Ethereum Fights to Maintain $4K Threshold While Bitcoin Defends Crucial $110K Support Level

Digital assets face critical resistance tests as major cryptocurrencies battle key psychological barriers.

Market Pressure Points

Ethereum struggles against selling pressure at the $4,000 mark—a level that's become both technical and psychological battlefield for traders. Meanwhile, Bitcoin faces its own showdown defending the $110,000 support zone that institutional players have identified as critical infrastructure.

Trading volumes surge as both assets test these make-or-break levels. The crypto market holds its collective breath watching whether these digital titans can maintain their positions or face significant corrections.

Market analysts note the unusual stability at these elevated price points—perhaps the traditional finance sector finally understands what 'store of value' actually means, though they'll probably still call it a bubble while quietly accumulating positions.

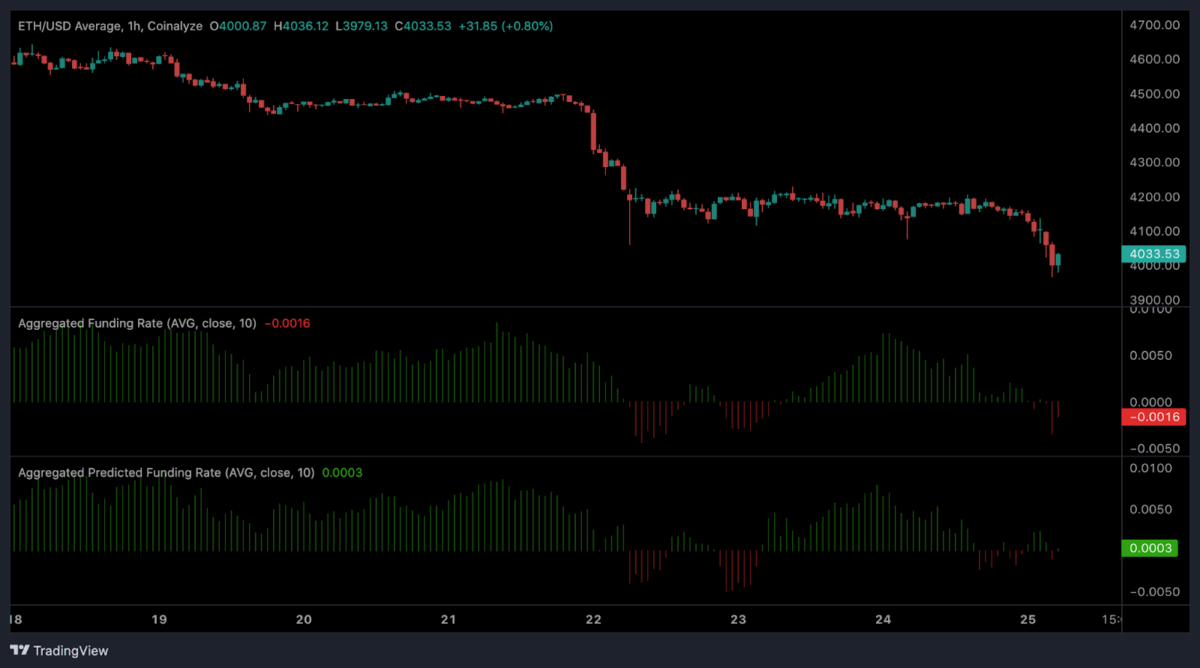

Ethereum struggles with negative funding rates

Market data from Coinalyz shows that ETH has taken a hit, dropping from over $4,600 to a recent low of around $3,900. Though the price bounced back above $4,012, sentiment is still weak.

As per the chart, the aggregated funding rates have dipped into negative territory at -0.0016, indicating expectations of decline in a larger part.

Notably, the predicted funding rate has edged up to 0.0003, showing that traders also may be anticipating a rebound or at least a pause in selling. Still, the risk of ETH falling below $4,000 is high if the bearish trend continues.

