🚀 Crypto Showdown: CRO Breaks Into ETFs as DEGE Surges on Trump Momentum

CRO just crashed the ETF party—Wall Street's latest 'innovation' is copy-pasting crypto into traditional finance wrappers. Meanwhile, DEGE memecoin rides the political hype cycle like a degenerate gambler at a Trump rally.

### The ETF Play: Institutional Validation or Latecomer FOMO?

CRO's ETF debut marks another step in crypto's march toward mainstream acceptance—or exposes how desperate asset managers are to stay relevant. Remember when they called Bitcoin a scam? Now they're repackaging altcoins for boomers.

### Meme Coin Mania 2.0: Politics Edition

DEGE's Trump-inspired pump proves memecoins will latch onto any narrative—elections, celebrity tweets, alien invasions. The only fundamentals? A viral tweet and enough liquidity for insiders to cash out before the drop.

Wake us when the SEC approves a Bitcoin ETF that doesn't bleed 1.5% in fees for the privilege of owning a synthetic derivative.

Meanwhile, FIS rallied on actual utility upgrades and exchange listings, MBOX jumped on a timely token burn, and Baby Doge saw renewed attention thanks to the memecoin sector rotation. Each token came with its own storyline, but what they share is a resurgence in volume and community buzz, two things that have been missing from the altcoin market for weeks.

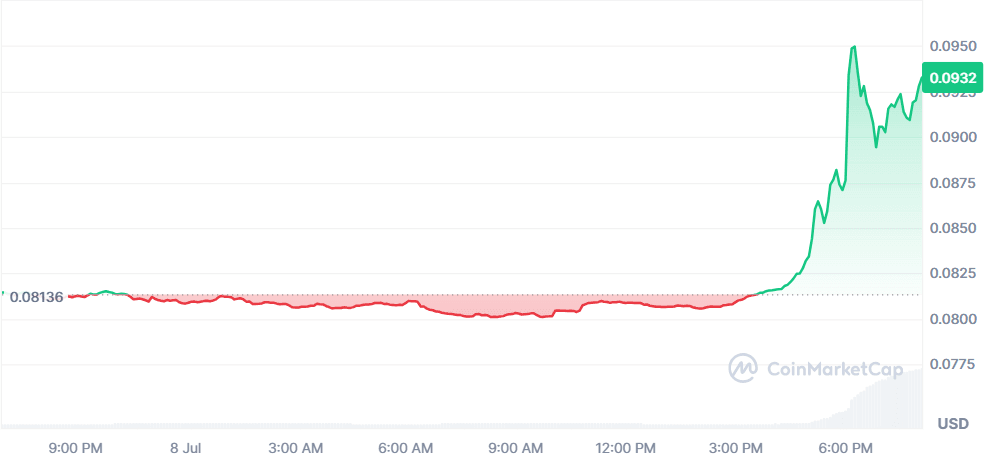

Cronos (CRO)

+16.3%$0.09432

CRO surged after the U.S. SEC confirmed Truth Social’s S-1 filing for a blue-chip cryptocurrency ETF. The ETF will include Bitcoin, Ethereum, SOL, XRP, and CRO bringing CRO into the spotlight due to its inclusion among major players. This official filing, combined with a sharp 1,156% spike in trading volume, signaled renewed investor interest.

