NYSE Bets Big on Polymarkets: Prediction Markets Go Mainstream - Top 3 Polymarket Plays for October 2025

Wall Street's old guard just placed its biggest bet yet on decentralized prediction markets. The New York Stock Exchange is diving headfirst into Polymarkets - signaling that forecasting platforms aren't just crypto's playground anymore.

Three Polymarket Bets That Could Print

While traditional finance finally wakes up to what crypto natives knew years ago, these three markets show where the smart money's flowing. Election outcomes, tech stock movements, even climate predictions - all becoming tradeable assets.

Prediction markets cutting out the middleman - no more waiting for quarterly earnings calls or Fed announcements. Real-time sentiment trading goes institutional.

Of course, Wall Street only embraces innovation once it's figured out how to charge fees for it. The revolution will be monetized.

What Steps Did Polymarket Take to Regain US Regulatory Access?

The MOVE marks one of Wall Street’s biggest steps into blockchain-based prediction markets, a space long viewed as too experimental for traditional finance.

ICE said it plans to syndicate Polymarket’s data to institutional clients while exploring ways to tokenize financial instruments using similar technology.

“Our investment combines ICE’s market infrastructure with a forward-thinking company shaping how data and events intersect,” ICE CEO Jeffrey Sprecher said in a statement.

Polymarket founder and CEO Shayne Coplan called the deal “a major step in bringing prediction markets into the financial mainstream.”

Polymarket has operated largely outside the United States since settling a case with the Commodity Futures Trading Commission (CFTC) in 2022. The company paid a $1.4M fine and agreed to shut down non-compliant markets.

To return to the US, Polymarket acquired QCEX, a CFTC-licensed exchange and clearinghouse for $112M in July.

In early September, CFTC staff granted QCEX a limited no-action letter related to data reporting and recordkeeping, clearing the way for a regulated relaunch of event-based contracts.

ICE’s entry into this space signals that prediction markets, once confined to the crypto niche, may soon be integrated into the broader financial system.

What Should Investors Watch for in ICE’s October 30 Earnings Call?

Reuters said ICE shares rose about 4% in pre-market trading after the news. The deal comes as prediction markets hit new highs.

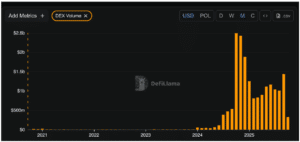

Data from DeFiLlama shows Polymarket’s 30-day DEX volume around $1.16Bn, while US-regulated Kalshi saw about $1.3Bn in September.

(Source: DeFiLlama)

Both platforms are competing for users and liquidity as interest in event-based trading grows.

ICE said the investment was made in cash and WOULD not affect its 2025 outlook. More details are expected on its Oct. 30 earnings call.

Polymarket, launched in 2020 and now the official prediction partner of X and Stocktwits, presents its prices as real-time probabilities that can serve as sentiment gauges for institutions and media.

