BITCOIN BRUTALITY: Price Plunges Below $112K Amid Max Pain - BSC Chain Defies Market Carnage

Digital assets face another gut-check moment as Bitcoin's violent swings continue rattling investors.

MARKET MELTDOWN

The flagship cryptocurrency briefly tumbled below the $112,000 threshold—triggering liquidation cascades across derivative markets. Traders grapple with maximum pain scenarios while institutional players watch for entry points.

BSC'S SURPRISE SURGE

Binance Smart Chain defies broader market weakness with notable momentum. The ecosystem's native token demonstrates resilience as developers flock to its low-fee environment despite regulatory headwinds.

OPPORTUNITY KNOCKS

Volatility creates prime conditions for strategic accumulation. Seasoned investors eye quality altcoins while weak hands capitulate—because nothing tests conviction like watching paper gains evaporate faster than a hedge fund's ethical standards.

Bitcoin Liquidity Levels and Market Sentiment

Socials are split between bulls and bears. Optimists believe the bottom is already in, calling for a recovery toward $125K. Bears, however, expect further pain, eyeing $110K and $107K as key downside targets. According to Hyblock Capital, $107K hosts the deepest liquidity cluster, where heavy buy and sell orders sit. Large liquidity levels often act like magnets, attracting price action before stabilizing. Traders tend to place orders around these levels, reinforcing the potential for a bounce.

$BTC retested the $111,000 support level today.

For now, Bitcoin has bounced back but is still looking weak.

Institutional demand has gone down, so a dip towards the $108,000 level could happen. pic.twitter.com/nVy8Z3cgy8

— Ted (@TedPillows) September 24, 2025

The ETF outflows highlight weakening institutional demand in the short term, but liquidity depth suggests strong support could emerge if bitcoin dips further. The next move may define whether September’s correction is nearing its end or just beginning.

Beyond Bitcoin: Altcoins and the Best Crypto to Buy Right Now

Not all corners of the market are bleeding. The BNB Chain ecosystem is showing strength, fueled by Aster’s explosive momentum. Aster’s perpetual futures exchange recently surpassed Hyperliquid in 24-hour volume, hitting $11.8 billion. Its native token is trading near $2.33 with over $2.4 billion in daily turnover.BNB ▼-1.58% itself broke the $1,000 barrier, setting a new all-time high around $1,080, trading now at $1028.

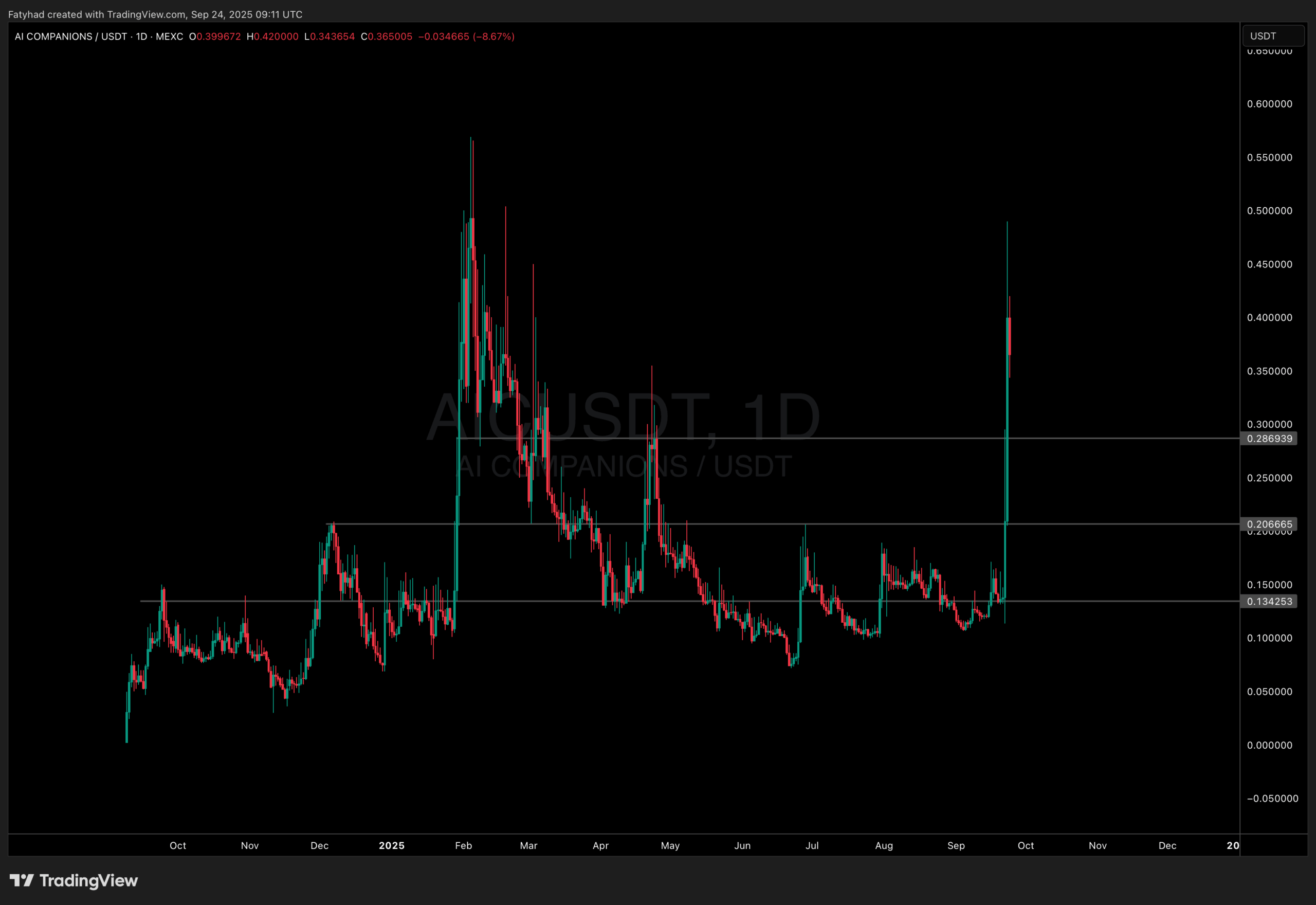

Meanwhile, AI-focused tokens like AIC are gaining traction. AIC surged 333% in just three days, peaking at $0.5 before retracing to $0.38, leaving it with a $380 million market cap. With capital rotating into BSC midcaps, these tokens could represent the best crypto to buy right now for those looking beyond Bitcoin.

At the policy level, SEC Chair Paul Atkins has proposed an “innovation exemption” to help crypto firms launch products faster, signaling a regulatory shift that could encourage fresh market activity into 2026.

35 minutes ago

Bless Crypto Network Rockets 250% at Launch: Can It Really Take on Big Tech?

![]()

Most airdrops end the same way: tokens get claimed, then dumped. Yeezy did it; hell the President and First Lady did it. But BLESS token jumped +250% on launch, climbing from $0.03 to over $0.08 after 3,200 tokens were dropped to Binance Alpha users.

The Bless crypto chart points to momentum holding. Support lines up NEAR $0.085, where the 20-day moving average has caught dips.

Resistance sits at $0.097–$0.10, with a golden cross now in play as the 20-day SMA moves above the 200-day. A cup-and-handle pattern is also forming, with upside targets of $0.11–$0.12.

Here’s what’s next for Bless Crypto:

Read The Full Article Here