🚀 Crypto Eruption: BTC Rockets to $123K as XRP & ETH Trigger Wall Street Stampede

Bitcoin just rewrote the rulebook—again. The OG crypto smashed through $123K today, leaving traditional assets choking on its exhaust fumes. Meanwhile, XRP and Ethereum are sparking a institutional gold rush that’s turning cold Wall Street offices into frenzied trading pits.

The BTC moonshot: No ‘slow grind’ here—just a vertical assault on price records that’s making gold bugs weep into their safety deposit boxes.

Altcoin arms race: XRP’s legal clarity and ETH’s staking yields have hedge funds scrambling like day traders on a Robinhood rally. (Bonus irony: the same suits who called crypto a ‘fraud’ in 2022 now can’t wire transfers fast enough.)

Reality check: Sure, the SEC will probably ‘protect investors’ by trying to ban whatever’s mooning next week. But for now? The crypto train’s left the station—and traditional finance is sprinting to catch up, Rolexes rattling.

With U.S. lawmakers kicking off “Crypto Week” and ETF inflows breaking records, institutional conviction is setting the tone. XRP surged on legal clarity and banking news, ETH is drawing fresh treasury interest and scaling momentum, while solana and Sui are benefiting from capital rotation into high-beta plays. The market is buzzing, not just from price action but from the unmistakable scent of regulatory resolution and next-cycle positioning.

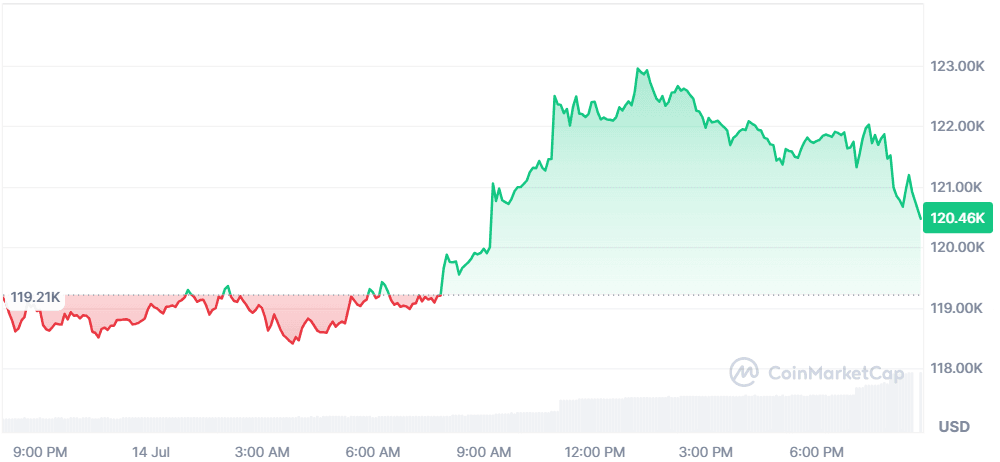

Butcoin (BTC)

+1.2%$120,483.54

Bitcoin soared to a new all-time high of $123,000, fueled by institutional inflows and political support. President Donald Trump signed an executive order establishing a U.S. Strategic Bitcoin Reserve, reinforcing a national commitment to digital assets. Simultaneously, BlackRock's Bitcoin ETF surpassed 700,000 BTC in holdings, now managing $83 billion in AUM, a growth pace 5x faster than historical ETF benchmarks. On-chain data shows high accumulation activity and steady transaction volumes, indicating strong long-term conviction. Despite the price rally, retail interest remains subdued, with most momentum attributed to institutions.

$2.39T$174.67B19.89M BTC

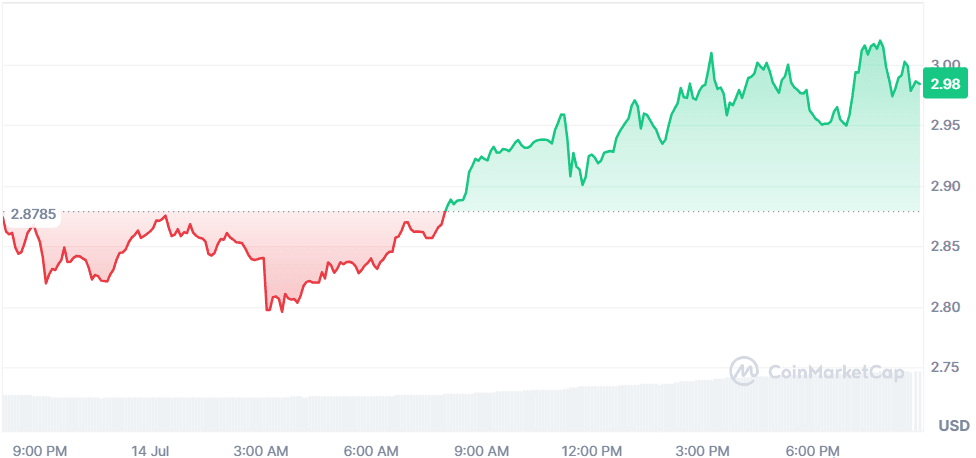

XRP (XRP)