$2.93B$132.4M31.12B CRO

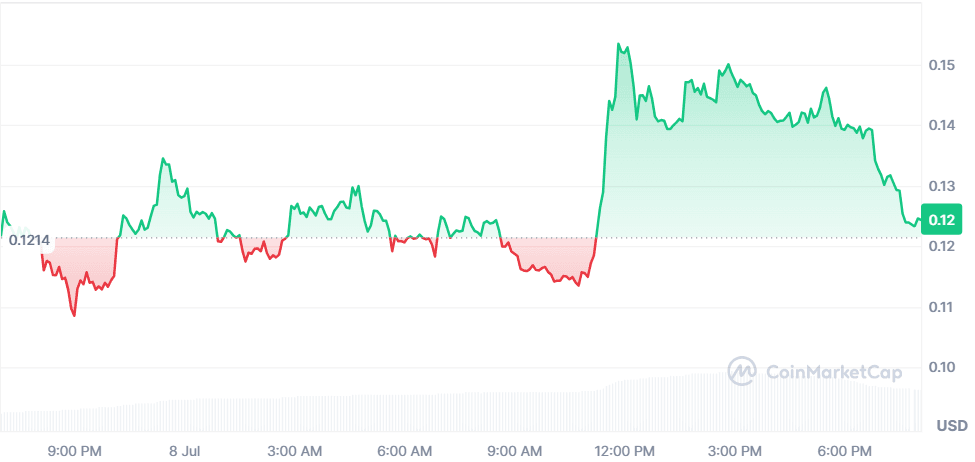

StaFi (FIS)

+8.75%$0.1248

FIS continued its rally after the launch of rToken v2 enabled Solana and Avalanche cross-chain staking, boosting TVL by 40%. The Q3 roadmap (AI staking + MEV integrations) reinvigorated bullish sentiment. The RSI jumped from oversold to overbought territory, while whale accumulation tightened liquidity. 24h volume hit 7.82x market cap.

$14.42M$112.28M115.54M FIS

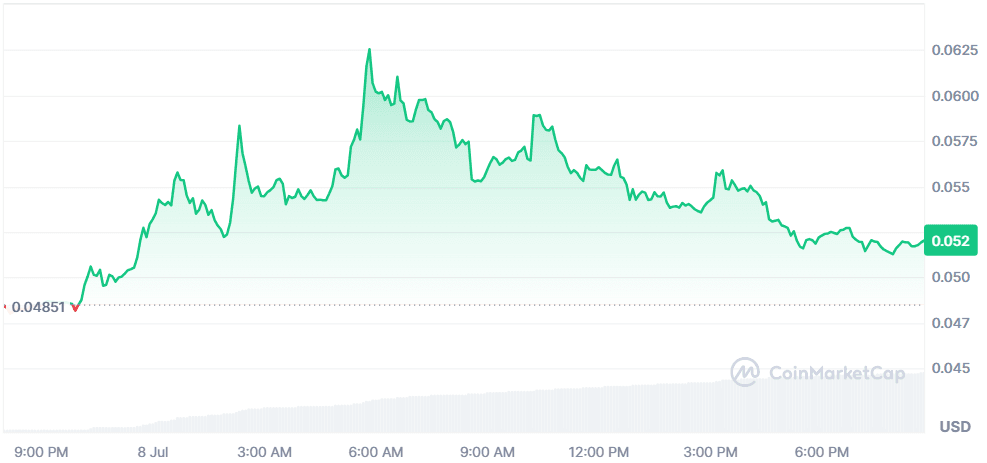

MOBOX (MBOX)

+7.39%$0.05202

MBOX pumped after announcing the burn of 153,467 MBOX and 7.37M MEC tokens reducing supply and triggering bullish momentum. Volume skyrocketed by 1,549% to $93.8M. Technical indicators confirmed strength: RSI reached 75.41 and the MACD flipped bullish. Price flipped both 7-day and 30-day SMAs into support.

