Crypto Bloodbath September 25: Bitcoin Crashes Below $112K, Ethereum Tumbles Under $4K - Here’s Why Markets Are Tanking

Digital assets face brutal selloff as major cryptocurrencies plunge across the board.

Bitcoin's Sharp Decline

The flagship cryptocurrency nosedives below the $112,000 psychological barrier, wiping out recent gains and triggering panic across derivatives markets. Trading volumes spike as long positions get liquidated in cascading fashion.

Ethereum's Rough Ride

Ethereum follows Bitcoin's lead, breaking through the $4,000 support level that traders had been watching closely. The drop reflects broader market sentiment rather than chain-specific issues—network activity remains robust despite price action.

Market-Wide Pressure

Regulatory uncertainty combines with traditional market spillover to create perfect storm conditions. While fundamentals remain strong, short-term sentiment gets hammered by macroeconomic fears and leveraged positions unwinding simultaneously.

Typical finance folks would call this 'profit-taking'—we call it weak hands folding under pressure. Digital assets have weathered worse storms, and this dip might just be another buying opportunity in disguise.

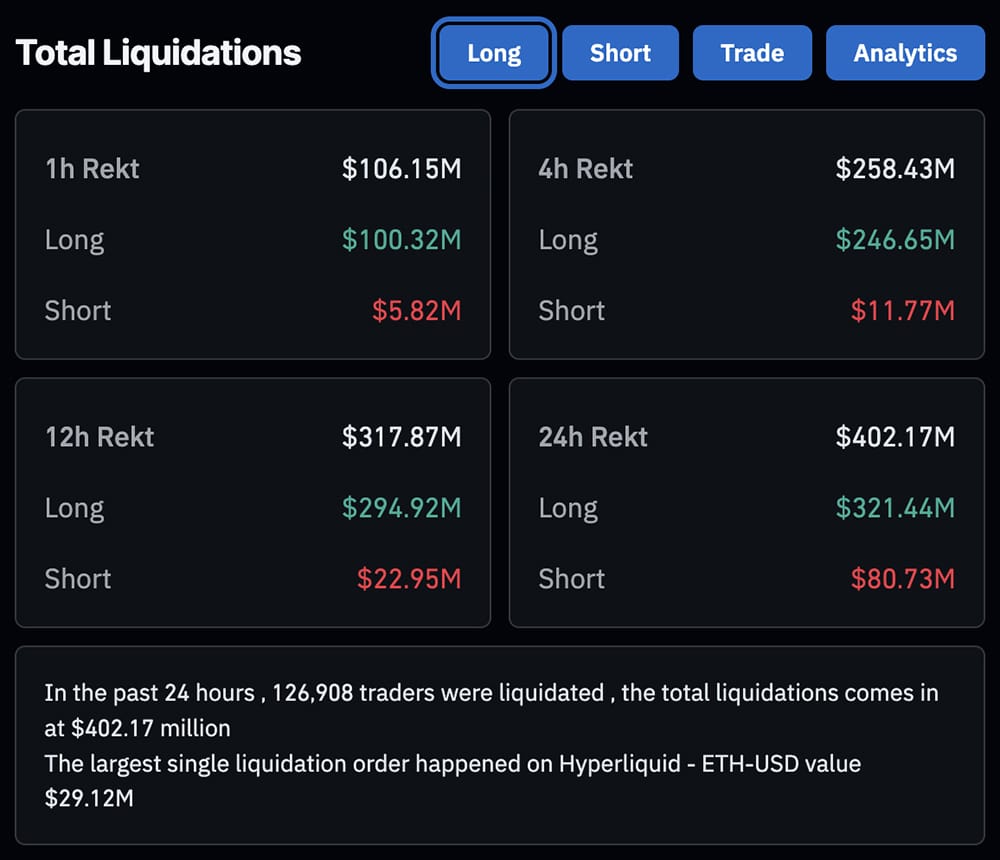

(source – Coinglass Liquidation Data)

The current situation could be a textbook flush as overleveraged traders are wiped out in a classic shakeout. It could be the end, but it could be just another chapter in crypto’s volatile cycles. But as we predicted yesterday, the current slump is not over.

ethereumPriceMarket CapETH$499.41B24h7d1y

DISCOVER: 9+ best memecoin to buy in 2025

BTC USD Price Dips: Why Is Crypto Down Today Amid ETF Outflows and Fed Signals?

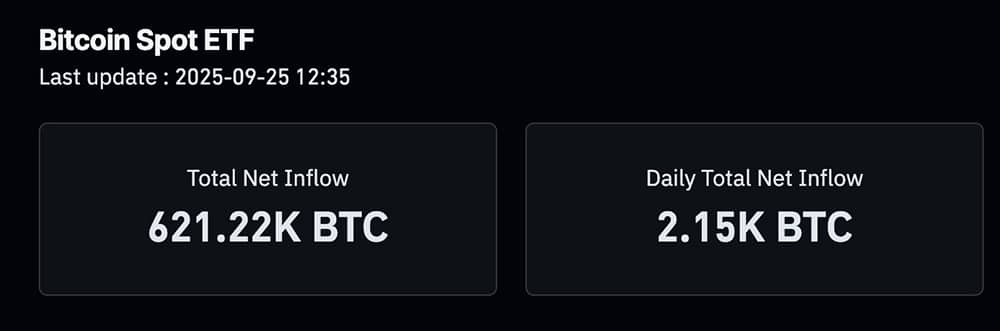

One major reason why crypto is down today is the sudden reversal in ETF flows. According to multiple on-chain analysts, outflows fromBTC ▲0.88% and

ETH ▼-0.87% ETFs totaled around $244 million are effectively ending a multi-week inflow streak. This coincides with the Federal Reserve’s 25 basis point cut which bring rates to 4.00%.

