Crypto Bloodbath Continues: Market Cap Plunges Below $4T as Bitcoin, Ethereum, XRP Extend Losses

The digital asset rout shows no signs of letting up—another brutal session hammers crypto valuations across the board.

Total Market Carnage

Investors watched in horror as the bleeding continued unabated. The once-unstoppable bull market now resembles a waterfall chart gone wrong.

Major Coins Get Hammered

Bitcoin leads the decline with another leg down, while Ethereum and XRP follow suit. The correlation between major cryptocurrencies remains painfully high—when BTC sneezes, the entire market catches pneumonia.

Traders Search for Bottom

Every attempted bounce gets sold into, creating a classic downtrend pattern. The 'buy the dip' crowd keeps catching falling knives while traditional finance veterans smugly adjust their monocles.

Market psychology has shifted from greed to outright fear. The real question isn't when the selling stops, but whether this is just healthy correction or something more sinister. Remember: Wall Street bankers still think crypto is a passing fad while simultaneously trying to patent blockchain technology.

(source – Crypto Market Cap, CoinGecko)

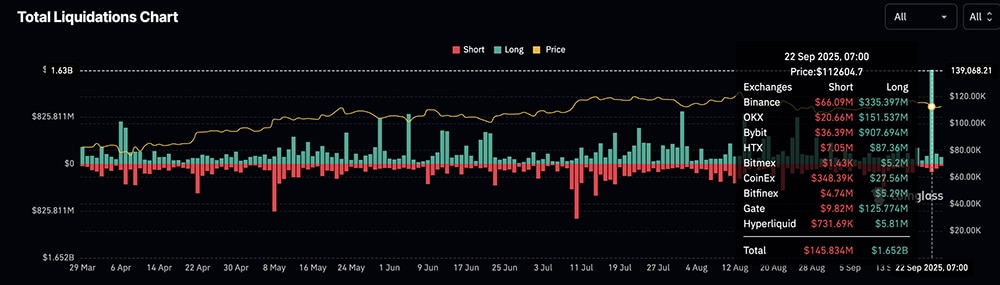

According to CoinGlass, liquidations have hit a staggering $1.6 billion, wiping out a lot of traders. While trading volume still ranges between $164 billion and $190 billion, desperate repositioning. This pattern is usually a sign of a downtrend that is far from over.

(source – Liquidation, Coinglass)

DISCOVER: 9+ best memecoin to buy in 2025

BTC USD and ETH USD: More Pain Before the Pivot?

BTC USD is testing key support levels. The 1% 24-hour drop (and nearly 4% weekly decline) is backed by a sharp decrease in open interest—over $1.5 billion in longs wiped out. This heavy selling pressure is consistent with macro jitters, especially the Fed’s hawkish stance on maintaining interest rates at 4.00%. If this pressure holds, expectBTC ▲0.45% to fall to $107,000 before finding meaningful support.

bitcoinPriceMarket CapBTC$2.26T24h7d1y

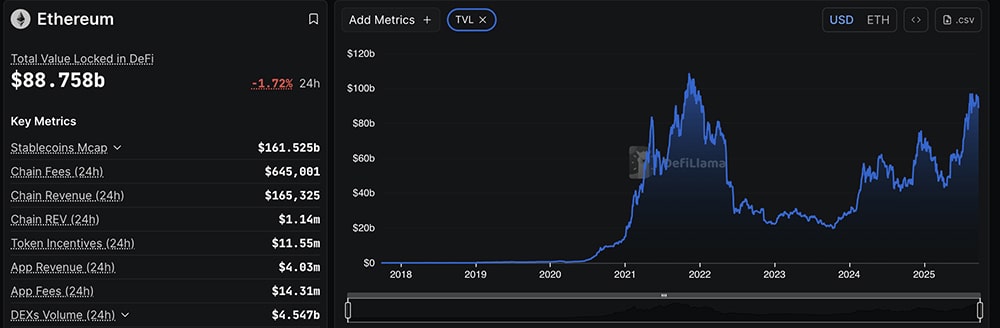

ETH is faring worse in percentage terms, down by almost 10% weekly against USD. DeFi is bleeding. Data from DefiLlama shows TVL dipping 1.73% to $88 billion, with protocols like PENDLE falling over 4%.

(source – ETH TVL, Defillama)

This signals a price weakness and collapsing onchain liquidity. Given ETF outflows and scheduled token unlocks,ETH ▲1.11% could revisit $3,900 levels before the next catalyst, Fusaka upgrades.

ethereumPriceMarket CapETH$507.42B24h7d1y

Meanwhile,XRP ▲2.01% is holding above $2.88, a 5% drop weekly after it stood strong above $3.

SOL ▼-0.40% has plunged 11%, and most altcoins are following suit. Interestingly,

BNB ▼-1.58% is up 6%blasting ath(all-time high) after ath. It shows how strong Binance and CZ influence are in the crypto space.