+4.29%$2.98

XRP gained momentum, climbing 26% this week and nearly 10% in the past 24 hours, with whale wallets hitting an all-time high, 2,743 addresses now control 47.32B XRP. Ripple's settlement with the SEC and its U.S. banking license application have significantly boosted sentiment. Analysts suggest this could mark a shift from speculation to utility, especially as Ripple eyes stablecoin custody with the Fed. The launch of a double-leveraged XRP ETF and an upcoming XRP Futures ETF on July 18 also signal a surge in institutional interest, with weekly ETF trading volume crossing $120M.

$176.55B$11.85B59.13B XRP

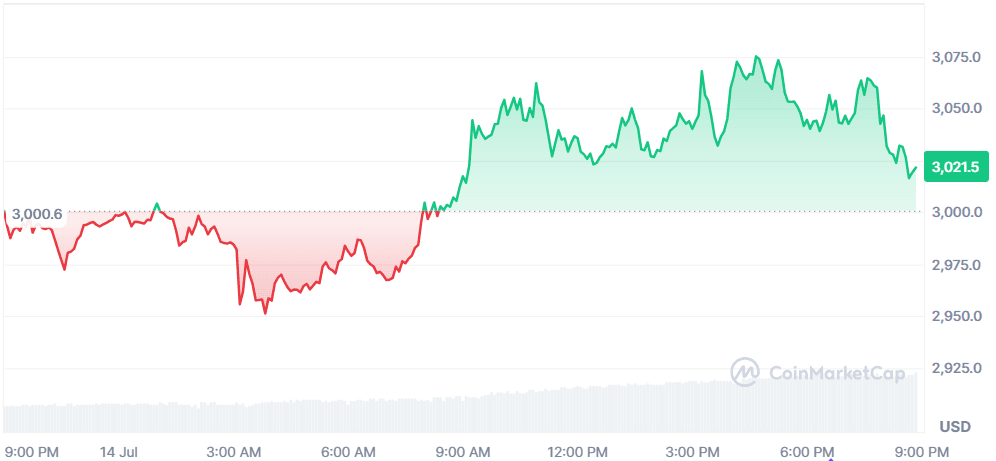

Ethereum (ETH)

+0.6%$3,021.56

Ethereum is climbing steadily toward the $3,050 breakout mark, supported by growing institutional adoption and staking participation. Over 33 million ETH are now staked (27% of supply), while BlackRock's ETH ETF surpassed 2 million ETH in holdings. Visa and PayPal have integrated ETH Layer 2s (Optimism and Arbitrum) into their global payment infrastructure. Meanwhile, the ethereum Foundation announced a native zkEVM Layer 1 rollout by 2025, aiming to enhance scalability and privacy. The SEC’s recognition of ETH as a commodity further solidifies its regulatory clarity and appeal to traditional finance.

$364.09B$31.55B120.71M ETH

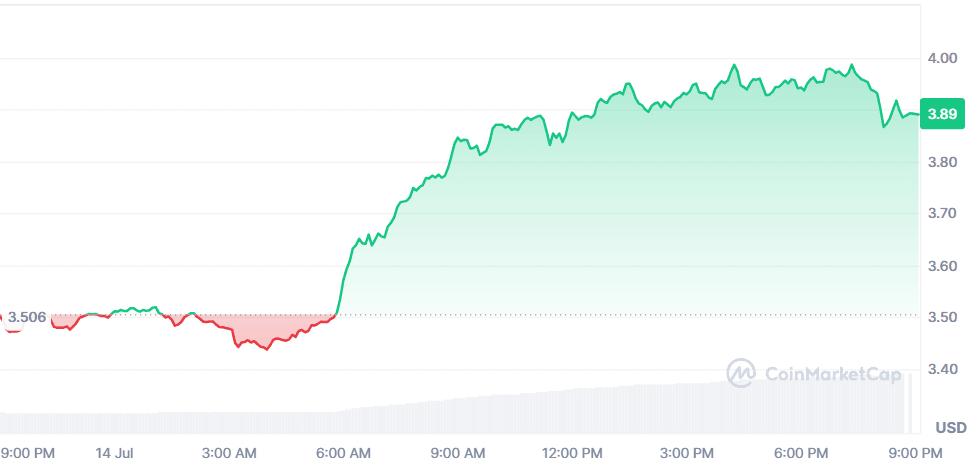

Sui (SUI)

+11.01%$3.89

SUI exploded 12.4% in 24 hours, crossing a key pivot level of $3.47 and triggering algorithmic buying. A symmetrical triangle breakout and 146% surge in trading volume confirmed strong institutional interest. Sui’s DeFi ecosystem continues to gain strength, with Total Value Locked hitting $2.2B, led by Suilend Protocol at $675M. Integration of tBTC injected $500M in BTC liquidity. Open Interest in SUI derivatives rose 19%, while the altcoin benefited from Bitcoin’s rally to $122K and broader risk-on capital rotation in the crypto market.

