🚀 Bitcoin Roars Back: BTC Dominance Climbs as UNI Defies Tariff Chaos in Global Markets | July 3, 2025

The crypto markets just flipped the script—again. While traditional assets reel from tariff shocks, Bitcoin’s dominance spikes like it’s 2021. Meanwhile, UNI laughs in the face of macro turmoil with a jaw-dropping rally. Here’s the breakdown.

Bitcoin: The Alpha Asset Flexes

No safe-haven debates today—BTC’s market share surge screams 'flight to quality.' Traders are ditching shaky equities for the OG crypto, proving (again) that decentralization beats geopolitics.

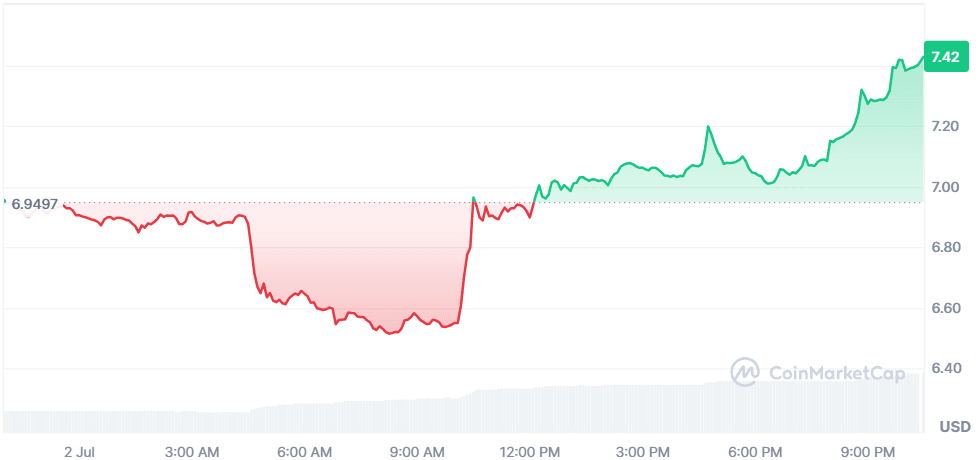

UNI’s Revenge: DeFi Eats the Dip

While Wall Street panics over trade wars, Uniswap’s token moons. Maybe those 'regulated' brokers should’ve hodl’d some Web3 exposure instead of overpriced ETFs.

The Bottom Line

Crypto’s decoupling narrative gets a credibility boost—until the next Fed tweet ruins the party. Stay nimble, degens.

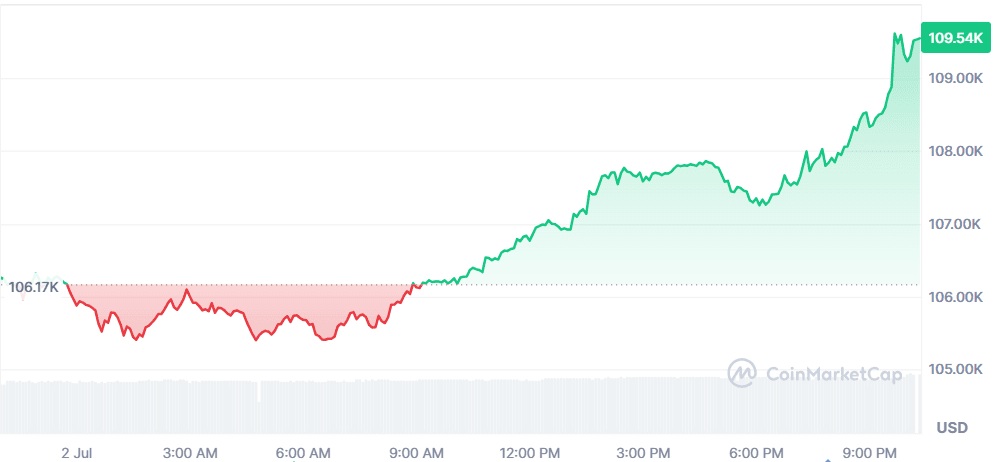

Bitcoin (BTC)

+3.27%$109,580.49

Bitcoin dominance surged to 65%, the highest in 2025, as institutional investors fled to safety amid rising geopolitical tensions and hawkish Fed tone. BlackRock’s iShares Bitcoin Trust (IBIT) led the ETF inflow spree, adding $3.85 billion in June alone, pushing its BTC holdings to $75B. Botanix’s Layer 2 mainnet launch also boosted Bitcoin’s programmability narrative, reducing block times to 5 seconds and bringing DeFi closer to Bitcoin-native rails. With traditional finance giants like BlackRock, Fidelity, and MicroStrategy increasing exposure, the market sees BTC as “digital gold” amid risk-off conditions.

