Jim Cramer Strikes Again: Declares Bitcoin and Gold Have Topped—Time to Double Down on BTC?

Jim Cramer's latest market call sends crypto traders scrambling—the CNBC host just declared both Bitcoin and gold have peaked. But history suggests doing the exact opposite of his predictions.

The Contrarian Indicator Strikes Again

When the Mad Money host announces a market top, seasoned investors instinctively reach for their buy buttons. Cramer's track record with crypto calls has become Wall Street's favorite reverse indicator—his bearish pronouncements often precede explosive rallies.

Gold and Bitcoin: Strange Bedfellows

Lumping the digital gold narrative with actual gold reveals a fundamental misunderstanding of crypto's value proposition. While both attract inflation-wary investors, Bitcoin's 24/7 global market operates lightyears beyond precious metals' trading constraints.

Timing the Untimeable

Declaring tops in volatile assets remains a fool's errand—especially when institutional adoption continues accelerating behind the scenes. Major financial firms keep building infrastructure while television personalities make dramatic pronouncements.

The Cramer Effect in Full Swing

Market veterans now watch for Cramer's crypto skepticism as potential confirmation of ongoing bull cycles. His latest warning might just signal the buying opportunity tactical investors have been waiting for.

Sometimes the best financial advice comes from doing the opposite of what loudest voices recommend—which explains why so many are loading up on BTC despite the 'top' call.

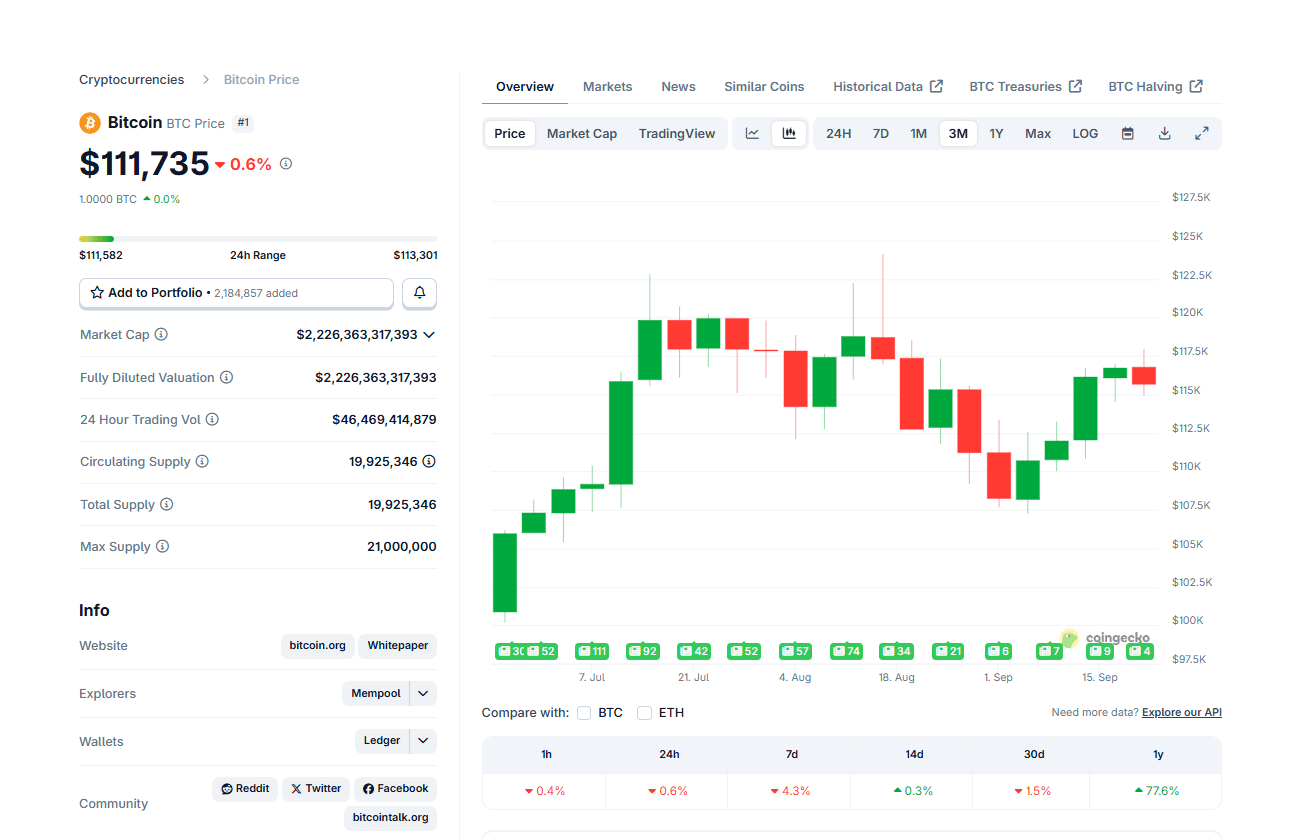

(Source: Coingecko)

As some of the best cryptos to buy come under renewed selling pressure, bitcoin crypto has become the go-to choice for conservative traders. On Coingecko, Ethereum’s dominance sits below +13%, while Bitcoin’s is steadily climbing, recently closing above -56%. In these turbulent times of fear and uncertainty, stacking Bitcoin alongside stablecoins like USDT and USDC might be the safest play, especially if sentiment worsens today.

