Why Avalanche Could Become the Next Crypto Treasury Powerhouse

Avalanche's infrastructure flexes serious muscle where it counts—transaction speeds that leave legacy chains in the dust and sub-second finality that makes traditional finance look like it's moving through molasses.

The Institutional Appeal

Corporate treasuries hunt for three things: scalability, security, and sanity. Avalanche delivers all three without the gas fees that make CFOs weep. Its subnet architecture lets enterprises build custom blockchains while staying connected to the main network—a feature that's already attracting Fortune 500 attention.

Defi's Silent Workhorse

While flashier coins grab headlines, Avalanche keeps processing transactions at a pace that would give Visa executives nightmares. The network handles over 4,500 transactions per second while maintaining decentralization—something the 'proof-of-work' dinosaurs still can't figure out decades later.

Regulatory Tightrope

Avalanche walks the fine line between innovation and compliance with surprising grace. Its eco-friendly consensus mechanism dodges the ESG bullet that's sinking other cryptos—because nothing says 'responsible investment' like using less energy than a small town just to process payments.

The Verdict: Treasury material? Absolutely. But remember—this is crypto, where today's darling becomes tomorrow's 'learning experience' faster than you can say 'bear market.'

AVAX is getting mainstream adoption, with Tradfi, Governments and giant corporations all wanting to launch their own LAYER 1 for various reasons, like for tokenizing real-world assets, stablecoins. Avalanche, according to its users, is the only platform that allows them to do this and people are slowly figuring it out so the FOMO keeps growing.

“Avalanche has stayed locked on on-chain finance and forged world-class partnerships,” said Hivemind founder Matt Zhang.

What Role Does Anthony Scaramucci Play in the Avalanche Crypto Strategy?

SkyBridge Capital founder Anthony Scaramucci will be a strategic advisor for AgriFORCE Growing Systems. He has been openly bullish on Avalanche for its tokenization potential and flexible architecture.

“Avalanche is like a Swiss army knife of Layer-1 networks, with a lot of flexibility,” Scaramucci said.

![]() BIG NEWS $AVAX: @Scaramucci :

BIG NEWS $AVAX: @Scaramucci :

“We’re going to have a Digital Asset Treasury for Avalanche” pic.twitter.com/UsoOtcM6b0

— Luana L1![]() (@Luacantu) September 22, 2025

(@Luacantu) September 22, 2025

The MOVE comes as BlackRock’s tokenized fund has expanded its operations onto Avalanche, signaling rising institutional validation.

What Do the Numbers Tell Us About AVAX’s Staking and Growth?

At $31.76 per token, a $700 Mn AVAX position equals about 22 million coins. With validator yields NEAR 6.7%, that stake could spin off $46.9 Mn a year in rewards, giving the treasury its own revenue stream.

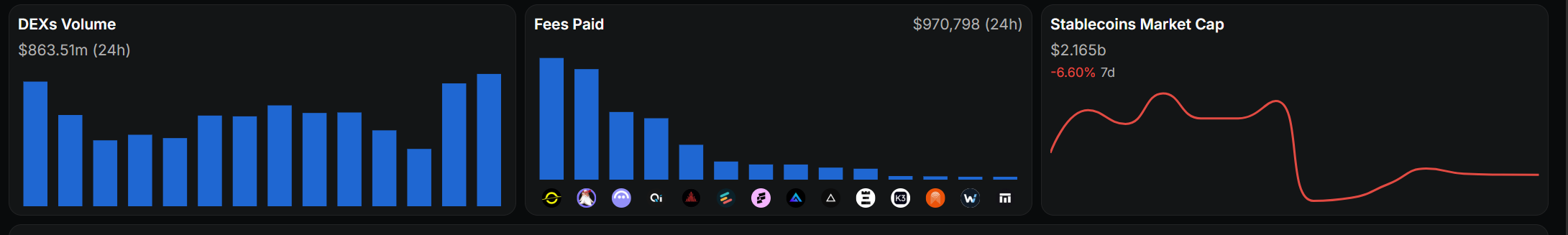

Network activity for AVAX is also climbing. Avalanche processed 11.9 million transactions in late August, up +66% in a week, according to DeFi Llama. TokenTerminal data shows monthly active users topping 1 million, while fees remain a fraction of Ethereum’s, reinforcing Avalanche’s cost advantage.

