Bitcoin Bull Run Nearing Climax: Veteran Trader Peter Brandt Predicts Imminent Peak as BTC Hits $46K

Bitcoin's explosive rally faces its moment of truth as legendary trader Peter Brandt signals the bull market peak could strike at any moment.

The Final Countdown

With Bitcoin trading around $46,000, the entire crypto market holds its breath. Brandt's track record of calling major market turns adds weight to his warning—this isn't another routine correction prediction.

Timing the Top

Historical patterns suggest Bitcoin's bull cycles typically last 12-18 months. We're deep into that window now. The veteran trader's analysis points to classic parabolic curve behavior—the kind that usually precedes dramatic reversals.

Market Psychology at Extreme

Retail FOMO meets institutional accumulation at these levels. Everyone from your Uber driver to pension funds suddenly has strong opinions about digital gold—usually a contrarian signal that makes traditional finance veterans roll their eyes.

Prepare for Volatility

Whether Brandt's prediction hits this week or next month, one thing's certain: the coming transition will separate disciplined traders from the emotional herd. Because in crypto, the only thing more predictable than volatility is how quickly people forget the last crash.

“Add 533 days to the April 2024 halving, and bingo, it’s this week,” Brandt said, noting that bitcoin set a new record above $126,000 on Monday.

Will Bitcoin Keep Crashing? The Delayed Halving Cycle and What Comes Next

Bitcoin’s current cycle low occurred on Nov. 9, 2022, exactly 533 days before the April 2024 halving. Brandt notes that every previous bull run peaked an equivalent number of days after the halving, suggesting that the pattern remains intact. Still, he cautions that markets occasionally break their own rules.“Trends that violate the prevailing cyclic nature of markets are typically the most dramatic,” he said. “Betting against a pattern with a perfect three-for-three record should not be done with reckless abandon.”

I believe I was the first trader to ID the parabolic chart construction by name in Bitcoin on Oct 2017 $BTC here: https://t.co/N5jSSGCUJM

If I am wrong, show X link

Let the suggest that I am also first to ID and "coin" the phrase "Bitcoin Banana"![]()

![]()

cc: @PeterLBrandt pic.twitter.com/TFzkpcqPas

— Peter Brandt (@PeterLBrandt) July 27, 2025

Brandt puts the probability of a near-term top at 50/50. If Bitcoin avoids peaking in the coming days, he expects an extended MOVE well beyond $150,000, with potential upside as high as $185,000 before the next correction.

Bitcoin ETF Flows and the “Debasement Trade” Narrative: Will We Hit $150,000?

