🚀 July 2025’s Crypto Powerhouses: H, HFT, and SUI Dominate Market Momentum

Crypto markets never sleep—and this week’s chart-toppers prove it. Three tokens are stealing the spotlight while TradFi analysts scramble to justify their 2% bond yields.

The H Factor: More Than Just a Letter

H isn’t just riding trends—it’s rewriting them. The token’s surge defies typical mid-year lulls, leaving skeptics eating dust.

HFT Flexes Its Speed Advantage

High-frequency trading protocols are crushing legacy systems. HFT’s rise exposes how Wall Street’s "cutting-edge" tech is still stuck in dial-up era.

SUI’s Layer-1 Breakout Moment

While Ethereum killers keep dying, SUI’s infrastructure gains suggest it might actually survive contact with mainnet reality.

One hedge fund manager muttered: "We called this rally—right after we finished shorting it." Classic finance foresight.

Meanwhile, Layer-1s and Layer-2s showed signs of quiet strength. Sui (SUI) continues to attract institutional inflows and developer interest, while Arbitrum (ARB) made headlines with its Timeboost upgrade and Robinhood’s tokenization push. XRP and ETH both stayed relatively flat but remain in strong positions due to renewed ETF activity and tokenization narratives. The data points to a clear pattern: high-momentum, real-utility altcoins are waking up, even as the majors hold the fort.

Humanity Protocol (H)

▲ 379.78%$0.09569

Humanity Protocol saw a meteoric rise following back-to-back listings on OKX Futures and Bithumb Spot on July 3. The protocol leverages zkProofs to solve real-world identity issues, boasting millions of users across its testnet and mobile app. Backed by major VCs like Pantera Capital and Jump, it recently acquired on-chain ticketing giant Moongate and partnered with Prenetics, a NASDAQ-listed firm, which will hold H in its treasury, fueling further confidence.

With RSI nearing 72, $H is currently in overbought territory but shows strong momentum backed by rising exchange listings and solid fundamentals. If bullish volume sustains, the next resistance sits near $0.115. However, short-term pullbacks to $0.080 are likely before continuation. Consolidation above $0.09 WOULD confirm bullish strength and open doors toward $0.13.

Hashflow (HFT)

▲ 92.45%$0.1049

Hashflow has stolen the spotlight this week after soaring over 80% in 24 hours, thanks to solana ecosystem integrations and renewed investor interest. Its unique RFQ model and cross-chain smart routing differentiate it in the crowded DEX space. With $25B in RFQ volume processed, over $500M in liquidity offered, and exposure via Binance Launchpool, it's seeing increased attention ahead of its next token unlock on July 7. The GENIUS Act’s passage may also provide regulatory tailwinds for DeFi projects like HFT.

HFT is forming a bullish flag pattern on the 4H chart with RSI cooling down to 61 after the surge. If buyers step in above $0.11, a MOVE toward $0.13–$0.14 is likely. However, failure to hold $0.097 support may push it to $0.085 before another leg up. Volume remains high, signaling continued trader interest.

Pudgy Penguins (PENGU)

▲ 32.85%$0.01591

PENGU surged nearly 90% this week as the SuperTrend indicator flipped bullish. As the token tied to the Pudgy Penguins NFT ecosystem, it gained traction from rising market sentiment around NFT-backed tokens. Analysts suggest a breakout above $0.018 could propel the token toward $0.028. However, the dip in trading volume to $314M signals slight market hesitation, likely due to profit-taking.

With RSI hovering around 64, $PENGU remains in bullish territory. A break above $0.0168 with strong volume could trigger a rally toward the $0.020–$0.022 region. Support lies at $0.0145. If the price holds the current range and volume rebounds, continuation toward the $0.028 target remains on track.

Bonk (BONK)

▲ 33.55%$0.00001823

Bonk’s 33% weekly surge follows the formation of a textbook Cup and Handle pattern on the daily chart. As Solana's top meme token, BONK is benefiting from increased ethereum and Solana activity. It’s now testing the 200-day moving average around $0.00001881, considered a key breakout zone. If it clears this, the next upside targets lie at $0.00002580 and eventually $0.000039.

RSI is trending NEAR 69, indicating BONK is on the edge of being overbought. If it decisively breaks the 200DMA, momentum could lift it to $0.000026. However, rejection at current levels could lead to a retrace toward $0.000016. The breakout looks healthy, but traders should watch for confirmation.