Is AVAX’s “Moment” Finally Here?

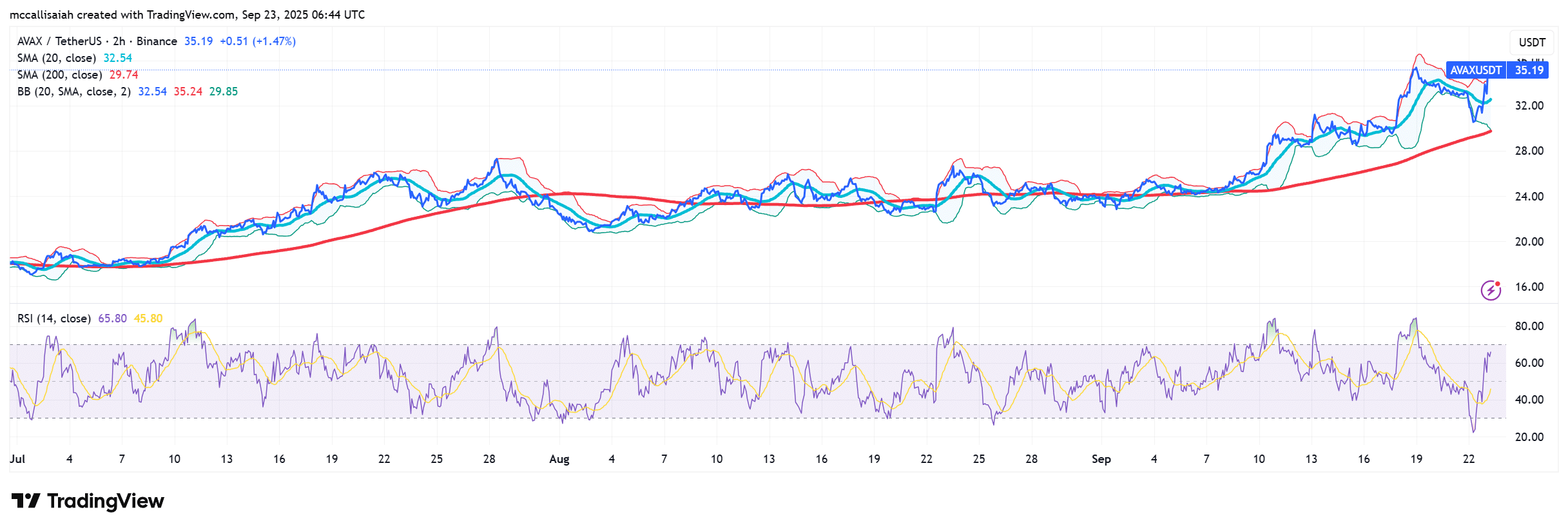

AVAX trades near $33.29, up 27% in a month but still far from its $144 all-time high. Momentum is supported by treasury accumulation, ETF filings from VanEck and Grayscale, and steady tokenization flows.

If Treasury yields ease later in 2025, money market capital could rotate into higher-yielding assets like AVAX. Coupled with Scaramucci’s endorsement and rising network activity, Avalanche could be a top altcoin for Q4.

Key Takeaways

- AgriFORCE Growing Systems is rebranding as AVAX One, a branch of Avalanche Crypto, aiming to create a Avalanche-focused treasury..

- AVAX trades near $33.29, up 27% in a month but still far from its $144 all-time high. Momentum is supported by treasury accumulation.