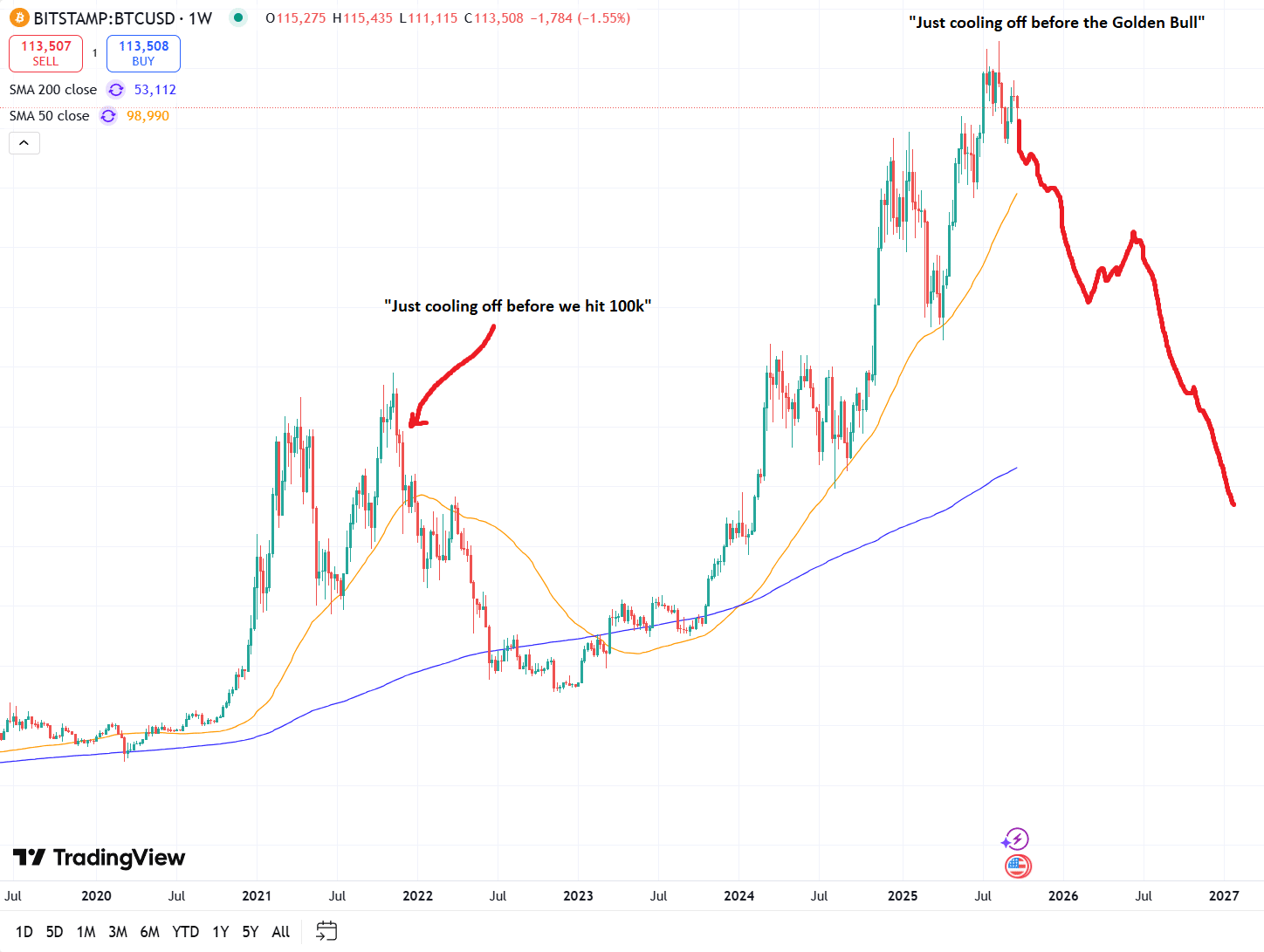

Bitcoin’s 2025 Trajectory: Navigating the Bull Market Correction

Bitcoin hits turbulence as the bull market takes an unexpected southern turn. The digital gold faces its first major test of 2025.