(source – ETF Flows, Coinglass)

While many expected relief, Powell’s tone on inflation risks has kept institutions cautious. That stronger dollar is now weighing on risk appetite, pushing BTC USD price down to $111,758 and ETH to $4,020 when this article was written.

bitcoinPriceMarket CapBTC$2.26T24h7d1y

From a technical standpoint, this reminds the market of the post-rate-cut dip around mid-last year when BTC dropped 11% in a week. Support at 115K didn’t hold, and ETH losing the 4.2K mark was keeping altcoins under pressure. Still, this is a correction.

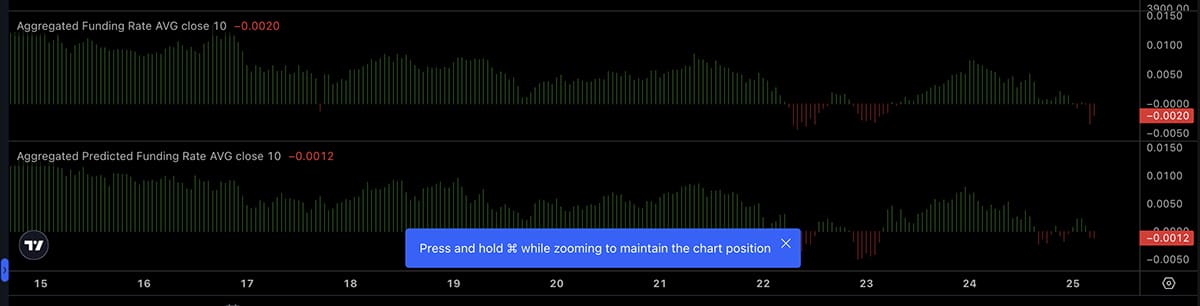

Funding rates, notably Ethereum, have flipped negative, a perfect sign of rising short interest. CoinGlass also shows declining open interest, which often precedes short squeezes when price bases hold.

(source – Funding Rate, coinalyze)

DISCOVER: 10+ Next Crypto to 100X In 2025

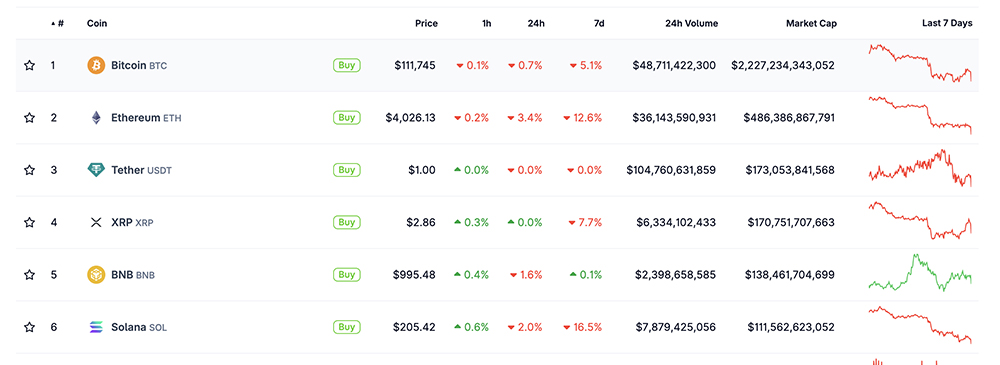

Why is crypto down today, even as some alts show strength? Altcoins like solana are down 11%, but BNB holding above 1K shows selective resilience. DeFi TVL, per DeFiLlama, dropped just under 1%, which is not really catastrophic, as some analysts made it look.

(source – CoinGecko)

Sentiment is DEEP in fear territory, but history tells us fear often precedes rebounds.

Fear & Greed Index: 03/04/2022#bitcoin #crypto pic.twitter.com/S1wWnz3Bt2

— Crypto Fear and Greed Index (@cFearGreedIndex) March 4, 2022

If BTC reclaims 114K and ETH finds footing, this correction will turn into a base for the next leg higher. Until then, accumulation of weakness is likely in the play. This is a patient trader’s market. And as always, the bold tend to win when others panic.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

6 minutes agoIs This The End of Memecoin Sector?

The crypto market has been highly volatile lately, with Bitcoin’s dip to $112K wiping billions from altcoin valuations. Memecoins were hit especially hard. PEPE fell 16%, TRUMP coin dropped 18%, and SHIB barely held its key support level. Yet history shows that meme tokens often rally hard after September’s weakness during altcoin season.

Here’s a breakdown of these three major memecoins and one fresh contender that could become the next crypto to explode.

![]()

Read the full story.