$13.44B$2.67B3.45B SUI

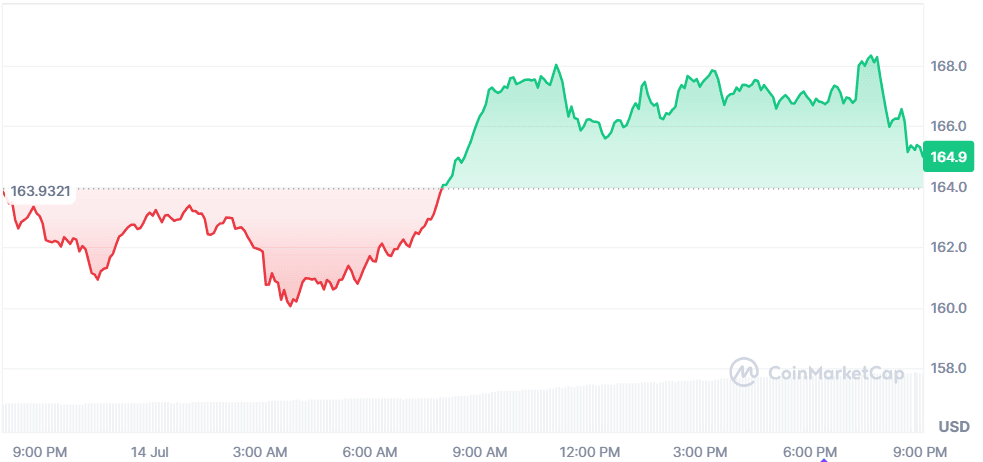

Solana (SOL)

+1.02%$164.97

Solana continues to ride institutional waves, with Upexi announcing a $200M investment to expand its SOL treasury, backed by Big Brain Holdings. The move mirrors corporate strategies like MicroStrategy’s BTC accumulation and signals growing interest in Layer 1 tokens for corporate treasuries. Additionally, Kenya launched its national digital token (KenyaNDT) on the Solana blockchain, adding real-world utility and regional adoption potential. Though still early, these developments hint at Solana's evolving role in both institutional portfolios and national digital infrastructure.

$88.45B$6.78B536.15M SOL

Global Market Snapshot

Bitcoin broke past $120,000 in early trading on Monday, setting a new all-time high ahead of what’s being dubbed as “Crypto Week” in Washington. A flurry of institutional inflows into spot bitcoin ETFs, totaling over $1.18 billion in a single day, combined with President Trump’s pro-crypto stance and the upcoming vote on the GENIUS Act, has fueled investor optimism. Trump’s executive order to create a Strategic Bitcoin Reserve and regulatory moves around stablecoins have deepened expectations of long-term adoption. Yet, this institutional-led rally has seen muted participation from retail traders, with many still on the sidelines.

Meanwhile, global equity markets opened cautiously. Despite Trump’s announcement of a 30% tariff on EU and Mexican imports effective August 1st, major indices remained flat as investors bet on a negotiated outcome. The S&P 500 and Nasdaq hovered NEAR record highs, while the Dow dipped slightly. European officials are scrambling to strike a deal, delaying countermeasures for now. Economists warn of heightened pressure on EU trade, but many expect a middle-ground tariff compromise. Eyes are also on U.S. earnings season kicking off this week, with banks like JPMorgan and Goldman Sachs in focus. All eyes remain on whether strong corporate results can outweigh escalating trade tensions.

Closing Thoughts

Investor sentiment is clearly tilting risk-on, but it’s being driven from the top. Institutions are dominating flows from ETF giants buying billions in BTC and ETH, to major players backing XRP futures and Solana treasuries. The retail crowd remains cautious, unsure if they’ve missed the wave or if volatility is lurking. Meanwhile, the GENIUS Act and stablecoin frameworks coming up in U.S. legislation are reinforcing long-term Optimism without the frothy euphoria of previous tops. It’s coordinated conviction, not chaotic hype.

Across sectors, infrastructure and utility tokens are leading with Ethereum’s DeFi upgrades and Sui’s DeFi TVL jump making headlines. Bitcoin, still the institutional anchor, is increasingly viewed as a macro hedge amid Trump’s tariff-fueled global trade anxiety. As crypto legislation gains traction and capital flows deepen, we’re seeing a shift: this market isn’t just chasing narratives anymore, it’s building them.