: Next 1000X crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

Will BTC USD Erupt Higher? Time to Fade Jim Cramer?

History offers clear lessons, and the latest came on Monday whenBTC ▲0.45% flash-crashed below $113,000. It was a sucker punch for optimistic permabulls who had anticipated a perpendicular, one-way rally to $124,500.

If anything, the Bitcoin price could slip even lower, flushing out more degen traders; some of whom aren’t afraid to deploy 500x leverage, or even 1001x on platforms like Aster.

bitcoinPriceMarket CapBTC$2.26T24h7d1y

Local support is between $107,500 and $1110,00, the former marking the recent swing low from late August 2025. On the flip side, if the bitcoin price breaks above $115,000 and $118,000, fresh capital could pour in, providing the much-needed tailwinds for BTC and even top Solana meme coins.

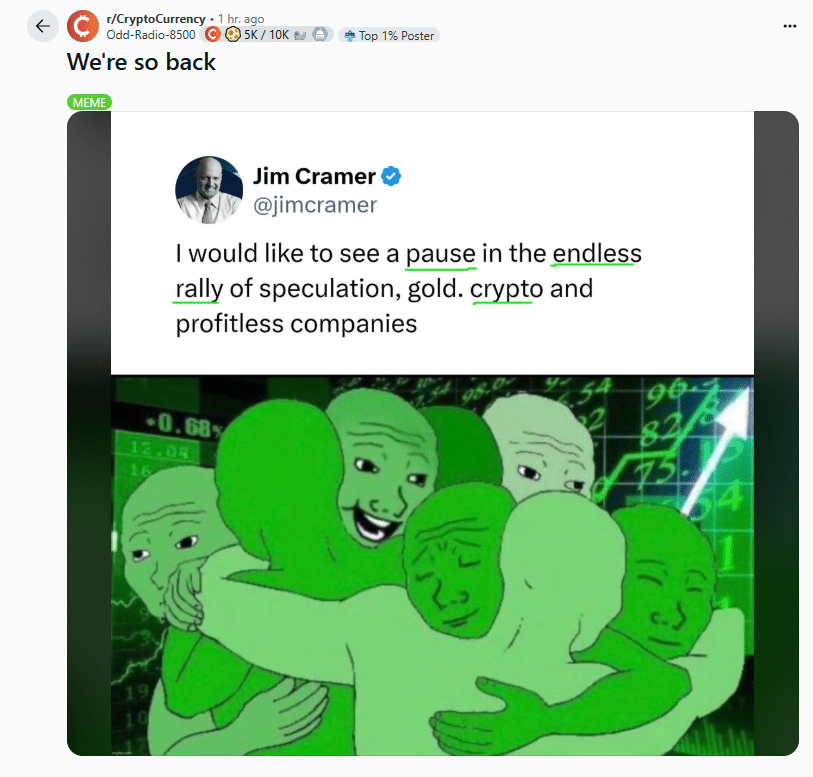

Amid the market bleed, it feels like prime time for Jim Cramer to chime in on X. Recently, the CNBC “Mad Money” host tweeted his wish for “a pause in the endless rally of speculation”, particularly in gold, crypto, and what he dubbed “profitless companies.” By “profitless,” he was taking a not-so-subtle swipe at top crypto treasury firms like MicroStrategy and SharpLink, whose Core operations lose money but command premium valuations thanks to their crypto exposure.

I WOULD like to see a pause in the endless rally of speculation, gold. crypto and profitless companies

— Jim Cramer (@jimcramer) September 22, 2025

As expected, the now-viral tweet sparked the usual barrage of memes and mockery on X and Reddit. Replies ran the gamut from “Inverse Cramer” calls to bold claims that his words could prove to be “the most bullish thing” in September.

(Source: Reddit)

: 9+ best memecoin to buy in 2025

What Is “Inverse Cramer”? Time to Buy the BTC USD Dip?

If you’re new to the “Cramer Effect,” here’s what it is: When Cramer tweets or opines that a bull run should keep rolling, it’s often a cue to fade the market. Conversely, his sell signals frequently turn into prime buy-the-dip opportunities.

Cramer skeptics swear by doing the exact opposite of whatever the CNBC host suggests. The good news: There’s sufficient evidence that fading him isn’t just entertaining, but profitable too, especially in Bitcoin.

A quick look back at his crypto commentary during pivotal moments reads like a montage of epic misses. In October 2023, just as the Bitcoin price surged on spot ETF news, he urged investors to dump BTC USD, dismissing it as a passing fad. Instead, the price rocketed to new all-time highs by late 2024.

Earlier this year, Cramer declared BTC USDT had “peaked” and pushed gold as the better bet. Yet the Bitcoin price staged a stunning recovery, peaking at $124,500 by August 2025.

With Cramer turning bearish on Bitcoin once more, it might be time to stack even harder. The Federal Reserve is poised to deliver more rate cuts by year-end.

A looser monetary policy means more liquidity flooding the system. If 2025 becomes like the 2020-2021 cycle, this dovish environment will be the perfect tailwind to propel BTC USD past $125,000.

Jim Cramer Tweets, Bitcoin BTC USD To $125,000?

- Jim Cramer calls crypto and gold tops

- Bitcoin is under pressure, trading below $112,000

- Cramer has been wrong on several occasions

- Will BTC USD recover and blow past $125,000?