ZCASH: Bottom Fishing Opportunity or Further Plunge Ahead?

Privacy coin at critical juncture as traders debate next move

The Technical Setup

ZCASH trades at a pivotal support level that's either launching pad or trap door. Chart patterns suggest we're either witnessing accumulation by smart money or distribution to retail bagholders.

Market Sentiment Divergence

Fundamental analysts point to ZCASH's unique privacy technology and upcoming protocol upgrades. Technical traders see weakening momentum and potential breakdown patterns. Meanwhile, Wall Street 'experts' who couldn't find blockchain on a map six months ago suddenly have strong opinions.

The Regulatory Wildcard

Privacy coins face heightened scrutiny globally—either ZCASH's selective transparency features become its saving grace or regulators treat all anonymity-enhancing tech like financial kryptonite.

Bottom Line: This is either the steal of the decade or another lesson in catching falling knives. In crypto, sometimes the difference between genius and idiot is just timing—and which side of the trade you're on when the music stops.

Can Whale Accumulation and Retail Inflows Drive the Zcash Rally?

Bitcoin is http

Zcash is https

— Thor Torrens (@ThorTorrens) October 12, 2025

According to TradingView data, Zcash’s Money FLOW Index (MFI) has surged above 95, signaling persistent buying even as broader markets cooled. What’s been more staggering about Zcash this time around is the Chaikin Money Flow (CMF), often used to gauge institutional participation, remains positive around 0.25, suggesting that Whales are still accumulating rather than exiting positions.

“Both institutional and retail activity have stayed strong, two segments that usually MOVE in opposite directions during crashes,” one analyst noted.

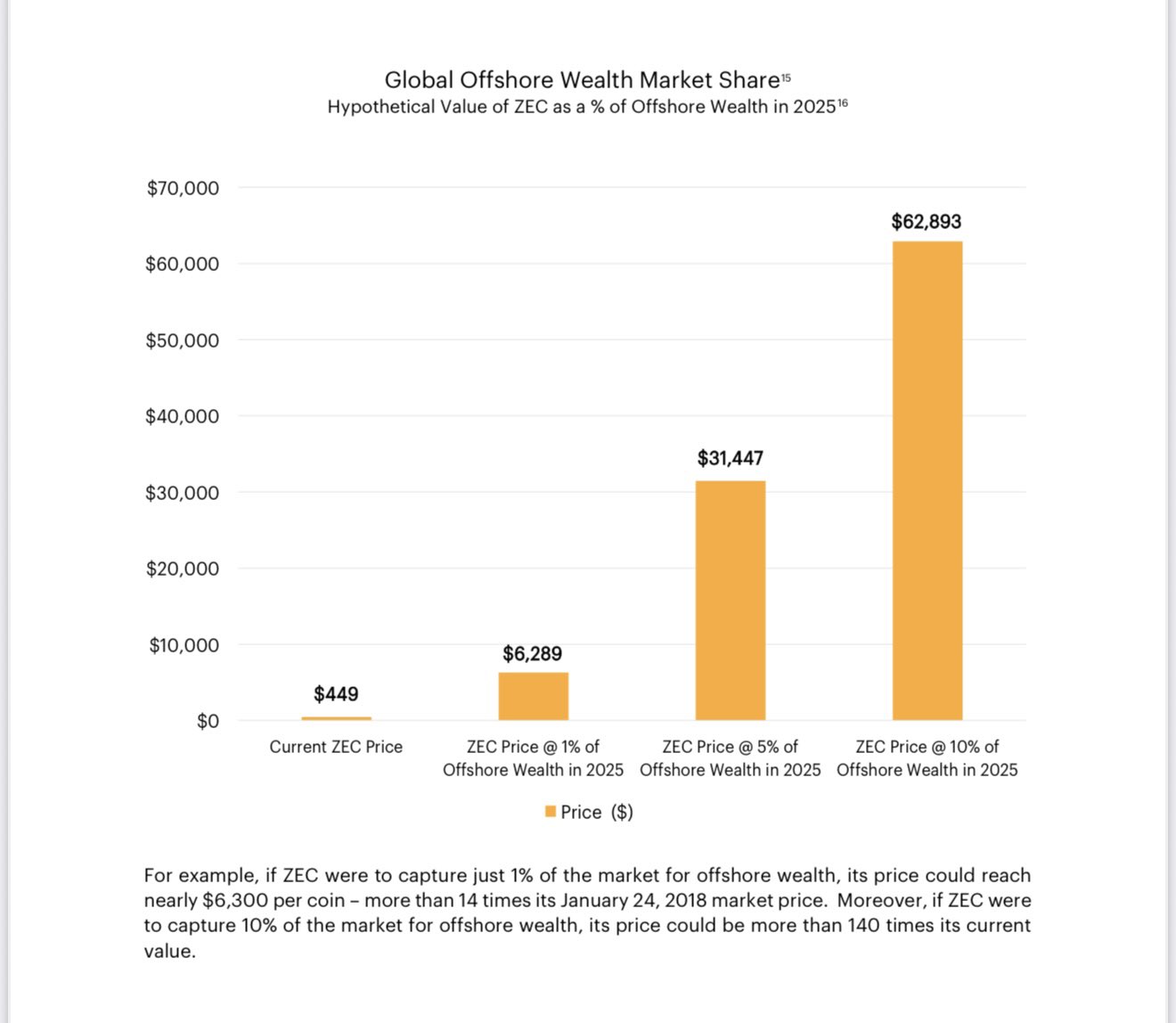

Right now the thesis in play for Zcash is that if just 10% of offshore wealth goes into the privacy coin, one ZEC can be worth $62,893 a coin.