Moo Deng (MOODENG)

▲ 27.17%$0.1791

MOODENG exploded 60% this week following its listing on Upbit (KRW, BTC, USDT pairs). The hippo-themed memecoin broke out of a falling wedge and a symmetrical triangle, with volume skyrocketing from $50M to over $320M. Technical indicators like MACD and ADX confirm bullish momentum, and sentiment remains strong across South Korean trading circles.

RSI sits at 66 with ADX at 32.94, signaling a sustained trend. If bulls hold above the $0.18 support, targets at $0.23 and $0.28 (Fib 0.236) remain viable. A dip below $0.16 would invalidate the setup short-term. Overall sentiment and volume point to a bullish continuation, especially if buying pressure remains elevated.

Arbitrum (ARB)

▲ 7.42%$0.3256

ArbitrumPrice Change (7D): ▲ 5.56% Current Price: $2.90

Ethereum (ETH) is back in the spotlight with the success of its Timeboost feature, a transaction ordering mechanism that has already generated $2 million in fees. The innovation ensures fairness in high-frequency trading on DEXs by minimizing MEV and slippage, and 20–30% of DEX volume is already adopting it. This technical edge is now being enhanced by Robinhood’s rollout of tokenized stocks on Arbitrum Orbit, with plans for a full Layer-2 deployment. As Ethereum’s leading L2, ARB is now poised to benefit from both DeFi and TradFi convergence.

RSI hovers near 56, indicating neutral momentum, while the price is consolidating just above the $0.30 support. A breakout above $0.34 would trigger a push toward $0.38–$0.40, aligning with May highs. If rejected, ARB could revisit $0.30. The current bullish structure remains intact, supported by the rise in protocol utility.

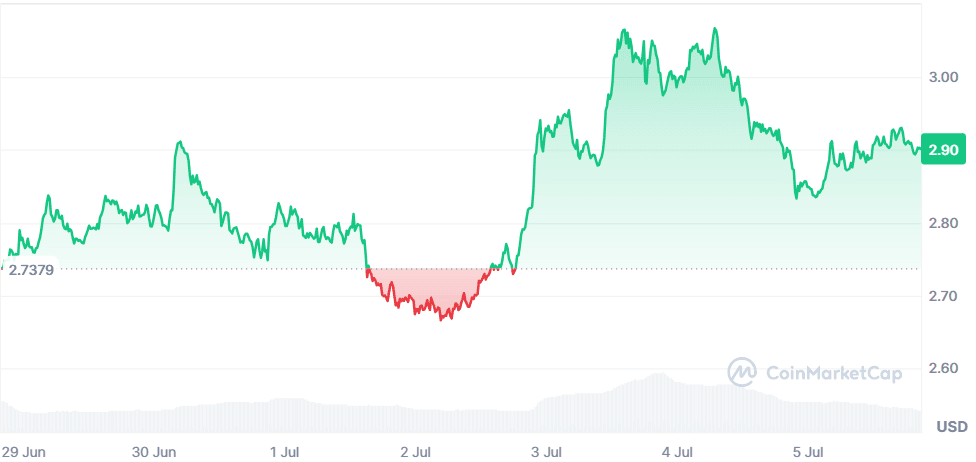

Sui (SUI)

▲ 5.56%$2.90

SuiPrice Change (7D): ▲ 3.23% Current Price: $2,509.18

News: Ethereum has shown stable growth as institutional flows hit $148.21M this week, fueled by inflows into spot ETFs by BlackRock and Fidelity. On-chain activity remains robust with over 2 million daily transactions, while the Pectra upgrade and EIP-7251 are enhancing wallet flexibility and scalability. Liquid staking continues gaining momentum, with 35M ETH staked and more institutions shifting reserves into ETH. New integrations and tokenized asset offerings are solidifying ETH's leadership across DeFi and real-world applications.

Forecast: ETH is range-bound between $2,480 and $2,550 with RSI at 58. A break above $2,560 would clear the path toward $2,640 and potentially $2,720. If it slips below $2,480, a retest of $2,420 is likely. Strong ETF inflows and protocol upgrades support bullish continuation if macro conditions remain steady.