DISCOVER: 10+ Next Crypto to 100X In 2025

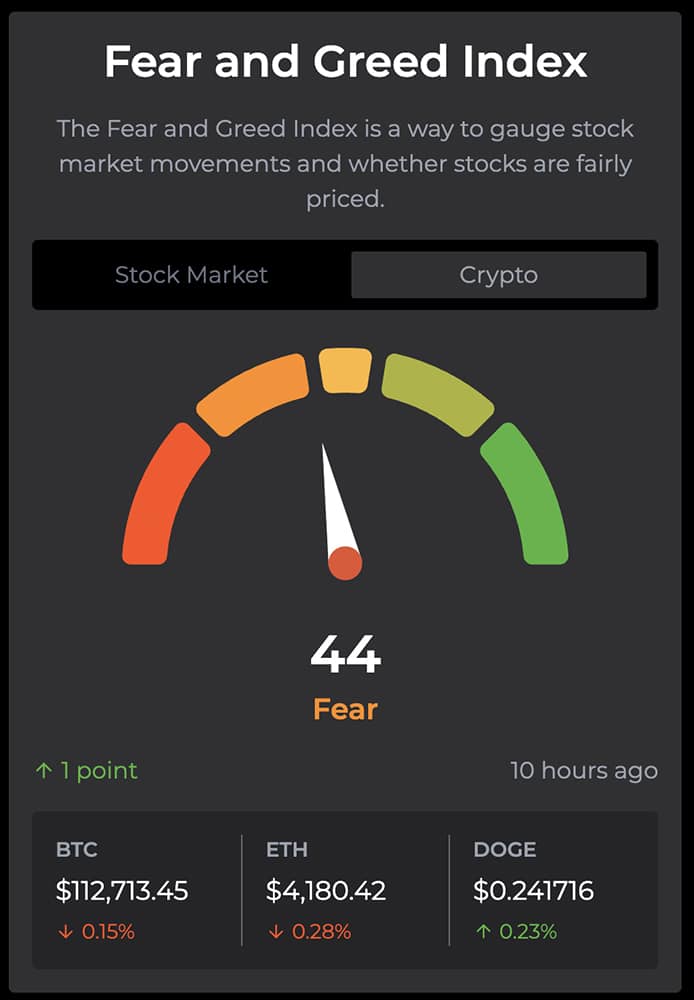

Crypto News Sentiment: Fear and Historic Patterns

Right now, the space is firmly in “fear” territory on sentiment indices. Historical averages show that BTC USD typically dropped around 4.5% in September, and this year is playing out on cue. ETH and BTC are trading at cycle lows not seen since 2021. Capitulation might be far from complete.

(source – Crypto Fear and Greed)

However, there are signs of quiet accumulation. Institutional flows into BTC ETFs totaled $222 million last week. Plus, Friday’s $23 billion options expiry could trigger whiplash volatility. If history holds, October could bring a sharp rebound. Uptober is just a week away.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

2 minutes ago

FLUID Crypto +60% on Upbit Listing: Is Fluid The Best Crypto to Buy Now?

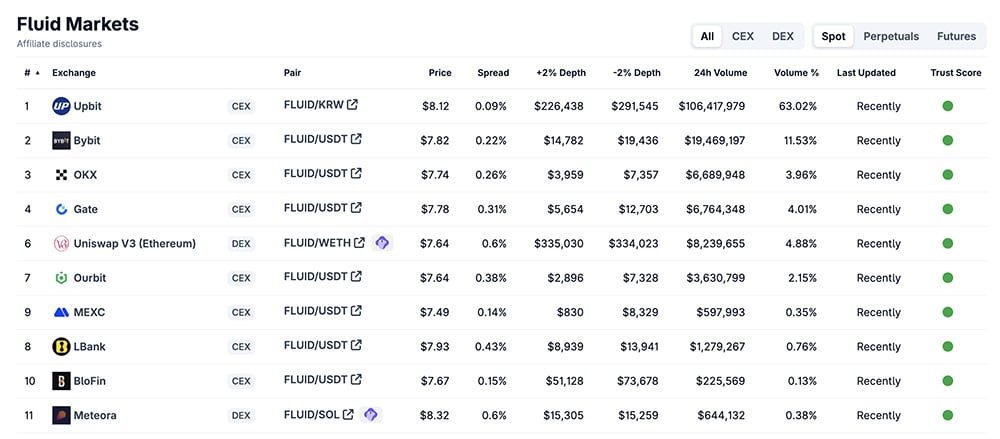

Fluid crypto exploded with a 63% pump in 24 hours of its Upbit debut, as expected, as the exchange draws intense attention from Korean markets. The Fluid Upbit listing catapulted trading volumes to more than $100 million just today. With the market growing in the DeFi space and the Fluid token price hovering around $8, people are calling it the best crypto to buy now, with the momentum in the early phase.

(source – CoinGecko)

Post-listing, Fluid saw open interest rise sharply. Coinglass data showed significant inflows matching historical patterns of other successful crypto listings. Fluid Upbit pairs (KRW, USDT, and BTC) are those with the most active pairs within hours, which catalyzes the current pump.

According to DefiLlama, its total value locked (TVL) recently broke $1.5 billion, climbing steadily over the past few months.

(source – Defillama)

Some compare Fluid to earlier-stage DeFi giants like Aave, pointing to stronger LTV ratios and a more efficient capital use model. Add to that a governance token with real utility and staking mechanics, and it comes with something more than just a hype, speculative pump. People even mentioned nearly $10 million in revenue-sharing and buybacks, a perfect metric for long-term plays.

(source – TradingView)

DISCOVER: 9+ Best Memecoin to Buy in 2025

Read the full story.

2 hours agoTrump Crypto Projects Plummet: New Presale to Buy For Real Gains?

The quest for a new presale to buy is gaining urgency as Trump-linked crypto projects like WLFI, Melania, and TRUMP face sell-offs. These tokens once promised politically backed breakthroughs; now they’re bleeding under pressure, and investor FUD is rampant. Are any of them salvageable, or is the real upside hidden in fresh launches elsewhere?

WLFIPriceWLFI24h7d30d1yAll timeRead the full story.