It might sound like hopium, yet in a world where cash is fading out, social credit scores are around the corner, and digital privacy is as ubiquitous as a $2 bill, Zcash has a strong use case. Can it reach $60k? Well, here’s the chart:

Zcash Technicals Signal a Golden Cross and Bullish Reversal

Still, not everything in ZEC’s world is risk-free. Coinglass data shows that long leverage on Bybit’s ZEC/USDT pair now sits at roughly $21.5 million, compared to just $3.4 million in shorts. That imbalance means if prices dip toward $178, overextended long positions could trigger another liquidation cascade.

If that happens, even a small correction could turn into a temporary flush-out.

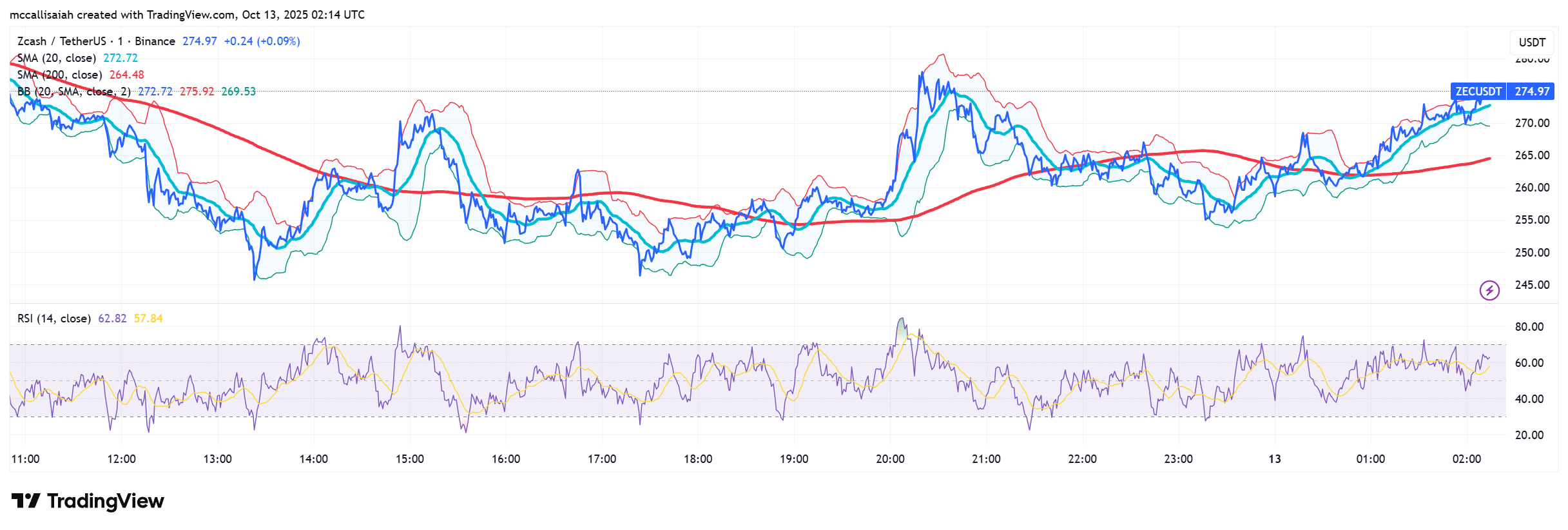

Meanwhile, Zcash is flashing every sign of a market that wants higher ground. The 20-day moving average has crossed above the 200-day, a textbook golden cross. Price action is coiling within an ascending triangle, anchored NEAR $287 with firm support at $251.

RSI is sitting at 62.8, slightly below being overbought and widening Bollinger Bands suggest volatility is creeping back. Structurally, ZEC’s chart looks clean. An inverse head-and-shoulders pattern has completed, and the neckline at $272 has flipped into support.

On-Chain Metrics Reinforce Zcash’s Strength: Should You Buy Now?

On-chain tightening and institutional accumulation gives Zcash a strong narrative heading into Q4. The question now is whether Leveraged traders will sustain or sabotage the trend.

In short, Zcash does have a strong case for being the new silver to Bitcoin’s gold: 1) It has a fixed supply, 2) Better privacy than BTC, 3) A strong, wildly intelligent community that sees the utility in privacy. The jury is out if it hits $60,000 ever, but this thing has room to run.

Key Takeaways

- While most altcoins are still limping from October’s sharp sell-off, Zcash (ZEC) has done the opposite. Yet can it actually reach $2k?

- Zcash is flashing every sign of a market that wants higher ground; the 20-day moving average has crossed above the 200-day.