$2.17T$50.18B19.88M BTC

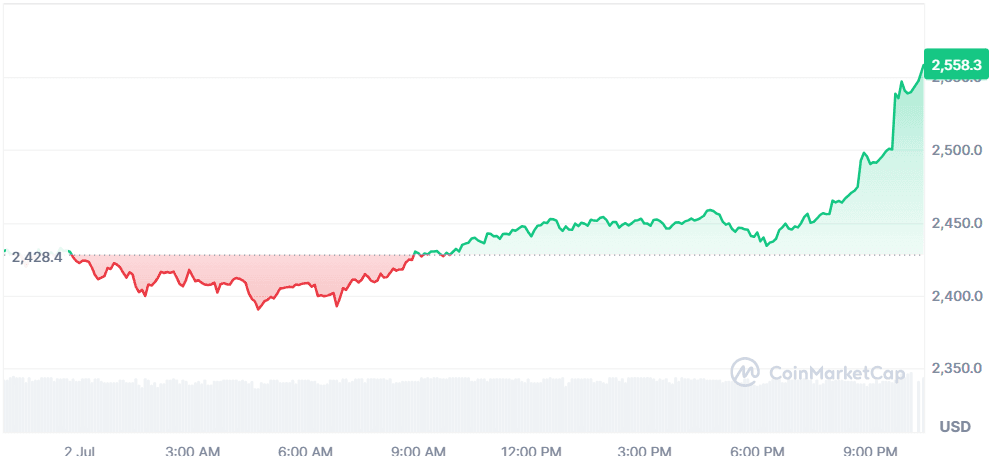

Ethereum (ETH)

+5.35%$2,558.83

Ethereum rallied as Fidelity added $25.7M worth of ETH, offsetting the ethereum Foundation’s controversial $32M sell-off. Spot ETH ETFs attracted $31.8M in inflows on June 30, signaling strong institutional confidence. Whale accumulation reached a record 14.2M ETH, the highest since the 2018 bear market, reinforcing a historic bullish setup. On-chain metrics surged to 2M daily transactions, while ETH ETFs have now seen 800K ETH added since April.

$308.89B$17.56B120.71M ETH

Humanity Protocol (H)

+22.31%$0.07003

Humanity Protocol soared 22% following whale-driven speculation, major exchange listings (Binance, KuCoin), and retail FOMO around its mainnet launch and airdrop. A 35M H ($2.7M) wallet deposit before the rally triggered wash trade concerns, while Jump Trading’s 25M H token movement stirred dilution debates. The Palm-scan zkProof identity model drew comparisons to Worldcoin.

$127.81M$318.79M1.82B H

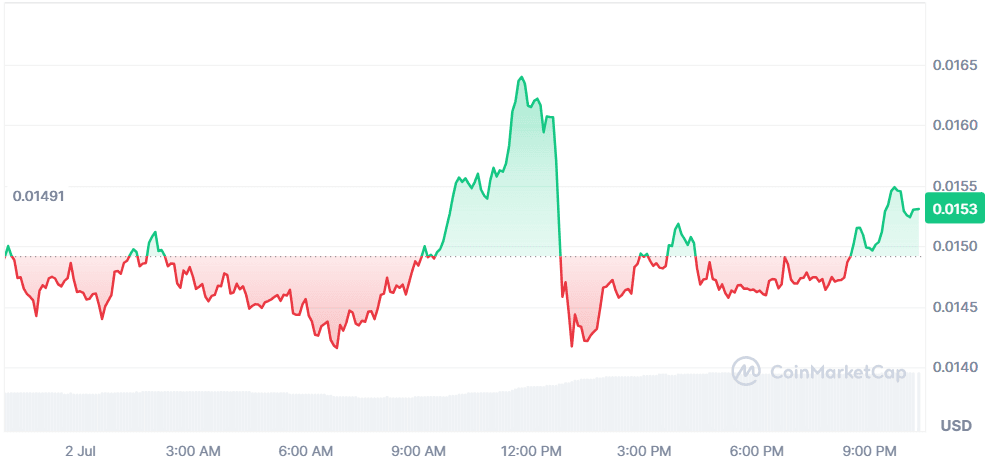

Pudgy Penguins (PENGU)

