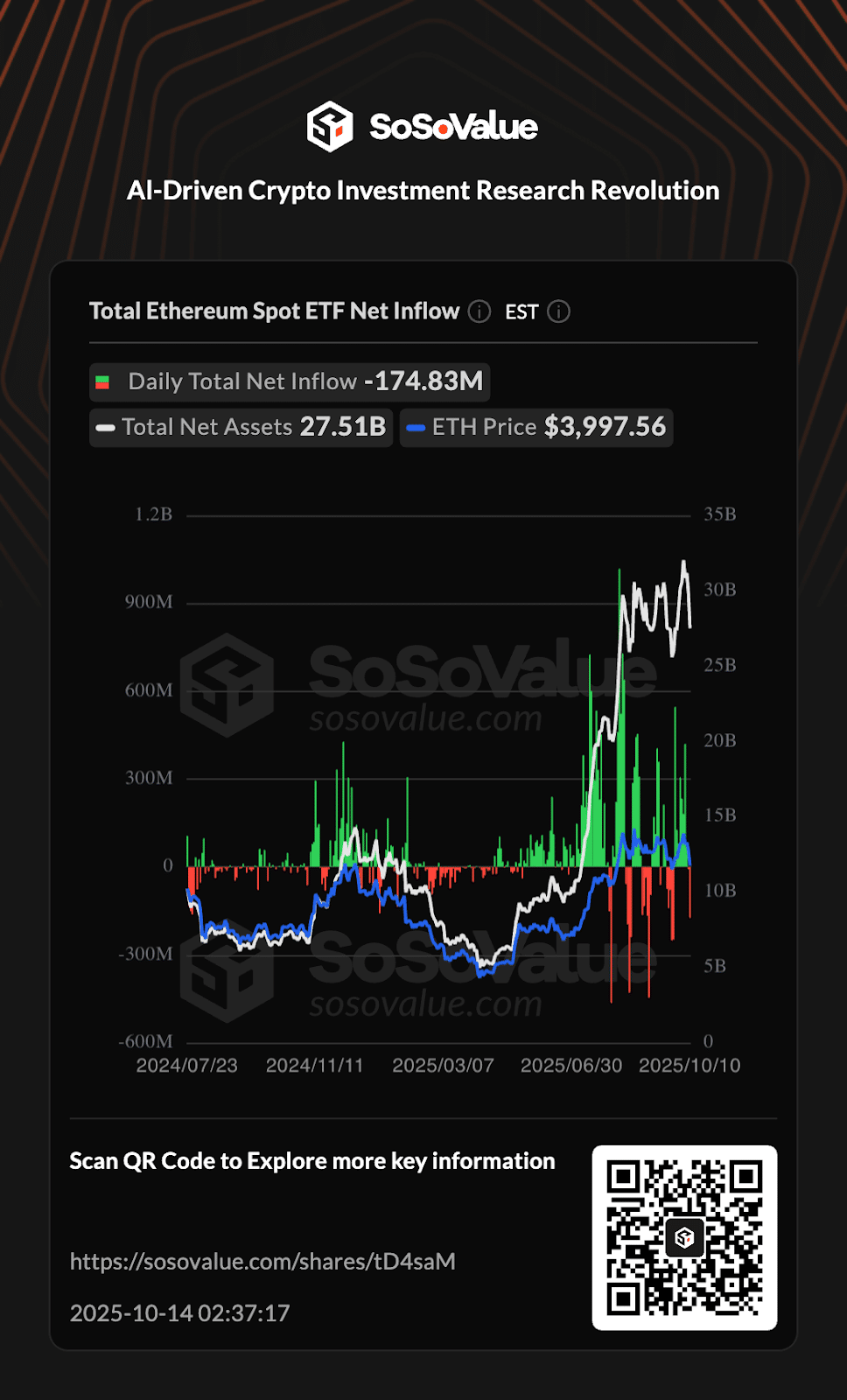

According to SoSoValue data, US spot Ether ETFs posted net outflows on Monday, led by BlackRock’s ETHA (-$80M) and Fidelity’s FETH (-$30M).

(Source: SoSoValue)

The data suggests large holders and institutions may be scooping up coins that ETFs are releasing back into circulation.

