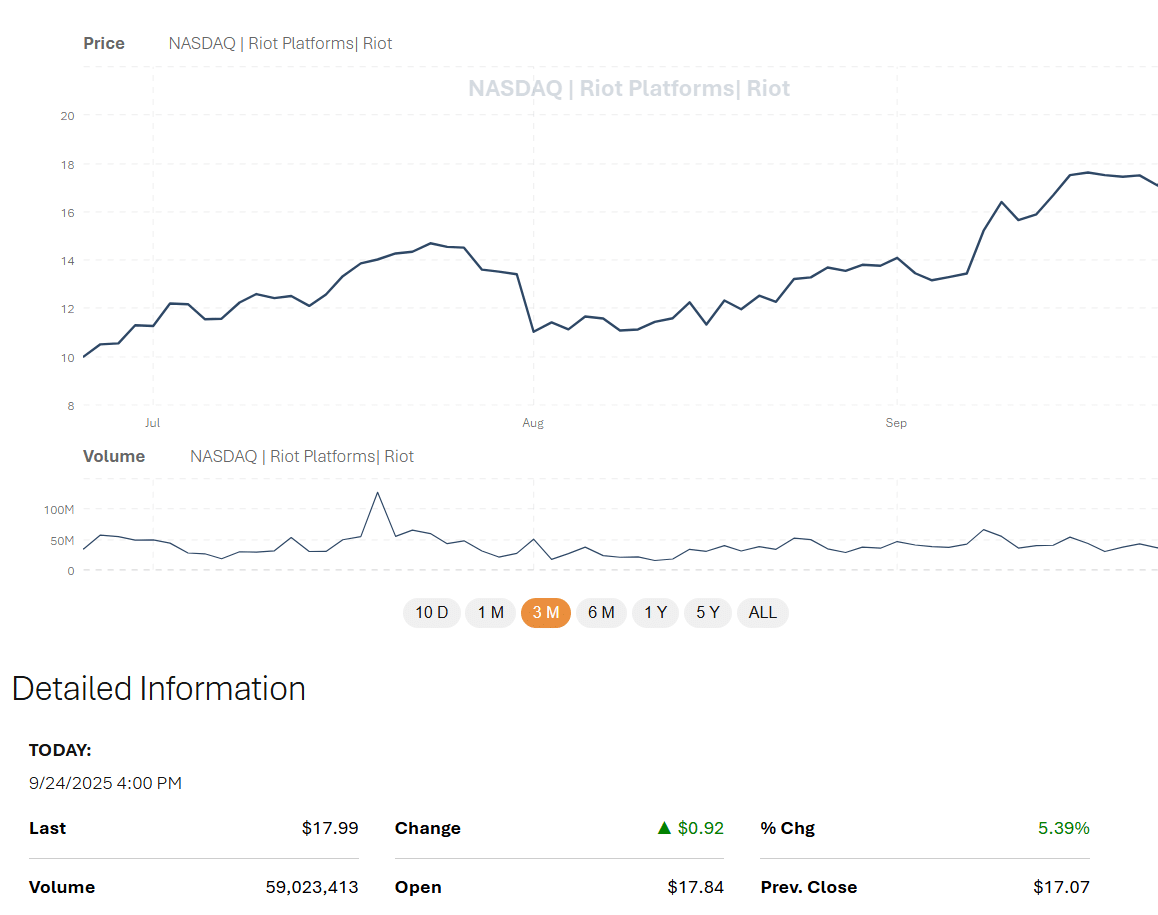

RIOT Stock Explodes +10% Following Record-Breaking Production: The Undisputed Crypto Stock Champion for Q4?

RIOT shatters expectations with unprecedented production numbers—sending shares skyrocketing double-digits in a single session.

Mining Momentum Builds

The bitcoin miner's operational efficiency hits new peaks just as institutional money floods back into crypto assets. Their infrastructure expansion appears perfectly timed with the market's bullish turn.

Wall Street's Crypto Conundrum

While traditional analysts scramble to update price targets, RIOT's performance continues outpacing legacy financial projections. Another quarter like this might force even the most skeptical fund managers to reconsider their crypto allocations.

Q4's Clear Frontrunner

With mining margins expanding and bitcoin's fundamentals strengthening, RIOT positions itself as the pure-play crypto stock to watch. The production surge suggests they're not just riding the wave—they're creating it.

Of course, Wall Street will probably still find a way to call this 'speculative' while quietly adding positions.

How Does The Riot Stock Price Compare in the Mining Landscape? Can It Sustain Hype?