+1.78%$0.0153

PENGU gained on ETF speculation and breakout momentum, outperforming most altcoins despite rising BTC dominance. Cboe’s ETF proposal to combine 80–95% PENGU tokens with NFTs made it the first hybrid fund of its kind, gaining visibility as the Pudgy mascot appeared at Nasdaq’s opening. Technically, PENGU broke out of a 6-week downtrend, validated by a bullish MACD crossover and strong RSI at 68. Whale accumulation of 240M PENGU and past partnerships with NASCAR and Lufthansa solidify its real-world utility narrative.

$968.05M$814.44M62.86B PENGU

Uniswap (UNI)

+7.34%$7.42

Uniswap rallied after Coinbase’s acquisition of LiquiFi, a key Uniswap partner for token vesting and compliance. The move positions UNI deeper into institutional rails and aligns with a broader $40B crypto M&A wave. UNI broke above $7.40 resistance with a 174% volume spike, confirming technical strength. DEXs like Uniswap captured a record 28.4% of June’s spot volume, further boosted by regulatory scrutiny on CEXs. As DeFi rotates back into investor favor, UNI’s dominance and on-chain liquidity story gain momentum.

$4.66B$695.8M628.73M UNI

Global Market Snapshot

Markets reacted to a whirlwind of political and economic developments across the U.S., U.K., and Europe today. In the U.S., President Donald TRUMP announced a new trade deal with Vietnam that imposes a 20% tariff on its imports and a 40% tariff on transshipped goods. While the move grants American businesses zero-tariff access to Vietnamese markets, analysts warned it could drive up consumer prices and reignite inflationary pressures.

Still, markets responded with cautious optimism, S&P 500 edged higher and investors bet on greater near-term clarity ahead of the July 9 tariff pause deadline. Meanwhile, Microsoft announced 9,000 new job cuts as part of broader cost-efficiency restructuring, adding to broader tech sector pressure.

Across the Atlantic, U.K. bond yields spiked and the pound dropped 1% after Prime Minister Keir Starmer declined to fully back Finance Minister Rachel Reeves in Parliament. Political uncertainty over her future, combined with a costly welfare bill compromise, rattled investor confidence in Britain’s fiscal outlook. The 10-year gilt yield jumped 22 basis points at one point, reflecting fears that Reeves may be forced to abandon her strict fiscal rules. Despite this, the broader European market closed slightly higher, buoyed by strong bank earnings and investor relief after ECB officials hinted at rate cuts in September. Traders now turn their eyes to Friday’s U.S. payrolls data, as Fed Chair Jerome Powell’s cautious stance keeps markets hypersensitive to labor signals.

Closing Thoughts

The global financial landscape is flashing mixed signals. U.S. equities held steady despite Microsoft layoffs and Trump’s aggressive new tariff regime, while European markets edged higher even as U.K. bond yields spiked on political drama. Risk-off sentiment hasn’t fully taken over, but it’s brewing beneath the surface. In crypto, bitcoin is absorbing most institutional flows, supported by ETF demand and its “digital gold” narrative, Bitcoin’s renewed rally past $109K, Ethereum’s ETF-fueled optimism, and Uniswap’s DeFi momentum have once again seized center stage—while newer names like Humanity Protocol and PENGU defied broader market jitters with retail-fueled gains. As Bitcoin dominance crosses 65%, it’s clear capital is flowing back into majors, with altcoins still seeing selective breakouts. At the same time, macro tensions—from U.S.-Vietnam tariffs to U.K. fiscal instability—are keeping traditional markets and crypto investors on alert.especially as traditional finance appears increasingly fragmented.

Among altcoins, DeFi and memecoins showed surprising strength. UNI rallied on the back of a Coinbase-LiquiFi deal and record DEX market share, while PENGU gained visibility through ETF speculation and community-driven momentum. Meanwhile, retail interest in identity-focused coins like Humanity Protocol remains volatile but persistent. The market’s message is clear: institutional capital is consolidating in blue-chip assets, but traders are still rotating into breakout narratives when the tech and story align.