The Correction Conundrum

Market analysts scramble to interpret the sudden dip. Traditional patterns break down as institutional money shows unusual behavior.

Technical Breakdown

Support levels crumble faster than a hedge fund's promises during volatility. The charts tell a story of profit-taking meeting regulatory uncertainty.

Institutional Whiplash

Wall Street's crypto experiment faces reality checks. The same firms that praised decentralization now beg for clearer rules—typical finance hypocrisy.

The Road Ahead

Bitcoin's fundamentals remain stronger than a banker's resistance to transparency. Network activity continues growing despite price action.

This isn't 2018's collapse—just the market reminding everyone that trees don't grow to the moon. The real question isn't if Bitcoin recovers, but which traditional finance giants get left behind.

(Source: TradingView)

(Source: TradingView)

Just one week after the Fed’s first rate cut of 2025, Chair Jerome Powell struck a cautious note on Tuesday. He admitted the US labor market is softening, inflation is still running hot, and policymakers face what he called “two-way risk.”

“There is no risk-free path forward,” Powell said, leaving October’s policy decision wide open.

Futures now price in a 92% chance of another cut in October, up from 89.8% before Powell spoke, with traders betting on three total cuts by year-end. But will all of this be enough for the crypto markets if we enter another recession?

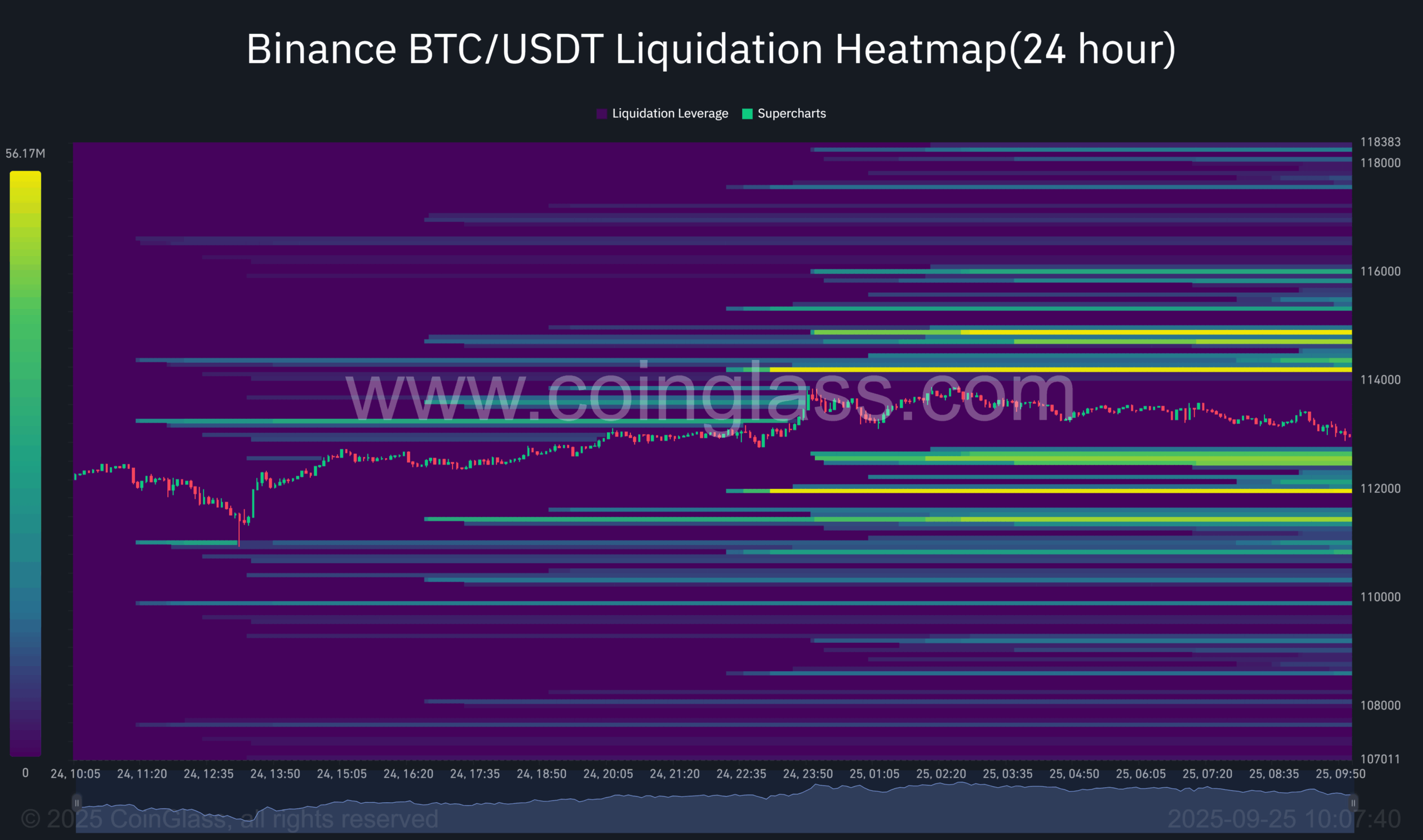

Is The Bull Crypto Market Dead? Why Stocks Rally While Crypto Cracks

Wall Street has treated easing talk as an all-clear. The S&P 500 hit fresh highs this week, with tech leading the charge. But crypto markets told a different story: on Sept. 22, nearly $1.7 billion in positions were liquidated in a single day, the largest wipeout since Dec. 2024, according to Coinglass.

That divergence highlights how risk assets aren’t moving in lockstep. Equities have fundamentals like earnings, AI-driven productivity, corporate buybacks. But crypto runs on liquidity, leverage, and sentiment.

Some traders on X and Reddit argue the recent volatility is just a prelude to a mania phase. Every past cycle, they note, ended in parabolic price action and a final FOMO-driven run before the crash.

