Crypto Millionaires Surge 40% in 12 Months: World’s Wealthy Ditch Traditional Assets for Digital Gold

The rich aren't just getting richer—they're getting crypto smarter. A seismic wealth transfer shakes the financial landscape as high-net-worth investors pivot hard toward digital assets.

Wealth Migration Accelerates

Forget your grandfather's portfolio. The global elite now park fortunes in blockchain-based assets—with crypto and gold emerging as the ultimate wealth preservation duo. Traditional finance watches from the sidelines as digital vaults overflow.

40% More Millionaires Enter Crypto

That number tells the whole story. Nearly half again as many seven-figure portfolios now hold significant digital exposure. They're not dipping toes—they're diving headfirst into decentralized futures while Wall Street still debates ETF approvals.

Gold's Unexpected Renaissance

The old guard gets a blockchain boost. Physical gold maintains its luster, but now shares wallet space with Bitcoin and Ethereum. Smart money recognizes that digital scarcity mirrors physical scarcity—just with better liquidity.

Of course, this all assumes the wealthy actually understand the technology behind their investments—and aren't just following the latest fad like they did with mortgage-backed securities in 2007.

(Source: Henley & Partners)

: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

Why are the wealthy flocking to crypto and gold?

![]() Record-breaking year for crypto millionaires!

Record-breaking year for crypto millionaires!

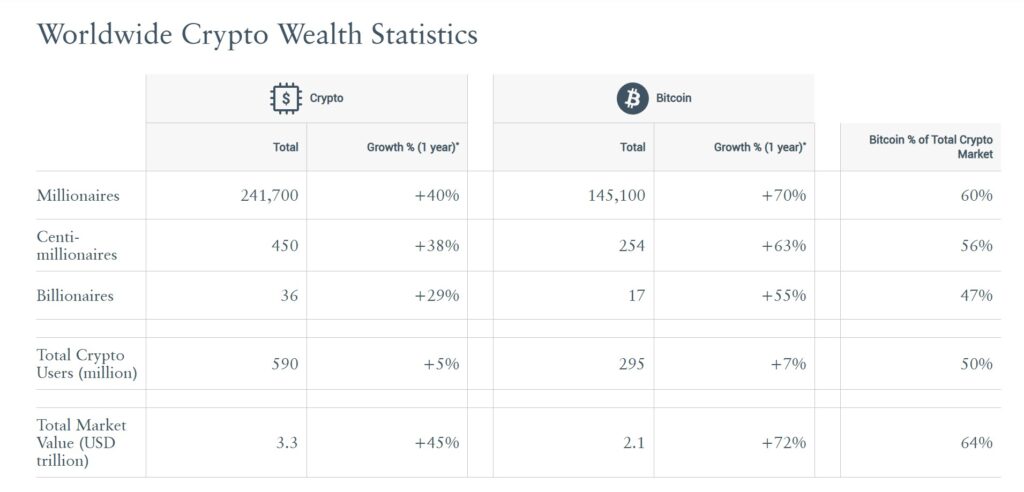

Henley & Partners reports that global crypto millionaires surged 40% YoY to 241,700:

– Bitcoin millionaires: 145,100 (+70%)

– Centimillionaires (> $100M): 450 (+38%)

– Crypto billionaires: 36 (+29%)

![]() Total market cap topped… pic.twitter.com/cxN90zER4f

Total market cap topped… pic.twitter.com/cxN90zER4f

— Degen Station (@Deg3nstation) September 24, 2025

Thanks to crypto and gold’s borderless aspect, traditional assets are loosing favour among the rich. Andrew Amoils, Head of Research at New World Wealth explained how crypto and gold have become the leading portable stores of wealth as global mobility surges. “In previous decades, diamonds were widely used to MOVE money discreetly. Today, crypto and gold have largely taken their place,” he said.

“Today, cryptocurrency has made geography optional — with nothing more than 12 memorized words, an individual can secure a billion dollars in Bitcoin, instantly accessible from Zurich or Zhengzhou alike,” said Dominic Volek, Group Head of Private Clients at Henley & Partners.

Notably, $14.4 trillion worth of wealth crossed national borders in 2024. “ The entire architecture of modern finance assumes that money has a home address — but cryptocurrency doesn’t,” said Volek.

According to the report, world’s most crypto-friendly jurisdictions are racing to attract mobile digital asset investors, as luxury migration is on the rise.

“Bitcoin is becoming the foundation of a parallel financial system”

“Bitcoin is becoming the foundation of a parallel financial system, where [it] is not merely an investment for speculation on fiat price appreciation, but the base currency for accumulating wealth,” said founder of Z22 Technologies, Philipp Baumann.

Bitcoin has gone from being seen as a volatile speculative asset to a cornerstone collateral for a parallel financial system. Samson Mow, CEO of JAN3, calls this shift “the defining paradox of our age.”

According to Volek, crypto empowers individuals to take control of their wealth on a global scale, while at the same time challenging governments whose fiscal systems depend on the ability to monitor, regulate, and tax economic activity.

Meanwhile, Strategy CEO Michael Saylor recently took to X to say, “Bitcoin is money. Everything else is credit.”

Today with @MorganLBrennan, I discussed the differences between Bitcoin, Gold, and other crypto networks — and the rise of Digital Treasury Companies, Digital Credit, and Digital Finance. pic.twitter.com/sdbWWEIq0E

— Michael Saylor (@saylor) September 23, 2025

Key Takeaways

-

Henley & Partners reports that global crypto millionaires surged 40% YoY to 241,700.

-

Top destinations for crypto investment migration include Singapore (for innovation and regulatory strength), Hong Kong (economic clout and tax perks), the USA (public adoption and technology), Switzerland (custody and stability), and the UAE (zero taxes on crypto trading and mining).