XRP (XRP) continues gaining traction after surpassing $500B in cumulative trading volume. With Grayscale adding sui to its high-growth watchlist and TVL touching $1.8B, institutional sentiment remains strong. Recent launches like zkLogin and cross-chain bridges are driving retail and enterprise adoption. Despite fears around a $123M token unlock, no major sell-offs were observed. Meanwhile, its parallel execution model and over 140 live dApps continue reinforcing developer interest.

RSI is approaching overbought at 68, and MACD shows bullish continuation. SUI is trading in a tight range between $2.90 and $3.15. A clean breakout above $3.30 could send the price toward $3.70–$4.00. However, a dip to $2.75 remains possible if momentum cools. Overall structure favors upside as long as price holds $2.80.

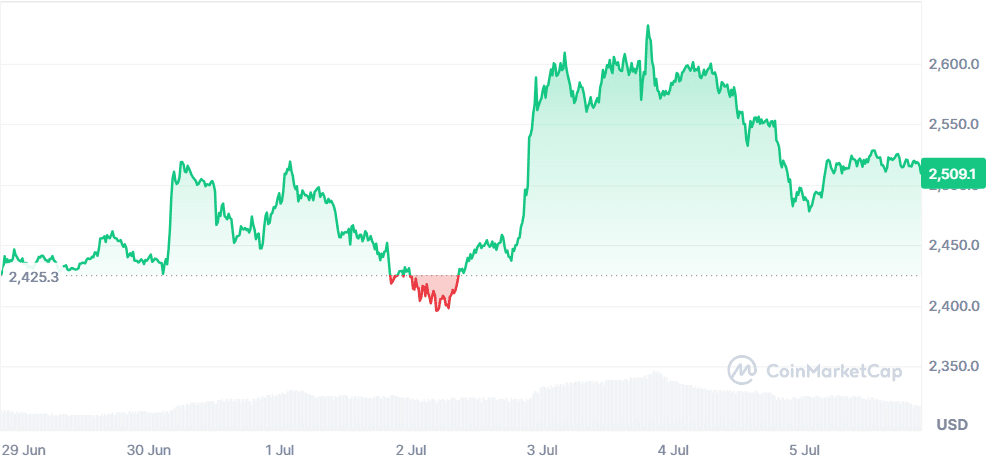

Ethereum (ETH)

▲ 3.23%$2,509.18

Ethereum has shown stable growth as institutional flows hit $148.21M this week, fueled by inflows into spot ETFs by BlackRock and Fidelity. On-chain activity remains robust with over 2 million daily transactions, while the Pectra upgrade and EIP-7251 are enhancing wallet flexibility and scalability. Liquid staking continues gaining momentum, with 35M ETH staked and more institutions shifting reserves into ETH. New integrations and tokenized asset offerings are solidifying ETH's leadership across DeFi and real-world applications.

ETH is range-bound between $2,480 and $2,550 with RSI at 58. A break above $2,560 would clear the path toward $2,640 and potentially $2,720. If it slips below $2,480, a retest of $2,420 is likely. Strong ETF inflows and protocol upgrades support bullish continuation if macro conditions remain steady.

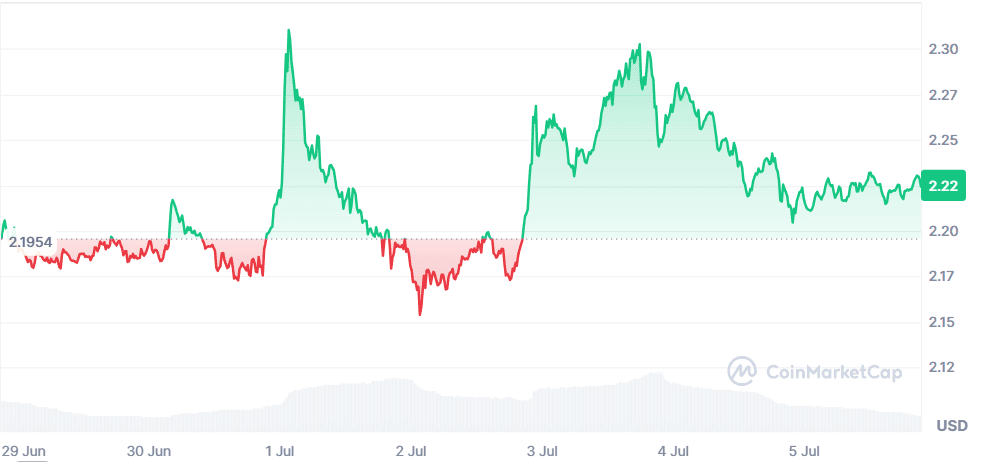

XRP (XRP)