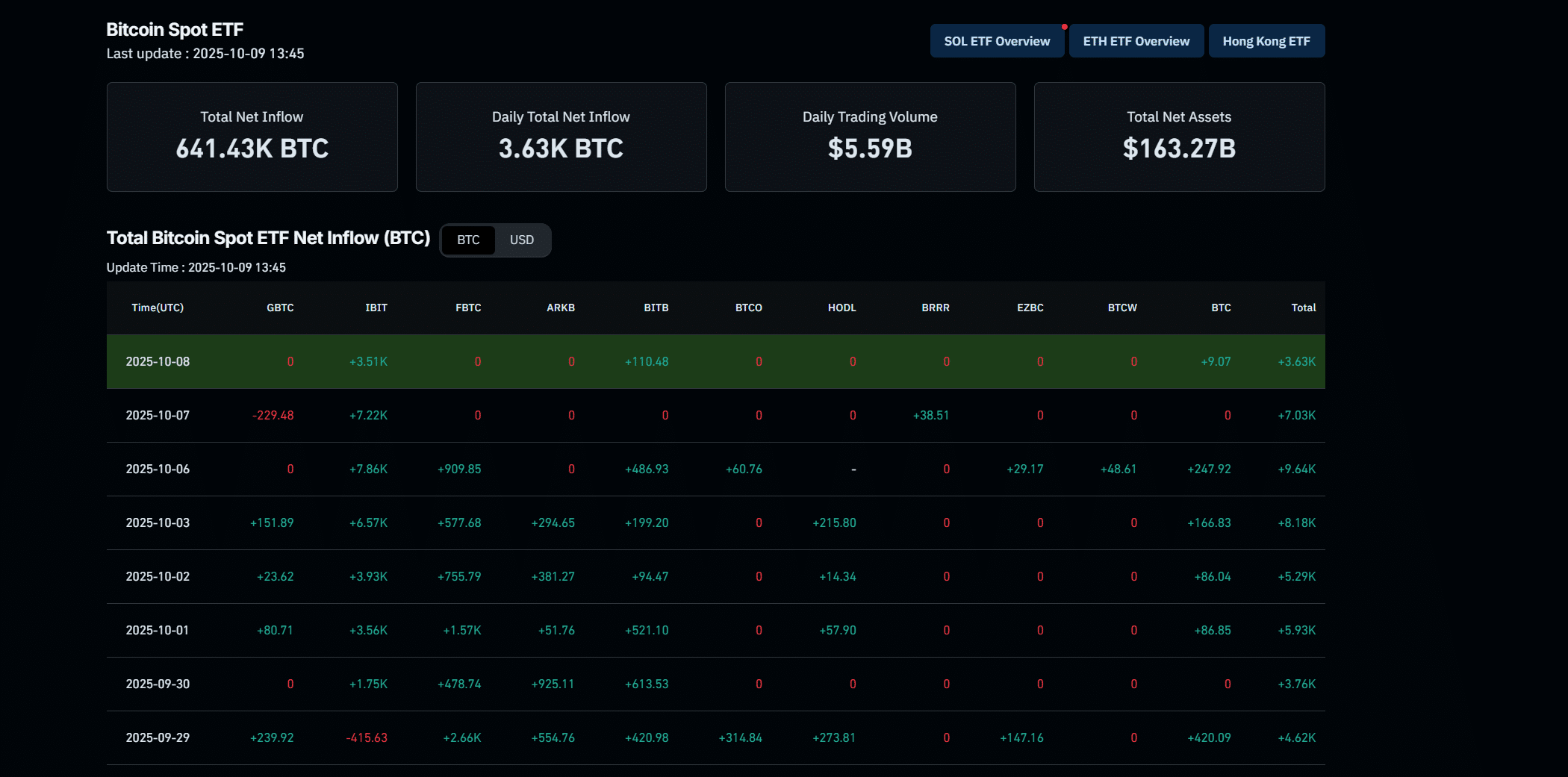

Even if a short-term pullback hits, ETF inflows continue to paint a structurally bullish backdrop. According to Bitwise CIO Matt Hougan, spot Bitcoin ETFs are on track to surpass last year’s $36 Bn record, fueled by a wave of late-year capital rotation.

He highlighted three catalysts for the surge: 1) Bitcoin’s exceptional price performance, mounting institutional adoption, and what Wall Street now calls the “debasement trade” (AKA investing in assets that lose purchasing power)

Bitcoin Vs Gold

A once in a generation breakout is coming. pic.twitter.com/Ss2N2uddkW

— The ₿itcoin Therapist (@TheBTCTherapist) October 9, 2025

Gold and Bitcoin remain the best-performing major assets of 2025. Since 2020, the US money supply has expanded by 44%, a trend that’s now driving even traditional firms, such as Morgan Stanley, to recommend allocations of up to 4% in BTC for risk-tolerant portfolios.

Data Confirms Institutional Demand and Market Strength

Economist Timothy Peterson estimates a 50% chance that Bitcoin will end the month above $140,000, based on decade-long simulations. Meanwhile, Arthur Hayes and Joe Burnett maintain even more aggressive forecasts that we will hit $250,000 BTC by the end of 2025.

Brandt’s model says the top could be imminent. But on-chain data, ETF flows, and institutional adoption all hint the opposite: Bitcoin may just be warming up.

Key Takeaways

- The clock is ticking on one of crypto’s longest legal dramas and the XRP price could be ready to rocket.

- Economist Timothy Peterson estimates a 50% chance Bitcoin ends the month above $140,000, based on decade-long simulations.