Macro tailwinds are building for such a move:

- M2 money supply is climbing again, per FRED data, after two years of contraction.

- ETF inflows remain steady. Glassnode shows U.S.-listed Bitcoin ETFs pulled in $890M in net inflows last week alone.

- Global policy is shifting: U.S. 401(k) reforms and Gulf sovereign funds exploring crypto could unlock trillions in sidelined capital.

Same thing happens all the time… the crypto market is focused on a big breakout, gets levered long ahead of it, it fails at first attempt so everyone gets liquidated… only then does the actual breakout occur, leaving everyone sidelined.

— Raoul Pal (@RaoulGMI) September 22, 2025

As one trader put it:

“Fear has been thrown at this market for two years straight—recession scares, bank failures, nuclear threats. None of it stopped Bitcoin from breaking $120K. At some point, fear fatigue becomes fuel.”

The Bearish Counterargument: Weak Buyers, Weak Bounce, Are We F*cked?

Not everyone sees fireworks ahead. Some analysts warn that the liquidation-driven selloff failed to spark the usual rebound. That, they say, is a red flag.

“The 80% rebound rule broke this time. That suggests no one wants to pick up the baton,” said one X trader.

$BTC usually bottoms in September.

In just 2 days, $17,500,000,000 in bitcoin options will expire with a max pain at $107,000.

Historically, BTC moves towards max pain during such huge expirations.

I think there's still a big leg down left before reversal. pic.twitter.com/VVlupHXjmq

— Ted (@TedPillows) September 24, 2025

With Bitcoin hovering NEAR $112,500 support, bears point to downside levels at $100K for BTC, $3,400 for ETH, and $160 for SOL as the next tests.

The real inflection point arrives with Thursday’s US data dump, including: GDP, jobless claims, and Treasury auctions. If numbers confirm a slowing economy, rate cuts could accelerate and liquidity could flood back into risk assets.

Either way, Powell is right about one thing. There is no risk-free path forward.

Key Takeaways

- The bull crypto market *is* over, for crypto at least. You should have sold. To be clear, the whole of twitter was saying altseason is here and it didn’t come

- With Bitcoin hovering near $112,500 support, bears point to downside levels at $100K for BTC, $3,400 for ETH, and $160 for SOL as the next tests.