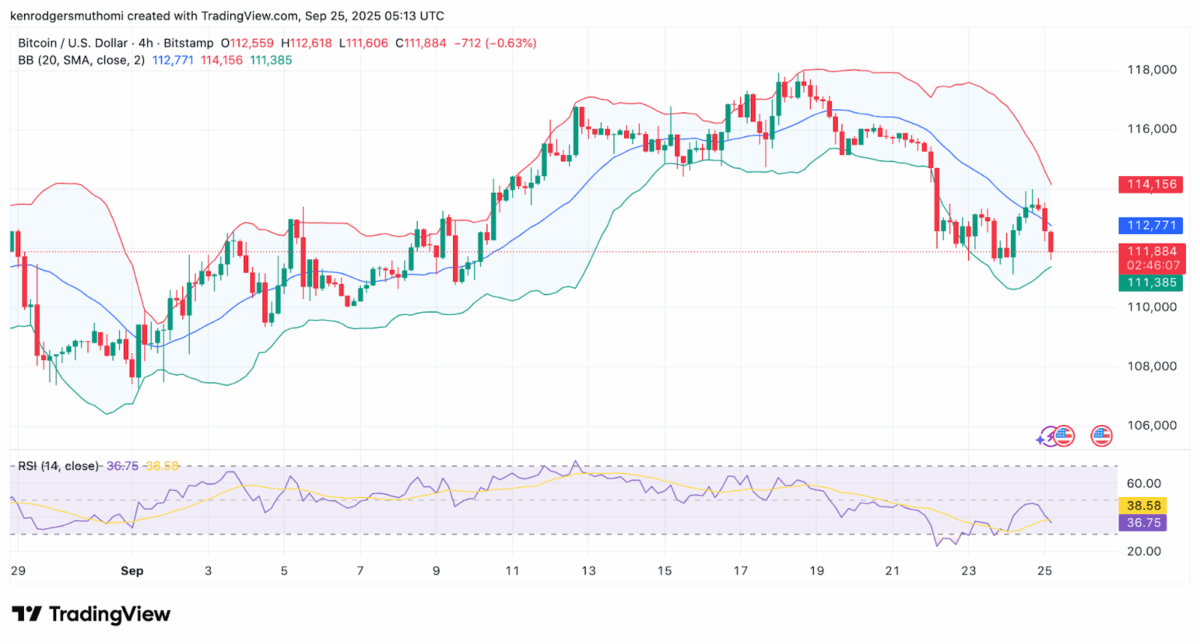

Bitcoin holds $110K amid sentiment shifts

According to TradingView data, Bitcoin has made multiple bounce-offs at the area of $111,000-$114,000 in a 4-hour timeframe. The Bollinger Bands show that BTC had just touched the lower band of $111,385, indicating it was oversold.

The chart further shows that attempts to recover have hit resistance levels of $112,771 and $114,156. On the other hand, the RSI is at 36.75, which points to weak buying momentum.

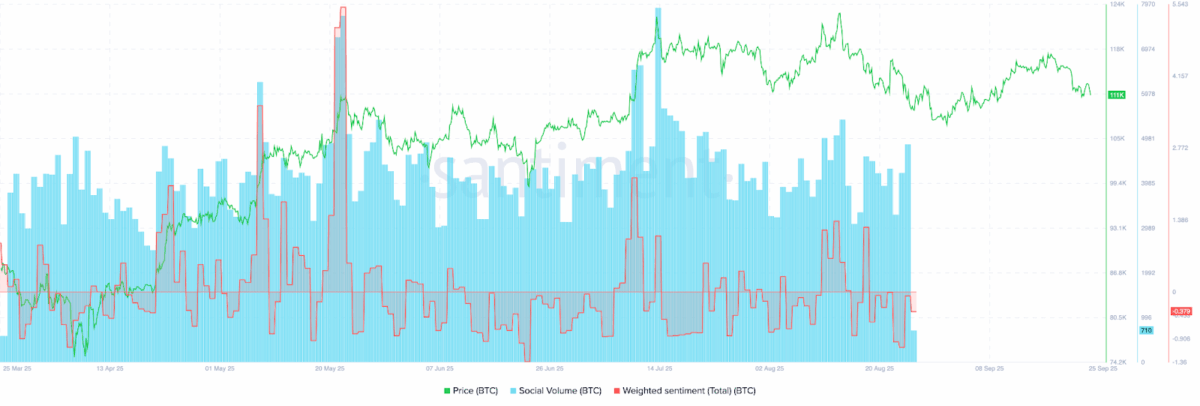

Based on Santiment data, Bitcoin’s social volume has remained high, but the overall sentiment is negative at 0.37. This kind of factor combination has historically tended to signal increased volatility and sharp corrections in the future.

Ethereum is at a tipping point near $4,000, and bitcoin is trying to hold steady at $110,000. If either coin makes a big move up or down, it could set the direction for the entire crypto market.

Also Read: Bitcoin Drops Below Cost Basis Quantile As $107K Liquidity Trap Deepens