▲ 1.07%$2.22

XRP’s settlement with the SEC and the launch of XRPL’s permissioned DEX have provided XRP with regulatory clarity and functional momentum. Ripple is now pursuing a U.S. banking license while exploring custody options for RLUSD. Mercado Bitcoin’s $200M tokenization initiative on XRPL and growing institutional interest in tokenized assets are building a solid case for XRP's use in real-world asset liquidity. The court’s reaffirmation of XRP’s non-security status is cementing its institutional appeal.

XRP’s RSI remains steady around 54, indicating neutral to mildly bullish sentiment. As long as it holds above $2.15 support, it may retest $2.28 resistance. A breakout could send it to $2.42. Downside risk remains low unless XRP dips below $2.10. Current structure supports gradual upward movement with regulatory tailwinds.

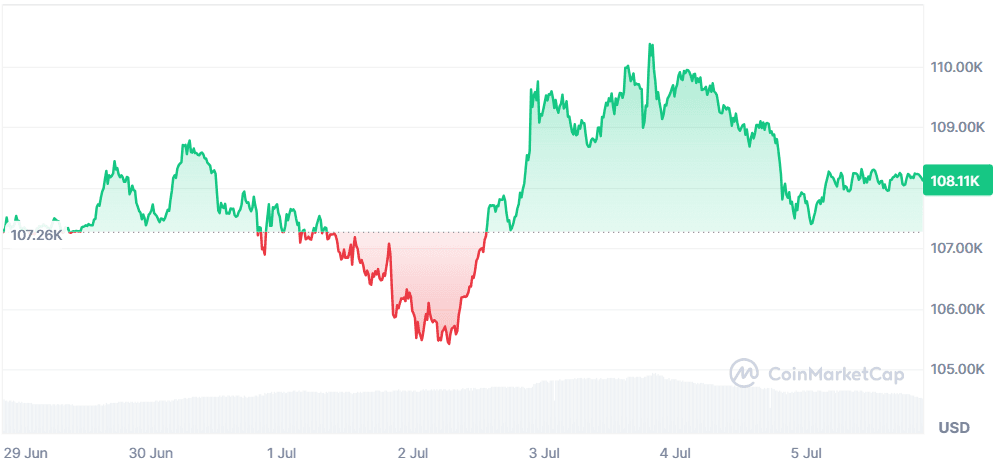

Bitcoin (BTC)

▲ 0.72%$108,111.71

Bitcoin had a quieter week in terms of price action but not fundamentals. Spot ETF inflows exceeded $600M, while long-dormant whales moved over $4.3B worth of BTC after 14 years. BlackRock’s ETF alone now holds $76B, and Fannie Mae’s consideration of BTC as mortgage collateral marks a pivotal TradFi shift. Regulatory clarity from the SEC and global reserve interest like Trump’s Bitcoin Act are strengthening BTC’s macro legitimacy, positioning it as the top digital asset for long-term institutional holding.

BTC RSI is around 52, signaling consolidation. The price has been bouncing between $107K and $109K, with key resistance at $110K. If broken, next upside lies near $114K. A dip to $106K remains a possibility but unlikely unless ETF outflows spike. Momentum remains positive with strong institutional undercurrents.

Closing Thoughts

This week’s market action is a compelling preview of the kind of altcoin-led rallies that often foreshadow a broader market breakout. The coins showing the most momentum, H, HFT, SUI, MOODENG, are not just riding HYPE cycles; they’re backed by infrastructure upgrades, cross-chain integrations, or mainstream adoption plays. The memecoin segment is also attracting renewed interest, particularly on Solana, where BONK and MOODENG continue to outperform—indicating that retail is slowly creeping back into the market.

DeFi infrastructure tokens like ARB and HFT are gaining both from technical upgrades and regulatory support, suggesting early accumulation by traders betting on Q3 upside. Meanwhile, BTC and ETH remain the ballast, stable, institutional, and holding ground while capital begins to rotate into mid-cap plays. Altcoin season isn’t fully here yet, but it’s knocking at the door, and the smart money appears to be listening.