Meanwhile, derivatives markets remain stable. Funding rates across major exchanges fell to their lowest levels since 2022, reflecting a broad reduction in leverage after the heavy liquidations.

Analytics firm Glassnode said rates had “dropped to their lowest levels since the 2022 bear market.”

Funding rates across the crypto market have plunged to their lowest levels since the depths of the 2022 bear market.

This marks one of the most severe leverage resets in crypto history, a clear sign of how aggressively speculative excess has been flushed from the system. pic.twitter.com/XBufZmA9vs

— glassnode (@glassnode) October 12, 2025

Ethereum Price Prediction: What Does the Wyckoff Accumulation Pattern Suggest for Ethereum?

Ethereum’s market structure shows a clear bullish setup forming toward the end of the year.

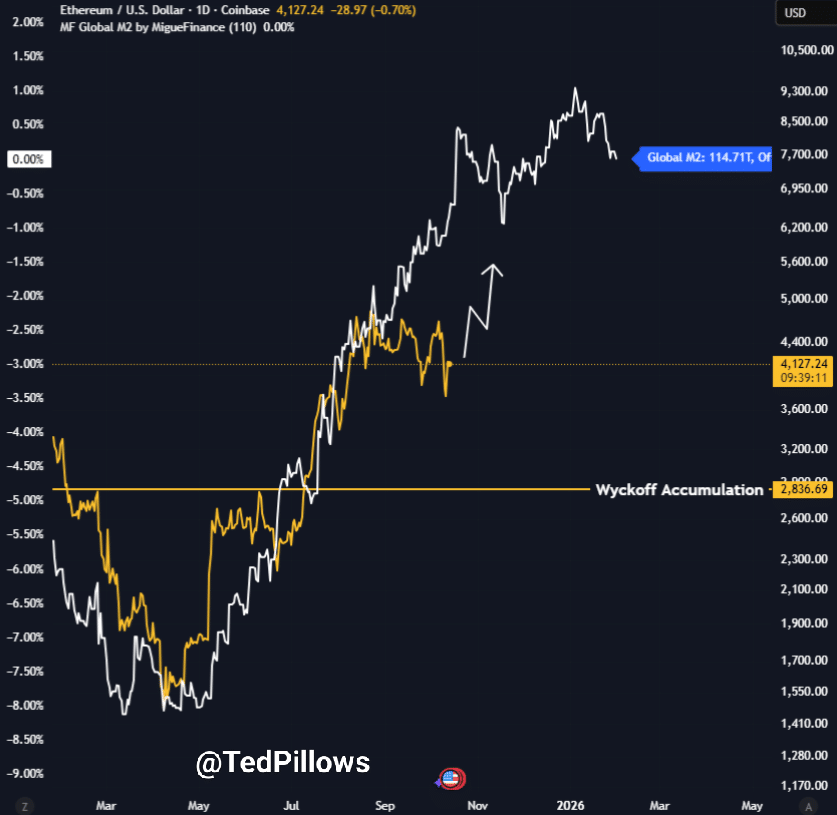

A chart shared by crypto investor TedPillows compares Ethereum’s price with the global M2 money supply. This has been closely followed by the two since mid-2024.

This indicates that ethereum is in a mid-cycle accumulation stage, commonly known as Wyckoff Accumulation, which has strong support at a price of approximately $2,836.

Both ETH and global liquidity fell at the beginning of 2025 and hit their lowest point in late spring.

Soon after, both rebounded. The ETH crypto price surpassed the $ 4,000 mark as worldwide M2, and global M2 surpassed the $114.7 trillion mark.

(Source: X)

It is a trend where macro liquidity continues to influence crypto prices, and Ethereum is more responsive to it than Bitcoin.

Technically, ETH appears ready for a continuation rally. The price is consolidating above $4,000 after a sharp move up, forming what seems to be a reaccumulation zone.

Higher lows and a tightening range indicate a potential breakout toward $6,500–$7,000 if market momentum persists.

TedPillows is optimistic that Ethereum will be able to cover the M2 supply in Q4 and have fair value in the range of $8,000-$10,000 by the beginning of 2026 as long as institutional demand and staking authorizations remain robust.

If the Wyckoff formation materializes and liquidity grows as anticipated, Ethereum may be entering one of its most productive periods since 2021.

Join The 99Bitcoins News Discord Here For The Latest Market Updates