Riot’s edge is easy to spot. August output hit 477 BTC, a 48% jump year-over-year, and electricity costs stayed at 2.6 cents per kWh. With mining economics dictated by power prices, that margin separates survivors from casualties.

“Riot continues to expand its Bitcoin-driven infrastructure, underlining its cost advantage,” analysts at BTIG wrote this week.

Riot’s August mining revenue was $1.46Bn, up from $1.1 Bn in July. They’re 477 BTC, which translates to about $53 million at current prices, roughly 3.6% of global rewards.

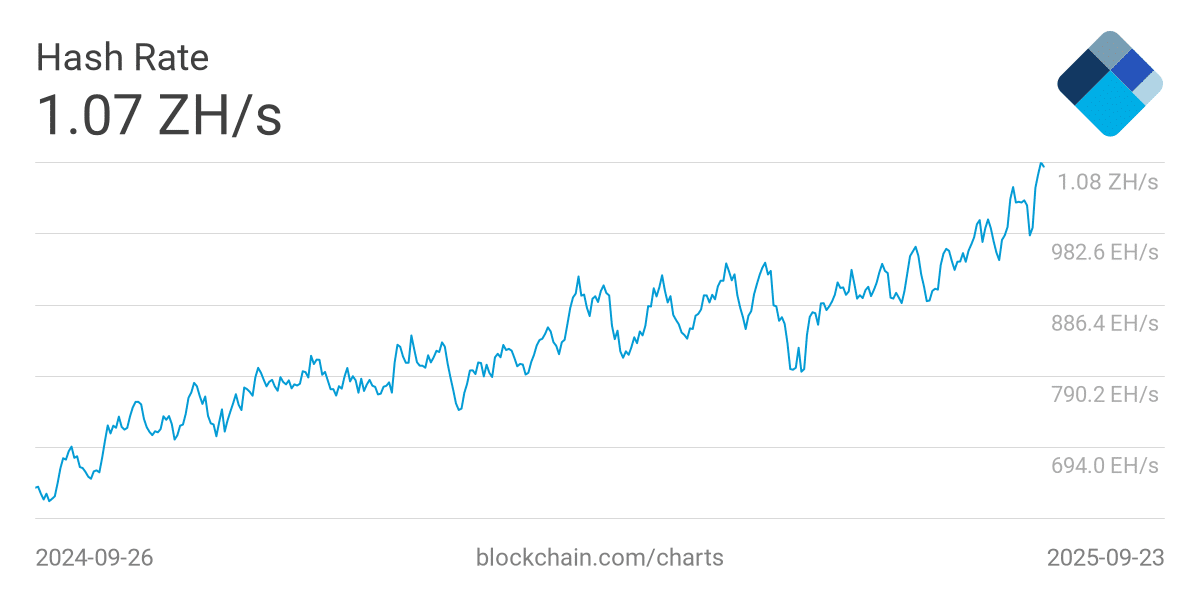

Meanwhile, Blockchain.com shows that the total mining hashrate, the entire mining power behind BTC, has slowly increased over the summer.

With US industrial power costs up 4% year-over-year (FRED), its sub-3 cent electricity rate is the edge that keeps margins intact.

Should You Be Worried About Riot Blockchain’s Red Flags?

Riot posted $376.7 Mn in quarterly revenue with margins that look enviable at first glance (76% EBITDA and 70.1% gross). But the devil is in the details and this netted RIOT a -17.5% net margin that raises questions about how durable the model really is.

The company’s liabilities total $989M, though a current ratio of 1.4 suggests the balance sheet can handle near-term obligations.

Efficiency is still a weak spot for Riot Platforms. Against a macro backdrop where Bitcoin hovers at $112,500, just above critical $112K support, Riot’s fate looks tied to whether BTC repeats its typical Q4 rally, averaging +23% since 2016, according to CoinGecko.

Energy markets also remain a swing factor. With oil flirting with $90 a barrel and natural gas supplies tightening into winter, Riot’s fixed low-cost power contracts provide insulation that rivals like Marathon Digital and Hut 8 Corp. may envy.

For crypto mining investors, the stock remains a high-beta play on Bitcoin. The numbers suggest Riot is building structural advantages, but profitability still depends on Bitcoin’s trajectory. We think it’s one of the best Bitcoin mining companies on the market.

Key Takeaways

- Why is no one shilling the RIOT Stock Price? Out of the many crypto stocks shares of Riot Platforms rocketed on Tuesday to new highs.

- Riot’s fate looks tied to whether BTC repeats its typical Q4 rally, averaging +23% since 2016, according to CoinGecko.