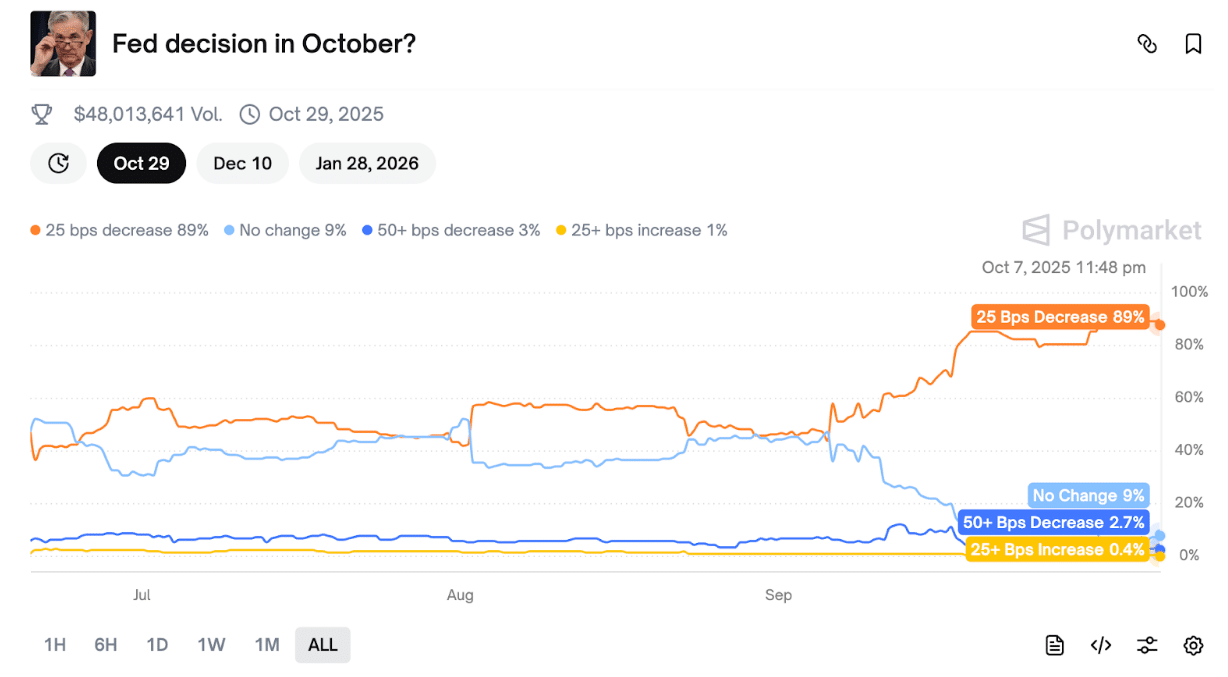

Traders are betting heavily on another 25-basis-point rate cut.

As of Tuesday, the “Decrease 25 bps” contract implied about 89% odds, compared with roughly 9% for “No change,” on total volume above $46M. The outcome will depend on the Federal Reserve’s Oct. 29 policy statement.

(Source: Polymarket)

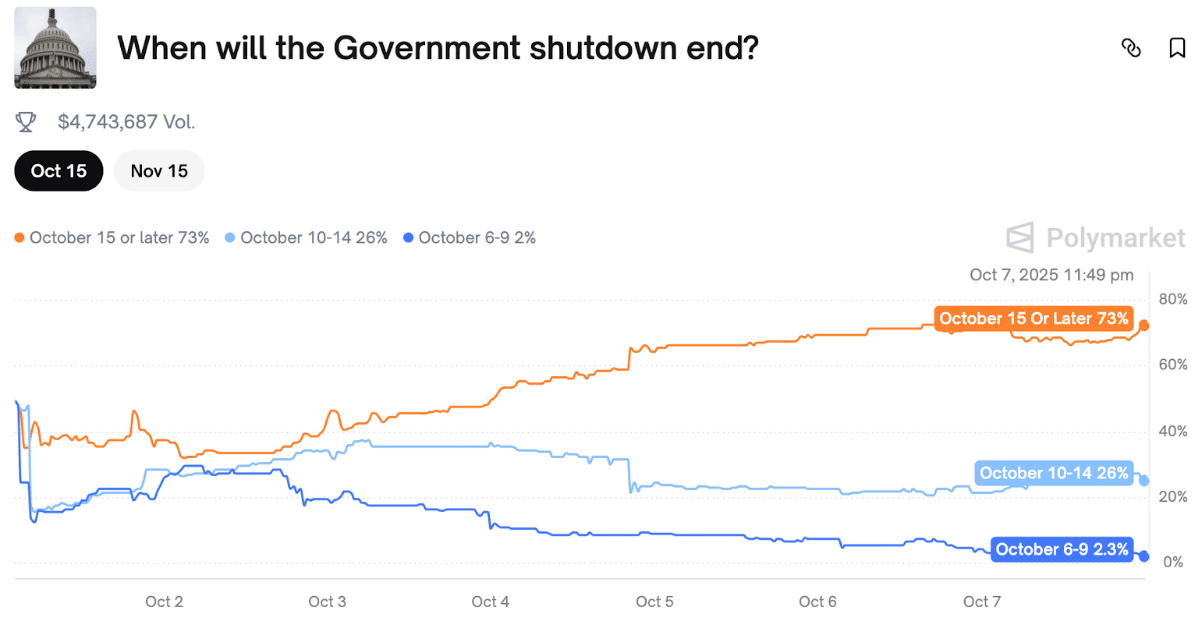

With the government shutdown in its first week, Polymarket’s contract tracking the reopening date shows “Oct. 15 or later” priced NEAR 69%, and “Oct. 10–14” at 28%, on more than $4.7M in volume.

(Source: Polymarket)

The result will be based on updates from the US Office of Personnel Management.

ICE plans to give further details on Oct. 30. Watch for Polymarket’s formal US relaunch timeline as QCEX expands, and for any regulatory shifts affecting event contracts.

How institutions adopt Polymarket’s data and whether Kalshi maintains its recent volume lead will be early indicators of how the prediction market landscape is shaping up.