$26.02M$93.84M500.32M MBOX

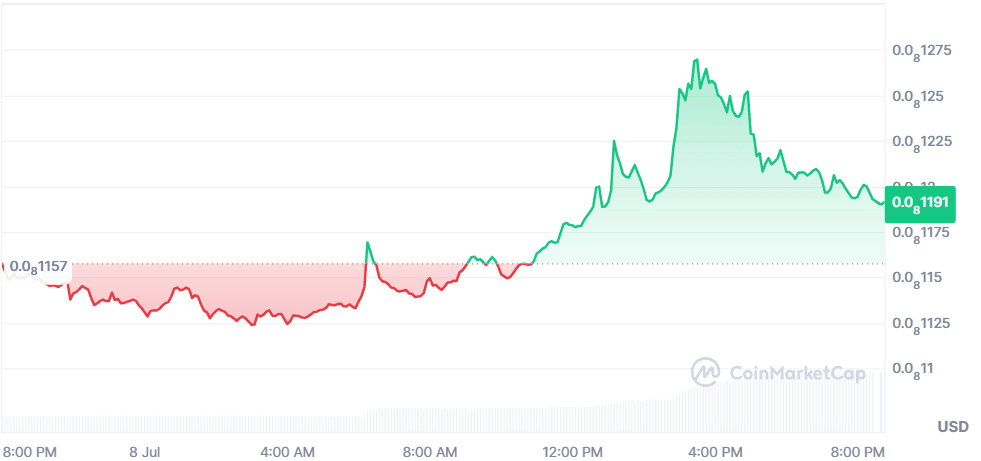

Baby Doge Coin (BABYDOGE)

+3.35%$0.000000001191

BabyDoge bounced from oversold levels, with its price crossing both 7-day SMA and EMA. The MACD turned positive, and a 266% spike in volume pointed to rising speculative interest. A 7.69% increase in the altcoin season index suggests meme coin rotation helped drive the short-term rally despite weak fundamentals.

$199.34M$40.08M167.35T BabyDoge

Dege Coin (DEGE)

-4.72%$0.03515

DEGE exploded nearly 350% in 24h, riding a speculative wave tied to U.S. political sentiment and its branding as the “American People’s Meme Coin.” With heavy tagging of Donald TRUMP and World Liberty Financial in its promotional posts, the coin surged on hype. It amassed over 10,000 holders in two weeks. Market interest is peaking as traders anticipate a possible official endorsement.

$35.1M$4.7MNot disclosed

Global Market Snapshot

Markets across the globe largely shrugged off U.S. President Donald Trump’s latest tariff threats, signaling growing investor desensitization to political brinkmanship. Fourteen countries, including Japan, South Korea, Malaysia, and South Africa, were hit with letters detailing steep tariffs set to take effect from August 1, ranging from 25% to 40%.

Yet, both Asia-Pacific and European equities held steady. South Korea’s Kospi led gains at +1.8%, while Japan’s Nikkei inched up 0.3%. Europe also held ground, with indices like the FTSE 100 (+0.48%) and DAX (+0.60%) showing resilience. Analysts cited Trump’s mixed messaging, labeling the deadline “firm, but not 100% firm”, as reassurance that deals could still be brokered.

On Wall Street, futures pointed higher despite Monday’s drop, as the “TACO” (Trump Always Chickens Out) trade narrative resurfaced. Bond yields ROSE globally, Germany’s 10Y jumped to 2.65% and the U.S. 10Y to 4.42%, hinting at cautious optimism. Spirits and banking stocks climbed on hopes of EU-U.S. trade deal exemptions, while retail lagged. With the tariff delay extending uncertainty and negotiations still evolving, investors seem comfortable, for now, navigating Trump’s unpredictable trade playbook. But the market’s calm could be tested if concrete deals fail to materialize before August.

Closing Thoughts

Both traditional and crypto markets seem to be tolerating policy noise with growing maturity. In global finance, investors largely ignored Trump’s fresh tariff threats, while bond yields rose and equities held steady. The calm in equity indices, especially in Europe and Asia, suggests that markets are betting on negotiation over escalation and that belief trickled into crypto sentiment as well. CRO’s ETF narrative aligned with today’s appetite for institutional credibility, and even DEGE’s meme-fueled rally echoed retail investors’ search for the next breakout amid policy-induced uncertainty.

On the crypto side, utility is getting rewarded again, as seen with FIS and MBOX, but speculative plays like DEGE and BabyDoge remind us that memecoins still hold weight in trader psychology, especially when tied to larger cultural moments. Volume spikes across all five trending coins suggest a return of short-term confidence, with traders rotating between narrative-driven and technically bullish assets. The broader takeaway? Crypto is back in the conversation, and it’s riding the same wave of cautious Optimism that’s propping up global risk assets.